|

市場調查報告書

商品編碼

1632057

洩漏檢測解決方案:全球市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Leak Detection Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

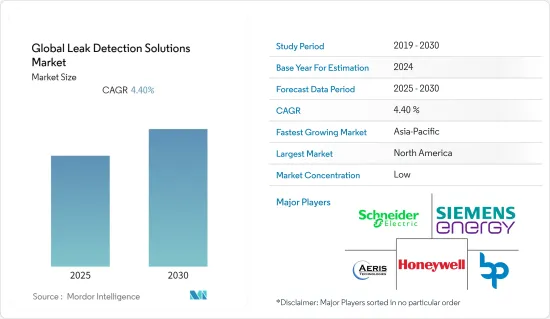

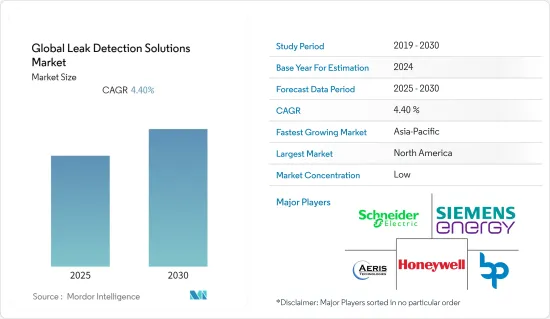

全球洩漏檢測解決方案市場預計在預測期內複合年成長率為 4.4%。

由於安全性提高、成本降低和環境保護等優點,世界各地的公共產業公司對洩漏檢測解決方案的需求不斷成長,推動了市場的成長。洩漏偵測解決方案還可以降低爆炸和火災的風險,幫助石油和天然氣產業提高職場的安全性。預計全球天然氣和石油基礎設施的不斷進步也將推動市場成長。

例如,2022 年 3 月,South West Water 與基於衛星的洩漏偵測公司 ASTERRA 合作,提供衛星資料分析,以找出地下水洩漏並降低整個網路的洩漏程度。此方法類似於在火星等其他行星上尋找水的方法,其工作原理是用太空衛星上的微波感測器拍攝地球。這些資料揭示了地面上看不見的潛在漏水。

為了及早發現洩漏,使用人工智慧改進了技術,專有的高光譜遙測氣體分析可以清楚地了解氣體噴射物的類型、位置、方向、大小以及油氣濃度。商。這樣可以在洩漏成為更嚴重的排放或安全問題之前做出更快、更有效的回應。

近年來,石油和天然氣行業對洩漏檢測系統的需求不斷成長,但一些洩漏檢測系統存在改造問題,例如基於光纖的分散式溫度感測 (DTS) 和分散式聲學感測 (DAS) 系統。市場的成長。將光纖洩漏檢測設備安裝到現有管道中既困難又昂貴。長管道(超過 50 公里)需要許多詢問器單元,增加了感測器和詢問器系統的安裝成本。

COVID-19 大流行凸顯了加速向自動化和遠端測試流程轉變的必要性。價格波動對全球石油和天然氣產業產生了重大影響。它影響了主要石油和燃氣公司的財務狀況,並抑制了未來的計劃。例如,2020年4月,由於疫情導致阿根廷經濟狀況惡化,阿根廷能源部暫停了瓦卡穆爾塔-布宜諾斯艾利斯天然氣管道開發競標計劃。

洩漏檢測解決方案市場趨勢

石油和天然氣可望推動市場成長

許多氣體排放監測公司正在利用機器學習和人工智慧 (AI) 來更有效地識別其基礎設施中的洩漏。機器學習演算法透過衛星影像檢測地面的氣體洩漏和排放風險。機器學習資料使操作員能夠隨著時間的推移識別趨勢和模式,從而實現資料主導的選擇。因此,許多石油和天然氣公司正在尋求以技術先進的替代方案來取代傳統的洩漏檢測解決方案。各種創業投資公司正在投資提供基於人工智慧的漏水檢測和監控系統的新興企業,開闢了新的市場前景。

例如,2021年11月,專注於投資能源服務公司的創業投資公司SCF Ventures宣布投資Cube Technologies。石油和天然氣業者可以依靠 Qube Technologies 提供連續排放和洩漏監測設備,以便更好地識別、減少和量化甲烷排放。這筆資金將支持 Qube Technologies 實施連續監測系統,幫助石油和天然氣產業進一步減少排放。

