|

市場調查報告書

商品編碼

1635340

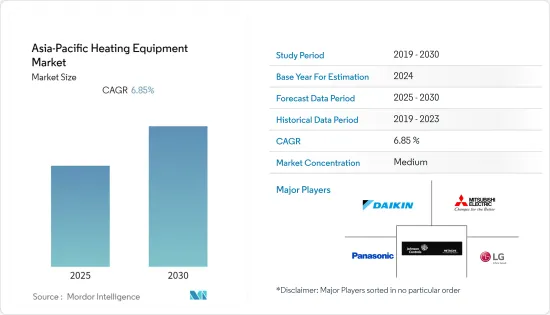

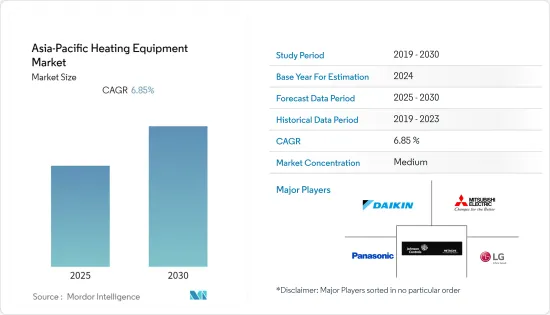

亞太地區暖氣設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia-Pacific Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區暖氣設備市場預計在預測期內複合年成長率為 6.85%。

主要亮點

- 預測期內暖氣設備市場的成長促進因素包括各個新興國家建設產業的快速成長和終端用戶市場的擴張。加熱設備的優點包括能源效率、改善效果和使用壽命。影響市場擴張的主要原因是都市化、工業化和移民的變化,導致採用暖氣設備的公司、製造設施和多用戶住宅數量的增加。

- 根據國際能源總署(IEA)統計,2020年全球區域供熱產量為16EJ,較2000年水準躍升30%,年複合成長率約1.3%。 2019 年至 2020 年顯著成長 2.3%,主要由中國和部分韓國推動(各成長 7%)。

- 2020年和2021年的COVID-19爆發對市場成長產生了負面影響。該地區政府於 2020 年和 2021 年實施了封鎖。由於終端用戶活動暫停,對市場產生了負面影響。此外,由於生產放緩和供應鏈中斷,該地區對暖氣設備的需求也收緊。

- 該地區快速的都市化正在推動需求,並鼓勵轉向使用再生能源來源進行集中供暖和冷氣。這種能源來源有助於滿足不斷成長的都市區能源需求、提高效率、減少排放並提供經濟高效的溫度控制。例如,由於都市化,中國正在北方地區迅速增加集中式系統的使用。設備高成本是亞太地區供熱市場面臨的一大挑戰。

亞太地區暖氣設備市場趨勢

工業用途預計將大幅成長

- 熱泵用於需要低溫熱量的工業製程。市售熱泵可提供高達 160°C 的熱量。熱泵的典型工業應用包括乾燥、清洗和巴氏殺菌。工業熱泵通常是為特定製程需求而設計的客製化系統。

- 這些對於透過餘熱、工業製程的區域供熱或風力發電提供的工業供暖解決方案至關重要。將製程能源重新用於熱水和空間加熱是實現顯著節能和永續未來的一條有吸引力的捷徑,推動了工業應用市場的成長。

- 為了滿足工業應用中熱泵日益成長的需求,公司正專注於產品開發。例如,近期,中國熱泵製造商PHNIX推出了適用於工業和商業應用的新型HeatForce系列二氧化碳熱泵熱水系統,該系統創造性地採用了新型環保二氧化碳製冷劑。本裝置可在低至-7°C的條件下保持高達4.3的高性能係數(COP)。

- 行業公司正專注於戰略聯盟,這將有助於他們佔領更高的市場佔有率並擴大在該國的影響力。此外,各國政府正迅速轉向綠色建築,這可能為市場相關人員開闢新的途徑。房地產顧問公司ANAROCK預計,2022年,印度綠色建築市場規模預計將達到350億美元至300億美元左右。

- 此外,快速的都市化也是DH引進的促進因素。例如,近年來在中國,集中式系統的使用在北方地區迅速增加。日本也是亞太地區率先為寒冷地區居住引入區域供暖的國家之一。

- 目前,日本需要應對低碳化、強化城市和街區、振興地方經濟等社會議題。日本於2016年修訂了《供熱商業法》,開放了供熱業務。根據減少二氧化碳排放的模擬計算,到2030年,日本的設備效率與2013年相比,在大都會模型中可以降低43%以上,在地方城市模型中可以降低46%以上。

中國可望創最快增速

- 可支配收入的增加、對二氧化碳排放的日益關注以及供暖和製冷系統的高消耗等因素是推動中國研究市場成長的主要因素。根據經濟合作暨發展組織(OECD) 的模型,到 2060 年,印度和中國的人均收入可能會增加七倍。

- 亞太地區各國政府也與當地企業合作,進一步推動國內市場。例如,北京集中供熱集團是中國重要的供熱企業之一。該公司還為北京中央政府和軍隊、駐華使館、大型公司和機構以及公眾部署供熱解決方案,並在其他省份擁有眾多計劃。

