|

市場調查報告書

商品編碼

1632079

全球網路錄影機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Network Video Recorder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

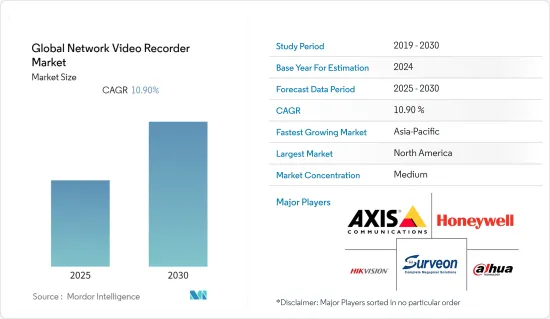

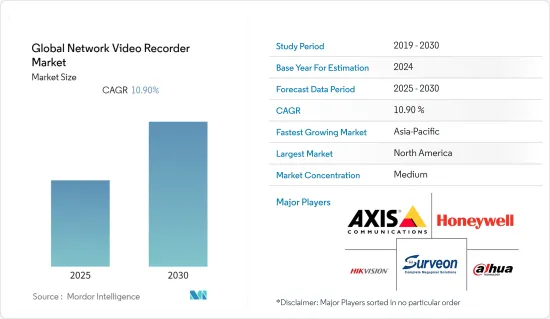

預計全球網路錄影機市場在預測期間內複合年成長率為 10.9%

主要亮點

- 此外,安全性變得越來越重要,尤其是在商業領域。在全球範圍內,IP 攝影機擴大用於安全領域,因為它們可以透過網路傳輸影像,而無需在本地儲存。 IP 攝影機是網路視訊錄影設備,常用於家庭和商務用。隨著安全性越來越受到關注,對網路錄影機設備的需求正在增加。

- 市場參與企業正在提供適合商業和工業用途的高品質 NVR 系統,以打入利潤豐厚的市場。此外,重點放在夜間監控攝影機等新產品的發布。例如,2021年8月,大華科技發表了更新的全彩2.0網路攝影機。這些相機配備雙鏡頭、可變焦距鏡頭、4K 彩色攝影,並由人工智慧提供支援。

- 銀行和金融機構的竊盜和非法貿易呈上升趨勢。世界各地 ATM 盜竊和可疑提款事件的增加進一步凸顯了採取適當安全措施的必要性。此外,法規環境日趨嚴格,我們預期網路錄影機的引進將會增加。

- 然而,網路錄影機系統的高成本和對網路安全日益成長的擔憂可能會抑制研究市場的成長。 2021年8月,安科網路錄影機(NVR)發現遠端程式碼執行(RCE)漏洞,導致物聯網設備完全被攻陷。此嚴重缺陷 (CVE~2021-32941) 是在 NVR 型號 N48PBB 的回放功能中發現的,該功能可捕獲和記錄多達 8 個 IP保全攝影機的即時串流,並提供視訊監控系統的集中遠端管理。

- 未經身份驗證的攻擊者可以存取影片中記錄的個人資訊、獲取有價值資產的位置並追蹤人員。還可以刪除視訊影像、重新配置運動偵測警報、停用指定攝影機以及完全關閉 NVR。 Nozomi Networks 於 2021 年 7 月 11 日向 Annke 發出有關漏洞的警報,供應商於 7 月 22 日發布了解決漏洞的韌體。此類事件增加了公眾的安全疑慮。

網路錄影機趨勢

各個最終用戶產業的採用率不斷提高推動了市場成長

- 網路錄影機廣泛應用於各種最終用戶產業,包括交通、國防和醫療。它們安裝在政府辦公室、醫院、軍事基地和許多其他建築物中以增強安全性。

- 交通運輸業已經證明了基於視訊的監控解決方案的價值。隨著人工智慧的出現,攝影機已經從常見的監控工具變成了可以幫助企業預防事故發生的工具。當與資訊和通訊技術 (ICT) 結合使用時,視訊設備可以幫助更有效地管理交通、更快地解決違規問題、降低事故率並提高合規性。這些系統透過讀取車牌、將其分組併計算速度來提供全面的車輛識別。還可以進行進階流量監控。它還可以檢測異常情況,例如交通堵塞或意外封路。

