|

市場調查報告書

商品編碼

1632063

移動式液壓幫浦:全球市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Mobile Hydraulic Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

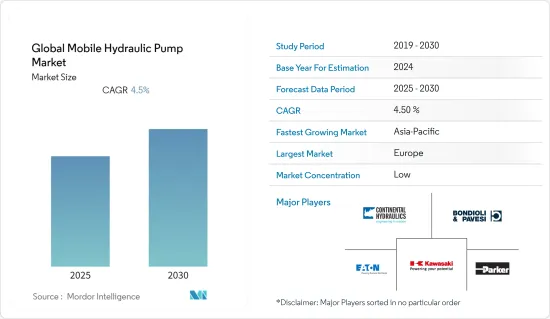

全球移動式液壓幫浦市場預計在預測期內複合年成長率為 4.5%。

移動式液壓泵在將機械動力轉化為液壓能的各個行業中普遍存在。這些泵浦用於挖土機、起重機、曳引機、裝載機、吸塵器、林業機械、平土機、自動卸貨卡車、採礦設備和其他應用。

技術創新和市場對高性能、高效高壓泵和液壓系統不斷成長的需求意味著需要高度的專業技術知識和能力。因此,泵需要不斷開發並整合到各個應用領域的生產過程中。

然而,符合法規要求的先進泵浦的價格高於標準泵浦。

此外,全球建設活動的增加、汽車銷售的增加以及採礦業使用的增加也推動了對移動式液壓泵的需求。此外,政府法規的重點是減少二氧化碳排放,民眾的節能意識也不斷增強。由於這些因素,預計移動式液壓幫浦市場在預測期內將出現良好的成長。

移動式液壓幫浦市場趨勢

建設產業主導市場

移動式液壓泵,特別是齒輪泵,主要用於建設產業。施工機械在挖掘、土方、起重、物料輸送等作業中的廣泛應用預計將推動施工機械市場的發展。

發展中國家,無論是已開發國家或開發中國家,都在加大對工具機的投資,以改善其生產流程和系統。未來,建築業和液壓系統將受益於這兩個行業的成熟。

已開發國家和新興國家的製造商都在增加對工具機的投資,以增強其生產流程和系統。這兩個市場的成熟可能在未來幾年對建築業和液壓系統有所幫助。

市場是由各國建設活動活性化和建築支出增加所推動的。

亞太地區是成長最快的市場

中國、印度等重要開發中國家的快速發展和都市化正在推動液壓泵產業的擴張。

城市人口的擴張導致許多國家快速工業化。因此,消費者需求和產品不斷增加,影響最終使用領域的擴大。

由於存在多個施工機械、物料輸送設備和施工機械製造設施,因此液壓齒輪幫浦是主要的消費者。亞太地區國家佔很大佔有率。

由於COVID-19的影響,最終用途產業的大多數公司正在尋求將生產設施遷移到印度和東南亞國協,以取代中國。政府的支持措施可能會鼓勵跨國公司向這些國家擴張,這將對該地區的商業機會產生直接影響。

移動式液壓幫浦產業概況

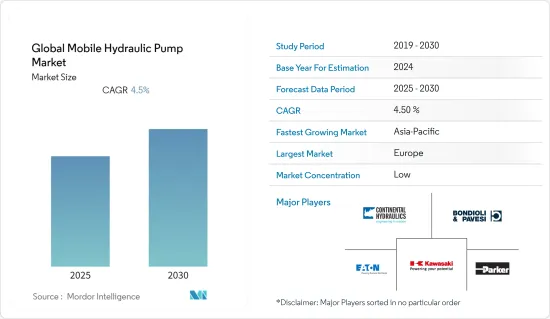

移動式液壓幫浦市場競爭相當激烈,企業規模各異。隨著組織繼續進行策略性投資以抵消目前所經歷的經濟放緩,預計該市場將出現大量聯盟、合併和收購。該市場由主要解決方案服務提供商博世力士樂、林德液壓、伊頓公司、川崎精密機械和 Bondioli &Pavesi Inc 組成。

2022年4月,林德液壓為其全球生產網路投資了5,000萬歐元。這些資金將用於升級德國和其他國際地點的設備。

2021 年 5 月,博世力士樂推出高速、高功率Hagglunds Atom 液壓馬達。 Hagglunds Atom 液壓馬達比類似尺寸的馬達每分鐘可提供更多轉數和更多功率。非常適合移動、船舶和回收應用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對產業的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 越來越多使用物聯網數位化,帶來更智慧的液壓泵產品

- 行動油壓設備小型化的需求

- 市場限制因素

- 一些最終用戶中售後市場供應商和翻新/二手產品的數量增加

第6章 市場細分

- 依產品類型

- 葉片

- 活塞

- 齒輪

- 按最終用戶產業

- 建造

- 農業

- 物料輸送

- 採礦/採礦

- 航太/國防

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 供應商排名分析

第8章 競爭格局

- 公司簡介

- Bondioli & Pavesi Inc

- Bosch Rexroth

- Bucher Hydraulics(Bucher Industries AG)

- Continental Hydraulics Inc

- Daikin-Sauer-Danfoss Ltd

- Dana Inc

- Danfoss Power Solutions

- Eaton Corporation

- Fluidyne Fluid Power

- HANSA-TMP Srl

- HAWE Hydraulik SE

- Jiangsu Hengli Hydraulic Co., Ltd

- Hydro Leduc

- Kawasaki Precision Machinery

- KYB Americas Corporation

- Liebherr Group

- Linde Hydraulics

- Mottrol Co., Ltd

- Parker Hannifin Corporation

- Poclain Hydraulics Inc

第9章市場展望

The Global Mobile Hydraulic Pump Market is expected to register a CAGR of 4.5% during the forecast period.

