|

市場調查報告書

商品編碼

1632084

美洲 3D 計量:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Americas 3D Metrology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

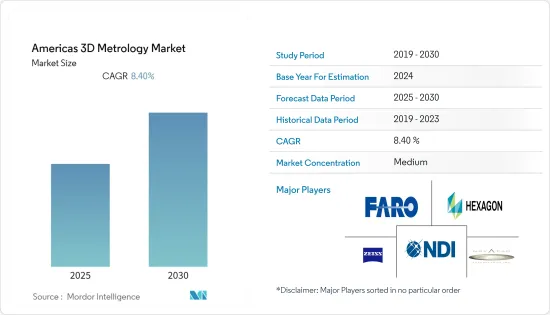

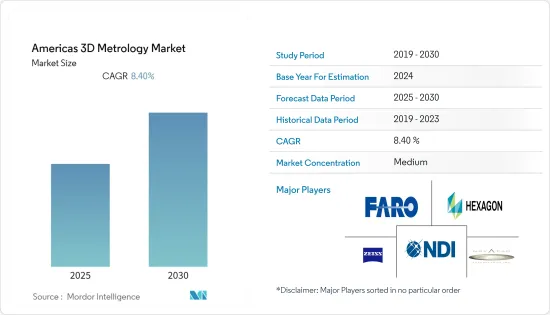

美洲 3D 計量市場在預測期內的複合年成長率預計為 8.4%。

主要亮點

- 隨著 3D資料擴大用於各行業的建模和分析,以及 3D 計量的研發 (R&D) 投資不斷增加,3D 計量市場預計將成長。

- 3D計量解決方案、可攜式CMM、機器人安裝的光學CMM掃描儀、雲端基礎的軟體應用平台和尺寸計量服務的發展導致了市場的快速成長。

- 3D 計量解決方案廣泛應用於消費和工業電子產品,以確保從致動器、智慧型手機機殼和導線架到感測器、揚聲器、智慧家居設備和白色家電的零件和產品的品質。例如,PCM Innovation 建構了 BuildIT 計量軟體,這是一種從 CAD 到零件的檢測解決方案,用於對製造零件和組件進行快速尺寸檢驗,以實現工具製造、組裝、對準、流程自動化、逆向工程和品管。

- 中小企業在安裝3D測量設備時面臨成本問題,包括測量設施成本、安裝成本和維護成本。

- 由於COVID-19的爆發嚴重影響了CMM價值鏈,不僅航太業,能源和電力產業也面臨需求低迷的情況。

美洲 3D 計量市場趨勢

產品設計的改變和工業4.0的投資增加

- 工業4.0是工業革命的新階段,製造業與資訊科技結合。

- 該行業基於高速行動網際網路、人工智慧 (AI)、方面學習、自動化、巨量資料分析、物聯網 (IoT) 以及雲端技術最新趨勢的使用而構建的互連技術基礎設施。透明度,這可以透過以下方式實現:

- 轉型浪潮正在進行,對工業發展、技能要求、全球價值鏈以及各國有效吸引工業 4.0 投資的努力產生重要影響。

- 製造工廠中使用的機器人與線上檢測系統整合,以提供即時資料分析測量。這有利於測量實驗室的測量並允許頻繁的品質檢查。工業物聯網 (IoT) 的出現刺激了自動化和線上測量的採用。

- 例如,2021 年 2 月,ABB Ltd 推出了 SWIFT cobot,這是一個協作機器人系列。

美國佔最大市場佔有率

- 該地區是福特汽車、通用汽車等眾多汽車製造商、研究機構和大型半導體公司的所在地,對3D測量設備的需求不斷增加。

- 此外,目前市場上有各種各樣的計量產品,可以單獨或組合使用用於各種目的,例如 3D 計量、品管、檢測、逆向工程以及在生產過程中最佳化產品品質。如此廣泛的應用預計將支持計量服務市場並提高其在全國的聲譽。

