|

市場調查報告書

商品編碼

1632113

中壓驅動器:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Medium Voltage Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

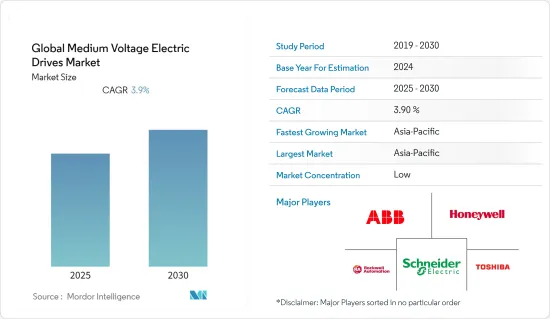

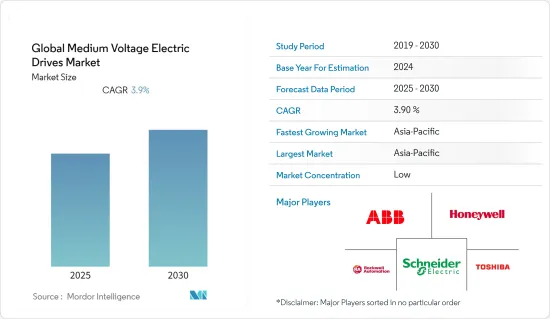

預計全球中壓驅動器市場在預測期內的複合年成長率為 3.9%。

主要亮點

- 中壓驅動器有兩種類型:電流源逆變器類型和電壓源逆變器類型,但VSI類型最可靠且諧波失真較小。大多數中壓交流變頻器在前端包含一個多相變壓器,與多電平逆變器配合使用以減少諧波。中壓交流變頻器還可與主動前端一起使用,用於高動態負載的應用。

- 中壓交流交流變頻器通常需要 500 至 20,000 馬力的電機,適用於低壓和中壓電流消耗差異較大的應用。此系列馬達廣泛用於驅動發電廠、石化廠、用水和污水處理廠、礦場等大型壓縮機幫浦和風扇。

- 根據西門子 2021 年 11 月的說法,高壓驅動器具有非常高的額定功率,尤其令人信服。尤其是轉速調節和系統軟啟動非常重要。很多人想到購買緩衝啟動器或專用變頻器來解決這個問題。此外,西門子在高壓驅動領域提供廣泛的可靠選擇。

- 安裝的高壓驅動器應該是可調速驅動器,以提高電能品質和系統響應能力,並降低營業成本和能源損失。然而,使用此類驅動器會帶來一些要求和挑戰。例如,在安裝高壓驅動器時,軌道側和馬達側都存在與變流器相關的挑戰。

- COVID-19 的爆發導致世界各地各種工業設施的成長和擴張停止。此外,非必要生產被完全淘汰,工業廠房中安裝了中壓變頻器。由於缺乏足夠的原料來生產電子機械和設備,有限的旅行和物流機會也阻礙了中壓驅動市場的成長。

中壓傳動市場趨勢

交流變頻器的需求正在上升

- 為了減少對其他國家原料和許多其他零件的依賴,全球高壓交流變頻器市場的公司依賴當地的製造能力。隨著一些國家的冠狀病毒感染率下降,製造商正在採取緊急應變計劃來應對消費者模式和需求的變化。

- 公司正在引入併購和新產品創新,以增加其產品的價值。保持一致的產品供應以確保業務永續營運。例如,2021 年 9 月,交流變頻器技術領跑者 Danfoss Drives 透過全新的 VACON 1000 中高壓力擴展了其中壓解決方案組合。

- 此外,雖然中壓交流變頻器與類似的解決方案相比可以降低資本和營業成本,但消費者必須針對不同的最終用途選擇合適的變頻器。認知到這一差距,美國工業自動化和資訊技術提供商羅克韋爾自動化公司正在擴大其通用和特種高壓交流變頻器產品組合。

- 同樣,ABB Limited 為化學、石油和天然氣行業提供高壓驅動器,以提高盈利和績效。正如在化學、石油和天然氣應用中所發現的那樣,ABB 的高壓變頻器即使在惡劣的環境下也能確保較長的使用壽命。 ABB 的高壓驅動器無需編碼器即可運行,從而降低了維護成本並提供了高可用性。

- 預測期內,亞洲將成為主要地區中高壓傳動投資增幅最大的地區。新興市場對新基礎設施的持續需求以及不斷成長的具有高消費潛力的中產階級為高壓交流變頻器市場的長期成長奠定了堅實的基礎。

亞太地區推動中壓變頻器的主要成長

- 用於監控馬達速度的高壓驅動器由於其最佳化能源消耗的能力,在發電、金屬採礦、石油和天然氣等多個地區的行業中廣受歡迎。高壓驅動器的廣泛使用和能源效率延長了馬達壽命,實現了整個生命週期的分散式使用,並透過避免其間的連續使用來減少馬達維護。