- 中國不僅擁有最多的人口,也是最高的二氧化碳排放。由於二氧化碳排放量大和空氣污染問題,中國強烈渴望轉型為綠色能源體系。目前,煤炭佔中國建築供暖所需能源的大部分。國際能源總署(IEA)表示,中國擁有世界上最大的區域供暖系統,超過2億中國公民可以從綠色供暖中受益匪淺。中國許多城市希望實施二氧化碳減排計劃,但缺乏充分發揮綠色區域供暖潛力所需的實際理解和有利的法律環境。

- 2021年7月,在此基礎上,丹麥能源總署與UNEP DTU夥伴關係同意在中國區域供熱方面進行更密切的合作。此次合作的目的是透過加速綠色轉型並在監管框架條件下共用丹麥的專業知識,幫助中國履行在《巴黎協定》下的承諾。

- 此外,中國建築業的成長正在加強對暖氣設備市場的需求。住宅及城鄉建設部(住建部)發布通知,將在「十四五」計畫中實施2020年都市更新行動。政府希望提高中國城市的生活水準。這就是為什麼這個城市更新計畫致力於讓城市變得更環保、更有效率。

- 中國建築業的產能不斷擴大,對工程服務的需求也不斷增加。住建部資料顯示,2021年,我國工程監督、造價顧問等工程諮詢服務收入達265億美元。

亞太供暖設備產業概況

暖氣設備市場競爭激烈,眾多企業進入市場。從市場佔有率來看,目前少數主要企業佔據市場主導地位。DAIKIN INDUSTRIES、江森自控日立空調和Honeywell國際是加熱設備市場上的主要企業。

- 2021 年 11 月Honeywell表示,浙江盾安環境將透過生產相容的 HVAC 組件系列,支持 HVAC 產業向 Solstice N41 (R-466A) 的過渡。盾安生產用於住宅和商用空調、熱泵以及冷凍和冷卻系統的冷凍閥門、熱交換器和壓力容器。

- 2021 年 9 月 - 代傲表計在中國洛陽開設了一個新的智慧供熱實驗室。透過研究院,該公司旨在為當地客戶提供更有效的服務,加快智慧暖氣創新,並佈局中西部地區的業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 該地區智慧城市的發展

- 都市化和工業化進程

- 市場限制因素

- 設備成本高

第6章 市場細分

- 按類型

- 鍋爐/散熱器/其他加熱器

- 熱泵

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按國家/地區

- 中國

- 日本

- 韓國

- 印度

- 其他國家

第7章 競爭格局

- 公司簡介

- Daikin Industries Limited

- Mitsubishi Electric Corp

- Panasonic Corporation

- LG Electronics Inc.

- Johnson Controls-Hitachi Air Conditioning

- Whirlpool Corp.

- Danfoss A/S

- ROBERT Bosch GmbH

- Emerson Electric Co.

- ANHUI MISOURI ECO-ENERGY SOLUTION CO., LTD.

第8章投資分析

第9章 未來趨勢

簡介目錄

Product Code: 91432

The Asia-Pacific Heating Equipment Market is expected to register a CAGR of 6.85% during the forecast period.

Key Highlights

- Significant drivers of the heating equipment market's growth over the projection period include the burgeoning construction industry in various emerging economies and the expanding end-user markets. A few advantages of heating equipment are energy efficiency, better outcomes, and lifespan. A few key reasons impacting the market's expansion are changes in urbanization, industrialization, and migration, which have increased the number of enterprises, manufacturing facilities, and residential complexes that employ heating equipment.

- According to International Energy Agency (IEA), global district heating production was 16 EJ of heat in 2020, jumping 30% from the 2000 level at an annual compound growth rate of around 1.3%. The striking 2.3% increase from 2019 to 2020 was prompted mainly by China and partially by Korea (7% growth each).

- The COVID-19 outbreak in 2020 and 2021 had a negative impact on the market's growth. Lockdowns were imposed on the region's governments in 2020 and 2021. As end users' activities were suspended, this had a negative effect on the market. Additionally, production has slowed down, and the supply chain has been disrupted, putting a strain on the region's demand for heating equipment.

- Rapid urbanization in the region is driving the demand and pushing to switch to renewable energy sources for centralized heating and cooling, which can help meet rising urban energy needs, improve efficiency, reduce emissions and provide cost-effective temperature control. For instance, driven by urbanization, China has rapidly increased its use of centralized systems in its northern regions. The Asia Pacific heating Market is facing a significant challenge due to the high costs of the equipment.

APAC Heating Equipment Market Trends

Industrial is Expected to Grow at a Signficant Rate

- Heat pumps are used for industrial processes that require low-temperature heat. Commercially available heat pumps can provide heat up to 160°C. Typical industrial applications for heat pumps include drying, washing, and pasteurization. Industrial heat pumps are most often bespoke systems designed for specific process needs.

- These are essential in industrial heating solutions, supplied by either surplus heat, district heating from the industrial processes, or wind power. Re-using the process energy for hot water and space heating is an attractive shortcut to significant energy savings and a sustainable future, thus driving the market growth in industrial applications.

