|

市場調查報告書

商品編碼

1632088

針對特定應用的電腦類比IC的全球市場佔有率分析、行業趨勢和統計數據以及成長預測(2025-2030)Global Application Specific Computer Analog IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

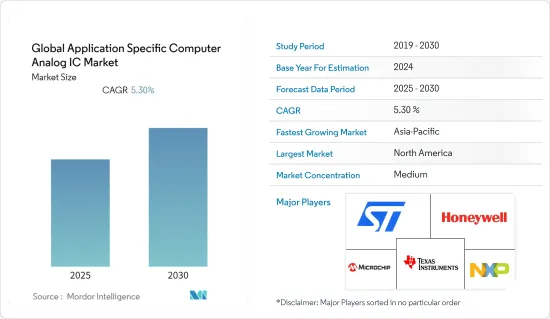

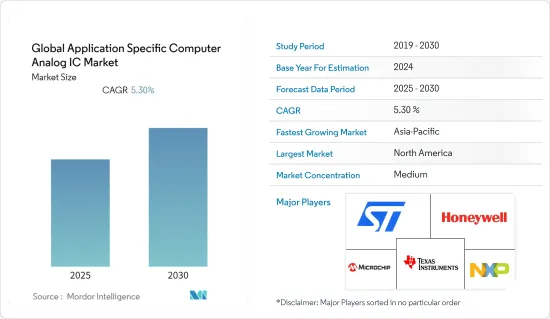

專用電腦類比IC的全球市場預計在預測期內複合年成長率為 5.3%

主要亮點

- 專用電腦類比類比IC是專門為特定應用而開發的積體電路 (IC)。現在可以使用現代處理技術(IC 的基本組件)來製造具有超過 10 億個電晶體的 ASIC。可用電晶體的數量令人難以置信,需要非常複雜和強大的設計才能在 ASIC 中實現。

- LED 驅動器、時序控制器、射頻 (RF) 收發器、串列器/解串器 (SerDes)、觸控感應器、顯示驅動器等都是一些專用類比類比IC。通用類比積體電路 (IC) 用於多種應用,包括擴大機、比較器和資料轉換器。

- 專用晶片主要用於家用電子電器和通訊設備,但它們在汽車領域也佔有重要地位。由於家用電子電器的需求和生產不斷增加,該市場在整個預測期內可能會擴大。同時,智慧型手機和穿戴式裝置的需求正在推動專用電腦類比IC市場的需求。

- 自訂電路製造成本高、電路設計成本高、功能可靠性困難等是影響專用積體電路市場成長的主要限制因素。

- COVID-19 情況影響了包括積體電路業務在內的許多行業。大多數國家的死亡率和受傷率都在上升。因此,在線工作的需求不斷增加,對新技術的需求不斷增加。此外,市場分析正在推動自動化技術以令人難以置信的速度執行其適當功能的能力。然而,疫情的爆發清楚地表明,所有行業的財務回報都在惡化。因此,生產和供應鏈產業致力於描繪未來幾年市場成長的恢復改善。

特定應用電腦的類比IC市場趨勢

消費性電子和汽車產業推動市場成長

- 全球專用電腦類比IC市場機會不斷湧現,前景看好。因此,我們能夠透過對存取記憶體的初步評估以及車輛感測器和網際網路通訊協定核心的平穩運行,更深入地了解當前趨勢。因此,可以得出結論,這個特定市場正在實施最佳化業務並保持競爭優勢的計劃。該應用的一個關鍵因素是消費性電子產業不斷成長的需求。

- 智慧電子產品中使用的物聯網等技術的擴展預計將在幾乎所有行業領域中採用,這將推動未來的成長。新興經濟體的政府措施正在鼓勵發展更多的電子製造單位並增加其全球類比IC市場佔有率。

- 交通燈指示器和資料通訊等 LED 應用擴大利用類比積體電路來提高電源效率,從而推動市場成長。類比積體電路在醫療電子領域的使用以及住宅和商業建築中的綠色能源管理將推動全球IC產業的發展。汽車領域電子產品的使用,例如複雜的引擎和安全控制、導航、音訊/視訊系統、混合動力驅動器和 LED 照明,正在推動類比IC市場的需求。美國、澳洲、挪威、法國和德國等國家汽車產業的進步預計將對類比IC市場的成長產生正面影響。

- ADAS(高級駕駛輔助系統)領域預計在預測期內將以更快的年複合成長率發展。 IC 等汽車積體電路的使用越來越多,可確保該應用中駕駛員和車輛的安全。此外,先進駕駛輔助系統在汽車領域的日益普及預計將加強車載積體電路的使用,進一步加速該類別的市場發展。

亞太地區佔最大市場佔有率

- 亞太地區是一個快速成長的市場,擁有大量電子元件製造商。此外,該地區不斷成長的精通技術的客戶群也推動了該行業的發展。此外,智慧型手機和電腦硬體在該地區越來越受歡迎,推動了該行業的發展。對輕型、緊湊型電子設備日益成長的需求正在推動專用電腦類比IC市場的成長。

