|

市場調查報告書

商品編碼

1632108

全球工業潛水泵市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Industrial Submersible Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

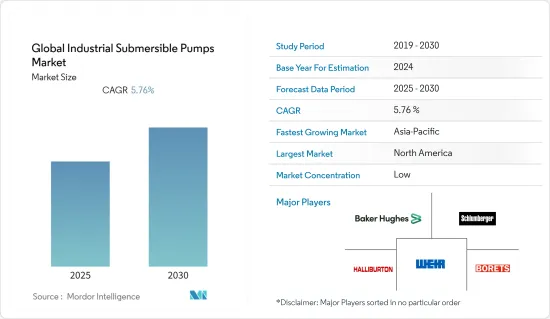

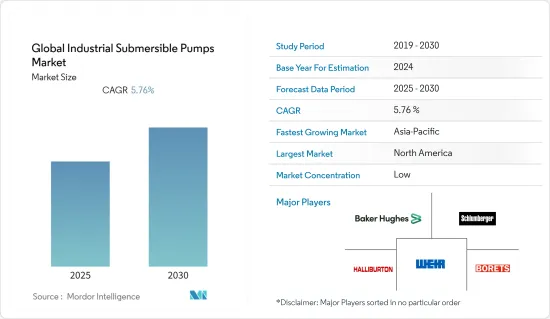

預計全球工業潛水泵市場在預測期內複合年成長率為5.76%

主要亮點

- 石油和天然氣行業透過增加資本支出、維持和增加油井產量、擴大頁岩礦床的利用以及增加大量污水的產生來主導市場。石油和天然氣產業預計將由北美主導。

- 許多製造和工業對工業潛水泵的需求是由對更高生產效率的需求所推動的。食品和飲料應用佔據主要佔有率,由於該領域的巨大需求和投資,分析顯示在預測期內保持其地位。潛水泵用於食品飲料生產過程中的清洗、消毒、填充以及食品飲料生產等。

- 在北美和歐洲等已開發地區,污水和水處理設施正在老化並接近其運作生命週期的終點。避免這種情況需要大量投資來重新引入或升級老化的基礎設施。然而,許多開發中國家缺乏足夠的清潔飲用水,並且才剛開始開發新的水基礎設施。更新此類老化基礎設施的努力必將為潛水泵創造市場機會。

- 然而,該市場也面臨維護和營運成本高、油氣價格波動等挑戰。這些限制阻礙了市場的擴張。

- COVID-19的爆發對潛水泵市場產生了負面影響。各最終用途產業投資停止帶來的經濟收縮是經濟放緩的主要原因。

工業潛水泵市場趨勢

石油和天然氣產業預計將佔據較大佔有率

- 鑽探石油和天然氣井採用重型潛水泵,可有效處理大量固態。為了在天然氣產量下降後最大限度地提高產量,全球 90% 以上的生產井現在採用人工抽油。最近的經濟衰退是潛水泵需求不穩定的一個主要因素。然而,分析期內的生產活動是由油價復甦和低損益平衡價格所推動的。

- 因此,該領域的投資正在增加,從而提高了市場成長率。例如,2022年1月,印度石油公司(IOCL)宣布計畫投資700億盧比用於城市燃氣發行(CGD)業務。印度石油公司 (IOC) 於 2021 年 8 月宣布,將投資 1 兆盧比,在未來四到五年內將精製能力提高近兩倍。

- 2021 年 9 月,韓國煉油和能源集團 SK 的天然氣子公司 SK E&S 宣布,計劃到 2025 年每年主要生產藍色氫氣,作為將其企業價值擴大五倍至 35 兆韓元計畫的一部分。產28萬噸、供應1000萬噸環保液化天然氣、運作可再生能源7GW的目標。

- IBEF表示,印度預計將為全球非經合組織國家石油消費的擴張做出重大貢獻。原油進口額從2017會計年度的707.2億美元大幅增加至2022會計年度(4月至1月)的943億美元。截至2021年9月1日,印度的精製能力為2.489億噸/年(MMTPA),使其成為亞洲第二大精製國。約35%的精製產能由私人公司控制。 IOC 的產能為 69.7 MMTPA,是該國最大的精製。

- 多年來,印度石油產品產量和消費量穩步成長。 2021年石油產品產量達2.5億噸,2020年為2.36億噸,年與前一年同期比較5.9%。 2022年5月,石油產品出口額達85.4764億美元,比2021年5月成長60.87%(資料來源:Invest India)。

