|

市場調查報告書

商品編碼

1635361

包裝器材:市場佔有率分析、產業趨勢/統計、成長預測(2025-2031)Packaging Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

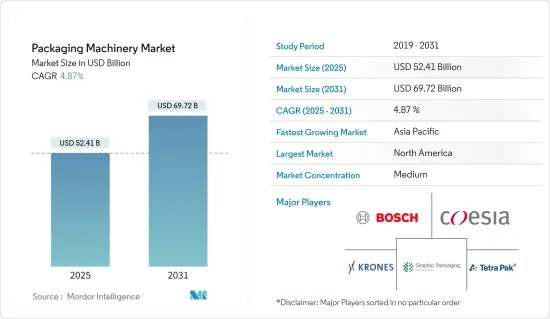

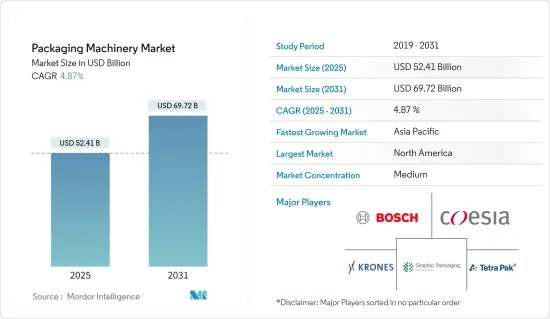

包裝器材市場規模預計到2025年為524.1億美元,預計到2031年將達到697.2億美元,預測期內(2025-2031年)複合年成長率為4.87%。

全球包裝器材市場在食品、飲料、藥品、化妝品等各行業中扮演重要角色。包裝器材可實現生產流程自動化,確保產品安全並符合嚴格的監管標準。主要市場促進因素包括自動化程度的提高、永續性和不斷變化的安全要求。食品和製藥等行業對於塑造包裝技術的需求、推動對創新機械的需求至關重要。此外,自動化顯著提高了生產率,減少了人為錯誤,並提高了工作效率,使包裝器材成為現代製造業的重要組成部分。

主要亮點

- 競爭對手和主要企業:Robert Bosch GmbH、Krones Inc. 和 Coesia SpA 等大公司處於行業領先地位,專注於大批量生產線的自動化解決方案。這些公司還優先考慮永續性,並跟上對環保包裝解決方案日益成長的需求。儘管 COVID-19 大流行擾亂了供應鏈並推遲了計劃,但它加速了自動化和軟性包裝器材的採用,以最少的人為干預來滿足不斷成長的需求。因此,該行業的長期前景仍然樂觀,特別是在以前採用自動化進展緩慢的地區。

技術進步徹底改變了包裝解決方案

主要亮點

- 自動化和智慧技術:技術進步,特別是自動化和智慧技術的進步,徹底改變了包裝器材產業。自動化包裝系統可簡化操作、降低人事費用並提高速度和準確性。例如,機械臂和機器視覺系統廣泛用於檢查、分類和堆疊。這些創新使公司能夠靈活地適應各種包裝類型和尺寸,而無需進行重大設定變更。

- 包裝數位化:包括物聯網(IoT)和人工智慧(AI)在內的數位技術在現代包裝中發揮關鍵作用。支援物聯網的系統可實現即時機器監控、預測性維護和流程最佳化。人工智慧主導的見解可幫助製造商預測設備故障、最大限度地減少停機時間並提高效率。此類創新提高了運作性能,同時延長了機器壽命,降低了製造商的長期成本。

- 包裝解決方案的永續性:隨著業界採用環保實踐,永續包裝器材正在取得進展。隨著旨在減少環境影響的法規不斷增加,公司正在設計能夠最大限度地減少材料浪費和能源消耗的機器。支持可回收和生物分解的包裝材料的環保設備越來越受歡迎。這些解決方案符合全球永續性目標,並鼓勵公司減少包裝過程中的碳排放和材料使用。

