|

市場調查報告書

商品編碼

1632083

全球 3D 虛擬平台 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Global 3D Virtual Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

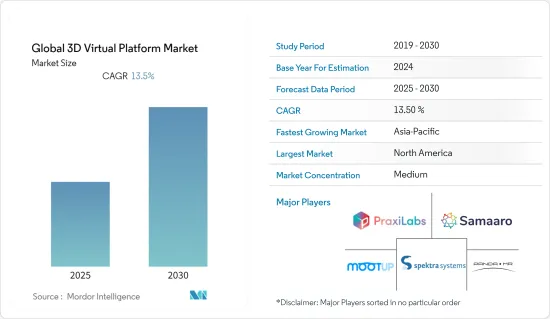

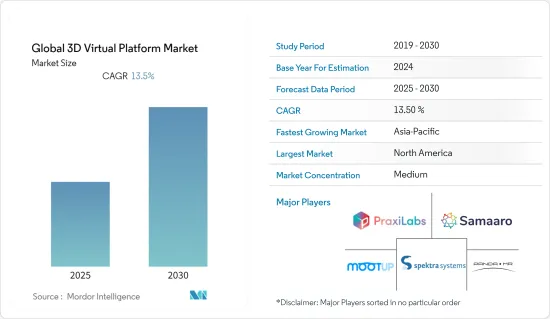

全球 3D 虛擬平台市場預計在預測期內複合年成長率為 13.5%

主要亮點

- 虛擬實境主要是利用軟體技術來創造模擬環境。 VR 讓使用者沉浸在體驗中。這意味著用戶可以與 3D 世界進行身臨其境的交互,而不是看著眼前的顯示器螢幕。科技透過模擬盡可能多的感官(包括視覺、觸覺、聽覺和嗅覺)改變了世界。

- 3D虛擬平台向使用者描述了一個局部虛擬環境。該平台採用半穿透技術,可提供逼真的 3D 圖形。這種虛擬實境主要用於活動以及教育和培訓目的。高解析度顯示器、投影機、功能強大的電腦或硬模擬器用於部分再現真實機器的形式和功能。

- 醫療產業也積極採用3DVR技術,一些高階醫療機構利用電腦產生的影像進行各種診斷。例如,2022年6月,醫療技術提供者Novard宣布其VisAR醫療技術擴增實境手術導引系統獲得FDA核准用於精準引導術中脊椎手術。該系統將患者影像資料轉換為透過光學面罩可見的3D全像圖,並以亞毫米精度將其疊加到患者身上。

- 卡達航空於 2022 年 6 月宣布,很快將為其元宇宙平台 QVerse 引入新功能。該公司計劃將 NFT 機票購買等功能整合到其虛擬實境平台中。該平台是使用 Epic Game 的虛幻引擎創建的,這是最先進的 3D 創作工具之一。

- COVID-19 大流行推動了產業的數位轉型,企業更加關注與客戶和消費者互動的數位平台。虛擬實境還可以捕捉不同的辦公環境,例如在虛擬實境平台上舉行會議,以及透過虛擬實境舉行多個品牌和產品發布會。教育和醫療保健領域也成為目標,因為這些產業在這場大流行期間正在經歷數位轉型。例如,2020 年 1 月,聯邦緊急災難管理署(FEMA) 推出了名為 IMMERSED 的虛擬實境體驗。新系統使人們能夠體驗現實生活中類似洪水的情況,並幫助當局製定減災計劃。透過虛擬財產採取行動可以減少生命和財產損失。在此類災難中使用虛擬實境可能有助於在大流行的背景下提供不利的解決方案。

3D虛擬平台市場趨勢

醫療產業推動市場成長

- 在醫療產業,對 3D 虛擬平台的需求不斷增加,以緩解患者的某些醫療狀況,並為醫療專業人員提供更好、更有吸引力的培訓解決方案。

- 醫療VR技術公司也見證了VR技術平台在醫療領域的成長。例如,2021 年 11 月,疼痛管理治療虛擬實境新興企業和供應商 AppliedVR 宣布籌集 3,600 萬美元,用於增強其虛擬實境平台,以支援更多醫療保健公司。

