|

市場調查報告書

商品編碼

1635353

全球電力工業閥門市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Valves in Power Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

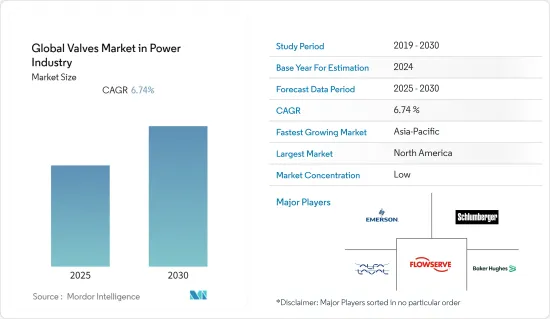

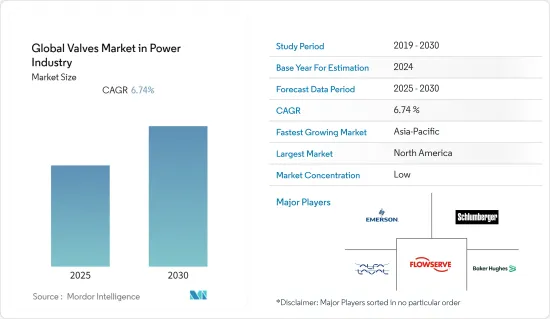

全球電力產業閥門市場預計在預測期間內複合年成長率為6.74%

主要亮點

- 由於氣候變遷以及開發更好、可再生和破壞性較小的發電來源的需要,電力消耗不斷增加。因此,發電廠工業閥門製造商正在尋找能夠提高電力生產效率的加工機械。

- 此外,收購和合作等策略發展的增加也將提高成長率。例如,2022年4月,Vexve Armatury Group收購了Armatury Group GmbH,後者在奧地利和德國市場銷售用於電力、天然氣和冶金行業的ARMATURY Group閥門。此次收購增強了 Vexve Armatury 集團的地位,特別是在 DACH 地區(德國、奧地利和瑞士)。

- COVID-19 擾亂了供應鏈,並在停工期間嚴重影響了能源生產。然而,影響是短期的。

- 這增加了更換閥門的額外成本。設備必須拆卸並重新組裝。管理閥門庫存所需的人員和材料也會增加成本。此外,由於處置舊閥門造成的環境破壞,可能會產生成本。所有這些還不包括因員工加班而給客戶帶來的額外成本以及因不得不關閉設施(即使是暫時關閉)而造成的收益損失。這是限制市場的一個因素。

閥門動力產業市場趨勢

不斷成長的電力行業預計將推動市場成長

- 每個發電應用都需要不同的流量控制需求。因此,發電廠中的特定管道系統可能包含多種閥門。發電廠的工業閥門還必須根據管道系統特定區域中發生的操作發揮不同的作用。

- 此外,可再生能源工廠的多樣性意味著不同的製程需要不同的閥門,例如一側需要低溫低壓原料,另一側需要高溫高壓蒸氣。這些工廠根據所涉及的特定任務使用不同類型的閥門來執行特定活動的情況並不少見。

- 控制閥在核能發電廠中常用於控制流體流量,一座核能發電廠的主迴路中有1500多個控制閥。控制閥可將流量引導至精確量的蒸氣或水,確保核能發電廠的能源效率。核子反應爐產生的電力約佔世界電力的 10%。目前有 55 座核子反應爐正在興建中,約佔目前發電能力的 15%。

- 此外,政府加強對核能發電廠發展的援助也是推動市場成長的因素。例如,2021年11月,美國政府宣布了《兩黨基礎設施法案》。該立法包括為美國能源局(DOE) 提供超過 620 億美元的資金,以幫助美國向清潔能源經濟轉型,並規定使用美國最大的單一清潔核能。該法案包括約 25 億美元的資金,用於在 2028 年之前示範兩座先進的美國核子反應爐,以及 60 億美元的資金用於啟動民用核能信貸計畫。

根據分析,北美將佔據主要市場佔有率。

- 由於發電廠數量眾多,預計北美將佔據很大的市場佔有率。此外,美國擁有最多的運作中核子反應爐。美國有92座正在運作的核子反應爐,總合容量為94.7 GWe。加拿大目前有 19 座核子反應爐在運作中,總合淨容量為 13.6 GWe。 2020年,核能發電廠發電量分別占美國和加拿大的14.6%和19.7%(資料來源:世界核能協會)。