- 此外,對乘客安全的日益關注以及政府對車輛法規的有利舉措也是推動亞太特定應用電腦類比IC市場成長的關鍵因素。

- 政府正在投資開發半導體市場。例如,2021年12月,印度政府批准“建立氮化鎵(GaN)生態系統支援中心和高功率射頻電子培養箱”,以促進半導體製造。該計劃由位於班加羅爾奈米科學與工程中心 (CeNSE) 的創新與發展協會 (SID) 在印度科學研究所 (IISc) 的支持下實施,總成本為 29.866 億印度盧比。

- 隨著中國經濟的不斷擴張以及雲端運算、5G、物聯網、人工智慧(AI)、智慧汽車、聯網汽車等新應用的出現,中國積體電路市場的需求預計將持續成長。工業與資訊化部電子資訊司司長喬躍山表示,「十三五」期間,中國積體電路產業成長率達到全球成長速度的4倍。

專用電腦類比IC產業概述

全球專用電腦類比IC市場高度細分。市場競爭十分激烈。為了在競爭環境中生存,公司正在積極投資電腦類比IC的開發。該市場的主要企業包括意法半導體、德州儀器、Microchip Technology 和霍尼韋爾國際公司。

- 2022年3月,義法半導體發布了用於下一代衛星的新版本2.5V耐輻射數位類比轉換器。 STMicroElectronics 的 RHRDAC121 耐輻射數位類比轉換器 (DAC) 工作電壓為 2.5V,可用於現今無法使用傳統 3.3V 元件的低功耗系統設計。

- 2022 年 4 月,意法半導體的 AMOLED 電源管理 IC 提高了行動裝置的顯示品質和電池壽命。意法半導體用於 AMOLED 顯示器的新型全整合電源管理 IC (PMIC) 結合了更低的靜態電流和更大的靈活性,可延長行動裝置的電池壽命。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 對產業的影響

第4章市場動態

- 市場促進因素

- 對先進家用電子電器產品的需求不斷成長

- 透過人工智慧和機器學習功能擴大專用類比電腦積體電路市場

- 市場限制因素

- 類比積體電路的複雜設計可能會阻礙全球市場的成長

第5章市場區隔

- 按地區

- 美洲

- 歐洲

- 日本

- 中國

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Texas Instruments Incorporated

- Intel Corporation

- Renesas Electronics Corporation

- STMicroelectronics NV

- Infineon Technologies AG

- Analog Devices, Inc.

- Qualcomm, Inc.

- Maxim Integrated Products Inc.

- ON Semiconductor

- NXP Semiconductors

- Skyworks Solutions, Inc.

- Broadcom Corporation

- Taiwan Semiconductor Co., Ltd.

- Microchip Technology

- Honeywell international inc

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 91220

The Global Application Specific Computer Analog IC Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- An Application-Specific Integrated Circuit (ASIC) is an integrated circuit (IC) developed explicitly for a specific application. ASICs with over one billion transistors can now be produced using modern processing techniques (the basic building block of an IC). Because of the incredible amount of transistors available, extremely sophisticated and powerful designs need to be implemented on an ASIC.

- LED drivers, timing control, radio frequency (RF) transceivers, Serializer/Deserializer (SerDes), touch sensors, and display drivers are some of the application-specific analog ICs. General-purpose analog integrated circuits (ICs) are utilized in various applications such as amplifiers, comparators, and data converters.

- Application-specific chips are primarily utilized in consumer electronics and communications equipment, but they also have a considerable presence in the automobile sector. This market will likely expand throughout the forecasted period due to rising consumer electronics demand and production. Simultaneously, demand for smartphones and wearables is driving demand for this Application Specific Computer Analog IC Market.

- The high cost of manufacturing custom circuits, circuit design costs, and functional reliability difficulties will be the primary restraints that will affect the growth of the Application Specific Integrated Circuit Market.

- The COVID- 19 scenario has impacted numerous industries, including the integrated circuit business. It has been shown that the death and injury rates have increased in the majority of nations. As a result, there has been an increase in the need for online work, and the requirement for new technology is growing. Furthermore, the market analysis has boosted the functioning of automated technologies for proper functioning at an incredible pace. Despite this, it has been seen that the financial profits of all industries have suffered due to the pandemic outbreak. As a result, it devotes itself to portraying that the production and supply chain industry has resumed improved market growth in the coming years.

Application Specific Computer Analog IC Market Trends

Consumer Electronics and Automotive Industry drive growth towards the market

- The opportunity arises, which leads to possible prospects within the worldwide regional ASIC market. As a result, the automobile sensor and its access memory towards the internet protocol cores and its initial assessment of the smooth working have provided a deeper grasp of the current trends. As a result, it can be concluded that this specific market optimizes its operations and has implemented a plan for maintaining a competitive advantage. The application's primary element is the increasing consumer electronics industry demand.

