|

市場調查報告書

商品編碼

1632027

感測器和致動器:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Global Sensors and Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

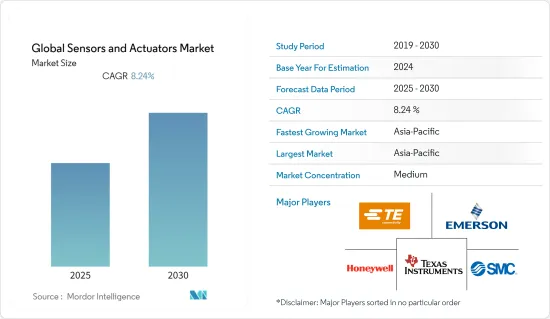

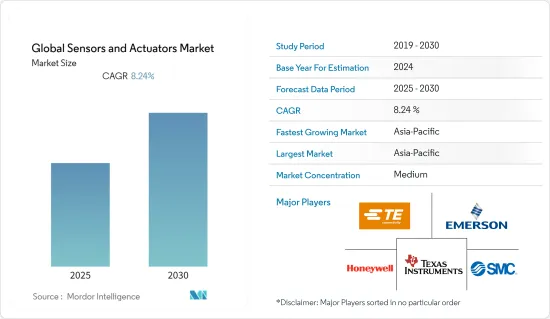

預計全球感測器和致動器市場在預測期內的複合年成長率為 8.24%。

主要亮點

- 工廠自動化產業旨在透過結合製造的數位和實體方面(方面感測器和致動器)來實現徹底變革並提供最佳性能。此外,對實現精益製造和縮短時間的關注正在加速感測器和致動器市場的成長。

- 離散製造業和流程工業中生產系統的自動化程度不斷提高,對能夠提供與生產過程相關的關鍵資料的組件的需求也不斷增加。這些感測器透過檢測金屬物體的存在和位置來促進工廠的製程控制。

- 電動致動器是包括物聯網在內的各種工業應用的標準選項,可將能量轉換為機械扭矩。與其他致動器類型相比,電能在運作過程中噪音較小。電動致動器不需要流體來驅動並且是可程式設計的,可以實現精確的定位控制。這些致動器優於氣動致動器,因此預計需求在不久的將來會增加。

- 氣動致動器需要手動設定和調節,要獲得準確的速度和位置回饋相對困難。相比之下,編碼器整合到電動致動器中,可以實現更精確的運動。

- 在利用現有半導體專業知識開發新感測器和致動器模式的支援下,小型化正在推動感測器和致動器市場的發展。

感測器和致動器市場趨勢

自動化和工業 4.0 的出現

- 感測器和致動器是工業自動化系統不可或缺的一部分,因為它們有助於實現精度和效率。使用感測器和致動器的運動控制技術的需求在工廠和工業自動化系統中發揮重要作用。

- SCADA(監控和資料採集)組件包括感測器和致動器。 SCADA 系統包括部署在現場收集即時資料的組件和相關系統,以實現資料收集和增強工業自動化。

- 伺服馬達伺服俱有馬達的功能,是實現傳統的高速、高精度工廠自動化的重要零件。

- 此外,工業機器人在工業自動化的應用也不斷進步。感測器和致動器是這些機器人的關鍵部件之一。中國、美國、日本在引進工業機器人方面走在前面。為了因應不斷成長的需求,市場上的公司也在推出機器人專用產品。

- 例如,2022年4月,科爾摩根宣布了一項新技術,可以簡化協作機器人、工業機器人、航太和國防機器人以及其他機器人的設計,同時在更輕、更緊湊的封裝中提供更好的性能,我們也宣布了新的TBM2G系列。

亞太地區預估複合年成長率最高

- 中國對工業現代化的政治推動正在創造對智慧感測器、無線感測網路、改進致動器等智慧製造產品的巨大需求。國際感測器和致動器技術供應商現在正轉向中國,以滿足中國製造業不斷成長的需求。中國工業對高階工具機、智慧感測器等技術有著龐大的需求。

- 印度正迅速加速幾種新興感測器和物聯網技術的部署。該國提供了更大規模部署這些技術並帶來規模經濟的機會。基於物聯網的先進機會和生態系統正在不斷發展。印度政府正在採取措施,透過「印度製造」、「數位印度」和「智慧城市」等創新措施來推動新興技術的採用。這些努力預計將進一步推動該國的感測器和致動器市場。

