|

市場調查報告書

商品編碼

1635339

美國藥品合約包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)US Pharmaceutical Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

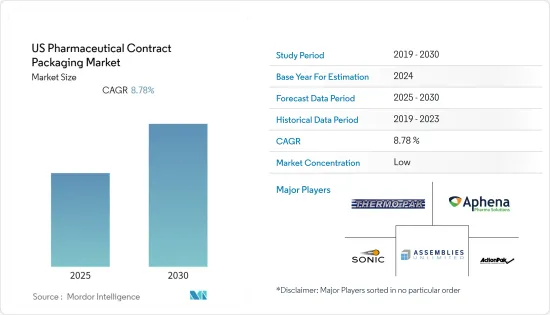

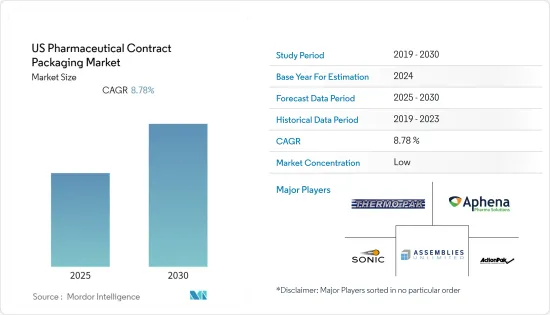

美國藥品合約包裝市場預計在預測期內複合年成長率為 8.78%。

主要亮點

- 合約包裝為製藥公司提供了使其產品在競爭中脫穎而出的機會。藥品包裝的差異化通常著重於使用者需求和使用案例。例如,特定指示要求部分就是合約包裝的此類需求之一。

- 此外,系列化仍然是醫療設備、裝置、植入式設備以及管瓶和注射器等消耗品的軟性無菌包裝的促進因素。對口服藥物、處方劑量藥物和非處方藥 (OTC) 藥物管理的需求不斷成長,預計將增加軟性鋁箔在製藥領域的使用。

- 此外,根據人類資料科學公司 IQVIA 的數據,全球藥品銷售額預計將從 2019 年的 4,910 億美元增至 2023 年的 1.5 兆美元。美國在醫藥產業的消費和開發方面均佔據主導地位。根據 STAT 的數據,該國處方藥支出預計將在 2023 年達到 6,000 億美元,高於 2019 年估計的 5,000 億美元。

- 由於 COVID-19 對管瓶、藥品和其他產品的需求產生了重大影響,該行業的製造商已爭奪資源並推動加速製造和包裝程序。亞太地區的供應鏈問題不僅對醫藥原料至關重要,對包裝產業原料至關重要,導致疫情爆發初期幾個月,CMO 和 CPO 市場均出現嚴重材料短缺,導致大量材料短缺。出現短缺。

美國藥品合約包裝市場趨勢

大型製藥企業外包數量增加

- 將救生藥品委託外包給值得信賴的服務供應商的競爭正在加速,尤其是在新冠肺炎 (COVID-19) 大流行期間,成本控制成為當務之急,同時還面臨著以前無法想像的其他業務中斷的威脅。

- 此外,藥物開發和製造是一項資本密集型業務。隨著學名藥淨利率下降,製造商正在縮減對該類別的投資。透過外包包裝系統,公司可以在與包裝專家合作的同時降低藥品包裝成本。

- 為了滿足不斷成長的市場需求,2021 年 10 月,服務於製藥業的美國合約包裝公司 Tjoapack 宣布收購了位於田納西州克林頓的領先醫療保健包裝服務提供商 Pharma Packaging Solutions。 Tjoapack 對 PPS 的收購創造了一個機會,為製藥市場打造合約包裝和供應鏈服務領域新的全球領導者。此次收購支持了 Tjoapack 的成長策略,並體現了我們對客戶的承諾。

泡殼包裝佔據最高市場佔有率

- 泡殼包裝主要用於保護產品免受濕氣、氣體、光線和溫度的影響,並延長其保存期限。泡殼包裝有助於保持產品完整性,因為泡殼包裝的藥品可以免受不利條件的影響。泡殼包裝主要用於包裝成藥、藥品(膠囊)、小型醫療設備等藥品。

