|

市場調查報告書

商品編碼

1632071

歐洲交流 (AC) 驅動器:市場佔有率分析、行業趨勢、成長預測(2025-2030 年)Europe Alternating Current (AC) Drive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

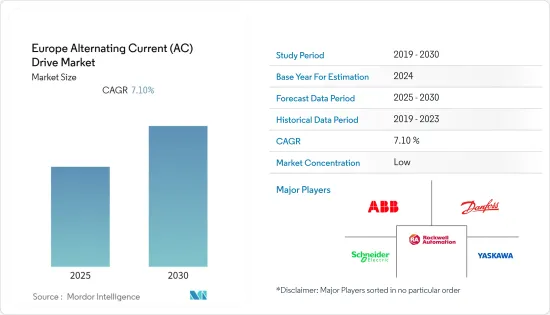

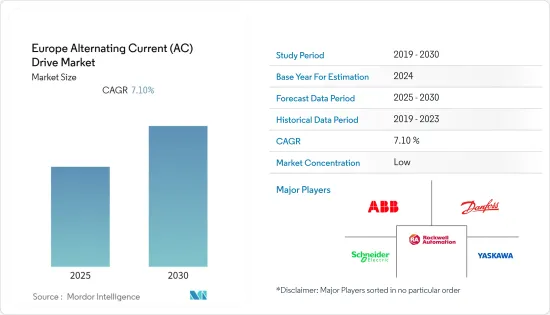

歐洲交流傳動市場預計在預測期內複合年成長率為 7.1%

主要亮點

- 交流變頻器是一種電子設備,可根據應用的需要調節馬達的轉速,從而顯著節省能源。例如,歐洲新的生態設計措施將規範這些驅動器的效率。

- 據丹佛斯稱,投資交流變頻器比投資節能馬達更昂貴。在工業領域,電動馬達佔全球最終能源使用的 30%,需要大量投資,透過安裝交流變頻器或升級馬達效率等級來最佳化現有馬達馬達的能源效率。

- 據 Invertek Drives 稱,歐洲約 50% 的電力由約 80 億台馬達消耗。全球 40% 的電力用作工業電源,其中三分之二用於馬達,但只有不到 20% 的馬達馬達由變頻驅動器(交流變頻器)控制。交流變頻器在需求和供應方面都發揮作用。這些驅動器主要用於減少馬達在扭矩負載下消耗的功率。

- 此外,透過在相關應用中增加交流變頻器的使用,例如提供隨時間變化的水流的泵,可以在應用層面產生顯著的節省。隨後的法規要求馬達和驅動器製造商提供不同速度/扭力點的相關能源效率資料。然而,其效益往往相當高,因此在初始投資回收期之後,交流變頻器是提高能源效率的最經濟的手段。

- 歐洲各國政府已經認知到使用交流變頻器的馬達和馬達變速控制是節能的主要機會。目前,25% 的馬達配備了這些驅動器,安裝其他驅動器的額外可能性為 40-50% 的馬達。國際能源總署(IEA)和歐洲各國政府制定了雄心勃勃的節能目標,並遵循效率第一的原則,將減少消耗視為實現這些目標的重要第一步。

- 新冠危機對全球和地方層面的能源使用和溫室氣體 (GHG)排放產生直接影響。 COVID-19 大流行暴露了其弱點,因為交流變頻器市場最初無法應對因邊境和製造地關閉而導致的供不應求。鑑於數位轉型的加速和交流電驅動器需求的不斷成長,這場危機凸顯了自動化、馬達和驅動器等價值鏈的戰略重要性。

歐洲交流 (AC) 驅動器市場趨勢

快速工業化推動市場成長

- 在大多數情況下,交流(交流)驅動器必須專門設計和製造,因為功率和電壓要求會根據應用需求而變化。人們越來越需要生產可擴展至各種應用且高度可靠的 AC(交流)驅動器。德國法規要求加熱能力為 25 kW 或以上的加熱系統必須配備交流電 (AC) 驅動器。