- 此外,由於 3D 計量在各種發電和工業應用(例如綠色鑄造、鍛造檢查、晶粒設計以及發電零件檢查)中的使用越來越多,美國的 3D 計量市場正在不斷成長,這是有原因的。 。例如,2021年8月,尼康公司宣布與美國Aeva Technologies, Inc.建立戰略合作夥伴關係,在工業和自動化應用中使用調變連續波(FMCW)技術。

- 由於該地區快速的工業化和強勁的汽車工業,預計該地區的計量服務市場將在預測期內獲得龐大的商機。

美洲 3D 計量行業概覽

美洲的 3D 計量市場適度集中,由幾家大型企業主導,包括 Hexagon AB、Faro Technologies、Zeiss、Northern Digital Inc. 和 Novacam Technologies Inc.。這些主要企業擁有重要的市場佔有率,並致力於擴大海外基本客群。

- 2022 年 5 月 - Hexagon AB 宣布收購 Vero Solutions 經銷商,擴大並加強對其在中歐的 CAM 軟體產品組合的支援。

- 2021 年 6 月 - Faro Technologies Inc. 宣布收購與硬體無關的影像擷取供應商 HoloBuilder, Inc.。此整合解決方案為數位雙胞胎市場提供全面的掃描和影像管理功能,包括機器人組裝3D 模擬、施工管理、

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 技術見解

- COVID-19對國內付款市場的影響

第5章市場動態

- 市場促進因素

- 產品設計的改變和工業4.0的投資增加

- 採用內嵌解決方案和技術進步

- 市場挑戰

- 筒倉檢測解決方案、雷射追蹤器等的更換率降低。

- 美國地區 3D 計量成長分析

第6章 市場細分

- 按成分

- 硬體

- 軟體

- 依硬體類型

- 三坐標測量機(CMM)

- 雷射追蹤儀

- 光掃描儀

- 其他

- 按最終用戶

- 航太/國防

- 車

- 建築/工程

- 製造業

- 其他

- 按國家/地區

- 美國

- 加拿大

- 其他地區(墨西哥、巴西等)

第7章 競爭格局

- 公司簡介

- FARO Technologies, Inc..

- Hexagon AB

- Zeiss(GOM)

- Northern Digital Inc

- Novacam Technologies, Inc.

- Keyence Corporation

- Nikon Metrology NV

- Automated Precision, Inc

- POLYRIX INC

- Creaform

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91207

The Americas 3D Metrology Market is expected to register a CAGR of 8.4% during the forecast period.

Key Highlights

- The growing use of 3D data for modeling and analysis in various industries and increased research and development (R&D) investments in 3D metrology is expected to grow the 3D metrology market.

- The development of 3D measurement solutions, portable CMM, robot-mounted optical CMM scanners, cloud-based software application platforms, and dimensional metrology services led to high growth in the market.

- 3D metrology solutions are widely used across consumer and industrial electronics sectors to ensure the quality of parts and products, ranging from actuators, smartphone enclosures, and lead frames to sensors, speakers, smart home devices, and white goods; for instance, PCM Innovation has built BuildIT Metrology Software which is a CAD-to-part inspection solution that enables quick and easy dimensional verification of manufactured parts and assemblies for tool building, assembly, alignment, process automation, reverse engineering, and quality control.

- Small- and medium-sized enterprises are facing cost issues while setting up a 3D metrology facility as it includes measuring equipment cost, installation cost, and maintenance cost, which is an extensive investment for enterprises.

- Due to the COVID-19 outbreak has had a significant impact on the CMM value chain, the energy and power industries, as well as the aerospace industry, are experiencing low demand, which is expected to continue in the short term due to the global slowdown.

Americas 3D Metrology Market Trends

Changing Product Designs and Growing Investments in Industry 4.0

- Industry 4.0 is a new phase of the industrial revolution, which has linked the manufacturing sector and information technology.