- 2022 年 5 月,泰米爾納德邦首席部長 M.K.斯大林在清奈的 500 輛公車上安裝了人工智慧 (AI) 緊急按鈕和CCTV監控系統,作為改善婦女和兒童安全的計劃的一部分。國家交通部門計劃在 Nirbhaya 安全城市計劃下為約 2,500 輛公車提供此設施,第一階段,該地鐵城市的 500 輛公車將配備四個緊急按鈕、一個支援人工智慧的行動網路錄影機( MNVR ),並安裝了三台攝影機。 MNVR 透過 4G GSM SIM 卡連接到雲端基礎的控制中心。如果女性乘客在旅途中受到其他乘客的滋擾或威脅,她可以按下緊急按鈕記錄該事件。這樣,控制中心就會響起警報(鈴聲),也會發送公車上事件的錄影記錄。此警報允許控制中心操作員即時監控情況並提示下一步行動。

- 2022年6月,德里政府啟動了第二階段計劃,在首都各地安裝28萬個CCTV攝影機。政府也正在安裝Wi-Fi網路和大約35,000個Wi-Fi路由器,這些路由器將在第二階段與攝影機一起安裝。每四台攝影機將安裝一個公共產業箱,其中包含 NVR(網路錄影機)、Wi-Fi 路由器、用於一小時備用電源的 UPS 以及用於攝影機定位和網路連接的 SIM 卡。此計劃由政府公共工程部(PWD)負責。居民福利協會的一名成員、公共部門官員、德里警方以及安裝和維護攝影機的公司代表將可以存取攝影機的即時影像,以增強安全性。

- 為了滿足不斷變化的消費者需求,多家公司正在為交通運輸業提供各種產品。例如,Idis 開發了一款強大的行動網路錄影機 (NVR),用於公共運輸和其他需要以高解析度可靠記錄車輛內外活動的情況。 DR-6308PM 和 DR-6361PSM 版本採用堅固、抗衝擊和抗振動的設計(美國軍方 MIL-STD-810 認證),可消除在困難的移動環境中困擾標準記錄設備的噪音和影像品質變化。 。

- 此外,大多數醫院和醫療安全系統都將影片作為關鍵要素。更高百萬像素的攝影機、180 度和 360 度視角攝影機的使用以及與其他系統增強視訊整合是一些關鍵的視訊發展。 NVR 系統補充了現代化醫療基礎設施。例如,當視訊監控公司 Pelco 的子公司亞利桑那大學醫學中心南校區 (UAMC South Campus) 增加一座新的行為健康醫院塔樓時,它將其模擬視訊監控系統遷移到能夠支援多種功能的 IP 系統。監控,試圖擴大。使用 Pelco 的 Endura IP 視訊管理系統 (VMS) 和 NSM5200 網路錄影機,醫院系統可以將所有視訊集中在一個平台上,同時允許多個操作員錄製日常事件的影片,現在您可以同時搜尋和查看。此外,在新塔樓、急診室和大部分入口處安裝了 150 多台 Sarix 和採用 SureVision 技術的 Sarix IP 攝影機。

預計亞太地區市場將顯著成長

- 在亞太地區,基礎設施開發和智慧城市計劃正在興起,預計將推動市場成長。此外,各國政府增加對智慧城市計劃的投資也可能為市場參與企業提供利潤豐厚的機會。

- 例如,印度政府在 2015 年提出了雄心勃勃的智慧城市使命,旨在創建 100 個智慧城市,在基礎設施和健康永續的環境方面為其他社區提供可複製的模式。該任務的工作完成速度比任何其他政府計劃都要快。政府宣布,迄今為止支持的所有智慧城市任務計劃將於 2023年終完成。智慧城市計畫於2015年6月25日啟動,預計總投資為25,018億印度盧比。

- 此外,2021 年 11 月,一群建築師宣布了韓國首都首爾的一項雄心勃勃的區域計劃:10 分鐘城市。該開發案被稱為“計劃 H1”,將把一個舊工業場地改造成一個互聯的“智慧”城市。這個佔地 125 英畝的地區將包括八棟住宅、共同工作空間和研究空間,還將包括娛樂場所、健身中心、游泳池,甚至還有一個水耕城市農場。