- 例如,交流變頻器可用於控制大型 HVAC 系統中風扇的氣流,或控制工業程中水或化學品的流量。交流變頻器還可用於更複雜的情況,例如污水處理、造紙廠、石油鑽探平臺和採礦。如果需要速度控制,交流變頻器是最佳解決方案。這是因為您可以透過向上、向下或連續加速來控制馬達的速度。

- 小型驅動器易於安裝。面板製造商可以在標準機櫃中安裝更多驅動器,從而使面板更小。這樣就可以使用更小、成本更低的控制室。它還使OEM更容易將驅動器安裝到他們的設備中。例如,起重機是安裝驅動器的空間有限的應用。驅動器更小、更強大、更易於使用且更便宜。

- 交流變頻器用戶可以透過採用特定於應用的傳動解決方案進一步降低成本。這些驅動器結合了增量功能來支援特定應用,例如風扇和泵浦控制、攪拌機和起重機控制。這些驅動器可以透過更快的啟動時間、更低的整合成本和更高的機器生產率來降低整體擁有成本。

發電業成長顯著

- 歐洲是交流 (AC) 驅動器的大型市場。德國是最大的進口國,其次是義大利和法國。對交流變頻器的需求主要受到歐洲穩定的製造業經濟的推動,該經濟隨著時間的推移持續成長。在發電業,交流變頻器取代了其他傳動系統,高功率、高壓傳動取代了低效率的風門和閥門控制系統。這提高了運作可靠性,同時也節省了能源。

- 例如,可以在高於 600Hz 的頻率下運作的交流變頻器通常稱為高頻驅動器。在歐洲,這些驅動器被認為是消費性應用中常用的兩用設備。在歐洲,交流變頻器廣泛應用於發電產業,以提高設備效率。它根據製程需求控制馬達的速度,通常可減少 35-40% 的能耗。

- 交流變頻器控制發電廠中風扇、泵浦和磨機的速度。德國、義大利和法國等歐洲國家對交流傳動 (AC) 提高能源效率的需求以及這些新興國家的大規模基礎設施投資是預計推動交流變頻器市場強勁成長的因素之一。交流變頻器具有改進的速度、控制和能源成本,以及更高的可靠性、軟啟動、高功率和效率。

- 在發電產業,交流變頻器的消費量是推動市場成長的關鍵因素之一。中壓和低壓交流變頻器在主風機、饋線和冷凝水水泵等主要發電廠應用中發揮重要作用。這些交流變頻器降低了發電業的能源、維護和停機成本。

歐洲交流 (AC) 驅動產業概覽

歐洲交流傳動市場競爭激烈,製造商眾多,包括丹佛斯、WEG、西門子、富士電機、施耐德電機、艾默生電氣公司、羅克韋爾自動化、ABB 和安川電機公司。公司正在透過建立多個夥伴關係關係、投資計劃以及將新產品推向市場來擴大市場佔有率。

- 2021 年10 月-西門子收購了Wattsense,這是一家為中小型建築提供創新的即插即用物聯網(IoT) 管理系統的硬體軟體公司,為我所做的中小型建築的物聯網系統提供動力。 Wattsense 將繼續作為西門子內部的一個獨立部門。此次收購將支持更廣泛的設施透過數位化降低能源消耗。

- 2021 年 6 月 - 羅克韋爾自動化收購 Plex Systems,以擴展其工業雲端軟體產品。 Plex Systems 是領先的基於訂閱的智慧製造平台,提供易於部署的雲端原生解決方案,以提高階到端生產系統的視覺性並加速客戶的數位轉型。 Plex 提供跨離散、混合和流程工業領域的供應鏈視覺性、製造執行和品管應用。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對歐洲交流 (AC) 驅動市場的影響

第5章市場動態

- 市場促進因素

- 能源效率法規

- 無感測器驅動器的需求不斷成長

- 市場問題

- 交流變頻器價格上漲

第6章 市場細分

- 按電壓

- 低的

- 中等的

- 按最終用戶產業

- 石油和天然氣

- 化工/石化

- 飲食

- 用水和污水

- 發電

- 金屬/礦業

- 紙漿/造紙製造

- 空調

- 個體產業

- 按國家/地區

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

第7章供應商市場佔有率分析

第8章 競爭格局

- 公司簡介

- ABB Ltd

- Danfoss

- Schneider Electric Corporation

- Rockwell Automation, Inc.

