|

市場調查報告書

商品編碼

1632080

亞太地區智慧卡:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

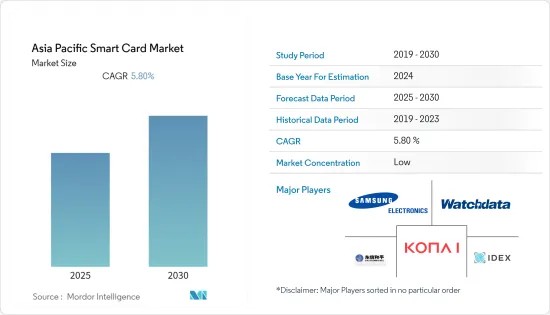

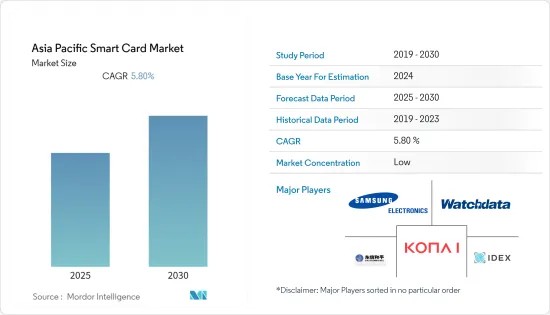

預計亞太地區智慧卡市場在預測期內的複合年成長率為 5.8%。

主要亮點

- 各種政府流程的數位化不斷提高,以及獲取政府服務所需的ID卡的需求不斷增加,正在創造新的潛在市場機會。除此之外,透過提供醫療保健、許可、社會福利文件等,政府當局正在實施智慧卡,從而加速未來幾年的市場成長。

- 高效儲存資料、對非接觸式和非現金付款偏好的改變以及付款流程數位化的趨勢不斷成長,正在推動醫療保健、零售和酒店業對智慧卡的需求。此外,透過區塊鏈技術出現的新興客戶資訊安全技術以及智慧卡在亞太地區人口最多的國家的廣泛採用預計將為智慧卡製造商提供利潤豐厚的成長潛力。

- 此外,安全性和小型化是IC卡技術發展最快的兩個領域。隨著世界向更安全的 EMV 銀行卡過渡,最新一代的智慧卡現在具有完整的片上加密功能,顯著提高了整個產業的卡片安全性。此外,智慧卡正在被小型化為更多樣化的外形尺寸,例如迷你標籤和智慧型穿戴裝置。隨著智慧卡擴大與電話和生物識別技術一起用作二因素憑證,這種趨勢可能會持續下去。

- 此外,付款卡無疑是日常生活和商業的重要組成部分。根據智慧付款協會 (SPA) 的數據,實體店大約 90% 的非現金消費者付款是透過銀行卡進行的。此外,根據 SPA 的數據,支付卡直接或間接促進了 40-60% 的線上付款。

- 自疫情爆發以來,觸碰付款的需求增加,各行各業對智慧卡的接受度正在推動市場向前發展。此外,智慧卡在門禁和個人識別應用中的高滲透率、電子政府服務對智慧卡的需求不斷成長以及網路購物和銀行業務的需求不斷成長,預計將在預測期內推動智慧卡市場的成長。

- 此外,由於全球消費者對非接觸式付款方式的需求不斷增加,因此 COVID-19 大流行預計將促進市場成長。部署電子銷售點 (EPOS) 終端的高昂成本以及行動錢包和付款應用程式的持續使用預計將在未來幾年限制智慧卡的需求。

亞太地區智慧卡市場趨勢

BFSI 產業在亞太地區智慧卡普及率中佔據主要佔有率

- 在 BFSI 中使用智慧卡有幾個優點,包括保護個人資料和安全交易。智慧卡在 BFSI 領域也用作信用卡、簽帳金融卡、支付認證卡和存取控制卡。透過將資金裝入智慧卡,它可以用作電子錢包,並可以使用加密通訊協定轉移到自動販賣機或帳戶。