- 亞太地區 NVR 系統市場預計將受益於零售業的成長。例如,根據新加坡統計局的數據,繼2022年3月年增8.8%之後,2022年4月零售額年增12.1%。 2022年3月,不包括汽車的零售額成長17.4%和13.6%。

- 隨著越來越多的展示室和零售店安裝高科技視覺監控系統,網路錄影系統的需求將繼續很高。隨著 NVR 在監控應用中擴大取代傳統 DVR,NVR 製造商有望獲得長期利益。 NVR系統的引入解決了夜間影像的影像品質、解析度和準確性問題。

網路錄影機產業概況

全球網路錄影機市場競爭適中,主要企業包括Axis Communications ab、Honeywell International Inc.、Surveon Technology Inc.和Dahua Technology Inc.進入市場。市場參與企業正在尋求透過創新綜合解決方案、與合作夥伴合作以獲得協同效應以及擴大其地理覆蓋範圍來滿足客戶不斷變化的複雜需求。

- 2021 年 11 月 - QNAP Systems 提供運算、網路和儲存解決方案, Inc. 擁有 16 個 30WGigabitPoE 端口、2 個RJ45/SFP 組合端口和2 個2.5GbE 主機管理端口,可支援各種PoE 設備並構建智慧監控基礎設施,推出內置內置NVR 網路監控伺服器QVP-41B 。 QVP-41B 配備四個 3.5 吋 SATA 磁碟托架和一個 Intel Celeron J4125四核心處理器,可監控中小型情況,同時提供大儲存可能性和高速網路。

- 2021 年 6 月 - 全球安全與監控技術參與企業D-Link 推出 JustConnect 16 通道 H.265 PoE 網路錄影機 (DNR),這是一款一體式 IP 視訊監控解決方案,可為小型企業提供強大的監控系統和企業。 DNR-4020-16P 具有內建 PoE 端口,可為最多 16 個攝影機供電和連接。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈分析

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 可以連接多個監視攝影機並儲存資料的便利商店。

- 越來越關注智慧城市

- 人們對安全的興趣日益濃厚

- 市場限制因素

- 逐步替換為 XDR

- 對網路犯罪的擔憂日益加劇

第6章 市場細分

- 按用途

- 住宅

- 商業的

- 工業的

- 其他(道路交通、公共工程、政府設施)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Axis Communications AB

- Tyco International Ltd.

- Honeywell International Inc.

- Panasonic

- Surveon Technology Inc.

- Dahua Technology Co., Ltd.

- Hangzhou Hikvision Digital Technology

- D-Link Corporation

- Teledyne FLIR LLC

- Avigilon Corporation

- VIVOTEK Inc.

- Synology Inc.

第8章投資分析

第9章 市場未來展望

The Global Network Video Recorder Market is expected to register a CAGR of 10.9% during the forecast period.

Key Highlights

- Furthermore, an enhanced emphasis is being given to security, especially in the commercial sector. Globally, there is a rise in the use of IP cameras for security, as they can feed video over the network without being stored locally. IP cameras are a type of network video recorder equipment that is commonly utilized in both the household and business sectors. The demand for network video recorder devices is rising as security is given more attention.

- Players in the market are offering high-quality NVR systems suitable for commercial and industrial use to expand their penetration across lucrative markets. Additionally, emphasis is placed on new product launches like night surveillance cameras. For instance, in August 2021, Dahua Technology unveiled its updated full-colour2.0 network cameras. These cameras feature dual lenses, variable focal length lenses, 4K color photos, and employ artificial intelligence.

- The number of thefts and fraudulent transactions in banks and financial institutions is increasing. The rising number of ATM thefts and suspicious ATM withdrawals worldwide further drive the need for adequate security measures. Besides, the regulatory environment has become stringent, which is expected to bolster the deployment of Network video recorders.

