|

市場調查報告書

商品編碼

1632105

歐洲智慧卡:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

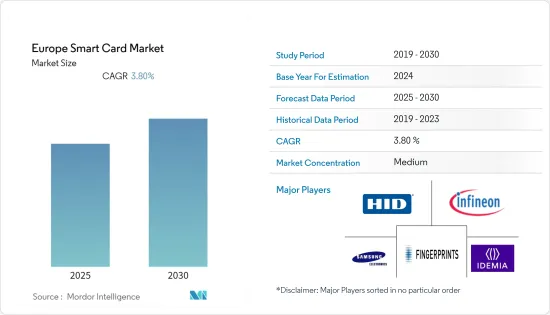

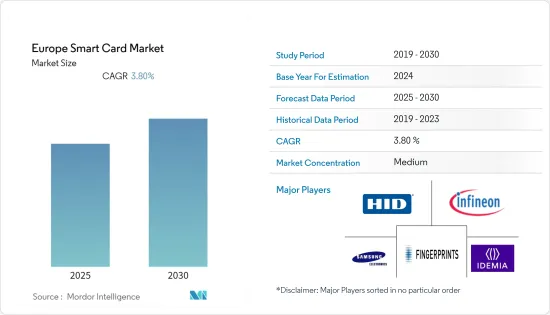

歐洲智慧卡市場預計在預測期內複合年成長率為 3.8%

主要亮點

- 物聯網和自動化技術的進步正在推動智慧卡市場的成長。智慧卡的常見範例有 Visa、MasterCard 和 Europay。高所得族群非常不喜歡攜帶現金的負擔,因此非常喜歡智慧卡。預計這將有助於未來幾年智慧卡市場的成長。

- 歐洲國家主導著醫療保健和健康保險系統,智慧卡在該地區的採用要早得多。歐盟委員會決定要求跨境醫療服務以卡片為基礎,以取代紙本 E-111 表格,導致其使用量激增。

- 作為業務擴張的一部分,公司正在關注新的智慧卡創新,這正在推動市場成長。例如,2022年4月,IDEX Biometrics ASA宣布與智慧卡技術和創新公司E-Kart合作,在東歐將生物辨識付款解決方案商業化。 E-Kart 和 IDEX Biometrics 之間的合作將滿足東歐對生物辨識智慧卡日益成長的需求,目標是在 2022 年第四季之前向發行人交貨。

- IC卡的問題之一是利用卡片或系統的設計或實現缺陷引起的漏洞進行攻擊。這些漏洞往往在駭客社群內共用,因為它們很容易被利用和複製。然而,這個問題可以透過對IC卡製造和分銷進行適當的監控和審核來解決。

- 在 COVID-19 大流行期間,智慧卡為醫療保健產業帶來了福音,智慧卡幫助醫療保健提供者保持患者照護的效率和隱私保護。智慧卡的優點還包括即時病患驗證、保險處理等。

歐洲智慧卡市場趨勢

智慧卡在醫療保健和教育領域的採用不斷增加

- 歐洲醫療保健系統採用智慧卡的時間比美國早得多。歐盟委員會決定要求跨境醫療服務以卡片形式取代紙本 E-111 表格,導致其使用量激增。在醫療智慧卡的特性和功能(尤其是安全性)方面,法國等國家處於領先地位。智慧卡技術不斷進入新的應用領域。應用程式隨著應用程式的安全需求而成長,包括敏感資訊、文件和憑證。

- 清晰、安全的線上管理實踐以及讓學生觸手可及的資訊對於提高整個歐洲的學生流動性至關重要。透過 Erasmus+ 行動應用程式,歐洲學生卡計劃將開發一個線上一站式商店,學生可以在其中管理與其旅行期間(住宿之前、期間和之後)相關的所有文書工作。這將確保學生獲得體驗優質國際流動體驗所需的所有資訊。

- 2021 年 11 月,歐盟委員會宣布癌症倖存者智慧卡的運作。這種智慧電子卡甚至以應用程式的形式出現,它允許患者與醫療專業人員聯繫,包括倖存者的醫生。

- 這張智慧卡由 EU4Health 計畫資助,是歐盟委員會「為癌症患者改善生活」舉措的一部分。歐盟委員會旨在透過這項技術加強醫療專業人員和患者之間的溝通。

- 同樣,2021 年 2 月,IDEMIA 聲稱是德國第一家提供三種採用新時代技術(名為 Generation 2.1)的健康卡的供應商。這些整合了 NFC 功能的智慧卡將促進包括醫療保健專業人員和患者在內的所有用戶的高效醫療通訊,IDEMIA 致力於支援德國醫療保健的數位化,將發揮重要作用。

非接觸感應卡的採用率增加

- 非接觸式科技正在發展成為日常生活的重要部分。接觸型智慧卡可以執行卡片上功能,安全地保存、存取和收集卡片上的資料,並與接觸型智慧卡讀卡機互動。多個最終用戶行業對可靠、安全的非接觸式付款選項的需求不斷成長,預計將成為推動該地區非接觸式智慧卡成長的因素。

