|

市場調查報告書

商品編碼

1632049

全球消費標準邏輯IC-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Consumer Standard Logic IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

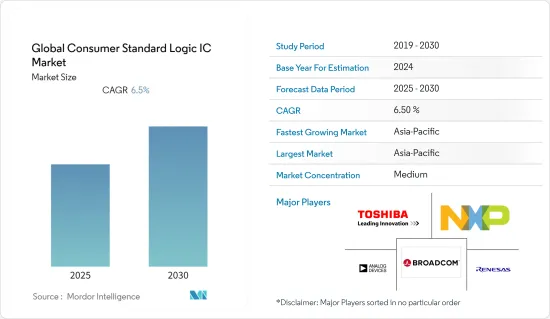

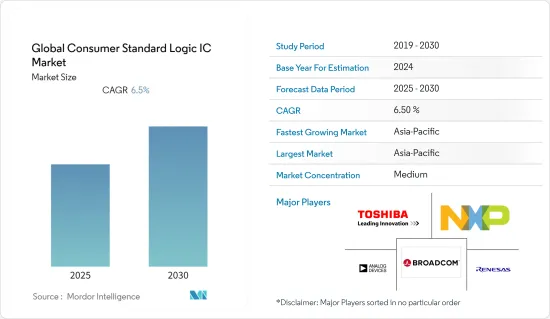

預計全球消費標準邏輯 IC 市場在預測期內複合年成長率為 6.5%

主要亮點

- 近年來,由於其應用領域的擴大,電子元件市場經歷了強勁的成長。這一成長主要是由 DVD、電視和行動電話等消費性電子產品以及電腦和印表機等辦公室自動化產品的成長所推動的。這種高成長迫使業內多家公司建立創新的製造設施並擴大產能。此外,持續的技術進步預計將擴大標準邏輯IC的應用領域,並推動未來幾年消費性標準邏輯IC市場的成長。

- CMOS 和雙極技術的進步已成為電子設計的關鍵。消費性標準邏輯裝置市場的成長得益於現代低功耗邏輯產品的先進封裝。配置和功能的基礎標準也同時成長。電子製造商不斷尋求利用雙極邏輯 IC 設計和開發的技術。標準邏輯 IC 已成為實現邏輯電路的新標準。

- 此外,標準邏輯 IC 和封裝已成為促進長生命週期產品生產並支援製造商通常面臨的高前置作業時間的重要框架。多年來,新的聯盟和合作不斷湧現,以滿足半導體公司對標準邏輯 IC 日益成長的需求。

- 隨著COVID-19冠狀病毒持續影響經濟、貿易、製造業,甚至消費者的購買習慣,半導體短缺現象顯著加劇,對市場產生負面影響。製造半導體產品的公司必須仔細規劃,以避免未來幾年即將出現的零件供應鏈陷阱。此外,《2021 會計年度國防授權法案》(NDAA) 中包含的《美國晶片法案》將確定並緩解短期半導體短缺問題,並為在美國製造獎勵設備的公司提供更多美國製造。

消費性標準邏輯 IC 的市場趨勢

家用電子電器產品需求穩定成長

- 隨著連網型設備生態系統的蓬勃發展,邏輯 IC 在智慧型手機中的應用預計將會增加。美國是該地區推動連網型設備採用並支持技術採用的領先國家之一。

- 例如,根據消費者技術協會 (CTA) 和美國人口普查局的數據,美國智慧型手機銷售額預計將從 2021 年的 730 億美元增加到 2022 年的 747 億美元。

- 由於在 COVID-19 大流行期間採用在家工作和在家上學的文化,對智慧型手機、筆記型電腦和平板電腦的需求增加,以及全球網際網路的普及,進一步推動了對先進半導體組件的需求。

- 此外,5G的出現導致全球對5G行動電話的巨大需求。例如,根據中國政府發布的最新數據,中國用戶正蜂擁購買昂貴的新型 5G行動電話。 2021年中國5G行動電話出貨量突破2.66億部,與前一年同期比較去年成長63.5%。中國資訊通訊研究院(CAICT)的資料顯示,5G佔行動電話總出貨量的75.9%。

- 因此,在預測期內,對行動電話的需求不斷成長預計將推動對標準邏輯 IC 等先進晶片的需求。

預計亞太地區在預測期內將佔據主要市場佔有率

- 預計亞太地區在預測期內將佔據很大的市場佔有率。印度、中國、日本和韓國等國家對智慧型手機的龐大需求鼓勵許多供應商在該地區設立生產設施。容易取得的原料以及較低的設置和人事費用也激勵公司在該地區建立生產。除了製造優勢外,強勁的需求和快速成長也推動行動電話企業在亞太地區設立生產設施。

- 中國智慧型手機製造商 Vivo 正在擴大在印度的業務,並計劃於 2022 年開始出口「印度製造」硬體。 Vivo計畫今年將年產能從5,000萬台增加到6,000萬台,並計畫進一步將印度產能擴大到每年1.2億台。目前,印度製造的行動電話100%滿足了該公司當地的需求。 Vivo計劃在2023年完成其7,500億盧比的製造業投資計畫中的350億盧比,以增加產能。出口相關產能的擴張必將刺激該地區各類行動電話對先進積體電路的需求。