Mobile Hydraulic Pumps have become widespread across industries that convert mechanical power into hydraulic energy. These pumps are used on excavators, cranes, tractors, loaders, vacuum trucks, forestry equipment, graders, dump trucks, mining machinery, and other applications.

The increasing number of innovations and the demands of the markets for high-performance, efficient high-pressure pumps and water hydraulics systems means that a high degree of specialist engineering knowledge and competence is required. As a result, continuous development of pumps and their integration into production processes in various application areas are necessary.

However, the prices of sophisticated pumps that meet regulatory requirements are higher than those of standard pumps.

Moreover, the need for mobile hydraulic pumps is driven by the increase in worldwide construction activities, rising automobile sales, and increased use in the mining industry. Furthermore, government regulations focus on reducing CO2 emissions and increasing public awareness regarding energy conservation. Such factors are expected to provide lucrative growth in the mobile hydraulic pump market during the forecast period.

Mobile Hydraulic Pump Market Trends

Construction Industry to Dominate the Market

Mobile Hydraulic Pumps, particularly gear pumps, are largely used in the construction industry. Extensive application of construction equipment in operations, such as excavation, earth-moving, and lifting and material handling, is expected to drive the market for construction equipment.

Manufacturers are expanding their investments in machine tools in developed and developing countries to improve their production processes and systems. The building industry and hydraulic systems will benefit from the maturation of both areas in the coming years.

In both developed and developing countries, manufacturers are increasing their investments in machine tools to enhance their production processes and systems. Both markets' maturity will help the construction sector and hydraulic systems throughout the next few years.

The market is being propelled forward by an increase in construction activity and rising construction spending in various countries.

Asia-Pacific to be the fastest growing market

Rapid development and urbanization in important developing nations such as China and India are driving the expansion of the hydraulic pumps industry.

Because of the expanding urban population, many countries are seeing fast industrialization. As a result, there has been an increase in consumer demands and products, affecting the expansion of end-use sectors.

Owing to the presence of the leading consumers of hydraulic gear pumps due to the presence of several manufacturing facilities for construction equipment, material handling equipment, and construction equipment, including key players such as Mitsubishi, Hangcha Group, and Komatsu Ltd. Countries in the Asia-Pacific region held the major share.

Due to the impact of COVID-19, the bulk of end-use sector companies are seeking to relocate their production facilities to India and ASEAN countries as an alternative to China. Supporting government actions may draw global players to these countries, which will directly impact the region's opportunities.

Mobile Hydraulic Pump Industry Overview

The mobile hydraulic pump market is quite competitive with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. The market comprises key solutions and service providers, Bosch Rexroth, Linde Hydraulics, Eaton Corporation, Kawasaki Precision Machinery, and Bondioli & Pavesi Inc.

In April 2022, Linde Hydraulics invested EUR50 million across its global production network. The money would be used for upgrading its facilities in Germany and other international locations.

In May 2021, Bosch Rexroth launched its fast and power-dense Hagglunds Atom hydraulic motor. The Hagglunds Atom hydraulic motor would be supplying more revolutions per minute, along with more power than motors of similar size. It would be ideal for mobile, marine, and recycling applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing use of IoT and digitization leading to smart hydraulic pump products

- 5.1.2 Demand for miniaturization of mobile hydraulic equipment

- 5.2 Market Restraints

- 5.2.1 Increasing presence of aftermarket suppliers and refurbished/used products in some end-users

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Vane

- 6.1.2 Piston

- 6.1.3 Gear

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Agriculture

- 6.2.3 Material Handling

- 6.2.4 Mining & Extraction

- 6.2.5 Aerospace and Defense

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bondioli & Pavesi Inc

- 8.1.2 Bosch Rexroth

- 8.1.3 Bucher Hydraulics (Bucher Industries AG)

- 8.1.4 Continental Hydraulics Inc

- 8.1.5 Daikin-Sauer-Danfoss Ltd

- 8.1.6 Dana Inc

- 8.1.7 Danfoss Power Solutions

- 8.1.8 Eaton Corporation

- 8.1.9 Fluidyne Fluid Power

- 8.1.10 HANSA-TMP S.r.l

- 8.1.11 HAWE Hydraulik SE

- 8.1.12 Jiangsu Hengli Hydraulic Co., Ltd

- 8.1.13 Hydro Leduc

- 8.1.14 Kawasaki Precision Machinery

- 8.1.15 KYB Americas Corporation

- 8.1.16 Liebherr Group

- 8.1.17 Linde Hydraulics

- 8.1.18 Mottrol Co., Ltd

- 8.1.19 Parker Hannifin Corporation

- 8.1.20 Poclain Hydraulics Inc