嚴格安全標準帶動市場需求

主要亮點

- 合規性和安全法規:安全標準和法規,尤其是食品、飲料和藥品等行業的安全標準和法規,正在推動對先進包裝機械的需求。隨著世界各地的監管機構制定嚴格的標準以確保消費者的健康和福祉,該行業擁有確保衛生和安全的包裝過程的機械非常重要。

- 包裝器材的安全創新:製造商正在將安全功能融入其機器中,例如自動清洗系統、無菌環境和防篡改技術。這些創新幫助公司遵守監管標準,並最大限度地降低與召回和違規相關的風險。此外,安全監控系統變得越來越重要,以確保設備在設定的監管參數內運作並提高操作安全性。

- 國際貿易合規性:國際安全標準和國際貿易法規也推動了對先進包裝器材的需求。隨著安全法規的發展,製造商需要投資適應性強的機械,以滿足不同地區和行業當前和未來的合規標準。隨著公司尋求確保合規性和產品完整性的機械,這一趨勢預計將支持市場的持續成長。

包裝器材市場趨勢

食品領域經歷顯著成長

- 自動化推動包裝器材銷售:自動化是包裝器材市場的關鍵成長要素。透過整合自動化系統,公司正在提高業務效率、降低人事費用並提高包裝過程的準確性。這種趨勢在食品和製藥等行業尤其明顯,這些行業的衛生和精度非常重要。隨著這些行業的擴張,對確保更快、更可靠的包裝流程的先進包裝機械的需求預計將大幅成長。

- 永續性推動市場創新:對永續性的關注正在影響包裝器材的發展。製造商正在投資支持可回收和生物分解性材料的技術,同時減少能源消耗。隨著環境法規的不斷加強,企業正在優先考慮環保包裝解決方案,推動市場創新和成長。

- 製藥業引領機器成長:由於對安全、防竄改和無菌包裝解決方案的需求,製藥業對專用包裝器材的需求不斷增加。這種需求促使製藥公司大力投資先進包裝技術,以確保產品完整性並符合嚴格的安全標準。

- 智慧技術提高工作效率:智慧技術在包裝器材中的整合正在改變生產過程。物聯網和人工智慧系統提供即時洞察,使製造商能夠最佳化效率並減少停機時間。隨著越來越多的製造商採用智慧包裝解決方案來保持競爭力,這些技術預計將推動成長。

食品領域經歷顯著成長

- 食品包裝器材的需求不斷增加:由於加工食品和簡便食品的消費不斷增加,對食品包裝器材機械的需求不斷增加。食品安全問題推動了對衛生、高效包裝解決方案的需求。製造商正專注於真空密封和無菌包裝等創新,以滿足消費者對新鮮和安全食品的需求。

- 推動食品包裝創新:調氣包裝(MAP)和智慧包裝等新型包裝技術在食品領域越來越受歡迎。這些創新有助於延長產品保存期限並保持新鮮度,同時滿足監管標準。這些技術的日益普及預計將推動市場進一步擴張。

- 自動化正在再形成食品包裝流程:自動化正在透過提高生產力和確保安全再形成食品包裝產業。工業 4.0 解決方案和 3D 列印等創新正在幫助推進生物分解性和節能的包裝解決方案。隨著企業尋求提高食品包裝的競爭力和效率,預計將持續到自動化的轉變。

- 亞太地區引領食品包裝成長:由於消費者對包裝食品的需求不斷成長以及可支配收入的增加,亞太地區正在成為食品包裝器材的主要成長地區。中國和印度等國家正在大力投資先進包裝技術,使該地區成為全球包裝機械市場的主要企業。

亞太地區正在經歷顯著成長

- 蓬勃發展的製造業推動需求:亞太地區製造業的快速擴張正在推動對包裝器材的需求。中國、印度和日本等國家正在投資自動化包裝系統,以滿足食品、製藥和消費品產業日益成長的需求。該地區的工業成長預計將極大地促進市場擴張。

- 永續性措施推動市場擴張:永續性在亞太包裝器材市場越來越受到關注。日益嚴格的環境法規正在推動製造商採用環保的包裝解決方案。向永續材料和節能機械的轉變預計將在未來幾年推動市場成長。