- The expansion of technologies such as the Internet of Things is used in smart electronic devices that are predicted to be employed in practically all industrial verticals, which will drive growth in the future. The emerging economies with government policies encourage the development of more electronic manufacturing units to increase the global analog IC market share.

- The increased usage of analog integrated circuits in LED applications such as traffic light indicators and data communication systems for power efficiency is likely to fuel market growth. The use of analog integrated circuits in medical and healthcare electronics and green energy management for residential and commercial buildings or premises propels the worldwide IC industry. The vehicle sector's usage of electronics in complex engine and safety controls, navigation, audio/video systems, hybrid electric drives, and LED lighting is likely to fuel Analog IC market demand. The advancement of the automotive sector in nations such as the United States, Australia, Norway, France, and Germany is predicted to impact the Analog IC market growth positively.

- The Advanced Driver Assistance System sector is expected to develop at a faster compound annual growth rate during the forecast period. The rising use of automotive integrated circuits, such as ICs, assures the safety of drivers and vehicles in this application. Furthermore, the growing use of sophisticated driver assistance systems in the automotive sector will enhance the use of automotive integrated circuits, accelerating the market development of this category even further.

Asia-Pacific to Hold the Largest Market Share

- The Asia-Pacific is the fastest-growing market that has witnessed the widespread presence of electronic component manufacturers. Furthermore, the region's growing tech-savvy customer base propels the industry. Moreover, the region's increased penetration of smartphones and computer hardware drives the industry. The growing need for lightweight and small electronic gadgets drives the application-specific computer analog IC market growth.

- Additionally, rising passenger safety concerns and favorable government initiatives regarding vehicle regulations are some of the important factors driving the growth of the APAC application-specific computer analog IC Market.

- The government is investing money in developing the semiconductor market. For Instance, In December 2021, the Indian government authorized the 'Establishment of Gallium Nitride (GaN) Ecosystem Enabling Centre and Incubator for High Power and High-Frequency Electronics' to boost semiconductor manufacturing. The project is being carried out by Society for Innovation and Development (SID) at the Centre for Nano Science and Engineering (CeNSE), Bengaluru, under the auspices of the Indian Institute of Science (IISc) at a total cost of Rs 298.66 crore.

- With the constant expansion of China's economy and new applications such as cloud computing, 5G, Internet of Things, artificial intelligence (AI), and intelligent and connected cars, demand for China's integrated circuit market is expected to continue growing. Qiao Yueshan, head of the electronic information department at China's Ministry of Industry and Information Technology, said China's Integrated Circuit Industry growth rate was four times the world growth rate during the country's 13th Five-Year Plan period.

Application Specific Computer Analog IC Industry Overview

The Global Application Specific Computer Analog IC Market is highly fragmented. The market is quite competitive. Companies are progressively investing in developing computer analog ICs to sustain themselves in the competitive environment. Key players in the market are STMicroelectronics N.V, STMicroelectronics N.V, Texas Instruments Incorporated, Microchip Technology, and Honeywell International Inc.

- In March 2022, STMicroelectronics released a new version of a 2.5V rad-hard digital-to-analog converter for next-generation satellite applications. The RHRDAC121 radiation-hardened digital-to-analog converter (DAC) from STMicroelectronics runs at 2.5V for usage in current, low-power system designs that older 3.3V components cannot support.

- In April 2022, The AMOLED power-management IC from STMicroelectronics improves viewing quality and battery life in portable devices. The new fully integrated Power-Management IC (PMIC) from STMicroelectronics for AMOLED displays combines a low quiescent current with more flexibility to prolong the battery life of portable devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Technology Snapshot

- 3.4 COVID-19 impact on the Industry

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing demand for advanced consumer electronics products

- 4.1.2 Artificial Intelligence and Machine learning capabilities to expand application specific analog computer Integrated Circuit Market

- 4.2 Market Restraints

- 4.2.1 Complex designing of analog integrated circuits is expected to hinder the global market growth

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 Americas

- 5.1.2 Europe

- 5.1.3 Japan

- 5.1.4 China

- 5.1.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Texas Instruments Incorporated

- 6.1.2 Intel Corporation

- 6.1.3 Renesas Electronics Corporation

- 6.1.4 STMicroelectronics N.V

- 6.1.5 Infineon Technologies AG

- 6.1.6 Analog Devices, Inc.

- 6.1.7 Qualcomm, Inc.

- 6.1.8 Maxim Integrated Products Inc.

- 6.1.9 ON Semiconductor

- 6.1.10 NXP Semiconductors

- 6.1.11 Skyworks Solutions, Inc.

- 6.1.12 Broadcom Corporation

- 6.1.13 Taiwan Semiconductor Co., Ltd.

- 6.1.14 Microchip Technology

- 6.1.15 Honeywell international inc

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219