|

市場調查報告書

商品編碼

1632059

全球齊納二極體 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Zener Diode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

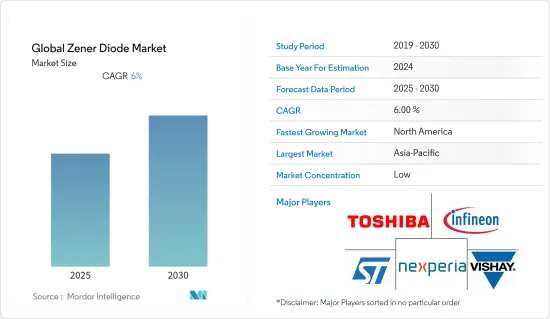

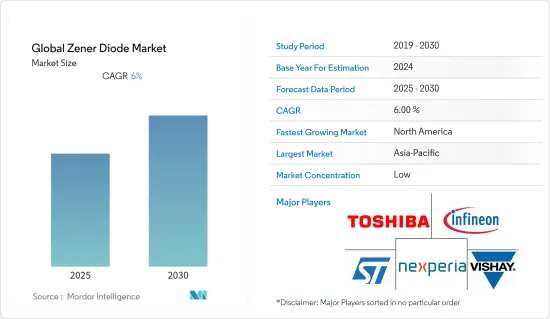

齊納二極體的全球市場預計在預測期內複合年成長率為 6%

主要亮點

- 電視、行動裝置和電動車等電子設備的日益普及正在推動齊納二極體市場的發展。齊納二極體用於穩壓器、參考元件、突波抑制器、開關應用、限幅電路等。政府在現代化配電和發電基礎設施方面採取的各種措施預計將推動市場向前發展。

- 工業設備中的安全、自動化、固態照明、運輸和能源管理也預計將推動齊納二極體市場的成長。

- 根據國際能源總署(IEA)的數據,2021年全球電動車銷量達660萬輛。電動車佔全球汽車銷量的 9%。齊納二極體用於驅動電動車電池管理系統中的冷卻風扇。電動車使用的增加將推動齊納二極體市場的發展。

- COVID-19 也影響主要電子品牌的全球供應鏈。中國是齊納二極體、電容器、二極體、整流器和放大器等電子輸入電源的最大生產國和出口國之一。由於中國持續停產,美國和歐洲多家電子公司被迫停止生產行動電話適配器等電子成品,導致電子產品出現供需缺口。

- 由於生產和供應鏈暫時停止,COVID-19 對齊納二極體市場產生了暫時的影響。隨著情況逐漸好轉,齊納二極體的生產、供應鏈和需求預計將會改善。

齊納二極體市場趨勢

汽車領域預計將推動市場成長

- 齊納二極體市場受到汽車行業不斷進步的技術進步的影響。所有汽車電氣模組均包含防止反極性連接的電路,以避免可能發生的災難。

- 隨著電動和混合動力汽車的普及,汽車已成為齊納二極體製造業不斷成長的領域之一。預計將佔據較大佔有率。自動駕駛技術、再生煞車以及各種感測器整合等創新正在推動對齊納二極體的需求。要求 ADAS(高級駕駛輔助系統)的政府法規進一步推動了這一領域的成長。汽車行業的電子元件對於安全至關重要,並且暴露在高電壓和惡劣條件下。因此,製造商開發了新的汽車齊納二極體產品線。

- 電動車市場競爭激烈,新廠商不斷挑戰創新極限。例如,保時捷使用 800V 系統製造 Taycan,但許多現代電動車使用 400V 電池。因此,現有的汽車零件製造商正在為汽車市場開發齊納二極體。

- 由於齊納二極體直接安裝在 PCB 上,因此表面黏著技術安裝齊納二極體的使用正在增加。此外,齊納二極體需求的增加是由於電訊業應用的增加、半導體生產基地數量的增加以及設備的小型化。

- 此外,隨著時間的推移,電子車輛系統的數量顯著增加。這需要在電池管理、安全系統和照明等應用中提供保護,以限制干擾和潛在故障,而齊納二極體可以避免這種情況。因此,齊納二極體在該業務中的使用量顯著增加。

北美地區預計將錄得最快成長

- 北美是齊納二極體最重要的市場之一。此外,市場領先供應商的強大存在預計將推動北美市場的成長。例如,ON Semiconductor Corporation、Diodes Incorporated 和 D3 Semiconductor LLC 是該地區的一些主要供應商。

- 半導體工業和齊納二極體製造嚴重依賴美國的生產、設計和研究。該地區的重要性將推動電子產品的出口需求,並促進最終用戶市場的成長,該市場在家用電子電器和汽車中使用大量齊納二極體。