- 此外,隨著供應鏈的轉變和宏觀經濟措施的進展,中國政府正在積極投資半導體投資、收購和確保人力資源,並透過與世界一流代工廠相媲美的本土晶片製造來擴大該產業。

- 中國繼續擴大其半導體製造供應鏈,宣布計劃在 2021 年新建 28 個晶圓廠建設計劃,總投資 260 億美元。中芯國際等中國半導體巨頭正著眼於成熟的技術節點,並加大與地方政府的合作,興建更多合資晶圓廠。由於政府的激勵措施,晶圓製造新興企業在先進製造領域蓬勃發展。

- 此外,為了實現自給自足,印度政府宣布了有利於該行業的舉措,以發展該國的半導體和顯示器製造生態系統。例如,2021年12月,聯合內閣核准了印度半導體製造生態系統7,600億印度盧比的預算,並宣布了對電子元件、子組件和成品的獎勵。在半導體與顯示製造系統綜合發展方案下,該措施將在半導體與顯示製造系統綜合發展方案下實施,包括矽半導體工廠、顯示實驗室、化合物半導體/矽光電/感測器工廠、半導體封裝Mohali (SCL)的半導體設計和半導體實驗室支持現代化和商業化。

消費標準邏輯 IC 產業概覽

消費性標準邏輯 IC 市場競爭激烈,有多個參與企業。市場參與企業正在採取各種策略,例如產品創新、併購和收購。此外,隨著 IC 製造流程的進步增強了應用,新的市場參與企業正在擴大其市場佔有率並擴大企業發展在新興經濟體的足跡。我們將介紹市場的一些最新趨勢。

- 2022年4月,日本國立材料科學研究所(NIMS)和東京理科大學宣布,透過調整雙閘的輸入電壓,可以執行五種邏輯閘操作(AND、NAND、OR、NOR、XOR)之一我們開發了一種有機POLA電晶體,可以執行。這種具有多種邏輯閘功能的輕量級電晶體可用於開發電氣可重構邏輯電路,並且可能是開發高性能行動裝置的關鍵。

- 2021 年 10 月,瑞薩電子公司宣布正在開發一款新型微控制器 (MCU),預計將支援藍牙 5.3 低功耗 (LE) 規格。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 透過物聯網數位化促進電子產業的發展

- 市場限制因素

- 與設計標準消費邏輯 IC 相關的複雜性

第6章 市場細分

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Renesas Electronics Corporation

- Toshiba Electronic Devices & Storage Corporation

- Analog Devices Inc.

- Broadcom Inc.

- NXP Semiconductors NV

- ROHM Semiconductor

- MediaTek Inc.

第8章投資分析

第9章 市場機會及未來趨勢

第10章 關於出版商

The Global Consumer Standard Logic IC Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- The electronic component market has encountered robust growth in the past few years owing to its expanding application areas. This growth is significantly contributed by the increase in consumer electronics products such as DVDs, TV, mobile phones, etc., and office automation products such as computers, printers, etc. This high growth has forced several companies in this industry to set up novel manufacturing facilities and expand their production capacity. Furthermore, continuous technological advancements are expected to boost the application areas of standard logic ICs, thus driving the growth of the consumer standard logic ICs market in the coming years.

- Advances made in CMOS and bipolar technologies have become an essential part of electronic designs. The growth of the consumer standard logic devices market has arisen from the advancements made in the packaging of modern, low-power logic products. The standards underlying configuration and functionality have grown simultaneously. The electronics manufacturers constantly seek to leverage the underlying technologies for designing and developing bipolar logic ICs. Standard logic ICs have emerged as a new staple for enforcing logic circuits.

- Further, standard logic ICs and packaging have become an essential framework for promoting the manufacturing of extended lifecycle products and generally supporting high lead times faced by manufacturers. Over the years, new partnerships and collaborations have cropped up to meet the rise in the need for standard logic ICs among semiconductor companies.

- COVID-19 has a negative market impact due to a significant increase in semiconductor shortages, as the COVID-19 coronavirus continues to impact economies, trade, manufacturing, and even consumer purchasing habits. Companies that manufacture semiconductor products must plan carefully to avoid impending component supply chain pitfalls in the coming years. Additionally, The CHIPS for America Act, included in the Fiscal Year 2021 National Defense Authorization Act (NDAA), seeks to identify and alleviate short-term semiconductor shortages and encourage more US manufacturing incentives for companies to manufacture these devices in the United States.

Consumer Standard Logic IC Market Trends

Steady Increase in Demand for Consumer Electronics

- With the ecosystem of connected devices flourishing, the application of logic ICs in smartphones is projected to boost the adoption rate. The United States is one of the major countries in the region, driving the adoption of connected devices and supporting the adoption of the technology.