- However, the high cost of network video recorder systems coupled with rising cybersecurity concerns will likely restrain the studied market's growth. In August 2021, a remote code execution (RCE) vulnerability in a network video recorder (NVR) manufactured by Annke was discovered, resulting in a complete compromise of the IoT device. The critical flaw (CVE-2021-32941) was found in the playback functionality of NVR model N48PBB, which captures and records live streams from up to eight IP security cameras and provides centralized, remote management of video surveillance systems.

- Unauthenticated attackers could access private information recorded on videos, obtain the position of valuable assets, or stalk people. Miscreants could also delete video footage, reconfigure motion detection alarms, disable specified cameras, or shut down the NVR altogether. Nozomi Networks alerted Annke to the flaw on July 11, 2021, and the vendor released firmware addressing the vulnerability on July 22. Such incidents amplify the security concerns among the common masses.

Network Video Recorder Market Trends

Increasing Adoption across Various End-User Industries is expected to drive market growth

- Network video recorders are finding applications in several end-user industries like transportation, defense, healthcare, etc. They are installed in government buildings, hospitals, military bases, and numerous other buildings to enhance security.

- The transportation sector has made the value of video-based surveillance solutions glaringly clear. With the advent of AI, cameras have been changed from a common monitoring tool to one that may enable this business to prevent accidents. When used with information and communication technology (ICT), video equipment can help control traffic more effectively, deal with violations more quickly, lower accident rates, and increase compliance. These systems offer comprehensive vehicle identification by reading license plates, categorizing them into groups, and calculating their speed. They also provide sophisticated traffic monitoring. Additionally, it enables the detection of unusual circumstances like traffic jams and unexpected roadblocks.

- In May 2022, Tamil Nadu Chief Minister M K Stalin launched an Artificial Intelligence (AI)-enabled panic button-cum-CCTV surveillance project in 500 Chennai buses as part of an initiative to improve women's safety and children. The state transport department has planned to provide this facility in about 2,500 buses under the Nirbhaya safe city project, and in the first phase, 500 buses in the metro city have been provided with four panic buttons, AI-enabled Mobile Network Video Recorder (MNVR) and three cameras each, respectively. The MNVR would be connected to a cloud-based control center via a 4G GSM SIM card. In case of any inconvenience or threat caused by fellow passengers while traveling, the women passengers could press the panic button to record the incident. While doing so, an alarm (bell) would be raised at the control center, along with a video recording of the incident on the bus. With this alarm, the operator at the control center would monitor the situation and facilitate, in real-time, the next course of action.

- In June 2022, the Delhi government started the second phase of its project to install 280,000 CCTV cameras across the national capital. The government is also setting up Wi-Fi networks and around 35,000 Wi-Fi routers, which will be installed along with cameras in the second phase. For every four cameras, there would be a utility box with an NVR (network video recorder), a Wi-Fi router, a UPS for power backup lasting an hour, and a SIM card to locate the cameras and for network connectivity. The project is being carried out by the government's public works department (PWD). One resident welfare association member, PWD officials, Delhi Police, and a representative of the company that is installing and maintaining the cameras would be allowed access to the live camera feed for enhanced security.

- Several companies are providing different products for the transportation sector to meet evolving consumer demands. For example, Idis developed a ruggedized mobile network video recorder (NVR) for usage in public transportation and other situations where interior and exterior vehicle activity need to be reliably and highly resolved recorded. The DR-6308PM and DR-6361PSM versions also eliminate the issue of noise and variable image quality that can plague standard recording devices in difficult, mobile circumstances due to their robust, anti-shock, and anti-vibration design (U.S. military MIL-STD-810 approved).

- Further, most hospital and healthcare security systems include video as a key component. The usage of higher-megapixel cameras, 180-degree and 360-degree view cameras, and the growing integration of video with other systems are a few of the major video developments. The NVR systems are complimenting the healthcare infrastructure in recent times. For instance, the University of Arizona Medical Center - South Campus (UAMC South Campus), an of Pelco, a video surveillance firm, when adding a new behavioral health hospital tower, sought to migrate and expand its analog video surveillance system to an IP system that would allow the capabilities of multisite monitoring. Using Pelco'sEndura IP video management system (VMS) with NSM5200 network video recorders, the hospital system could centralize all videos onto a single platform while allowing several operators to look for and view videos simultaneously of daily events. In addition, more than 150 Sarix and Sarix with SureVision technology IP cameras were deployed throughout the new tower, emergency room, and most entrances and exits.