- 技術進步促進成長:智慧技術和自動化的採用是亞太包裝器材市場的關鍵成長要素。支援物聯網和人工智慧的機器正在提高生產力和業務效率。對這些先進技術的持續投資預計將支持該地區的市場成長並加強其在全球包裝產業的地位。

- 電子商務和消費品推動成長:亞太地區電子商務的興起正在推動對包裝器材的需求。網路購物的趨勢,特別是雜貨和藥品的趨勢,正在推動對高效包裝解決方案的需求。政府對技術和製造的投資進一步促進了市場擴張,亞太地區在全球包裝器材市場上確立了主導地位。

包裝器材行業概況

市場適度整合:全球包裝器材市場適度整合,羅伯特·博世有限公司、克朗斯公司和 Coesia SpA 等主要企業佔據市場主導地位。這些公司為食品、飲料、製藥和消費品等行業提供各種機器。利基市場和區域參與者正在透過提供適合當地需求的客製化解決方案來補充市場。

創新和客製化推動競爭:領先的公司都專注於創新,尤其是自動化和永續性。利樂和 Graphic Packaging International 等公司在環保包裝技術方面處於領先地位,而克朗斯則透過不斷改進飲料包裝系統來擴大其全球影響力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 持續的技術開發

- 安全標準和法規的影響

- 新興市場的主要發展

- 市場限制因素

- 高成本和進口關稅對新客戶來說是一項挑戰

第6章 市場細分

- 依產品類型

- 填充

- 標籤、裝飾、編碼

- 案件處理

- 瓶裝線

- 碼垛

- 包裝/裝訂

- 泡殼、貼體、真空包裝

- 其他解決方案

- 按最終用戶產業

- 食物

- 飲料

- 藥品

- 個人護理、化妝品和洗護用品

- 工業/化工

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Robert Bosch GmbH

- Coesia SpA

- Krones Inc.

- Tetra Pak International SA

- Graphic Packaging International, LLC

- IMA Industria Macchine Automatiche SpA

- MULTIVAC Group

- Ishida Co. Limited

- Sidel SA

- PAC Machinery Group

- Heal Seal LLC

- Ossid LLC

- Marchesini Group SpA

- Ross Industries Inc.

- Starview Packaging Machinery, Inc.

第8章投資分析

第9章市場的未來

The Packaging Machinery Market size is estimated at USD 52.41 billion in 2025, and is expected to reach USD 69.72 billion by 2031, at a CAGR of 4.87% during the forecast period (2025-2031).

The global packaging machinery market plays a critical role across various industries such as food, beverage, pharmaceuticals, and cosmetics. Packaging machinery automates production processes, ensuring product safety and meeting strict regulatory standards. Key market drivers include advancements in automation, sustainability, and evolving safety requirements. Industries like food and pharmaceuticals are pivotal in shaping demand for packaging technologies, fueling the need for innovative machinery. Moreover, automation has significantly enhanced productivity, reduced human error, and boosted operational efficiency, making packaging machinery indispensable in modern manufacturing.

Key Highlights

- Competition and Key Players: Major players such as Robert Bosch GmbH, Krones Inc., and Coesia S.p.A lead the industry, focusing on automated solutions for high-volume production lines. These companies also prioritize sustainability, aligning with the rising need for eco-friendly packaging solutions. The COVID-19 pandemic disrupted supply chains and delayed projects, but it accelerated the adoption of automated and flexible packaging machinery to meet increasing demand with minimal human intervention. As a result, the long-term industry outlook remains positive, particularly in regions previously slow to adopt automation.

Technological Advancements Revolutionize Packaging Solutions

Key Highlights

- Automation and Smart Technologies: Technological advancements, particularly in automation and smart technologies, have revolutionized the packaging machinery industry. Automated packaging systems streamline operations, reduce labor costs, and increase speed and precision. Robotic arms and machine vision systems, for example, are widely used for inspection, sorting, and palletizing. These innovations provide businesses with flexibility, allowing them to handle various packaging types and sizes without significant retooling.