- YASKAWA ELECTRIC CORPORATION.

- Mitsubishi Electric Corporation

- Siemens

- Fuji Electric Co., Ltd.

- Emerson Electric Co.

- WEG

第9章投資分析

第10章投資分析市場的未來

簡介目錄

Product Code: 91173

The Europe Alternating Current Drive Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- AC drive is an electronic device that can adjust the rotation speed of an electric motor according to the application's needs, which can result in considerable energy savings. For example, the new ecodesign measures by Europe will now regulate the efficiency of these drives.

- According to Danfoss, the investment in an AC drive is higher than in an energy-efficient motor. In the industrial sector, where electric motors account for 30% of global final energy use, it requires significant investment to install AC drives or upgrade motor efficiency classes to optimize existing motors for energy efficiency.

- According to Invertek Drives, nearly 50 percent of the electricity produced in Europe is consumed by around eight billion electric motors. Forty percent of electricity is used to power the industry, with two-thirds of this used by electric motors globally, and yet less than 20 percent of electric motors are controlled by variable frequency drives (AC Drives). AC drives have a role on both the demand and supply sides of the equation. These drives primarily act to reduce electricity consumption drawn by motors under torque loading.

- Besides, increased usage of AC drives in relevant applications, such as a pump delivering a water flow that changes with time, can generate considerable savings at the application level. This is followed by the regulation requiring manufacturers of motors and drives to provide relevant energy efficiency data at different speed/torque points. However, the advantage is often considerably higher, so after the initial payback time, the AC drive is the most economical means to generate energy efficiency.

- The European Government has already identified motors and variable speed control of motors using AC drives as huge opportunities for energy-saving. Currently, 25% of the motors are equipped with these drives, and the additional potential to install other drives is 40-50% of the motors. The International Energy Agency (IEA) and the European Government have set ambitious targets for energy savings and regard cutting back consumption as a vital first step in achieving the targets, following the principles of the Efficiency First concept.

- The COVID crisis directly impacts energy use and greenhouse gas (GHG) emissions at both global and regional levels. The Covid-19 Pandemic unveiled weaknesses, as the AC Drives market was initially unable to cope with shortages in supplies caused by closed borders and manufacturing sites. The crisis accentuated the strategic importance of value chains such as automation, motors, and drives in light of the accelerating digital transformation and growing demand for Alternating Current (AC) Drives.

Europe Alternating Current (AC) Drive Market Trends

Rapid Industrialization is Driving the Market Growth

- The power and voltage requirements vary with the application's demands, and in most cases, the AC (Alternating Current) drives have to be specially designed and manufactured. The need to manufacture AC drives (Alternating Current) that are scalable for different applications yet reliable has increased. Germany's regulations require Alternating Current (AC) drives to be installed with heating systems larger than 25 kW (heating capacity).

- For example, AC drives can be used to control the airflow of a fan for large heating and air conditioning systems or the flow of water and chemicals in industrial processes. AC drives can also be used in more complex situations like wastewater processing, paper mills, oil drilling platforms, or mining. When speed control is necessary, AC drives are the best solution because it allows controlling the motor speed to ramp up, down, or continuous.

- Smaller drives are easier to install. Panel builders can fit more drives into a standard cubicle, enabling panels to be smaller. This allows the use of smaller and less costly control rooms. Also, drives become easier for OEMs to fit into equipment. An example is cranes, an application with limited space for drives. Drives have become smaller, more capable, easier to use, and less costly.