亞太地區預計將錄得強勁成長率

- 經分析,亞太地區在預測期內的成長率處於領先地位。快速工業化正在推動中國、印度、日本和韓國等新興國家的市場成長。該行業受到該地區製造業崛起的推動。

- 由於印度政府的「印度製造」和中國政府的「中國製造2025」等政府舉措,預計未來幾年製造業將會成長。因此,亞太國家製造業的快速發展預計將擴大工業潛水泵的使用,為該細分市場創造良好的成長潛力。

- 在食品和飲料領域,食品泵用於在加工和生產應用中傳輸、混合和計量流體和半流體成分。食品加工業中使用的泵浦由可安全食用的材料製成,並具有光滑的表面,以避免細菌生長和食品污染。因此,分析食品和飲料領域的成長以刺激市場需求。

- 例如,印度政府透過食品加工工業部 (MoFPI) 正在大力增加對該國食品加工產業的外國投資。 2020-2021年進入食品加工領域的FDI金額為3.9341億美元。 2021年4月至10月,印度加工食品和農產品出口增加了15%左右。

工業潛水泵產業概況

全球工業潛水泵市場與各種規模的公司競爭激烈。隨著企業繼續進行策略性投資以抵消當前的經濟放緩,預計該市場將出現大量聯盟、併購和收購。該市場包括貝克休斯公司、斯倫貝謝有限公司、哈里伯頓公司、威爾Group Limited和博雷茨國際有限公司等主要製造商。

- 2022 年 2 月 - Tapflo 推出了一系列新的工業潛水泵。此潛水泵浦系列包括用於污泥和泥漿遏制、脫水和平面排水的泵浦。所有這些都可以毫無問題地泵送泉水、雨水、地下水以及含有沙子和磨料的水。它也非常適合含有漂浮軟顆粒或纖維成分的水。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 製造業成長

- 老化用水和污水處理設施更新及新建設

- 市場限制因素

- 整個使用壽命期間的高維護成本是市場成長的挑戰

第6章 市場細分

- 按下驅動器類型

- 電動式

- 油壓

- 其他

- 按最終用戶

- 用水和污水

- 採礦/建築

- 石油和天然氣

- 飲食

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 其他

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Baker Hughes Co.

- Schlumberger Limited

- Halliburton Co.

- Weir Group PLC

- Borets International Ltd

- Grundfos Group

- The Gorman-Rupp Company

- Franklin Electric Co. Inc.

- Atlas Copco AB

- Ebara Corporation

第8章投資分析

第9章 未來趨勢

The Global Industrial Submersible Pumps Market is expected to register a CAGR of 5.76% during the forecast period.

Key Highlights

- The oil and gas industry dominates the market, mostly as a due to rising capital expenditure, sustaining or boosting well production, expanding the use of shale deposits, and increasing the creation of a lot of wastewater. The oil and gas industry is predicted to be dominated by North America.

- The demand for industrial submersible pumps in many manufacturing and processing industries has been spurred by the demand for greater production efficiency. Food and beverage applications is analyzed to hold significant share and is analyzed to sustain the position during the forecast period owing to the signficant demand and investments in the sector. The submersible pumps are deployed in food and beverage manufacturing processes for cleaning, sanitizing, filling, brewing and so on.

- In developed regions such as North America and Europe, wastewater and water treatment facilities are ageing and moving toward the end of their operating lifecycles. To avoid this situation, significant investments in reinstalling and upgrading the outdated infrastructure are needed. However, many developing nations lack appropriate access to clean drinking water and are only now developing new water infrastructure. Such efforts to update old infrastructure are certainly going to present a market opportunity for submersible pumps.

- However this market has its share of challenges, including high maintenance and operating expenses and the erratic nature of oil and gas prices. These constraints prevent the market from expanding.

- The COVID-19 pandemic had a detrimental effect on the market for submersible pumps. Economic contractions brought on by a cessation of investments from various end-use industries were the main cause of the slowdown.

Industrial Submersible Pumps Market Trends

Oil and Gas Industry is Expected to Hold Major Share

- When drilling oil and gas wells, a heavy-duty submersible pump is employed as it is effective at handling a lot of solids. In order to maximize output after the fall in natural drives, more than 90% of producing wells in the globally currently employ an artificial lift. The recent downturn in the sector has been a major factor in the erratic demand for submersible pumps. However, the production activity in the market analysed period is being driven by the recovery in crude oil prices and the low breakeven price.