- 製藥業不斷成長的需求是北美地區泡殼包裝需求的主要驅動力之一。 FDA 法規的實施要求醫院和療養院配發的所有處方箋藥均以帶有條碼的單位劑量形式包裝,以減少配發錯誤,這也增加了近年來 Masu泡殼的銷量。

- 在美國,泡殼包裝用於非處方箋櫃檯後面的產品,例如過敏藥物和口香糖。在處方藥包裝方面,美國零售商和消費者正在追趕世界其他地區。國內對泡殼包裝的需求不斷增加。

- 美國醫藥市場是全球最重要的國內市場之一。光是美國就佔全球醫藥市場的45%以上。該國預計每年在藥物研發上花費近600億美元。

- 製藥公司對藥品安全和包裝有效性有嚴格的政策,這導致泡殼包裝等藥品包裝的增加,這積極促進了市場的成長。

美國藥品合約包裝產業概況

美國藥品包裝市場競爭激烈,由多家大公司組成。從市場佔有率來看,目前少數大公司佔據市場主導地位。然而,處方藥和疫苗的廣泛採用正在增加市場需求。許多公司透過贏得新契約和開發新市場來擴大其市場佔有率。

- 2021 年 12 月 - 製藥和營養保健品行業的國際契約製造公司 KD Pharma Group 最近宣布收購了總部位於瑞士的化學品製造商前 Rohner AG 的製造資產。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 市場促進因素

- 外包的成本效益

- 獲得尖端技術和專業知識

- 市場限制因素

- 監控問題和缺乏標準化

第5章市場區隔

- 按服務類型

- 基本的

- 醫療袋

- 泡殼包裝

- 藥筒和注射器

- 管瓶

- 安瓿

- 其他產品類型

- 中學

- 第三

- 基本的

- 依材料類型

- 塑膠

- 紙板

- 玻璃

第6章 競爭狀況

- 公司簡介

- Thermo-Pak Co., Inc.

- Aphena Pharma Solutions

- Sonic Packaging Industries, Inc.

- Assemblies Unlimited, Inc.

- Action Pak, Inc.

- AmeriPac, Inc.

- MBK Tape Solutions

- Elitefill, Inc.

- Tru Body Wellness

- Deluxe Packaging

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 91407

The US Pharmaceutical Contract Packaging Market is expected to register a CAGR of 8.78% during the forecast period.

Key Highlights

- Contract packaging gives pharmaceutical companies a chance to differentiate their product against the competition. Differentiation in pharmaceutical packaging is usually focused on the user's needs and use case. For example, the specific indication requirements section is one such need for contract packaging.

- Further, Serialization continues to be a driving factor for flexible, sterile packaging used for medical equipment, devices, implantable devices, and consumables, such as vials and syringes, among others. Increased demand for administering oral drugs, prescription dose medicines, and over-the-counter (OTC) medicines is expected to increase the use of flexible aluminum foil in the pharmaceutical sector.

- Furthermore, according to IQVIA, a human data science company, pharmaceutical sales worldwide are anticipated to reach USD 1.5 trillion in 2023 from USD 491 billion in 2019. The United States dominates the pharmaceutical sector, both in consumption and development. According to STAT, prescription drug spending in the nation is considered to add up to USD 600 billion by 2023, up from an estimated USD 500 billion in 2019.

- Manufacturers in the sector rushed their resources and pushed for quicker manufacturing and packaging procedures as a result of COVID-19's considerable impact on the demand for vials, medications, and other products. Due to supply chain issues in the Asia-Pacific region, which holds a prominent position when it comes to pharmaceutical raw materials as well as packaging industry raw materials, there was a significant shortage of materials for both CMOs and CPOs in the market during the early months of the pandemic, which caused slower manufacturing and packaging.