- 該公司的虛擬平台使用護目鏡和耳機創建身臨其境的3D虛擬世界,可以幫助減輕分娩時的陣痛、減輕燒燙傷疼痛以及減輕癌症治療期間靜脈輸液期間的不適。

- 受訪的市場中的主要企業希望與競爭對手建立更多的夥伴關係。透過這種合作關係,我們可以提高 3D 虛擬平台在醫療保健領域的採用率。例如,2022 年 5 月,PrecisionOS 宣布與西門子 Healthineers 合作,推出身臨其境型虛擬實境(VR)培訓。此模組允許外科醫生和技術人員使用西門子 Health Inears 移動 3D C 臂 Cios Spin 練習術中品管和手術工作流程指導。 PrecisionOS VR 軟體可讓外科醫生在超現實環境中進行逼真的協作練習和行動。

- 同樣,2022 年 4 月,基礎手術平台 FundamentalVR 宣佈在其觸覺 VR 醫學模擬套件中添加血管內手術。這些功能為個人提供了探索患者病例、解剖結構、手術、設備等所需的動態環境,以實現他們的學習目標。

預計北美將佔據主要佔有率

- 北美見證了 3D 虛擬平台市場的巨大進步,美國和加拿大有許多重要公司的存在,為該地區的市場成長做出了貢獻。該地區主要企業擴大採用雲端和人工智慧,將進一步推動預測期內 3D 虛擬平台的成長。

- 該地區的醫療保健行業正在與市場參與企業建立合作夥伴關係,以提供增強的醫療保健解決方案。例如,2022 年 6 月,醫療培訓和績效解決方案提供者 Relias 推出了 Health Scholars,這是一項針對醫療專業人員的虛擬實境 (VR) 臨床培訓,旨在改善產科 (OB) 產品交付。

- 這將使 Seaspan 和加拿大的海洋產業能夠存取虛擬實境環境來整合、開發、測試和展示新的數位雙胞胎功能,從而改變船舶的建造、建造和維護身臨其境型。 HoloShip 使用 3D 和虛擬實境耳機,參與者可以透過耳機在船內旅行,查看其空間、設備、系統、組件和子系統並與之互動。

- 其他產業,包括航太、醫療、軍事、遊戲和零售,也在投資這項技術,以利用成長潛力。例如,2021 年 11 月,產生和運作即時 3D (RT3D) 內容的平台 Unity 最近強調了對多參與企業遊戲的高需求以及發布後內容在維持參與企業參與度方面的相關性。根據 Unity Gaming Services 代表 Unity 和 Harris Poll 進行的跨平台遊戲調查,超過一半 (56%) 的美國人在過去一年中玩過參與企業遊戲;平台遊戲。

- 此外,該地區的市場參與企業正在積極考慮投資多樣化的 VR 技術解決方案。例如,2021 年 12 月,Facebook 宣布推出 Horizon Worlds,這是一個面向北美公民的虛擬實境 (VR) 平台,朝著建構其未來的元宇宙願景邁出了一步。

- 研究市場中的公司提供先進的 3D虛擬平台相關解決方案。例如,2021 年 12 月, 元宇宙公司和擴增實境(AR) 技術供應商 Nextech AR Solutions Corp. 宣布與加拿大餐廳達成多年期元宇宙 Marketplace 協議。該公司將其虛擬活動和 Metaverse Studio 列為託管服務,其中包含 3D AR 展位、3D AR 產品體驗、人體全像圖和擴增實境廣告。

3D虛擬平台產業概況

全球 3D 虛擬平台市場似乎已被細分,許多參與企業的出現加劇了競爭。全球 3D 虛擬平台市場的主要企業正在透過收購和聯盟來擴大其影響力,覆蓋全球更多消費者。付款市場的主要企業包括 Praxilabs、Spektra Systems 和 Samaaro。

- 2022 年 4 月,全球產品開發公司 Flaxon 宣布推出 Pluto,這是一個虛擬活動平台,允許用戶在元宇宙中協作和閒逛,以馬爾地夫、火人節和奧地利阿德蒙特修道院等 3D 世界為背景。此次收購透過提供生產力和協作工具(包括即時問答應用程式 Dory)來推動公司的成長策略。

- 2022 年 3 月,NVIDIA 宣布推出一個科學數位雙胞胎平台,為實體機器學習模型提供支持,解決 100 萬 x 100 萬規模的科學和工程問題的速度比以前快很多倍。用於科學運算的加速數位雙胞胎平台由用於不斷發展的實體 ML 神經網路模型的 NVIDIA Modulus AI 框架和 NVIDIA Omniverse(TM) 3D虛擬世界模擬平台組成。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 使用案例(教育、汽車、建築、航空領域的活動策劃、模擬、會議等)