- 2020 年 5 月,智慧付款產業協會智慧付款協會 (SPA)付款歐洲各地商店和零售商的銷售點 (POS) 終端付款的客戶擴展即時即時信用付款提案。 SPA 的新提案將允許消費者使用接觸式或非接觸式功能在商店進行即時轉帳。

- 智慧卡預計將在法國消費者的錢包中繼續變得更加流行。儘管Apple Pay和Android Pay等行動付款管道被採用,但實體商店付款的接受率已經放緩。另一方面,非接觸感應卡具有更大的吸引力。

- 2022 年 3 月,半導體、區塊鏈和物聯網公司 WISKey International Holding Ltd. 宣布將與 Identiv 重振並擴大其智慧卡讀卡機業務。 2022年,該公司將以超過100萬美元的價格向Identiv供應高階智慧卡讀卡機晶片。此合作關係擴展到 Identiv 的接觸式、非接觸式和雙介面智慧卡讀卡器,適用於醫療、製藥、政府和教育應用。

- 此外,Fingerprint Cards AB 於 2021 年 7 月進行的一項調查發現,2020 年,超過 80% 的法國消費者認為非接觸式付款卡易於使用。法國和英國是第一個推出非接觸式付款卡的國家。此外,調查表明,這也不是一種短期時尚,64% 的法國消費者希望更多地採用非接觸式方式。

歐洲智慧卡產業概況

歐洲智慧卡市場競爭激烈,該地區的領導企業為電子商務市場的各種最終用戶開拓了新的解決方案。該公司也正在進行投資並建立夥伴關係,以發展其在該地區的業務,並為消費者提供安全可靠的智慧卡。

- 2021 年 10 月 - 英飛凌推出採用 40 奈米技術的全新 SECORA Pay 產品組合,具有一流的非接觸式效能。該解決方案透過各種解決方案使非接觸式付款更加安全,包括先進的 Java 卡技術、預授權付款選項、智慧配件和穿戴式裝置以及對 Visa、Mastercard、Discover 和 American Express 的付款支援。

- 2021 年 3 月 - IDEMIA、G+D 和 NXP 聯合智慧卡和線上付款營運商,響應全球對國內和自有品牌付款品牌的下一代付款解決方案的需求,推出公平地提供非接觸式充電的WLA(白標聯盟)。 WLA制定並更新開放、全面的付款標準,支援快速部署涵蓋接觸式和非接觸式付款卡等的雙介面付款解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19對國內付款市場的影響

第5章市場動態

- 市場促進因素

- 旅行和旅遊業的成長正在推動市場

- 非接觸式付款需求增加

- 市場問題

- 隱私和安全問題、標準化問題

第6章 市場細分

- 按類型

- 接觸式

- 非接觸式

- 按行業分類

- BFSI

- 資訊科技/通訊

- 政府機構

- 運輸

- 其他最終用戶產業(教育、醫療保健、娛樂等)

- 按國家/地區

- 英國

- 德國

- 法國

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- Bundesdruckerei GmbH

- Secura Key

- Gemalto NV(Thales Group)

- Giesecke & Devrient GmbH(MC Familiengesellschaft GmbH)

- Idemia France SAS

- Infineion Technologies AG

- Fingerprint Cards AB

- Samsung Electronics Co., Ltd.

- CardLogix Corporation

- HID Global Corporation

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91330

The Europe Smart Card Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- Improvements in IoT and automation technologies drive the growth of the smart card market. Common examples of smart cards are Visa, MasterCard, and Europay. High-income people are very reluctant to take on the burden of carrying cash, so they are very fond of smart cards. This will contribute to the growth of the smart card market over the next few years.

- The European states dominated the healthcare and health insurance system, smart cards were adopted much earlier in this region. The European Commission's decision to mandate the introduction of a card-based alternative to the paper E-111 form for cross-border healthcare has led to explosive growth in its use.

- Companies are focsued on innovating new smart card as part of the business expansions by collaborating which is driving the market growth. For instance, in April 2022, IDEX Biometrics ASA announces collaboration with smart card technology and innovation company E-Kart to commercialize biometrics payment solutions in Eastern Europe. The collaboration between E-Kart and IDEX Biometrics allows demand growth for biometric smart cards in Eastern Europe, with targeted delivery to issuers by Q4 2022.

- One of the issues with smart cards is an attack that exploits a vulnerability caused by a poorly designed or implemented card or system. These vulnerabilities tend to be easier to exploit, replicate, and therefore share within the hacking community. However, proper monitoring and auditing of smart card manufacturing and distribution can resolve this issue.

- During the COVID-19 pandemic, smart cards benefited the healthcare sector, smart cards helped assist the healthcare providers in maintaining the efficiency of patient care and privacy safeguards. The benefits of smart cards also include instant patient verification, insurance processing, and more.