- 此外,分析認為,發電閥門先進技術整合方面不斷加強的合作將提高預測期內的市場成長率。例如,2021 年 5 月,柯蒂斯-萊特核能事業部宣布與 Exelon Generation Company LLC 達成協議,許可該公司閥門專案的性能資料。 Curtiss-Wright 與 Exelon Generation 合作,利用性能資料提高 StressWave超音波洩漏檢測技術的效率,並促進美國核能和發電行業採用閥門評估、分析和性能最佳實踐。

- 根據分析,亞太地區在預測期內顯著成長。電力產業的龐大需求是市場的促進因素。例如,2021年,中國發電量8.11兆千瓦時(KWh),比上年成長8.1%。 2021年發電量較2019年成長11%,近兩年平均成長率為5.4%。 12月,中國風能、太陽能和核能發電量與前一年同期比較%(資料來源:中國國家統計局)。

- 此外,為滿足發電領域需求而不斷進行的產品創新也進一步滿足了市場需求。 2022年5月,ARMATURY集團宣佈為菲律賓水力發電設施生產了三種型號的蝶閥,DN為1,800至2,000。作為截止閥,蝶閥 L32.71 PN 10 和 PN 6 完全打開和關閉工作介質通過管道的通道。

閥門產業電力產業概況

據分析,全球電力產業閥門市場分散且競爭激烈。兩家公司正在利用策略性聯合措施來增加市場佔有率和盈利。製造商應該能夠透過併購來改善其產品範圍並獲得更大的市場佔有率。主要企業包括艾默生電氣公司、斯倫貝謝有限公司、阿法拉伐公司、福斯公司和克瑞公司。

- 2021 年12 月- 包括Severn 和LB Bentley 在內的專門從事高階閥門工程和製造的跨國公司塞文集團(Severn Group) 很高興地宣布,專門從事高階閥門工程和製造的跨國公司塞文集團(Severn Group),包括 Severn 和 LB Bentley 收購的先鋒 Valv Technologies。該協議是 Evern 集團實現成為工業能源產業嚴酷工況閥門全球領先供應商此目標的墊腳石。作為更大集團的一員,ValvTechnologies 將與 Severn 和 LB Bentley 一起獲得更多的資源和知識,同時保持營運獨立。

- 2021 年 6 月 - Neles Corp 簽訂資產收購協議,收購 Flowrox 的閥門和泵浦業務。這些公司為採礦、選礦、冶金、建築、能源、環境和化學工業開發和製造閥門和泵浦解決方案。這些解決方案包括夾管閥、刀閘閥和蠕動幫浦。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 電力產業在全球經濟的成長

- 電力業採用智慧閥門

- 市場限制因素

- 缺乏標準化措施,更換成本高

第6章 市場細分

- 按類型

- 球

- 蝴蝶

- 門/手套/檢查

- 插頭

- 控制

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Baker Hughes

- Valmet Oyj

- KITZ Corporation

- IMI Critical Engineering

- L&T Valves Limited

第8章投資分析

第9章 未來趨勢

The Global Valves Market in Power Industry is expected to register a CAGR of 6.74% during the forecast period.

Key Highlights

- Power consumption is increasing due to climate change and the need to develop better, renewable, and less damaging resources to create electricity. Due to this, manufacturers of industrial valves for the power plant sector look for process machinery that can improve the effectiveness of electricity production.

- Further, the growing strategic developments such as acquisitions, collaborations, and so on are set to bolster the growth rate. For instance, in April 2022, Vexve Armatury Group acquired Armatury Group GmbH, a distributor of ARMATURY Group valves in the Austrian and German markets for the power, gas, and metallurgy sectors. Through the acquisition, Vexve Armatury Group's position is strengthened, particularly in the DACH region (Germany, Austria, Switzerland).

- COVID-19 has created supply chain disruptions and has significantly impacted energy production during the lockdowns. However, the impact has been short-term.

- Along with additional expenses, valve replacement adds up. Equipment needs to be taken apart and then put back together. The personnel and materials required to manage valve inventory control have a cost. Additionally, there can be a fee for the environmental damage caused by the disposal of old valves. All of this is on top of the additional costs for customers caused by employee overtime and the revenue lost due to the facility having to shut down, even momentarily. This acts as a restraint on the market.

Power Sector in Valves Market Trends

Growing Power Sector is Expected to Cater the Market Growth

- A different set of flow control requirements are needed for each kind of power generation application. That so, a power plant's particular pipeline system may contain a wide variety of valves. Industrial valves for power plants also need to play diverse roles depending on the operations occurring in a specific area of the pipe system.