第5章市場動態

- 市場促進因素

- 更多採用數位媒體平台以擴大受眾基礎。

- 虛擬實境在教學培訓中的使用越來越多,包括對機械師、工程師、飛行員、國防人員、現場工作人員、技術人員和製造部門的培訓,推動了市場成長。

- 市場問題

- 資料隱私、安全和資料遷移是可能阻礙市場成長的挑戰。

第6章 市場細分

- 按最終用戶

- 製造業

- 運輸/物流

- 醫療保健

- 教育

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Praxilabs

- Spektra Systems LLC(Cloudlabs AI)

- Samaaro

- PandaMR

- MootUp(Hyperspace)

- 3D Bear

- Outreal XR

- Holo-SDK

- Wevr

- Worldviz, Inc

- Aviantet

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 91205

The Global 3D Virtual Platform Market is expected to register a CAGR of 13.5% during the forecast period.

Key Highlights

- Virtual Reality is the usage of software technology, primarily to create a simulated environment. VR places the user inside an experience, which means instead of viewing a monitor screen in front of them, users are immersed and can interact with the 3D world. Technology has transformed the world by simulating as many senses as possible, such as vision, touch, hearing, and even smell.

- The 3D virtual platform offers users a partially virtual environment. The platform is equipped with semi-immersive technology offering realism through 3D graphics. This virtual Reality is fundamentally used for the conduction of events and educational or training purposes. It relies on high-resolution displays, projectors, powerful computers, or hard simulators to partially reproduce the form and functionality of real-world machinery.

- The healthcare industry has also adopted the 3D virtual reality technology in an intrinsic manner where some high-grade institutions have been using the images a computer has generated to do multiple types of diagnoses. For instance, In June 2022, Novard, a healthcare technology provider, announced that VisAR, an augmented reality surgical navigation system from healthcare technology, received FDA approval for precision-guided intraoperative spine surgery. It transformed a patient's imaging data into a 3-dimensional hologram visible through an optical visor and superimposed onto the patient with submillimeter accuracy.

- In June 2022, Qatar Airways announced to soon introduce new features in its metaverse platform, QVerse. The company plans to integrate 'NFTs ticket purchases and more into its virtual reality platform. The platform was created using Epic Game's Unreal Engine, which is one of the enhanced 3D creation tools.

- The COVID-19 pandemic has boosted the digital transformation of industries, and companies are focusing more on a digital platform to interact with their clients and customers. Virtual reality can also capture various office environments as the conferences can take place on virtual reality platforms, and multiple brands and product launches can be conducted through it. The education and healthcare sector is also targeted as they are the industry getting high digital transformation in this pandemic. For Instance, In January 2020, Federal Emergency Management Agency (FEMA) launched a virtual reality experience called IMMERSED. The new system could create an experience of actual flood-like situations which can help the authorities to plan the mitigation. The action taken through the virtual property can reduce the loss of life and property. Such use of virtual reality for disasters will help in providing adverse solutions during the pandemic situation.

3D Virtual Platform Market Trends

Healthcare Industry to Drive Market Growth

- The healthcare industry is witnessing increased demand for 3D virtual platforms to ease certain healthcare conditions of patients and provide better and more engaging training solutions for healthcare professionals.

- Medical VR technology companies have also witnessed the growth of VR technology platforms in the Healthcare sector. For instance, In November 2021, AppliedVR, a startup and a provider of therapeutic virtual reality for pain management, announced that they had raised USD 36 million to enhance its virtual reality platform to support even more health care companies.

- The company's Virtual platform uses goggles and headsets to create an immersive, 3D virtual world aiming toward reducing labor pains during childbirth and reducing the pain from burns to discomfort experienced undergoing infusions during cancer treatment.

- Major players in the studied market are looking forward to adopting more partnerships with competitors. Through this collaboration, the company can increase the adoption of the 3D virtual platform in healthcare. For instance, In May 2022, PrecisionOS announced a partnership with Siemens Healthineers to provide immersive virtual reality (VR) training. The module allows surgeons and technicians to practice using Siemens Healthineers' mobile 3D C-arm Cios Spin for intraoperative quality control and surgical workflow guidance. PrecisionOS' VR software will enable surgeons to practice and behave authentically and collaboratively in a hyper-realistic environment.

- Similarly, In April 2022, FundamentalVR, a Fundamental Surgery platform, announced the addition of endovascular surgery to its suite of haptic VR medical simulations. These features ensure that individual is provided with the dynamic environment needed to explore patient cases, anatomy, procedures, devices, and more to attain their learning goals.