國際能源總署 (IEA) 表示,減少碳氫化合物作業中的甲烷等氣體排放是幫助實現世界氣候和環境目標的最具成本效益和影響力的方法之一。洩漏檢測解決方案採用多種技術,包括超音波、壓力分析、熱成像、光纖、雷射吸收、LiDAR、蒸氣檢測和 E-RTTM。

能源公司正在製定有效管理甲烷排放的目標,以應對全球氣候變遷。例如,2021年4月,Honeywell在歐洲推出了氣體雲成像(GCI)系統,該系統可自動連續識別歐洲各地石油和天然氣、化學和發電設施中甲烷等有害污染氣體的洩漏情況。監控。

2021 年 11 月,Teledyne FLIR 推出了 Si124超音波洩漏偵測相機。檢測空氣洩漏和識別高壓系統的局部放電是聲學成像的兩個最常見的應用。 Si124-LD 專門用於壓縮空氣洩漏檢測。 FLIR Systems 的 Si124-LD 透過 124 個內建麥克風進行聲學成像,檢測洩漏和局部放電的速度比標準方法快 10 倍。

北美地區預計成長最快

北美是成長最快的洩漏檢測解決方案市場。由於石油天然氣產業工業化進程的快速推進,洩漏檢測解決方案市場需求旺盛,霍尼韋爾、施耐德電氣等主要企業也在洩漏檢測解決方案方面推出新產品。

北美地區的主要企業提供各種用於檢測石油、天然氣和化學品外洩的產品。例如,2021年10月,Honeywell即使在霧、雨、雪和其他惡劣天氣條件下也能持續監測有害氣體,以確保石油和天然氣石化、化工等工人和工業場所的安全,我們已宣布發布兩項規定。

嚴格的政府法律和規範促進了該地區的進步。對於危險液體管道,美國運輸部部管線和危險物質安全管理局要求安裝洩漏檢測系統。美國政府對石油和天然氣產業的支持也支持了該國的工業發展。隨著美國石油和天然氣產業的擴張,對洩漏檢測解決方案的需求也隨之增加。此外,政府對石油和天然氣的補貼也推動了區域市場的擴張。

據國際能源總署(IEA)稱,2020與前一年同期比較液化天然氣合約活動年減近30%,但活動可能在2021年反彈。最終投資決策 (FID) 也較 2019 年的歷史高點有所下降,其中一個北美計劃於 2020 年獲得批准,卡達的一項重大擴張計劃於 2021 年初敲定。除了 2020 年實施的 FID 浪潮之外,這些新投資應該足以滿足未來幾年額外的液化天然氣需求。

近年來,世界各地不斷發現油氣蘊藏量,並啟動了多個油氣探勘計劃,以滿足世界油氣需求。因此,監測石油和天然氣設施的需求增加,從而導致對洩漏檢測系統的需求。例如,2022年2月,BPPlc宣布啟動墨西哥灣赫歇爾擴建計劃。 Herschel 是 2022 年在全球實施的四個重大計劃中的第一個。計劃的第一階段是開發新的海底生產系統。第一口井預計在高峰時將使該平台的年總產量增加10,600桶油當量/日。

洩漏檢測解決方案產業概述

洩漏檢測解決方案市場高度分散。工業化的快速發展增加了石油、天然氣和化學工業的數量。因此,洩漏偵測解決方案市場的需求增加,並且有多家公司從事該領域的業務。領先的公司現在專注於夥伴關係關係,以提供高效和永續的服務。

2021 年 11 月 -Schneider Electric和 Prisma Photonics 宣佈建立夥伴關係,透過提供石油和天然氣基礎設施的即時情報和準確監控來防止事故和惡意活動,從而為石油和天然氣管道所有者和營運商提供服務。因此,客戶可以透過避免能源和資源損失來提高效率和永續性。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 石油和天然氣管道基礎設施的增加和防漏需求的增加

- 政府措施防止甲烷外洩檢測

- 市場限制因素

- 危險環境條件下洩漏檢測的相關挑戰

第6章 市場細分

- 依技術

- 聲波/超音波

- 壓力分析

- 熱成像

- 光纖

- 雷射吸收和LiDAR

- 蒸氣感

- E-RTTM

- 其他技術

- 按最終用戶產業

- 石油和天然氣

- 化學

- 水處理

- 發電

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Honeywell International Inc

- Aeris Technologies, Inc.