- Due to the growing demand for heat pumps in industrial applications, players are focusing on product development. For instance, recently, PHNIX, a manufacturer of heat pumps in China, launched a new HeatForce series Co2 heat-pump water-heating system for industrial and commercial applications, with the creative use of a new eco-friendly CO2 refrigerant. The unit can maintain a high coefficient of performance (COP) of up to 4.3 under the low-temperature condition of -7°C.

- Industry players are laying high emphasis on forming a strategic alliance, which may aid the companies in garnering higher market share and boost their presence across the country. Moreover, the government is rapidly heading toward green buildings, which may create new avenues for market players. According to ANAROCK, a property consultant, the green building market in India is expected to reach a value of about USD 35-30 Billion by 2022.

- In addition, rapidly increasing urbanization is another driving factor for adopting DH. For instance, in recent years, China rapidly increased its use of centralized systems in its northern regions. Japan is another major country in the Asia-Pacific region that is adopting district heating for parts residing in colder weather conditions.

- At present, Japan must respond to social issues, such as low carbonization, strengthening of cities and blocks, and revitalizing local economies. The country's heat supply business was liberalized by revising the Heat Supply Business Law in 2016. According to a low-carbon simulation calculation of CO2 emissions, it is possible to reduce the efficiency of equipment in Japan by 2030 by 43% or more compared to 2013 in the large city model and 46% or more in the local city model.

China is Expected to Register the Fastest Growth Rate

- Factors such as rising disposable income, growing concern for CO2 emission, and high consumption of heating and cooling systems are some of the major factors driving the studied market growth in China. According to the Organization for Economic Cooperation and Development (OECD) models, India and China may witness a seven-fold increase in income per capita by 2060.

- The governments in the Asia Pacific region are also collaborating with a local companies, further boosting the domestic market. For instance, the Beijing District Heating Group is one of the significant heating enterprises in China. The company also deployed its heating solutions for the central Beijing government and army, embassies in China, large enterprises and institutions, and the public and owns numerous projects in other provinces.

- In addition to having the greatest population, China also produces the most CO2. China is strongly motivated to transition to a more environmentally friendly energy system because of the country's significant CO2 emissions and air pollution problems. Today, coal accounts for most of the energy needed to heat buildings in China. The International Energy Agency (IEA) stated that China has the largest district heating system in the world, and more than 200 million Chinese citizens may potentially benefit greatly from green heating. Many Chinese cities desire to adopt CO2-saving projects but lack the practical understanding and favorable legal environment needed to operate green district heating to its full potential.

- In July 2021, based on this, the Danish Energy Agency and UNEP DTU Partnership agreed to collaborate more closely on district heating in China. The cooperation aims to accelerate the green transition and assist China in upholding its commitments under the Paris Agreement by sharing Danish expertise under regulatory framework conditions.

- Further, the growing construction sector in the country is bolstering the demand for the heating equipment market. The Ministry of Housing and Urban-Rural Development (MOHURD) published a notice for implementing Urban Renewal Actions in 2020 as part of China's 14th Five-Year Plan. The government wants to improve the standard of urban living in China. Therefore this urban regeneration initiative strives to create greener, more efficient cities.

- The capacity of China's construction sector has expanded, which has benefited the need for engineering services. Data from MOHURD indicates that in 2021, China generated USD26.5 billion in income from engineering consulting services such as engineering supervision and cost consultancy.

APAC Heating Equipment Industry Overview

The Heating equipment market is quite competitive and consists of significant players. In terms of market share, a few prominent players currently dominate the market. Daikin Industries Ltd., Johnson Controls - Hitachi Air Conditioning Company, and Honeywell International, Inc. are some of the leading players operating in the Heating Equipment market.

- November 2021-Honeywell stated that Zhejiang DunAn Artificial Environment Co., Ltd (DunAn Environment) will support the HVAC industry's transition to Solstice N41 (R-466A) by producing a compatible product range of HVAC components. DunAn manufactures refrigeration valves, heat exchangers, and pressure vessels for residential and commercial air conditioners, heat pumps, and refrigeration and freezing systems.

- September 2021-Diehl Metering has opened a new Smart Heating Laboratory in Luoyang, China. The company aims to serve local clients more effectively, speed up innovation in smart heating, and organize operations in Central and West China through the lab.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Cities in the Region

- 5.1.2 Rising Urbanization and Industrialization

- 5.2 Market Restraints

- 5.2.1 High Costs of Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Boilers/Radiators/Other Heaters

- 6.1.2 Heat Pumps

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 South Korea

- 6.3.4 India

- 6.3.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Limited

- 7.1.2 Mitsubishi Electric Corp

- 7.1.3 Panasonic Corporation

- 7.1.4 LG Electronics Inc.

- 7.1.5 Johnson Controls-Hitachi Air Conditioning

- 7.1.6 Whirlpool Corp.

- 7.1.7 Danfoss A/S

- 7.1.8 ROBERT Bosch GmbH

- 7.1.9 Emerson Electric Co.

- 7.1.10 ANHUI MISOURI ECO-ENERGY SOLUTION CO., LTD.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219