- The Industry provides transparency across all aspects of business which can be enabled by an interconnected technological infrastructure built on recent developments in high-speed mobile internet, artificial intelligence (AI), machine learning, automation, use of big data analytics, and the internet of things (IoT), and cloud technology.

- The wave of transformation is ongoing with important implications for industrial development, skills requirement, global value chains, and efforts of countries to attract investment in Industry 4.0 effectively.

- The robots used in manufacturing plants are integrated with in-line inspection systems to provide real-time data analysis measurements. This enables easy measuring in the measurement labs and frequent quality testing. The advent of the Industrial Internet of Things (IoT) is fueling the adoption of automation and in-line metrology.

- For instance, In February 2021, ABB ltd launched SWIFT cobot, a collaborative robot family wi safety measures and ease of use with speed for various applications, including manufacturing and logistics.

United States to hold largest Market share

- The presence of numerous automobile manufacturers such as Ford Motors, General Motors, research institutes, and huge semi-conductor corporations in the region has enlarged the demand for 3-Dimensional metrology equipment, along With a strong presence of pharmaceutical, automotive, and aerospace equipment manufacturers, the United States leads the region's 3D metrology market.

- Moreover, at present, there is a wide range of metrology products available in the market which are being utilized individually or in combination for different purposes such as 3D measurement, quality control, inspection, reverse engineering, and product quality optimization in the production processes. This wide range of applications is projected to help the metrology services market and gain valuation across the country.

- Furthermore, the 3D metrology market has witnessed growth in the united states due to the increased usage of 3D metrology in various power generation and industrial applications such as raw casting, forging inspection, mold & die design, and inspection of power generation components. For instance, In August 2021, Nikon Corporation announced a strategic collaboration with US firm Aeva Technologies, Inc. to use Frequency Modulated Continuous Wave (FMCW) technology in industrial and automation applications.

- The metrology services market in the region is prognosticated to gain sizable business opportunities during the forecast period, owing to a surge in industrialization and robust automotive industry in the region.

Americas 3D Metrology Industry Overview

The Americas 3D Metrology Market is moderately concentrated and dominated by a few major players like Hexagon AB., Faro Technologies., Zeiss., Northern Digital Inc., and Novacam Technologies Inc. These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries.

- May 2022 - Hexagon AB announced the acquisition with the Distributor of Vero Solutions, which expands and strengthens Central European support for the CAM software portfolio.

- June 2021- Faro Technologies Inc has announced the acquisition of HoloBuilder, Inc. to deliver hardware-agnostic image capture; the combined solution will provide comprehensive scanning and image management capabilities for the Digital Twin market, including robotic assembly 3D simulation, construction management,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Insights

- 4.4 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Changing product designs and growing investments in industry 4.0

- 5.1.2 Adoption of in-line solutions and Technological advancements

- 5.2 Market Challenges

- 5.2.1 Slower replacement rates | Siloed Inspection Solutions, laser trackers etc.

- 5.3 Analysis of the growth of 3D metrology of region of united states

6 Market Segmentation

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Hardware Type

- 6.2.1 Coordinate Measuring Machine (CMM)

- 6.2.2 Laser Tracker

- 6.2.3 Light Scanners

- 6.2.4 Others

- 6.3 By EndUser

- 6.3.1 Aerospace & Defense

- 6.3.2 Automotive

- 6.3.3 Construction & Engineering

- 6.3.4 Industrial Manufacturing

- 6.3.5 Others

- 6.4 By Country

- 6.4.1 United states

- 6.4.2 Canada

- 6.4.3 Rest of America (Mexico, Brazil among others)

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 FARO Technologies, Inc..

- 7.1.2 Hexagon AB

- 7.1.3 Zeiss (GOM)

- 7.1.4 Northern Digital Inc

- 7.1.5 Novacam Technologies, Inc.

- 7.1.6 Keyence Corporation

- 7.1.7 Nikon Metrology NV

- 7.1.8 Automated Precision, Inc

- 7.1.9 POLYRIX INC

- 7.1.10 Creaform

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219