North America is Expected to Hold a Major Share

- North America is witnessing many advancements in the 3D virtual platform market as numerous significant companies are present in the US and Canada, contributing to the regional market's growth. The increasing adoption of cloud and artificial intelligence by key players across the region will further drive growth in the 3D virtual platform in the forecast period.

- The healthcare sector in the region is experiencing partnerships with market players to provide enhanced medical solutions. For instance, In June 2022, Relias, Healthcare Training and Performance Solutions provider, announced a partnership with Health Scholars, the virtual reality (VR) clinical training for healthcare professionals to improve obstetrics (OB) product offerings.

- Furthermore, In March 2022, Seaspan Shipyards announced the launch of its new HoloShip facility, an immersive visualization system that allowsSeaspan and the Canadian marine industry community to access a virtual reality environment to integrate, develop, test, and demonstrate new digital twin capabilities and transform how ships are constructed, built, and maintained. The Holoship uses 3D and virtual reality headsets, through which participants are transported onto the ship, offering the ability to view and interact with the space and the equipment, systems, components, and subsystems.

- Other industry verticals, including aerospace, healthcare, military, gaming, and retail, are investing in this technology to take advantage of the growth potential. For instance, In November 2021, Unity, a platform for generating and operating real-time 3D (RT3D) content, recently released two reports detailing the high demand for multiplayer games and the relevance of post-launch content in maintaining player engagement. Over half of all Americans (56%) played multiplayer games in the last year, with 87% of those gamers playing cross-platform games, according to Unity Gaming Services' Cross-Platform Gaming Study, performed on behalf of Unity by The Harris Poll.

- Moreover, the market players in this region are actively looking to invest in diverse VR technology solutions. For instance, In December 2021, Facebook announced the launch of its Horizon Worlds virtual-reality (VR) platform for the citizens of North America, to put a step forward to build its metaverse vision for the future.

- Companies in the studied market are providing advanced 3D virtual platform-related solutions. For instance, In December 2021, Nextech AR Solutions Corp, a Metaverse Company and a provider of augmented reality technologies, announced a multi-year, Metaverse marketplace deal with Restaurants Canada. It will offer the company's virtual events and Metaverse Studio as a managed service, incorporating 3D AR booths, 3D AR product experiences, human holograms, and augmented reality ads.

3D Virtual Platform Industry Overview

The Global 3D Virtual Platform market appears to be fragmented owing to the availability of the large number of players intensifying the competition. Major players in the Global 3D Virtual Platform market are adopting acquisitions and partnerships to expand their reach to more consumers worldwide. Some of the major companies in the payments market are Praxilabs, Spektra Systems, and Samaaro, among others.

- In April 2022, Fluxon, a global product development firm, announced the acquisition of Pluto, a virtual event platform through which users can collaborate and hang out in metaverse, in 3D worlds such as the Maldives, Burning Man, or Admont Abbey in Austria. The acquisition is adding to the company's growth strategy by offering productivity and collaboration tools, including the real-time Q&A application, Dory.

- In March 2022, NVIDIA announced a platform for scientific digital twins that promotes physics machine-learning models to solve million-x scale science and engineering problems multiple times faster than earlier. The accelerated digital twins' platform for scientific computing comprises the NVIDIA Modulus AI framework for advancing physics-ML neural network models and the NVIDIA Omniverse(TM) 3D virtual world simulation platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Use Cases (Education, automotive, construction, aviation sectors vis-a-vis event planning, simulations, meeting, etc)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing adoption of digital media platform to expand audience base.

- 5.1.2 Growing usage of virtual reality in instructive training, such as for training mechanics, engineers, pilots, soldiers in defense, field workers, and technicians, and manufacturing sectors is driving the market growth

- 5.2 Market Challenges

- 5.2.1 Data privacy, security, and data migration are some challenges that are likely to impede the growth of the market

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Manufacturing

- 6.1.2 Transport & Logistics

- 6.1.3 Healthcare

- 6.1.4 Education

- 6.1.5 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Praxilabs

- 7.1.2 Spektra Systems LLC (Cloudlabs AI)

- 7.1.3 Samaaro

- 7.1.4 PandaMR

- 7.1.5 MootUp(Hyperspace??)

- 7.1.6 3D Bear

- 7.1.7 Outreal XR

- 7.1.8 Holo-SDK

- 7.1.9 Wevr

- 7.1.10 Worldviz, Inc

- 7.1.11 Aviantet

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219