- 從長遠來看,COVID-19 的影響將使在亞太地區營運的製造商能夠採用工業 4.0 程序,變得更加敏捷並降低生產成本,如果類似事件再次發生,預計這將減少生產成本。

- 亞太地區長期以來一直是主要的製造中心,該行業繼續積極採用物聯網 (IoT)。根據 2022 年 2 月發布的微軟物聯網訊號報告,物聯網現在在行業和全球整體得到更廣泛的採用,其中智慧空間是亞太地區許多市場的重點關注點,成為主要應用之一。

感測器和致動器產業概述

全球感測器和致動器市場由多家國際公司經營,包括 TE Connectivity、德克薩斯、Honeywell國際、艾默生電氣公司和 SMC 公司。

- 2021 年 9 月,主要企業TE Connectivity 收購了工廠自動化和汽車電子連接領域的主要企業ERNI Group AG (ERNI)。收購 ERNI 補充了 TE Connectivity 廣泛的連接產品系列,專門生產用於汽車、工廠自動化和其他工業應用的高速和細間距連接器。

- 2021年8月,主要企業派克漢尼汾公司宣布收購航太和國防運動控制技術公司Meggitt PLC。 Meggitt PLC 總部位於英國考文垂,2020 年年銷售額約 23 億美元。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 自動化和工業 4.0 的出現

- 汽車產業需求增加

- 市場挑戰

- 根據產品的不同,初始設備成本和安裝/維護成本可能會增加。

第6章 市場細分

- 依產品類型

- 感應器

- 壓力感測器

- 溫度感測器

- 位置感測器

- 液位感測器

- 影像感測器

- 化學感測器

- 扭力感測器

- 致動器

- 使用電源類型

- 液壓致動器

- 氣動致動器

- 電動式致動器

- 磁致動器

- 機械致動器

- 操作類型

- 線性致動器

- 旋轉致動器

- 感應器

- 按最終用戶產業

- 車

- 衛生保健

- 石油和天然氣

- 家電

- 製造業

- 航太/國防

- 其他最終用戶產業(能源、水、用水和污水、採礦等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- TE Connectivity

- Texas Instruments Inc.

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Renesas Electronics Corporation

- Emerson Electric Co.

- SMC Corporation

- Flowserve Corporation

- Schlumberger Limited

- Parker-Hannifin Corporation

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 90887

The Global Sensors and Actuators Market is expected to register a CAGR of 8.24% during the forecast period.

Key Highlights

- The factory automation industry has been revolutionized by combining the digital and physical aspects of manufacturing, including sensors and actuators, which aim to deliver optimum performance. Further, the focus on achieving zero waste production and shorter time to market has augmented the sensors and actuators market growth.

- The rise in automation of production systems in both discrete and process industries has increased the demand for components capable of providing critical data related to the production process. These sensors facilitate process control in factories by detecting the presence and position of metal objects.

- Electric actuators, a standard option for various applications across industries, including IoT, convert energy into mechanical torque. Electric energy is considered less noisy in operation than other actuator types. Electric actuators don't require fluid to run, and they offer high-control precision positioning owing to programmability. These actuators are poised to witness increasing demand in the near future due to their advantages over pneumatic actuators.

- Manual setup and adjustment are required for pneumatic actuators, and it is relatively difficult to get precise feedback on their speed and position. In contrast, the encoder is embedded into the electric actuator enabling more precise movement.

- Miniaturization has been driving the sensors and actuators market, supported by the development of new sensor and actuator modalities by leveraging the available semiconductor expertise.

Sensors and Actuators Market Trends

Emergence of Automation and Industry 4.0

- Sensors and actuators are an integral part of the industrial automation system as they help achieve precision and efficiency. The need for motion control technologies using sensors and actuators plays a significant role in the factory and industrial automation systems.

- SCADA (supervisory control and data acquisition) components include sensors and actuators. SCADA systems include components deployed in the field to collect real-time data and related systems to allow data collection and enhance industrial automation.

- Servo motors have become an essential component for realizing factory automation where the servo motor itself functions as a sensor and the traditional high-speed and high-precision performance.