- Therefore the growing investments in the sector are boosting the market growth rate. For instance, in January 2022, Indian Oil Corp. Ltd. (IOCL) announced plans to invest INR 7,000 crore in its city gas distribution (CGD) business. Indian Oil Corp (IOC) announced an investment of INR 1 lakh crore in August 2021 to nearly triple its refining capacity over the next 4-5 years.

- In September 2021, SK E&S, the natural gas arm of South Korean refinery and energy conglomerate SK, set a target of producing 280,000 t/yr of mostly blue hydrogen, supplying 10 million t/yr of eco-friendly LNG, and operating 7GW of renewable energy by 2025, as part of a plan to increase the company's value fivefold to KRW 35 trillion.

- As stated by IBEF, India is anticipated to be a significant contributor to global non-OECD petroleum consumption growth. Crude oil imports increased dramatically from USD 70.72 billion in FY17 to USD 94.3 billion in FY22 (April to January). India's oil refining capacity was 248.9 million metric tonnes per annum (MMTPA) on September 1, 2021, making it Asia's second-largest refiner. About 35% of total refining capacity was controlled by private businesses. With a capacity of 69.7 MMTPA, IOC is the largest domestic refiner.

- Over the years, both the production and consumption of petroleum products have steadily increased in India. The output of petroleum products reached 250 MMT in 2021 compared to 236 MMT in 2020, representing a 5.9% YoY growth. Exports of petroleum products reached USD 8547.64 million in May 2022 and increased by a positive 60.87% from May 2021 (Source: Invest India, The National Investment Promotion and Facilitation Agency of the Government of India).

Asia Pacific is Expected to Register the Major Growth Rate

- Asia Pacific is analyzed to grow at major rate during the forecast period. Rapid industrialisation is increasing market growth in rising economies such as China, India, Japan, and South Korea, among others. The industry is being propelled forward by the region's rising manufacturing sector.

- The manufacturing industry is anticipated to increase in the next years as a result of government efforts such as "Make in India" by the Indian government and "Made in China 2025" by the Chinese government. Therefore, it is projected that the rapid development of the manufacturing sector in several Asia-Pacific nations will expand the use of industrial submersible pumps for industrial reasons, creating lucrative growth possibilities for the sector.

- In the food and beverage sectors, food pumps are used to transfer, mix, and dosage fluid and semi-fluid ingredients in processing and production applications. Pumps used in the food processing industry are made from materials that are safe for consumption, and they have smooth surfaces to avoid bacterial growth and food contamination. Therefore the growing food and beverage sector is analyzed to boost the demand for the market.

- For instance, the Indian government is making signficant effort to increase foreign investment in the country's food processing sector through the Ministry of Food Processing Industries (MoFPI). The amount of FDI that entered the food processing sector in 2020-21 was USD 393.41 million. From April to October, 2021 India's exports of processed food and agricultural products increased by almost 15%.

Industrial Submersible Pumps Industry Overview

The Global Industrial Submersible Pumps Market is competitive with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. The market comprises key manufacturers including Baker Hughes Co., Schlumberger Limited, Halliburton Co., Weir Group PLC, Borets International Ltd. among others.

- February 2022 - Tapflo introduced a new line of submersible pumps for industrial uses. The submersible pump series includes pumps for sludge and slurry containment, dewatering, and drainage of flat surfaces. All are designed for trouble-free pumping of spring, rain, and ground water, as well as water carrying sand and abrasives. They are also optimised for water containing suspended soft particles and fibrous components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Manufactruing Sector

- 5.1.2 Upgradation of aging and construction of new water & wastewater treatment facilities

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost Over the Entire Lifespan is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Drive Type

- 6.1.1 Electric

- 6.1.2 Hydraulic

- 6.1.3 Others

- 6.2 By End-users

- 6.2.1 Water & Wastewater

- 6.2.2 Mining & Construction

- 6.2.3 Oil and Gas

- 6.2.4 Food and Beverage

- 6.2.5 Other End-users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Baker Hughes Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Halliburton Co.

- 7.1.4 Weir Group PLC

- 7.1.5 Borets International Ltd

- 7.1.6 Grundfos Group

- 7.1.7 The Gorman-Rupp Company

- 7.1.8 Franklin Electric Co. Inc.

- 7.1.9 Atlas Copco AB

- 7.1.10 Ebara Corporation