- Moreover, due to the diversity of renewable energy plants, different valves are needed for different processes, such as low temperature, low-pressure raw material at one end of the process and high temperature, high-pressure steam at the other. It's not unusual for these plants to use various valve types to carry out particular activities, depending on the exact duties involved.

- In nuclear power plants, control valves are frequently employed to control fluid flux, and the principal circuit of one nuclear power plant contains more than 1500 control valves. They enable the flux to be directed to a precise amount of steam or water, ensuring the nuclear power plant's energy efficiency. Nuclear power reactors generate around 10% of the world's electricity. A total of 55 more reactors, or roughly 15% of the current capacity, are now being built.

- Further, the growing government aid in developing nuclear power plants is set to boost the market growth rate. For instance, in November 2021, the US government announced The Bipartisan Infrastructure Law that includes over USD 62 billion for the US Department of Energy (DOE) to assist in the country's transition to a clean energy economy, which provides for utilizing nuclear energy, the country's greatest single source of clean power. The law includes around USD 2.5 billion to enable the demonstration of two advanced American reactors by 2028 and USD 6 billion to launch a Civil Nuclear Credit program.

North America is Analyzed to Major Share in the Market

- North America is expected to hold the major share in the market owing to the significant presence of the power generation plants. Moreover, The United States has the most operational nuclear reactors. The 92 operating nuclear reactors in the USA have a net combined capacity of 94.7 GWe. With a total net capacity of 13.6 GWe, Canada has 19 nuclear reactors that are currently in operation. Nuclear power plants produced 14.6% and 19.7% of the nation's electricity in 2020 in the US and Canada, respectively (Source: World Nuclear Association).

- Further, the growing collaborations in integrating advanced technologies in the valves in power generation are analyzed to boost the market growth rate during the forecast period. For instance, in May 2021, The Nuclear Division of Curtiss-Wright stated that it had reached a contract with Exelon Generation Company LLC to license the firm's valve program performance data. Curtiss-Wright will use the performance data in collaboration with Exelon Generation to improve the efficiency of its StressWave ultrasonic leak detection technology and encourage the adoption of best practices in valve assessment, analysis, and performance throughout the U.S. nuclear fleet and the power generation sector.

- Asia-Pacific is analyzed to grow at a significant rate during the forecast period. The significant demand from the power sector is a driving factor for the market. For instance, in 2021, China generated 8.11 trillion kilowatt-hours (KWh), an increase of 8.1 percent from the previous year. Power generation in 2021 increased by 11% from 2019, making the average rise over the last two years 5.4%. In December, China's wind, solar, and nuclear energy production increased year over year by 30.1%, 18.8%, and 5.7%, respectively (Source: National Bureau of Statistics (NBS)).

- Moreover, the growing product innovations to meet the demand in the power generation sector further contribute to the market's need. In May 2022, The ARMATURY Group announced that the company had manufactured three butterfly valves with DNs ranging from 1,800 to 2,000 for the Philippine hydroelectric power facility. As shut-off valves, butterfly valves L32.71 PN 10 and PN 6 will completely open or close the passage of the working medium through the pipeline.

Power Sector in Valves Industry Overview

The Global Valves Market in Power Industry is fragmented and is analyzed to be highly competitive. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. Manufacturers should be able to improve their product ranges and get a larger market share through mergers and acquisitions. Major firms include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co., among others.

- December 2021- Severn Group, a multinational company of dedicated high-end valve engineering and manufacturing companies that includes Severn and LB Bentley, has acquired ValvTechnologies, a pioneer in the design and manufacture of metal-seated, zero-leakage isolation valve products for demanding applications. The agreement is a milestone toward Severn Group's goal of being the leading global expert in severe service valves for the industrial and energy industries. Along with Severn and LB Bentley, ValvTechnologies will remain operationally independent while gaining access to a larger pool of resources and knowledge as a larger group member.

- June 2021- Neles Corp has inked an asset acquisition agreement to buy Flowrox's valve and pump operations. The companies develop and produce valve and pump solutions for the mining, minerals processing, metallurgy, construction, energy, environmental, and chemical industries. These solutions include pinch valves, knife gate valves, and peristatic pumps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Power Sector in the Global Economy

- 5.1.2 Adoption of Smart Valves in the Power Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Policies and High Replacement Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Baker Hughes

- 7.1.7 Valmet Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 L&T Valves Limited