- 此外,隨著技術的進步,詐欺操作的數量也在增加。因此,卡片和付款領域變得數位化,引入了 EMV 晶片、PIN 卡和行動電子錢包等新的付款方式。在 BFSI 領域,由於智慧卡上儲存的資料難以破解,智慧卡變得越來越流行。

- 例如,2021年1月,總部位於新加坡的新興企業StashFin與印度SBM銀行合作,推出了一款儲值卡。該合作夥伴關係旨在透過讓銀行帳戶的個人更容易使用智慧卡獲得信貸來縮小印度的信貸缺口。

- 隨著各金融機構意識到這一趨勢,生物辨識非接觸式 IC 卡可能會在預測期內在 BFSI 產業中流行。此外,安全始終是重中之重,因為關鍵的財務業務是業務的核心。例如,IDEMIA正在利用生物辨識技術推動IC卡的發展。

- 同樣,2021 年 2 月,ICICI 銀行與 Greater Chennai Corporation 和 Chennai Smart City Limited 合作推出了「Namma Chennai 智慧卡」。這種RuPay聯名非接觸式儲值卡將安裝在GCC中心,以實現稅金和公用事業收費等各種數位付款。該儲值卡也可用於在清奈及全國各地的零售商店和電子商務網站付款。

中國主導亞太地區智慧卡成長

- 中國是最早廢除支票並引入非接觸式付款的國家之一,帶動了亞洲數位卡的發展。該國已在包括交通在內的各個行業引入了智慧卡。隨著中國政府控制行業並鼓勵整合產業以提高在全球市場的競爭力,預計大中型企業將迅速整合。

- 此外,許多中國銀行正在開發數位人民幣硬錢包,中國人民銀行已表示客戶將能夠在實體錢包和數位錢包中持有數位貨幣。中國人民銀行(PBOC)擴大了中央銀行數位貨幣(CBDC)試點範圍,將非接觸式「硬錢包」和NFC穿戴式設備納入其中,允許客戶使用數位人民幣在商店和公共交通上購買商品。服務。

- 例如,中國建設銀行在 2021 年 6 月表示,將試行生物識別「硬錢包」智慧卡,允許客戶儲存數位人民幣,並使用指紋來驗證使用央行數位貨幣的付款。先進的指紋辨識和身份驗證用於保護卡上儲存的價值。

- 此外,IDEX Biometrics ASA 於 2021 年 11 月宣布,中國銀聯已核准解決方案合作夥伴恆寶股份有限公司的最新生物辨識智慧卡認證 (CUP)。這款新卡採用IDEX Biometrics的感測器和生物辨識軟體解決方案,已通過中國銀行卡檢測中心(BCTC)的所有要求。此智慧付款卡可實現多用途應用、安全的全球付款以及存取控制和個人識別等附加功能。

亞太地區智慧卡產業概況

亞太地區智慧卡市場競爭激烈,多家全球和地區公司都在爭取市場佔有率。儘管該市場進入門檻較高,但少數新參與企業取得了成功。此市場的特點是產品中/高度差異化、產品滲透率不斷提高、競爭水平較高。解決方案通常作為捆綁銷售,其中濃縮服務似乎是整個套件的一部分。

- 2022 年 6 月 - Wisecard Technology 和 Zwipe 宣佈建立合作夥伴關係,為亞太地區的消費者提供生物識別付款卡。 Wisecard 為 Zwipe Pay 生物辨識付款卡提供客製化腳本,使銀行和卡片個人化機構能夠更快速、更有效地部署該卡。

- 2022 年 1 月 - 全球創新半導體技術領導者三星電子宣布推出 S3B512C,這是一款具有改進安全功能的新型指紋安全 IC(積體電路)。新系統已通過 EMVCo 和 CC EAL 6+ 認證,並符合萬事達卡針對生物識別付款卡的最新 BEPS(生物辨識評估計畫摘要)標準。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 智慧卡廣泛應用於存取控制和個人識別應用。

- 非接觸式付款需求不斷成長

- 市場挑戰

- 隱私和安全問題以及標準化問題

- 行動電子錢包的出現影響智慧卡需求

第6章 市場細分

- 按類型

- 接觸式

- 非接觸式

- 按最終用戶

- BFSI

- 資訊科技/通訊

- 政府機構

- 運輸

- 其他最終用戶產業(教育、醫療保健、娛樂等)

- 按國家/地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. ltd.