- 根據國際貿易協會(ITA)統計,超過82%的半導體直接從美國出口,並由美國子公司銷往海外,而美國本土的研發、智慧財產權(IP)創造、設計等考慮高附加價值的業務。根據世界半導體貿易統計(WSTS)的數據,美國約佔整體半導體市場的22%,但在離散半導體市場的比重超過10%。

- 根據世界半導體貿易統計,2021年,包括齊納二極體在內的全球半導體產業銷售額為5,560億美元,較2020年成長26.2%。感測器和離散半導體(包括齊納二極體)成長了 28%,其次是記憶體,成長了 30.9%,邏輯元件成長了 30.8%。模擬成長率為33.1%。

- 由於新冠肺炎 (COVID-19) 大流行,工廠關閉和生產設備運作,訂單可能會減少,可能導致銷售延遲。對蘋果、高通和博通有大量銷售的齊納二極體製造商可能會在短期內受到影響。總體而言,德州儀器 (TI) 等強大的電子和齊納二極體製造公司正在推動該地區的齊納二極體製造業,最終用戶遍及消費電子和汽車零件等眾多領域。需求是由全部區域的消費者需求所驅動的。

齊納二極體產業概況

全球齊納二極體市場高度分散,有許多齊納二極體製造商提供產品。這些公司不斷投資於產品和技術,以促進永續的環境成長並防止環境危害。大公司也收購其他專門生產這些產品的公司,以增加其市場佔有率。

- 2022 年 1 月 - Nexperia 推出多種低電流穩壓二極體。 50μA 齊納二極體採用三種類型的表面黏著技術(SMD) 封裝、超小型分立扁平無引線 (DFN) 封裝和符合 AEC-Q101 要求的組件,為消費者提供更多選擇和靈活性。這些二極體非常適合低偏壓、可攜式、電池供電設備,具有低測試電流 (50μA),可用於移動、穿戴式、汽車和工業應用。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 汽車和電子領域對高節能設備的需求不斷成長

- 綠色能源發電需求拉動市場

- 市場限制因素

- COVID-19 大流行導致供應鏈中斷

第6章 市場細分

- 按類型

- 表面黏著技術

- 通孔技術

- 按最終用戶產業

- 通訊

- 消費性電子產品

- 車

- 電腦及電腦周邊設備

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- NXP Semiconductors

- Nexperia

- Vishay Intertechnology, Inc.

- Toshiba Corporation

- STMicroelectronics

- SHINDENGEN ELECTRIC MANUFACTURING CO., LTD.

- Diodes incorporated

- Infineon Technologies AG

- Toshiba Corporation

- ROHM CO., LTD.

- Semiconductor Components Industries, LLC(ON Semicondusctors)

- Texas Instruments Incorporated

- Vicor Corporation

第8章投資分析

第9章 未來趨勢

簡介目錄

Product Code: 90971

The Global Zener Diode Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- The growing use of electronic devices such as television, mobile devices, electric vehicles, etc., boosts Zener diode market development. Zener diodes are used in voltage regulators, reference elements, surge suppressors, switching applications, and clipper circuits. The adoption of different government efforts on modern power distribution and generating infrastructure are projected to drive the market forward.

- Security, automation, solid-state lighting, transportation, and energy management in industrial equipment are also predicted to fuel the growth of the Zener diode market.

- According to the International Energy Agency (IEA), worldwide sales of electric automobiles had reached 6.6 million in 2021. Electric vehicles accounted for 9% of all vehicle sales worldwide. Zener diodes are used in the cooling fan drive of the Electric Vehicle battery management system. The increase in the use of Electric Vehicles boosts the Zener diode Market.

- COVID-19 has also impacted the global supply chain of major electronic brands. China is one of the largest producers and exporters of electronics input supplies such as Zener diodes, capacitors, diodes, rectifiers, amplifiers, etc. Due to the continuous production standstill in China, several electronic companies in the United States and Europe have been compelled to halt manufacturing of finished electronic items like mobile phone adaptors, resulting in a demand-supply gap in electronic products.

- COVID-19 temporarily impacted the Zener diode market because the production and supply chain was stopped temporarily. Production, supply chains, and demand for Zener diodes are expected to improve as the situation improves progressively.

Zener Diode Market Trends

The Automotive Segment is Expected to Drive the Market Growth

- The automobile industry's rising technical improvements influence the Zener diode market. All automobile electrical modules include circuitry to prevent reverse-polarity connections to avoid possible mishaps.