Europe Smart Card Market Trends

Healthcare and Education To Witness Rise In Adoption of Smart Cards

- The European health and health insurance system adopted smart cards much earlier than the United States. The European Commission's decision to mandate the introduction of a card-based alternative to the paper E-111 form for cross-border healthcare has led to explosive growth in its use. Countries like France is one of the leaders in the features and capabilities of healthcare smart cards, especially regarding security. Smart card technology is continually finding its way to new applications. The application grows according to the application's security needs with important information, documents, and credentials.

- Straightforward and secure online administrative practices and putting information at students' fingertips are essential to boosting student mobility across Europe. The European Student Card Initiative will develop an online one-stop-shop through the Erasmus+ Mobile App for students to manage all administrative steps related to their mobility period - before, during, and after their stay. It will allow students to find all the information they need to experience a high-quality mobility experience abroad.

- In November 2021, the European Commission announced that it operates on a Cancer Survivor Smart Card. The smart eCard, which even comes in the form of an app, will permit patients to associate with medical specialists, including the survivor's general practitioner.

- Funded by the EU4Health Program, the smart card is part of the commission's Better Life for Cancer Patients Initiative. With this technology, the European Commission seeks to enhance communication between healthcare professionals and patients.

- Similarly, in February 2021, IDEMIA claims to be the first supplier to provide Germany with three different health cards, all based on the new era of technology labeled generation 2.1. Integrating NFC capabilities, these smart cards will drive health care communication efficiently for all users, both the medical profession and the patients, making IDEMIA play a major role in supporting the digitalization of health care in Germany.

Increase In The Adoption of Contactless Cards

- Contactless technology has evolved into a major part of daily lives. A contactless smart card can perform on-card functions, securely hold, access, and collect data on the card and interact with a contactless smart card reader. The growing demand for reliable and secure contactless payment options across several end-user industries is anticipated to be a factor that drives the growth of contactless smart cards in the region.

- In May 2020, the Smart Payment Association (SPA), the body of the smart payments industry, published proposals for an Instant Payment Card that would expand SEPA instant Credit Transfer functionality to customers paying at the point of sale (POS) terminals in stores and retail outlets across Europe. Under new proposals from SPA, real-time transfers can be made available to consumers in-store using contact or contactless functionality

- The adoption of smart cards is expected to keep on growing in the wallets of French consumers. Despite the introduction of mobile payment platforms such as Apple Pay and Android Pay, the acceptance rate of actual point-of-sale payments is slowing. Contactless cards, on the other hand, have much greater traction.

- In March 2022, WISKey International Holding Ltd., a semiconductor, blockchain, and IoT enterprise announced that it is restoring and extending its business in smart card readers with Identiv. In 2022, the company will supply Identiv with high-end smart card reader chips for more than USD 1 million. The partnership extends to Identiv's contact, contactless, and dual-interface smart card readers, targeting healthcare, pharmaceuticals, government, and education applications.

- Moreover, in a survey conducted by Fingerprint Cards AB in July 2021, the company found that in 2020 over 80% of French consumers consider the contactless payment card easy to use. France was the first nation to roll out contactless payment cards along with the UK. Further, the survey implies this is not a short-term boom either, as 64% of French consumers desire to use contactless more.

Europe Smart Card Industry Overview

The Europe Smart Cards market is moderately competitive as crucial players in the region are developing new solutions in the e-commerce market for various end-user applications. Companies are also investing and forming partnerships to grow their businesses in the region and provide the consumers with secure and safe smart cards.

- October 2021 - Infineon launches a new SECORA Pay portfolio on 40 nm technology with best-in-class contactless performance. The solution delivers increased contactless payment safety through various solutions, including sophisticated Java Card technologies, pre-certified payment options, smart accessories and wearables, and Visa, Mastercard, Discover, and American Express payment support.

- March 2021 - IDEMIA, G+D, and NXP release White Label Alliance (WLA) to provide smart card and online payment corporations an unbiased contactless charge popular as a response to develop the worldwide call for next-generation payment solutions for domestic and private-label payment brands. WLA sets and updates an open, comprehensive payment standard that enables ready-to-deploy dual interface payment solutions covering contact, contactless payment cards, and more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Travel and Tourism is Driving The Market

- 5.1.2 Increased Demand For Contactless payments

- 5.2 Market Challenges

- 5.2.1 Privacy and Security Issues and Standardization Concerns

6 Market Segmentation

- 6.1 By Type

- 6.1.1 Contact-based

- 6.1.2 Contacless

- 6.2 By End-User Vertical

- 6.2.1 BFSI

- 6.2.2 IT and Telecommunication

- 6.2.3 Government

- 6.2.4 Transportation

- 6.2.5 Other End-User Industries ((Education, Healthcare, Entertainment, etc.)

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest Of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bundesdruckerei GmbH

- 7.1.2 Secura Key

- 7.1.3 Gemalto NV (Thales Group)

- 7.1.4 Giesecke & Devrient GmbH (MC Familiengesellschaft GmbH)

- 7.1.5 Idemia France SAS

- 7.1.6 Infineion Technologies AG

- 7.1.7 Fingerprint Cards AB

- 7.1.8 Samsung Electronics Co., Ltd.

- 7.1.9 CardLogix Corporation

- 7.1.10 HID Global Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219