- Watchdata Co., Ltd.

- KONA I Co., Ltd.

- Eastcompeace Technology Co., Ltd

- IDEX Biometrics ASA

- Seshaasai Business Forms Pvt Ltd.

- Advanced Card Systems Ltd.(ACS)

- Pura Group

- Asia Credit Card Production Ltd.

- Thales Group

- Assa Abloy AB

- IDEMIA SAS(Advent International, Inc.)

第8章投資分析

第9章 未來市場展望

The Asia Pacific Smart Card Market is expected to register a CAGR of 5.8% during the forecast period.

Key Highlights

- The increasing digitalization of different government processes and the rising demand for identity cards necessary to access government services create new potential market opportunities. Along with that, the provision of healthcare, licenses, and social benefit documentation of people has resulted in government authorities' introduction of smart cards, hence accelerating the market's growth in the coming years.

- The growing trend of storing data effectively, shifting preferences toward contactless and cashless payments, and digitizing payment processes drive demand for smart cards in healthcare, retail, and hospitality. Additionally, blockchain technology's new customer information security technique and the widespread use of smart cards in the APAC region's most populous nation are projected to provide profitable growth possibilities for smart card producers.

- Also, security and miniaturization are two areas where smart card technology is evolving most quickly. With worldwide migration to higher security EMV banking cards, the newest generation of smart cards is capable of full on-chip cryptography, significantly increasing the security of cards across the industry. In addition, smart cards are increasingly miniaturized into more diverse form factors, such as mini-tags and smart wearables. These trends will continue as smart cards, along with phones or biometrics, are increasingly used as a two-factor credential.

- Additionally, Payment cards are, without even a doubt, essential in everyday life and business. According to the Smart Payment Association (SPA), about 90% of non-cash consumer payments in physical establishments are conducted with cards; in reality, payment cards are essential for obtaining cash. Furthermore, according to the SPA, payment cards facilitate 40-60% of online payments, either directly or indirectly.

- The increased need for a tap-and-pay payment method following the pandemic and the expanding acceptance of smart cards in various industries propel the market forward. Furthermore, high smart card penetration in access control and personal identification applications, rising need for smart cards to access e-government services, and rising demand for online shopping and banking drive smart card market growth throughout the forecast period.

- Furthermore, the COVID-19 pandemic is expected to boost market growth due to consumers' growing need for contactless payment methods worldwide. The expensive cost of implementing electronic point of sale system (EPOS) terminals and the expanding use of mobile wallets and payment applications are expected to limit smart card demand in the coming years.

APAC Smart Card Market Trends

BFSI Sector will Hold Significant Share in Smart Card Deployment Across Asia Pacific

- Smart card usage in BFSI has several advantages, including personal data protection and secure transactions. Smart cards are also employed in the BFSI sector as credit or debit cards, payment authentication cards, and access control cards. It can be used as an electronic wallet by putting funds into the smart card, which can then be transferred using cryptographic protocols to a vending machine or an account.

- Furthermore, as technology progresses, the number of fraudulent operations has risen. As a result, the card and payments sector has undergone a digital transition, with new payment methods, including EMV chips, PIN cards, and mobile wallets, being introduced. Smart cards are gaining traction in the BFSI sector, owing to the difficulty decoding the data stored on them.

- For instance, in January 2021, StashFin, a Singapore-based neo banking start-up, teamed with SBM Bank India to develop a contactless prepaid card powered by VISA and equipped with an EMV chip that provides greater safety and security. The alliance aims to close the credit gap in India by giving underbanked individuals simple access to credit using smart cards.

- Biometric contactless smart cards will likely gain popularity in the BFSI industry over the forecast period, with various financial institutions recognizing the trend. Furthermore, because critical financial operations are at the heart of a business, security is always a top priority. IDEMIA, for example, is advancing the evolution of smart cards by utilizing biometric technologies.