The Asia Pacific Region is Expected to Witness Significant Market Growth

- Rising infrastructure developments and smart city projects across the Asia Pacific are anticipated to drive market growth. Also, the increasing investments by various governments in smart city projects will likely provide lucrative opportunities for market players.

- For instance, the Indian government's ambitious Smart City Mission was introduced in 2015 to create 100 smart cities that can serve as replicable models for other communities in terms of their basic infrastructure and healthy, sustainable environments. The mission's initiatives are completed more quickly than any other government program. The government said that all Smart City Mission projects it has supported would be finished by the end of 2023. Smart Cities Mission, launched on 25th June 2015, envisaged a total investment of INR 2,05,018 crore.

- Further, in November 2021, a group of architects revealed their plans for an ambitious neighborhood in South Korea's capital, Seoul: a 10-minute city. Dubbed "Project H1," the development is set to transform an old industrial site into an interconnected "smart" city. Combining eight residential buildings with co-working offices and study spaces, the 125-acre district is set to house entertainment venues, fitness centers, swimming pools, and even hydroponic urban farms.

- The market for NVR systems in the APAC region is anticipated to benefit from the rising retail sector. For Instance, according to the Singapore Department of Statistics, retail sales climbed 12.1% year over year in April 2022, continuing the 8.8% year over year growth in March 2022. Retail sales increased 17.4% when motor vehicles were excluded, compared to 13.6% in March 2022.

- Network video recording systems will remain in demand as more showrooms and retail establishments implement high-tech vision surveillance systems. Long-term benefits are anticipated for NVR makers as NVRs increasingly replace traditional DVRs in surveillance applications. The installation of NVR systems resolves problems with image quality, resolution, and the caliber of nighttime footage.

Network Video Recorder Industry Overview

The Global Network Video Recorder Market is moderately competitive with significant players like Axis Communications ab, Honeywell International Inc., Surveon Technology Inc., and Dahua Technology Co., Ltd., among others. The market players are striving to cater to their customers' evolving and complex needs by innovating comprehensive solutions and collaborating with partner companies to obtain synergies and expanded geographic reach.

- November 2021 - QNAP Systems, Inc., a player in computing, networking, and storage solutions, unveiled the QVP-41B, a new NVR network surveillance server that incorporates a Power-over-Ethernet (PoE) switch with sixteen 30-watt Gigabit PoE ports, two RJ45/SFP combo ports, and two 2.5GbE host management ports to support a variety of PoE devices and build an intelligent surveillance infrastructure. The QVP-41B, which has four 3.5-inch SATA disc bays and an Intel Celeron J4125 quad-core processor, can monitor small- to medium-sized situations while offering significant storage potential and fast networking.

- June 2021 - D-Link, a global security and surveillance technology player, unveiled the JustConnect 16-Channel H.265 PoE Network Video Recorder (DNR-4020-16P) - an all-in-one IP video surveillance solution that offers SMBs and enterprises a robust surveillance system. It has integrated PoE ports, which can power and connect up to 16 individual cameras, and is specifically designed to provide extensive monitoring wherever needed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Convenience of connecting with multiple video surveillance cameras to store data

- 5.1.2 Rising Smart City Initiatives

- 5.1.3 Growing Safety Concerns

- 5.2 Market Restraints

- 5.2.1 Gradual replacement with XDR

- 5.2.2 Rising Concerns Regarding Cybercrime

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Residential

- 6.1.2 Commercial

- 6.1.3 Industrial

- 6.1.4 Others (Road Traffic, Public Utility, and Government Facility)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Axis Communications AB

- 7.1.2 Tyco International Ltd.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Panasonic

- 7.1.5 Surveon Technology Inc.

- 7.1.6 Dahua Technology Co., Ltd.

- 7.1.7 Hangzhou Hikvision Digital Technology

- 7.1.8 D-Link Corporation

- 7.1.9 Teledyne FLIR LLC

- 7.1.10 Avigilon Corporation

- 7.1.11 VIVOTEK Inc.

- 7.1.12 Synology Inc.