- 由於技術的快速進步,驅動器已在多個行業中獲得廣泛接受。進步的重點是高可靠性和降低能源成本。當商業建築中安裝引擎驅動系統時,這有可能將每平方英尺的消費量降低 30-40%。此外,最新的先進驅動器整合了網路和診斷功能,以提高效能和生產力。

- 此外,中國能源產業擴張活動的活性化預計將顯著增加該地區對電壓驅動器的需求。據中國國家能源局稱,中國已擁有19.23吉瓦的抽水蓄能裝置容量,另有30吉瓦在建裝機容量,目標是到2025年佔發電量的50%。因此,預計預測期內對 VFD 的需求將會增加。

- 該地區的公司也注重新產品創新,作為其擴張努力的一部分。近日,Bergen與印度合作夥伴Nankal Electric合作推出了一款高壓電動螺絲起子。 35 年來,卑爾根在電子製造、可再生能源(太陽能)、LED 解決方案、電力電子、醫療保健、公共產業、工廠建設和技術諮詢等不同領域提供了強大的業務基礎和廣泛的服務。一直在這麼做。

- 此外,西門子於 2021 年 9 月推出了 Sinamics,這是一款用於高壓驅動器的軟體,可保護工廠、技術、設備和網路免受網路威脅。有必要實施並持續維護最先進的工業安全理念。西門子產品和解決方案包含此類概念的元素。

- 此外,對節能設備的需求不斷成長以及政府支援計劃預計將推動亞太地區交流變頻器市場的發展。有利的政府政策和專注於製造業發展的政策、人口和人均可支配收入的成長導致該地區能源需求的增加以及對能源最佳化的興趣日益成長是該地區市場成長的主要因素。

中壓傳動產業概況

全球中壓變頻器市場呈現碎片化狀態,主要企業不斷專注於新技術的產品創新,並透過合併和聯盟擴大業務。主要參與者包括Schneider Electric、東芝和 ABB Limited。主要進展如下。

- 2021年12月-三菱電機公司宣布,其低壓氣動斷路器裝置可保護工廠和商業建築的低壓配電系統,榮獲美國《R&D world》雜誌頒發的2021年R&D 100獎。

- 2021 年 3 月 - 羅克韋爾自動化改進了 PowerFlex 6000T 高壓變頻器的性能。工業公司可以從 Allen-Bradley PowerFlex 6000T 高壓變頻器的多項增強功能中受益。該驅動器採用羅克韋爾自動化的 TotalFORCE 技術,可精確控制速度和扭矩、追蹤系統運行狀況的診斷資料以及確保流程平穩運作的自動調整。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 注重降低電力和能源消耗

- 高壓交流變頻器的廣泛應用

- 市場挑戰

- 由於競爭加劇,中壓變頻器價格不斷波動。

第6章 市場細分

- 按類型

- 交流變頻器

- 直流驅動

- 伺服驅動器

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 食品及飲料

- 用水和污水

- 發電

- 金屬/礦業

- 紙漿/造紙製造

- 空調

- 個體產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Eaton Corporation

- ABB Ltd

- Crompton Greaves Ltd

- GE Company

- Honeywell Internaional Inc.

- Rockwell Automation Inc.

- Hitachi Group

- Mitsubishi Corporation

- Toshiba Corporation

- Schneider Electric Company

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91377

The Global Medium Voltage Electric Drives Market is expected to register a CAGR of 3.9% during the forecast period.

Key Highlights

- Medium voltage drives are either current source inverters or voltage source inverter types, but the VSI type is more common due to its high reliability and low harmonic distortion. Most medium voltage AC drives include a multiphase transformer on the front end that works with a multilevel inverter to reduce harmonics. The medium electric drives can also use the active front end for highly dynamic-loaded applications.

- Medium voltage AC drives are useful for applications that generally require a 500-20,000 hp motor with a large difference in current consumption between low and medium voltage. Motors in this series are widely used in power plants, petrochemical plants, water/wastewater treatment plants, and mines to drive large compressor pumps and fans.

- According to Siemens in November 2021, medium voltage drives are particularly compelling at very high rated power. Adjusting the speed and ensuring a soft start of the system is especially important. Many people initially associate a solution to this problem with purchasing soft starters and special frequency converters. In addition, Siemens has many reliable options in the field of medium voltage drives.

- The installed medium voltage drive should be an adjustable speed drive to improve power quality and system responsiveness and reduce operating costs and energy losses. Nevertheless, using such drives is associated with some requirements and challenges. For instance, when installing a medium voltage drive, there are some converter-related challenges, both on the line and motor sides.

- The outbreak of Covid-19 has stopped the growth and expansion of various industrial facilities in all parts of the world. In addition, non-essential manufacturing was completely phased out, and medium voltage drive drop-ins were installed in industrial plants. Limited travel and logistic opportunities also hindered the growth of the medium-voltage electric drives market, as sufficient raw materials were not available for producing electrical machinery and equipment.

Medium Voltage Electric Drives Market Trends

Demand for AC Drives is on the Rise

- To reduce the dependence of raw materials and many other components on other countries, companies in the global medium voltage AC drive market rely on local manufacturing capacity. Manufacturers are adopting emergency response plans to accommodate changing consumer patterns and demand after coronavirus infection rates have declined in some countries.