- Bridger Photonics

- Schneider Electric SE

- Siemens Gas and Power GmbH & Co. KG

- Xylem.Inc

- Krohne Messtechnik GmbH

- PSI Software AG

- Teledyne FLIR LLC

- Clampon AS

- PermAlert

- OptaSense Ltd

- Physical Sciences Inc.

- Veeder-Root Company.

第8章投資分析

第9章 未來趨勢

The Global Leak Detection Solutions Market is expected to register a CAGR of 4.4% during the forecast period.

The market's growth can be attributable to an increase in demand for leak detection solutions among utility companies worldwide, owing to its advantages, including increased safety, cost savings, and environmental protection. Leak detection solutions also assist oil and gas industries make the workplaces safer by reducing the hazards of explosions and fire breakouts. Market growth is also predicted to be fueled by increased advances in natural gas and oil infrastructure worldwide.

For Instance, In March 2022, South West Water partnered with ASTERRA Satellite-based leak detection company to provide satellite data analysis to locate subterranean water breaches and cut leakage levels across its network. The method is similar to that used to search for water on other planets, such as Mars, and works by taking images of the globe with microwave sensors onboard a satellite in space, and microwaves can penetrate up to 2 meters deep. The data will reveal possible leaks that are not visible above ground.

For early leak detection, the technology has increased by using artificial intelligence, and proprietary hyperspectral gas analytics provide facility operators with an easy-to-understand, color depiction of the gas plume type, position, direction, size, and concentration of oil or gas. It enables a quicker and more effective reaction before leaks become more serious emissions or safety concerns.

Though the demand for leak detection systems in the oil and gas sector has grown in recent years, retrofitting issues in some leak detection systems, such as distributed temperature sensing (DTS) and distributed acoustic sensing (DAS) systems based on fiber optic, are limiting the market's growth. Fiber-optic leak detection devices are difficult and expensive to adapt to existing pipelines. Longer pipelines (more than 50km) need many interrogator units, which raises sensor and interrogator system installation costs.

COVID-19 pandemic highlighted the need for accelerating the shift towards automation and remote inspection processes. A changing price dynamics have affected the global oil and gas industry significantly. It has affected key oil & gas players' financial positions and obstructed upcoming projects. For example, in April 2020, the Energy Ministry of Argentina suspended auctioning projects to develop the Vaca Muerta-Buenos Aires natural gas pipeline due to the country's aggrevating economic scenario resulting from the pandemic.

Leak Detection Solutions Market Trends

Oil & Gas is Expected to Drive the Market Growth

Many gas emission monitoring firms utilize machine learning and Artificial Intelligence (AI) to identify leaks in infrastructure more efficiently. A machine learning algorithm detects leaks and emission risks on the ground through satellite pictures. Machine learning data enables operators to recognize trends and patterns across time, allowing them to make data-driven choices. As a result, many oil and gas firms are attempting to replace the old leak detection solutions with technologically advanced ones. Various venture capital firms are investing in startups that provide AI-based leak detection and monitoring systems, opening new market prospects.

For Instance, In November 2021, SCF Ventures, a venture capital firm focusing on investing in energy services firms, announced its investment in Qube Technologies provides customers with internet-of-things ("IoT") devices to continuously monitor a host of gases, including methane, carbon dioxide, and hydrogen sulfide. Oil and gas operators can use Qube Technologies to provide continuous emission and leak monitoring equipment to better identify, decrease, and quantify methane emissions. The funding will aid Qube Technologies implementation of continuous monitoring systems, allowing the industry to reduce emissions even further.

According to the International Energy Agency, reducing gas emissions such as methane from hydrocarbon operations is one of the most cost-effective and impactful methods to help reach global climate and environmental goals. Various technologies are used for leak detection solutions, such as ultrasonic, pressure analysis, thermal Imaging, fiber optic, Laser absorption, LiDAR, vapor sensing, E- RTTM, etc.

Energy companies are establishing goals to manage methane emissions effectively to help address global climate change. For instance, in April 2021, Honeywell launched its gas cloud imaging (GCI) system in Europe to provide automated and continuous monitoring for leaks of hazardous and polluting gases such as methane at oil and gas, chemical industries, and power generation facilities across the continent.