- Digitalization in Packaging: Digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), play a crucial role in modern packaging. IoT-enabled systems allow real-time monitoring of machinery, predictive maintenance, and process optimization. AI-driven insights help manufacturers predict equipment malfunctions, minimizing downtime and improving efficiency. These innovations enhance operational performance while extending machinery lifespan, reducing long-term costs for manufacturers.

- Sustainability in Packaging Solutions: Sustainable packaging machinery is gaining traction as industries adopt eco-friendly practices. With increasing regulations aimed at reducing environmental impact, companies are designing machines that minimize material waste and energy consumption. Eco-friendly equipment that supports recyclable and biodegradable packaging materials is becoming more popular. These solutions align with global sustainability goals, encouraging companies to reduce carbon emissions and material usage in packaging processes.

Stringent Safety Standards Propel Market Demand

Key Highlights

- Compliance and Safety Regulations: Safety standards and regulations, particularly in sectors like food, beverage, and pharmaceuticals, are driving demand for advanced packaging machinery. Regulatory bodies worldwide enforce stringent standards to ensure consumer health and welfare, making it critical for industries to adopt machinery that guarantees hygienic and safe packaging processes.

- Safety Innovations in Packaging Machinery: Manufacturers are integrating safety features like automated cleaning systems, sterile environments, and tamper-proof technologies into their machinery. These innovations help businesses comply with regulatory standards and minimize risks associated with recalls or non-compliance. Additionally, safety monitoring systems are becoming essential, ensuring that equipment operates within set regulatory parameters and enhancing operational security.

- Global Trade Compliance: International safety norms and regulations for global trade are also propelling demand for sophisticated packaging machinery. As safety regulations evolve, manufacturers need to invest in adaptable machinery that can meet both current and future compliance standards across various regions and sectors. This trend is expected to support sustained market growth as companies look for machinery that ensures regulatory compliance and product integrity.

Packaging Machinery Market Trends

Food Segment to Have a Significant Growth

- Automation Driving Packaging Machinery Sales: Automation is a major growth driver in the packaging machinery market. By integrating automated systems, companies are improving operational efficiency, reducing labor costs, and enhancing accuracy in packaging processes. This trend is especially pronounced in industries like food and pharmaceuticals, where hygiene and precision are critical. As these sectors expand, the demand for advanced machinery that ensures faster, more reliable packaging processes is set to grow significantly.

- Sustainability Pushing Market Innovation: The focus on sustainability is influencing the development of packaging machinery. Manufacturers are investing in technologies that support recyclable and biodegradable materials while reducing energy consumption. With environmental regulations tightening, businesses are prioritizing eco-friendly packaging solutions, driving innovation and growth in the market.

- Pharmaceutical Sector Leading Machinery Growth: The pharmaceutical industry is seeing increased demand for specialized packaging machinery due to the need for secure, tamper-evident, and sterile packaging solutions. This demand is pushing pharmaceutical companies to invest heavily in advanced packaging technologies, ensuring product integrity and compliance with stringent safety standards.

- Smart Technology Enhancing Operational Efficiency: The integration of smart technology in packaging machinery is transforming production processes. IoT and AI-enabled systems provide real-time insights, allowing manufacturers to optimize efficiency and reduce downtime. These technologies are expected to drive growth as more manufacturers adopt smart packaging solutions to remain competitive.

Food Segment to Have Significant Growth

- Rising Demand for Food Packaging Machinery: The demand for food packaging machinery is growing due to the increasing consumption of processed and convenience foods. Food safety concerns are driving the need for hygienic and efficient packaging solutions. Manufacturers are focusing on innovations such as vacuum sealing and aseptic packaging to meet consumer demands for fresh and safe food products.

- Technological Innovations Boosting Food Packaging: New packaging technologies, such as Modified Atmosphere Packaging (MAP) and smart packaging, are gaining traction in the food sector. These innovations help extend product shelf life and maintain freshness, while also complying with regulatory standards. The growing popularity of these technologies is expected to fuel further market expansion.