- Companies introduce mergers and acquisitions and new product innovations to increase the value of their products. They maintain a consistent product supply to ensure business continuity. For instance, in September 2021, Danfoss Drives, a frontrunner in AC drives technology, has expanded its medium-voltage solutions portfolio with the brand new VACON a thousand medium-voltage force.

- Further, medium voltage AC drives save capital and operating costs compared to similar solutions, but consumers must choose the right drive for various end applications. Recognizing this gap, US-based industrial automation and information technology provider Rockwell Automation, Inc. is expanding its portfolio of general-purpose and specialty medium-voltage AC drives.

- Similarly, ABB Limited offers medium voltage drives for chemical, oil, and gas industries for more profitability and performance. As observed in chemical, oil, and gas applications, ABB medium voltage drives were designed to ensure an extended lifetime in harsh environments. ABB's medium voltage drives can perform without an encoder, lowering maintenance costs and ensuring excessive availability.

- Asia will experience the largest increase in investment in medium voltage drives in major regions during the forecast period. Emerging markets with continued demand for new infrastructure and middle-class growth with strong consumer potential provide a solid foundation for long-term growth in the medium-voltage AC drive market.

Asia Pacific to Witness Major Growth in Medium Voltage Drives

- Medium voltage drives used to monitor motor speeds have gained significant traction due to their ability to optimize energy consumption in various regional industries such as power generation, metal mining, oil & gas and more. The popularity of medium voltage drives and energy efficiency extends motor life and reduces motor maintenance by allowing distributed use throughout the life cycle and avoiding continuous use between them.

- Rapid advances in technology have made drives widely accepted in multiple industries. Progress is focused on high reliability and reduction of energy costs. This could reduce energy consumption per square foot by 30-40% when an engine drive system is installed in a commercial building. In addition, advanced, modern drives integrate network and diagnostic capabilities to improve performance and productivity.

- Furthermore, increasing expansion activity in China's energy sector is expected to create considerable demand for voltage drives in the region. China's National Energy Administration stated that there are already 19.23 gigawatts of pumped hydro capacity in China and another 30 gigawatts (GW) under construction and aims to account for 50% of its electricity generation by 2025. This is expected to fuel the demand for VFDs over the forecast period.

- Companies in the region are also focsuing on innovating new products as part of the business expansion. Recently, Bergen release medium voltage electric drivers in collabortion with it partner Nancal Electric in India. For more than 35 years, Bergen has delivered a robust medium and a wide range of services in the diversified areas of Electronic Manufacturing, Renewable Energy (Solar), LED solutions, Power Electronics, Healthcare, Utilities, Plant set-up, and Technical consultancy.

- Further, in Spetember 2021, Siemens released Sinamics software for medium voltage drives to protect plants, techniques, appliances, and networks against cyber threats. It is necessary to implement and continuously maintain a state-of-the-art industrial security concept. Siemens' products and solutions include one element of such a concept.

- In addition, increasing demand for energy-efficient equipment and supportive government programs is expected to drive the Asia-Pacific AC drive market. Preferred government policies and regulations focused on the development of the manufacturing industry, the growing demand for energy in the region due to the increasing population and per capita disposable income, and the growing concern about energy optimization are some key factors to support the regional market growth.

Medium Voltage Electric Drives Industry Overview

The Global Medium Voltage Electric Drive market is fragmented with the presence of major players who are constantly focusing on innovating new technological products, expanding their business with mergers and partnerships in the market. Major players are Schneider Electric, Toshiba Corporation, ABB Limited, and others. Key developments are -

- December 2021 - Mitsubishi Electric Corporation announcged it has received 2021 R&D 100 award from the U.S. publication R&D world for its low-voltage air curicuit breaker device that can protect low voltage power distribution systems in the factories and commercial buldings.

- March 2021 - Rockwell Automation improves the performance of PowerFlex 6000T Medium Voltage Drives. Industrial companies can now benefit from multiple enhancements to the Allen-Bradley PowerFlex 6000T medium voltage drives. The drives now include TotalFORCE technology from the company, which delivers precise control of speed and torque, diagnostic data for tracking system health, and automatic adjustments to maintain processes running smoothly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Focus on reducing power and energy consumption

- 5.1.2 Wide range of applications for medium voltage AC drives

- 5.2 Market Challenges

- 5.2.1 Due to intensifying competition, prices of medium-voltage electric drives is fluctuating

6 Market Segmentation

- 6.1 By Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By End-User Indsutry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochecmical

- 6.2.3 F&B

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Pulp & Paper

- 6.2.8 HVAC

- 6.2.9 Discrete Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Eaton Corporation

- 7.1.2 ABB Ltd

- 7.1.3 Crompton Greaves Ltd

- 7.1.4 GE Company

- 7.1.5 Honeywell Internaional Inc.

- 7.1.6 Rockwell Automation Inc.

- 7.1.7 Hitachi Group

- 7.1.8 Mitsubishi Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Schneider Electric Company

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219