In November 2021, Teledyne FLIR launched Si124, an ultrasonic leak detection camera. Air leak detection and identifying partial discharge from high-voltage systems are two of the most common applications for acoustic imaging. The Si124-LD is specific for compressed air leak detection. The FLIR Si124 can detect leaks and partial discharge up to 10 times quicker than standard methods using sound imaging from 124 built-in microphones.

North America is Expected to Register the Fastest Growth

North America is the fastest-growing leak detection solutions market. Due to rapid industrialization growth in the oil and gas industries, the use of leak detection solutions market has a high demand, and key players in North America, such as Honeywell International Inc, and Schneider Electric S.E., are also launching new products in Leak detection solution.

The key players in the North American region are launching different products to detect oil, gas, and chemical leaks. For instance, In October 2021, Honeywell announced the release of two Bluetooth-connected gas detectors that can continuously monitor dangerous gases even in fog, rain, snow, and other inclement weather and provide facilities to keep the oil and gas petrochemicals, chemicals, and other workers and industrial sites safe.

Strict government laws and norms can be credited to the region's progress. On hazardous liquid pipelines, the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration mandates the installation of a leak detection system. The United States government's backing for the oil and gas industry also propels the country's industrial development. As the oil and gas sector expands in the United States, the demand for leak detection solution increases. Furthermore, government subsidies to the oil and gas fuel regional market expansion.

According to International Energy Agency(IEA), LNG contracting activity shrank by almost 30% year-on-year (y-o-y) in 2020, while activity during 2021 has potential for recovery. Final investment decisions (FIDs) were also down from 2019 record high, with one North American project sanctioned in 2020, plus Qatar's major expansion plan confirmed in early 2021. These new investments, added to the wave of FIDs taken before 2020, should therefore prove sufficient to satisfy additional LNG demand in the coming years. which is a driving factor for the market players in North America.

With the discovery of several oil and gas reserves worldwide in recent years, several oil and gas exploration projects were initiated to fulfill the global demand for oil and gas. It has led to the increased requirement for monitoring oil and gas facilities, leading to the demand for leak detection systems. For Instance, In February 2022, B.P. Plc announced the startup of the Herschel Expansion project in the Gulf of Mexico. Herschel is the first of four major projects to be delivered globally in 2022. Phase 1 of the project comprises developing a new subsea production system. The first well is expected to increase platform annual gross production by an estimated 10,600 barrels of oil equivalent daily at its peak.

Leak Detection Solutions Industry Overview

The leak detection solutions market is highly fragmented. The rapid growth of industrialization increased the number of oil, gas, and chemical industries. Due to this, the demand for leak detection solutions market increased, With several companies operating in the segment. Leading players are currently focusing on Partnerships to provide efficient and sustainable services.

November 2021 - Schneider Electric and Prisma Photonics announced a partnership to provide services to oil and gas pipeline owners and operators to prevent accidental and malicious activity by providing real-time intelligence and precise monitoring of oil and gas infrastructure. As a result, customers can drive efficiency and sustainability through energy and resource loss avoidance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Oil and Gas Pipeline Infrastructure & Need To Prevent Leakage

- 5.1.2 Rising Government Initiatives to Prevent Methane Leak Detection

- 5.2 Market Restraints

- 5.2.1 Challenges Involved in Leak Detection in Hazardious Environmental Conditions

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Acoustic/ Ultrasonic

- 6.1.2 Pressure Analysis

- 6.1.3 Thermal Imaging

- 6.1.4 Fiber Optic

- 6.1.5 Laser Absorption and LiDAR

- 6.1.6 Vapor Sensing

- 6.1.7 E-RTTM

- 6.1.8 Other Technologies

- 6.2 By End-User Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical

- 6.2.3 Water treatment

- 6.2.4 Power Generation

- 6.2.5 Other End-Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc

- 7.1.2 Aeris Technologies, Inc.

- 7.1.3 Bridger Photonics

- 7.1.4 Schneider Electric S.E

- 7.1.5 Siemens Gas and Power GmbH & Co. KG

- 7.1.6 Xylem.Inc

- 7.1.7 Krohne Messtechnik GmbH

- 7.1.8 PSI Software AG

- 7.1.9 Teledyne FLIR LLC

- 7.1.10 Clampon AS

- 7.1.11 PermAlert

- 7.1.12 OptaSense Ltd

- 7.1.13 Physical Sciences Inc.

- 7.1.14 Veeder-Root Company.