- Moreover, industrial robots have been increasingly utilized in industrial automation. Sensors and actuators are one of the key components of these robots. China, the United States, and Japan are at the forefront of industrial robots adoption. In response to the growing demand, market players also introduce robot-specific products.

- For instance, in April 2022, Kollmorgen announced a new TBM2G series of frameless servo motors having features that simplify the design of collaborative, industrial, aerospace and defense, and other robots while offering better performance in a lighter and more compact package.

Asia-Pacific is Expected to Grow with the Highest CAGR

- China's political push for industrial modernization creates a huge demand for smart manufacturing products, like smart sensors, wireless sensor networks, improved actuators, etc. International suppliers of sensors and actuator technologies are currently focusing on China to cater to growing demand from the country's manufacturing industry. China's industry has an enormous demand for high-end machine tools, smart sensors, and other technologies.

- India is fast accelerating the deployment of several emerging sensors and IoT technologies. The country provides an opportunity to deploy these technologies at a larger scale to bring economies of scale. Advanced IoT-based opportunities and ecosystems are developing consistently. The Indian Government is taking steps to push the adoption of emerging technologies with innovative initiatives, including Make in India, Digital India, Smart Cities, etc. These initiatives are expected to further boost the sensors and actuators market in the country.

- With the COVID-19 impact, in the long-term, it is expected that manufacturers operating in the Asia Pacific adopt Industry 4.0 procedures to become more agile and limit production and distribution shortfalls should an event similar to this ever happen again.

- The Asia-Pacific region has long been a major manufacturing base, and the industry continues to be a strong adopter of the Internet of Things (IoT). According to Microsoft IoT Signals Report published in February 2022, IoT is currently much more widely adopted across industry verticals, and across the world, with smart spaces, a significant focus for many markets in the Asia Pacific region, becoming one of the leading application areas.

Sensors and Actuators Industry Overview

The global sensors and actuators market is fragmented as numerous international companies, such as TE Connectivity, Texas Instruments Inc., Honeywell International Inc., Emerson Electric Company, and SMC Corporation, are operating.

- In September 2021, TE Connectivity, a leading company in connectivity and sensors, acquired ERNI Group AG (ERNI), a leading player in electronic connectivity for factory automation and automotive. The acquisition of ERNI complements TE Connectivity's wide connectivity product portfolio, specifically in high-speed and fine-pitch connectors for automotive, factory automation, and other industrial applications.

- In August 2021, Parker Hannifin Corporation, a leading market player in motion and control technologies, announced the acquisition of Meggitt PLC, a company operating in aerospace and defense motion and control technologies. In Coventry, United Kingdom, Meggitt PLC had approximately USD 2.3 billion in annual revenue in annual revenue in 2020.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Automation and Industry 4.0

- 5.1.2 Increasing Demand from Automotive Industry

- 5.2 Market Challenges

- 5.2.1 Higher Initial Equipment Cost coupled with Installation and Maintenance Costs for Some Products

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Sensors

- 6.1.1.1 Pressure Sensors

- 6.1.1.2 Temperature Sensors

- 6.1.1.3 Position Sensors

- 6.1.1.4 Level Sensors

- 6.1.1.5 Image Sensors

- 6.1.1.6 Chemical Sensors

- 6.1.1.7 Torque Sensors

- 6.1.2 Actuators

- 6.1.2.1 Type of Power Used

- 6.1.2.1.1 Hydraulic Actuators

- 6.1.2.1.2 Pneumatic Actuators

- 6.1.2.1.3 Electrical Actuators

- 6.1.2.1.4 Magnetic Actuators

- 6.1.2.1.5 Mechanical Actuators

- 6.1.2.2 Type of Motion

- 6.1.2.2.1 Linear Actuators

- 6.1.2.2.2 Rotary Actuators

- 6.1.1 Sensors

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Oil & Gas

- 6.2.4 Consumer Electronics

- 6.2.5 Manufacturing

- 6.2.6 Aerospace & Defense

- 6.2.7 Other End-user Industries (Energy, Water & Wastewater, Mining, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TE Connectivity

- 7.1.2 Texas Instruments Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 Renesas Electronics Corporation

- 7.1.6 Emerson Electric Co.

- 7.1.7 SMC Corporation

- 7.1.8 Flowserve Corporation

- 7.1.9 Schlumberger Limited

- 7.1.10 Parker-Hannifin Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219