- AC-drive users can reduce costs even more by employing application-specific drive solutions. These drives incorporate incremental functionality that supports specific applications such as fan and pump control, mixers, or crane controls. They can reduce the total cost of ownership through shorter startup times, lower integration costs, and improved machine productivity.

Power Generation Industry to Witness Significant Growth

- Europe is a large market for alternating current (AC) drives. Germany is the largest importer, followed by Italy and France. The demand for AC drives is driven primarily by a stable manufacturing economy in the European region that continues to grow over time. In the power generation industry, AC Drives would replace other drive systems, and the high power high voltage drives will replace inefficient damper and valve control systems. This will give reliability of operation coupled with energy-saving.

- For instance, AC drives capable of operating at 600 Hz or greater frequencies are generally referred to as high-frequency drives. The European region considers these drives to be dual-use devices commonly used in civilian applications. In Europe, AC drives are widely used in power generation industries to increase equipment efficiency. It controls the speed of electric motors according to the process needs and typically reduces energy consumption by 35-40%.

- AC drives control power plants' speed of fans, pumps, and mills. In European countries like Germany, Italy, and France, the need to boost energy efficiency Alternating Current drives (AC) along with massive infrastructure investments in these developing countries are among the factors expected to drive strong market growth for the AC drives. In addition to speed, control, and energy costs, AC drives offer greater reliability, soft-start, higher power, and improved efficiency.

- In Power Generation Industry, the low energy consumption of AC drives is one of the prime factors driving the market's growth. The medium and low-voltage AC drives play a major role in key power plant applications, such as primary fans, electric feed, and condensate pumps. These AC drives can save energy, maintenance, and downtime costs in the power generation industry.

Europe Alternating Current (AC) Drive Industry Overview

The Europe Alternating Current (AC) Drive Market is competitive and consists of several partakers like Danfoss, WEG, Siemens, Fuji Electric Co., Ltd., Schneider Electric, Emerson Electric Co., Rockwell Automation, Inc., ABB, Yaskawa Electric Corporation, and many more. The companies are increasing their market share by forming multiple partnerships, investing in projects, and launching new products in the market.

- October 2021 - Siemens acquired Wattsense, a hardware and software company that offers an innovative, plug-and-play Internet of things (IoT) management system for small and mid-size buildings to boost IoT systems for small and medium buildings. Wattsense to remain a separate, standalone unit within Siemens. The acquisition supports a wider range of facilities in reducing energy consumption through digitalization.

- June 2021 - Rockwell Automation acquired Plex Systems to expand the industrial cloud software offerings. Plex Systems, a leading subscription-based smart manufacturing platform with easy-to-deploy, cloud-native solutions, improves visibility into end-to-end production systems and accelerates customers' digital transformation with the answers. Across discrete, hybrid, and process industry segments, Plex provides applications in supply chain visibility, manufacturing execution, and quality management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Europe Alternating Current (AC) Drive Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulation on Energy Efficiency

- 5.1.2 Emerging Demand for Sensorless Drives

- 5.2 Market Challenges

- 5.2.1 Increasing Prices of AC Drives

6 MARKET SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low

- 6.1.2 Medium

- 6.2 By End-User Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Food & Beverages

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Pulp & Paper

- 6.2.8 HVAC

- 6.2.9 Discrete Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 Italy

- 6.3.4 France

- 6.3.5 Russia

- 6.3.6 Rest of Europe

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd

- 8.1.2 Danfoss

- 8.1.3 Schneider Electric Corporation

- 8.1.4 Rockwell Automation, Inc.

- 8.1.5 YASKAWA ELECTRIC CORPORATION.

- 8.1.6 Mitsubishi Electric Corporation

- 8.1.7 Siemens

- 8.1.8 Fuji Electric Co., Ltd.

- 8.1.9 Emerson Electric Co.

- 8.1.10 WEG

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219