- Similarly, in February 2021, ICICI Bank announced the 'Namma Chennai Smart Card' launch in collaboration with Greater Chennai Corporation and Chennai Smart City Limited. This Rupay-powered co-branded contactless prepaid card at GCC centers would enable various digital payments such as tax and utility bills. The prepaid card can also be used to make retail payments in Chennai, India, and in retail outlets and e-commerce websites around the country.

China will Dominate Smart Card Growth in Asia Pacific

- China was one of the first countries to phase out checks in favor of contactless payments, which led to the developing of digital cards across Asia. The country has implemented smart cards in various industries, including transportation. Since the Chinese government has encouraged industry consolidation to control the industry and improve competitiveness in the global market, rapid consolidation between medium-sized and big businesses is expected.

- In addition, numerous Chinese banks are working on digital yuan hard wallets, and the People's Bank of China has indicated that clients will be able to hold digital currency in both physical and digital wallets. The People's Bank of China (PBOC) has expanded its central bank digital currency (CBDC) trial to include a contactless "hard wallet" and NFC wearables that allow customers to use their digital yuan to pay for goods and services in stores and on public transportation.

- For instance, China Construction Bank stated in June 2021 that it would be testing a biometric 'hard wallet' smart card that would allow clients to store digital yuan and confirm payments made using the central bank's digital currency using their fingerprint. Advanced fingerprint recognition and authentication are used to secure the card's stored value.

- In addition, IDEX Biometrics ASA stated in November 2021 that China UnionPay had approved the latest biometric smart card from its solution partner Hengbao Corporation Ltd for certification (CUP). The new card, which uses IDEX Biometrics' sensor and biometric software solution, passed all China's Bank Card Test Center's requirements (BCTC). This smart card will all be possible with multi-use applications, secure global payments, and additional capabilities such as access control and personal identification.

APAC Smart Card Industry Overview

Several worldwide and regional firms compete for market share in the Asia Pacific smart card market, which is highly competitive. Despite the market's high barriers to entry for new competitors, a few newcomers have achieved traction. Moderate/high product differentiation, increasing product penetration levels, and high competition levels characterize this market. The solutions are usually sold as a bundle, making the condensed offering appear part of the whole suite.

- June 2022 - Wisecard Technology and Zwipe are set to unveil their collaboration to provide biometric payment cards to consumers of Asia Pacific (APAC). Wisecard will supply pre-built customization scripts for Zwipe Pay biometric payment cards, allowing banks and card personalization bureaus to install the cards significantly quicker and more effectively.

- January 2022 - Samsung Electronics Co., Ltd., a global leader in innovative semiconductor technology, has unveiled the S3B512C, a new fingerprint security IC (integrated circuit) with improved security features. The new system is EMVCo and CC EAL 6+ certified, and it meets Mastercard's latest Biometric Evaluation Plan Summary (BEPS) criteria for biometric payment cards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Smart Cards are Being Extensively Used in Access Control and Personal Identification Applications

- 5.1.2 Growing Demand for Contactless Payments

- 5.2 Market Challenges

- 5.2.1 Privacy and Security Issues and Standardization Concerns

- 5.2.2 Emergence of Mobile Wallets Impacting Demand for Smart Cards

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Contact-based

- 6.1.2 Contact-less

- 6.2 End-User

- 6.2.1 BFSI

- 6.2.2 IT and Telecommunication

- 6.2.3 Government

- 6.2.4 Transportation

- 6.2.5 Other End-user Industries (Education, Healthcare, Entertainment, etc.)

- 6.3 Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. ltd.

- 7.1.2 Watchdata Co., Ltd.

- 7.1.3 KONA I Co., Ltd.

- 7.1.4 Eastcompeace Technology Co., Ltd

- 7.1.5 IDEX Biometrics ASA

- 7.1.6 Seshaasai Business Forms Pvt Ltd.

- 7.1.7 Advanced Card Systems Ltd. (ACS)

- 7.1.8 Pura Group

- 7.1.9 Asia Credit Card Production Ltd.

- 7.1.10 Thales Group

- 7.1.11 Assa Abloy AB

- 7.1.12 IDEMIA SAS (Advent International, Inc.)