- Automation Reshaping Food Packaging Processes: Automation is reshaping the food packaging industry by improving productivity and ensuring safety. Innovations such as Industry 4.0 solutions and 3D printing are driving advancements in biodegradable and energy-efficient packaging solutions. This shift towards automation is expected to continue, as companies seek to enhance competitiveness and efficiency in food packaging.

- Asia-Pacific Region Leading Food Packaging Growth: The Asia-Pacific region is emerging as a significant growth area for food packaging machinery, driven by rising consumer demand for packaged foods and increased disposable income. Countries like China and India are investing heavily in advanced packaging technologies, positioning the region as a key player in the global packaging machinery market.

Asia Pacific to Have Significant Growth

- Booming Manufacturing Sector Driving Demand: The rapid expansion of manufacturing sectors in Asia-Pacific is driving demand for packaging machinery. Countries like China, India, and Japan are investing in automated packaging systems to meet rising demand from food, pharmaceutical, and consumer goods industries. The region's industrial growth is expected to fuel market expansion significantly.

- Sustainability Efforts Accelerating Market Expansion: Sustainability is a growing focus in the Asia-Pacific packaging machinery market. With stricter environmental regulations, manufacturers are adopting eco-friendly packaging solutions. This shift towards sustainable materials and energy-efficient machinery is projected to drive market growth in the coming years.

- Technological Advancements Fueling Growth: The adoption of smart technologies and automation is a key growth driver in the Asia-Pacific packaging machinery market. IoT and AI-enabled machinery are improving productivity and operational efficiency. Continued investment in these advanced technologies is expected to bolster the region's market growth and strengthen its position in the global packaging industry.

- E-commerce and Consumer Goods Driving Growth: The rise of e-commerce in Asia-Pacific is fueling demand for packaging machinery. The growing trend of online shopping, especially for groceries and pharmaceuticals, is boosting the need for efficient packaging solutions. Government investments in technology and manufacturing are further contributing to the market's expansion, positioning Asia-Pacific as a leading force in the global packaging machinery market.

Packaging Machinery Industry Overview

Moderately Consolidated Market: The global packaging machinery market is moderately consolidated, with key players like Robert Bosch GmbH, Krones Inc., and Coesia S.p.A dominating the landscape. These companies offer a wide range of machinery catering to industries such as food, beverages, pharmaceuticals, and consumer goods. Niche and regional players complement the market by providing customized solutions tailored to local demands.

Innovation and Customization Driving Competition: Major players are focused on technological innovation, particularly in automation and sustainability. Companies like Tetra Pak and Graphic Packaging International are leading in eco-friendly packaging technologies, while Krones Inc. has strengthened its global presence by continuously enhancing its beverage packaging systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Technological Developments

- 5.1.2 Impact of Safety Standards & Regulations

- 5.1.3 High Development in the Key End User Market

- 5.2 Market Restraints

- 5.2.1 High Costs and Import Duties Pose a Challenge for New Customers

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Filling

- 6.1.2 Labelling, Decorating, and Coding

- 6.1.3 Case Handling

- 6.1.4 Bottling Line

- 6.1.5 Palletizing

- 6.1.6 Wrapping and Bundling

- 6.1.7 Blister, Skin/Vacuum Packaging

- 6.1.8 Other Solutions

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Personal Care, Cosmetics, and Toiletries

- 6.2.5 Industrial and Chemicals

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GmbH

- 7.1.2 Coesia S.p.A.

- 7.1.3 Krones Inc.

- 7.1.4 Tetra Pak International S.A

- 7.1.5 Graphic Packaging International, LLC

- 7.1.6 I.M.A Industria Macchine Automatiche S.p.A

- 7.1.7 MULTIVAC Group

- 7.1.8 Ishida Co. Limited

- 7.1.9 Sidel S.A.

- 7.1.10 PAC Machinery Group

- 7.1.11 Heal Seal LLC

- 7.1.12 Ossid LLC

- 7.1.13 Marchesini Group S.p.A

- 7.1.14 Ross Industries Inc.

- 7.1.15 Starview Packaging Machinery, Inc.