US Pharmaceutical Contract Packaging Market Trends

Increasing Outsourcing Volumes by Major Pharmaceutical Companies

- With cost containment a priority, especially in the era of the COVID-19 pandemic and the threat of other previously unimagined business disruptions, the race to contract packaging of life-saving drugs for trusted service providers is accelerating.

- Also, the development and manufacturing of medications is a capital-intensive business. With margins shrinking for generics, manufacturers are reducing the scale of their investments within this category. Outsourcing the packaging mechanism enables companies to work with packaging experts while reducing the packaging expenses of the drugs.

- Owing to the increasing demand in the market, in October 2021, Tjoapack, a Netherlands-based contract packaging organization serving the pharmaceutical industry, acquired US-based Pharma Packaging Solutions ("PPS"), a leading healthcare packaging services business based in Clinton, TN. Tjoapack's acquisition of PPS creates an opportunity to build a new global leader in contract packaging and supply chain services for the pharmaceutical market. The acquisition supports Tjoapack's growth strategy and is indicative of our commitment to customers

Blister Packs to Hold the Highest Market Share

- Blister packaging is mostly used to provide barrier protection from moisture, gas, light, and temperature and longer shelf life. Blister packaging helps retain product integrity as drugs that are pre-packed in blisters are shielded from adverse conditions. Blister packs are mainly used for packaging pharmaceutical products, such as OTC drugs and medicines (capsules), and small medical devices.

- The growing demand for the pharmaceutical industry is one of the primary drivers of the blister packaging demand in the North American region. The implementation of FDA regulations that require that all prescribed pharmaceuticals that are dispensed in hospitals and nursing homes are to be packaged in unit-dose formats, including barcodes to reduce dispensing errors, has also increased the sales of blister packs over the past few years.

- In the United States, blister packaging is used for products that are not behind the prescription counter, such as allergy medication or chewing gum. The US retailers and consumers are catching up with the rest of the world when it comes to packaging prescribed medications. The demand for blister packaging is increasing in the country.

- The US pharmaceutical market is among the world's most important national markets. The United States alone holds over 45% of the global pharmaceutical market. It is expected that almost USD 60 billion is spent annually on pharmaceutical R&D purposes in the country.

- Pharmaceutical companies are stringent about their policies regarding drug safety and effectiveness of drug packaging, and this, in turn, is leading to an increase in pharmaceutical packaging such as blister packs, thereby, driving the market's growth positively.

US Pharmaceutical Contract Packaging Industry Overview

The United States Pharmaceutical Packaging market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with extensive adoption of prescription drugs and vaccines is increasing the demand in the market. Many companies are increasing their market presence by securing new contracts and by tapping new markets.

- December 2021 - KD Pharma Group, an international contract manufacturer for the pharmaceutical and nutraceutical industries, announced recently that it has acquired the manufacturing assets of the former Rohner AG, a chemical manufacturer based in Switzerland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the market

- 4.4 Market Drivers

- 4.4.1 Cost-Effectiveness Of The Outsourcing

- 4.4.2 Access to the advanced technologies and expertise

- 4.5 Market Restraints

- 4.5.1 Monitoring issues and lack of standardization

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Primary

- 5.1.1.1 Medical Pouches

- 5.1.1.2 Blister Packs

- 5.1.1.3 Cartridges and Syringes

- 5.1.1.4 Vials

- 5.1.1.5 Ampoules

- 5.1.1.6 Others Product Types

- 5.1.2 Secondary

- 5.1.3 Tertiary

- 5.1.1 Primary

- 5.2 Material Type

- 5.2.1 Plastic

- 5.2.2 Paper & Paperboard

- 5.2.3 Glass

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Thermo-Pak Co., Inc.

- 6.1.2 Aphena Pharma Solutions

- 6.1.3 Sonic Packaging Industries, Inc.

- 6.1.4 Assemblies Unlimited, Inc.

- 6.1.5 Action Pak, Inc.

- 6.1.6 AmeriPac, Inc.

- 6.1.7 MBK Tape Solutions

- 6.1.8 Elitefill, Inc.

- 6.1.9 Tru Body Wellness

- 6.1.10 Deluxe Packaging

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219