- With the increased adoption of electric and hybrid vehicles, automotive is one of the rising segments of the Zener diode manufacturing industry. It is expected to have a significant share. Innovations like autonomous car technology, regenerative braking, and the integration of various sensors have raised the demand for Zener diodes. Government rules requiring advanced driver assistance systems (ADAS) have further supported this segment's growth. Electronic components in the automobile sector are vital for safety and are exposed to high voltages and extreme Conditions. As a result, manufacturers have developed a new line of automotive Zener diodes.

- The electric vehicle market is very competitive, and new manufacturers are constantly pushing the boundaries of innovation. Porsche, for instance, built its Taycan with an 800V system, although many modern electric vehicles use 400V batteries. As a result, established automotive component makers are developing Zener diode offerings for the automobile market.

- The use of Zener diodes has increased due to the surface-mounted Zener diodes as they are directly installed on a PCB. Furthermore, the increased demand for Zener diodes is due to their rising uses in the telecom industry, increasing the number of semiconductor production hubs and device miniaturization.

- In addition, the number of electronic car systems has increased significantly over time. Thus, in applications such as battery management, safety systems, lighting, and others, the need for protection to limit interference and potential failures emerges, which may be avoided with zener diodes. As a result, the use of zener diodes in this business has increased significantly.

North America Region is Expected to Register the Fastest Growth

- North America is one of the most important markets for Zener diode because of the region's automotive component and other sectors. Further, the strong presence of leading market vendors is expected to boost the market growth in North America. For instance, ON Semiconductor Corporation, Diodes Incorporated, and D3 Semiconductor LLC are some of the leading market vendors in this region.

- The semiconductor industry and Zener diode manufacturing rely heavily on the United States for production, design, and research. The region's significance fuels demand electronic equipment exports and increase the growth of end-user sectors that utilize large amounts of Zener Diode in consumer electronics and automobiles.

- According to International Trade Association(ITA), over 82% of semiconductors consist of direct US exports and sales by US-owned subsidiaries overseas and take into account US-based R&D, creation of intellectual property(IP), design, and other high-value-added work. While the region occupies a share of around 22% in the overall semiconductor market, it has over 10% share in the discrete semiconductor market, according to World Semiconductor Trade Statistics (WSTS) organization.

- According to World Semiconductor Trade Statistics, in 2021, sales of the global semiconductor industry, including zener diodes, were 556 USD billion, an increase of 26.2% from 2020. The Sensors and Discrete Semiconductors, including zener diodes, have a 28% increase, followed by Memory 30.9% and Logic 30.8%. The Analog category accounted for a 33.1% growth rate.

- Due to the Covid-19 pandemic, plant closures or underutilization of production facilities may result in order reductions and, as a result, delays in sales. Zener diode manufacturing companies with significant sales exposure to Apple, Qualcomm Inc., and Broadcom Inc. might be impacted in the short run. Overall, powerful electronics and Zener diode manufacturing firms like Texas Instruments drive the Zener diode manufacturing industry in the area, with end consumers from numerous sectors such as consumer electronics and automotive parts. Demand is fueled by consumer demand throughout the region.

Zener Diode Industry Overview

The global Zener diode market is highly fragmented, with numerous Zener diode manufacturers providing the products. The companies continuously invest in the product and technology to promote sustainable environmental growth and prevent environmental hazards. The major companies are also acquiring other companies that specifically deal with these products to boost their market share.

- January 2022 - Nexperia has announced a wide range of low-current voltage regulator diodes. The 50 µA Zener diode comes in three distinct surface-mountable (SMD) package variants, ultra-small Discretes Flat No-leads (DFN) packaging, and AEC-Q101 approved components consumers the more options and flexibility. These diodes are ideal for low-bias and portable battery-powered devices, specified at a low test current (50 μA), and used in mobile, wearable, automotive, and industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics

- 5.1.2 Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Supply Chain Disturbances Due to Covid-19 Pandemic

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Surface Mount Technology

- 6.1.2 Through Hole Technology

- 6.2 By End-user Industry

- 6.2.1 Communications

- 6.2.2 Consumer Electronics

- 6.2.3 Automotives

- 6.2.4 Computer and Computer Peripherals

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductors

- 7.1.2 Nexperia

- 7.1.3 Vishay Intertechnology, Inc.

- 7.1.4 Toshiba Corporation

- 7.1.5 STMicroelectronics

- 7.1.6 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD.

- 7.1.7 Diodes incorporated

- 7.1.8 Infineon Technologies AG

- 7.1.9 Toshiba Corporation

- 7.1.10 ROHM CO., LTD.

- 7.1.11 Semiconductor Components Industries, LLC (ON Semicondusctors)

- 7.1.12 Texas Instruments Incorporated.

- 7.1.13 Vicor Corporation

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219