- For instance, according to the Consumer Technology Association (CTA) and the US Census Bureau, the sales value of smartphones sold in the United States is forecasted to increase from USD 73 billion in 2021 to USD 74.7 billion in 2022.

- The increasing demand for smartphones, laptops, and tablets, and internet penetration across the world owing to the adoption of work-from-home and learn-from-home culture during the COVID-19 pandemic has further led to demand for advanced semiconductor components.

- Further, the advent of 5G has led to significant demand for 5G-enabled mobile phones worldwide. For instance, according to the most recent figures given by the Chinese government, Chinese subscribers are flocking to buy pricey new 5G cellphones. China's 5G phone shipments surpassed 266 million units in 2021, an increase of 63.5 % over the previous year. 5G accounted for 75.9% of total mobile phone shipments, according to data from the China Academy of Information and Communications Technology (CAICT).

- Thus, the growing demand for mobile phones is anticipated to drive the demand for advanced chips such as standard logic ICs during the forecast period.

Asia-Pacific is Expected to Register a Significant Market Share During the Forecast Period

- Asia-Pacific is anticipated to hold a substantial market share during the forecast period. Significant demand for smartphones from countries such as India, China, Japan, and South Korea, are encouraging many vendors to set up production facilities in the region. The availability of raw materials along with low establishment and labor costs have also motivated companies to establish their production centers in the region. Along with manufacturing benefits, the strong demand and rapid growth are also influencing mobile phone companies to set up their production facilities in the Asia-Pacific region.

- Vivo, a Chinese smartphone manufacturer, is expanding its base in India and plans to start exporting 'Made-in-India' hardware in 2022. Vivo plans to boost yearly production capacity from 50 million devices to 60 million units this year, with the goal of scaling the manufacturing capacity further to 120 million units annually in India. Currently, cellphones made in India are meeting 100 % of the company's local demand. Vivo intends to complete Rs 3,500 crore of the Rs 7,500 crore manufacturing investment plan by 2023 in order to grow up its production capabilities. This increase in production capacity for export-related purposes will certainly drive the demand for all types of advanced ICs for mobile phones in the region.

- Moreover, during shifting supply chains and macroeconomic policy, the government of China is spending aggressively on semiconductor investment, acquisition, and talent recruitment to uplift the industry by on-shoring chip manufacturing equal to those of the top global foundries.

- With 28 additional fab construction projects totaling USD 26 billion in new planned funding announced in 2021, China continues to expand its semiconductor manufacturing supply chain. SMIC and other Chinese semiconductor giants have increased their collaborations with local governments to build more joint venture fabs, focusing on mature technology nodes. Wafer manufacturing startups are flourishing in the cutting-edge fabrication area, thanks to government incentives.

- Furthermore, in order to achieve self-sufficiency, India's government has announced industry-friendly initiatives for the development of the country's semiconductor and display manufacturing ecosystem. For instance, in December 2021, the Union Cabinet approved an INR 76,000 crore budget for India's semiconductor manufacturing ecosystem, with incentives announced for electronic components, sub-assemblies, and finished items. The policy will support silicon semiconductor fabs, display labs, compound semiconductors/ silicon photonics/ sensors fabs, semiconductor packaging, semiconductor design, and modernization and commercialization of the Semiconductor Laboratory (SCL) at Mohali under the scheme for holistic development of the semiconductor and display manufacturing system.

Consumer Standard Logic IC Industry Overview

The consumer standard logic IC market is highly competitive and consists of several players. The market players adopt various strategies such as product innovation, mergers, and acquisitions. In addition, with the advancement in the IC manufacturing process, which provides enhanced applications, new market players are expanding their market presence and increasing their business footprint across the emerging economies. Some of the recent developments in the market are:

- In April 2022, the National Institute for Materials Science (NIMS) and the Tokyo University of Science developed an organic anti-ambipolar transistor that can perform any one of the five logic gate operations (AND, NAND, OR, NOR, or XOR) by adjusting the input voltages to its dual gates. This lightweight transistor with multiple logic gate capabilities can be utilized to develop electrically reconfigurable logic circuits that are possibly key to the development of high-performance mobile devices.

- In October 2021, Renesas Electronics Corporation announced that it is developing novel microcontrollers (MCUs) that are expected to support the Bluetooth 5.3 Low Energy (LE) Specification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute

- 4.2.5 Intensity Of Competition Rivarly

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Electronics Industry Drive by IoT Digitalization

- 5.2 Market Restraints

- 5.2.1 Complexity Associated with the Design of Consumer Standard Logic IC

6 MARKET SEGMENTATION

- 6.1 Geography

- 6.1.1 North America

- 6.1.2 Europe

- 6.1.3 Asia-Pacific

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Renesas Electronics Corporation

- 7.1.2 Toshiba Electronic Devices & Storage Corporation

- 7.1.3 Analog Devices Inc.

- 7.1.4 Broadcom Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 ROHM Semiconductor

- 7.1.7 MediaTek Inc.