|

市場調查報告書

商品編碼

1635370

全球應用外包-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Application Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

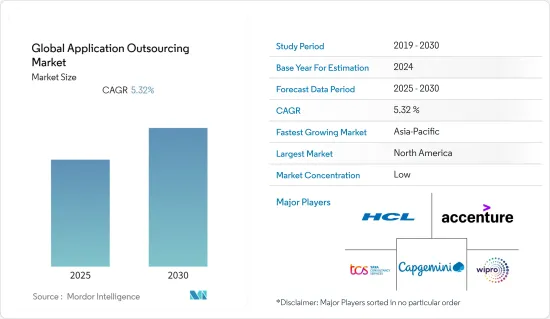

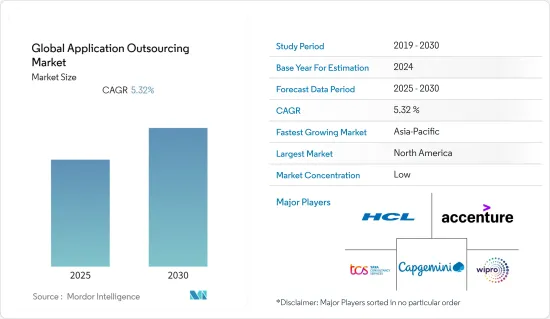

預計預測期內全球應用外包市場複合年成長率為5.32%

主要亮點

- IT公司透過向其他公司提供應用外包服務來外包業務。這些服務包括測試、設計和產生業務應用程式。它還包括應用程式重新設計、應用程式維護、支援、入口網站開發、資料遷移等。

- 第三方公司透過監控您的部門來照顧您的業務,避免了這項工作的負擔。此外,雲端運算具有成本效益,使我們的工作變得更輕鬆。銀行和零售等各種終端用戶已經在使用這些服務,推動了應用外包市場的成長。

- 許多公司正在尋求策略聯盟來增強他們的產品和服務。例如,2022 年 5 月,IBM 與 Amazon Web Services 簽訂了策略合作夥伴協議,在 AWS 上提供 IBM 軟體即服務。 IBM 和 AWS 的夥伴關係使客戶能夠快速輕鬆地存取 IBM 軟體,涵蓋自動化、人工智慧和資料、安全性和永續性,這些軟體基於AWS 上的紅帽OpenShift 服務(ROSA) 構建,在AWS上以雲端原生方式運行。

- 此外,跨國公司正在增強和創新其產品,以服務更廣泛的客戶。例如,2022 年 5 月,IBM 加強了其全球資料平台,以應對人工智慧採用的挑戰。根據 2021 年全球人工智慧採用指數,資料複雜性和資料孤島是人工智慧採用的最大障礙。

- COVID-19 大流行對應用外包市場產生了一定影響。許多企業的封鎖和在家工作的採用影響了應用外包和企業工作流程的採用。

應用外包市場趨勢

BFSI 佔有較大佔有率

- 新時代不斷擴大的基本客群迫使銀行、金融服務和工業 (BFSI) 努力提供更好的客戶體驗。再加上產業參與企業眾多,轉換成本已降至最低,客戶可以輕鬆更換服務供應商。為了提高客戶維繫並提高盈利,BFSI 部門必須為客戶提供有吸引力的使用者體驗和便利性。技術支援的解決方案可協助企業提供更準確、個人化的服務和更好的客戶體驗。

- 金融科技公司可以利用巨量資料建立全面的使用者檔案和準確的客戶細分策略,以客製化服務以滿足消費者的需求。可以使用先進的建模方法提供個人化服務,這些方法考慮到一個人的風險感知、年齡、性別、財務狀況、位置,甚至關係狀態。

- Crisil表示,IT產業預計在2022會計年度強勁復甦,收益成長率為11%。這項復甦將主要由銀行、金融援助、保險、零售和醫療保健領域外包的增加和數位轉型服務的加速所推動。 BFSI 佔 IT業務收益的 28%,預計 2022 會計年度將成長 13-14%。

- 市場上的主要企業正在探索策略併購,以擴大其全球足跡。例如,2021 年 1 月,Tech Mahindra 以 900 萬美元收購了 Payments Technology Services,擴大其在 BFSI 領域的足跡。支付技術服務為亞洲的金融服務公司提供銀行和付款解決方案。

- 在這個市場上,許多參與企業正在推出各種產品開發和創新,以提高其在市場上的影響力。例如,2022 年 4 月,IBM 發布了 IBM z16,這是一種用於大規模交易處理的即時人工智慧,也是業界首個量子安全系統。 IBM z16 專門設計用於防範可能被用來破壞當前加密技術的近期威脅。

- 2022年5月,TCS宣布BaNCS雲端產品套件使金融服務公司能夠加速數位化,並啟用雲端原生功能來推動成長和轉型。

亞太地區預計將出現顯著成長

- 對 BFSI 的需求不斷成長以及數位轉型的趨勢預計將推動該地區的市場成長。該地區各國政府正在大力投資數位轉型。例如,電子和資訊技術部 (MeitY) 宣布數位印度計畫的預算支出為 1,067.618 億印度盧比(去年預算為 638.80 億印度盧比)。

- 隨著醫療保健服務支出的增加以及政府醫療保健計劃的成本轉移到醫療保健來源,對醫療保健外包的需求正在增加。該地區正在湧現許多整合多家醫院的新計劃,增加了外包的需求。

- 醫院也開始使用第三方服務來獲取診斷影像結果和醫生的病例記錄,這有望繁榮醫療外包市場。據中華人民共和國財政部公告,2021年,我國衛生健康公共支出總額約1.92兆元。

應用外包產業概況

應用外包市場競爭激烈,國內外參與企業活躍。國際參與企業透過與當地參與企業聯盟在每個國家開展業務。隨著市場預計將擴大並提供更多機會,預計將有更多參與企業很快進入市場。市場上的一些主要參與企業包括 Wipro、IBM 和埃森哲。近期市場發展趨勢如下。

- 2022 年4 月- 塔塔諮詢服務(TCS) 將其作為BFSI 客戶的領先轉型合作夥伴的經驗與Microsoft 的金融服務雲解決方案以及龐大的Microsoft 認證顧問人才庫相結合,幫助客戶實現創新和重新構想,以滿足市場需求。

- 2022 年 4 月 - TCS 與加拿大支付局建立戰略夥伴關係關係,以支持該國的業務轉型和即時鐵路 (RTR) 的實施。這個新的即時付款系統將允許加拿大人在幾秒鐘內發起付款並收到不可撤銷的資金。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- BFSI 需求增加

- 更加重視客戶維繫和參與

- 邁向數位轉型

- 市場限制因素

- 安全和隱私問題

第6章 市場細分

- 按最終用戶產業

- BFSI

- 醫學生命科學

- 媒體娛樂

- 物流/運輸

- 其他

- 按地區

- 北美洲

- 美國

- 中國

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Accenture

- Wipro

- TCS

- Capgemini

- CSC

- HCL

- IBM Global Services

- Infosys

- NTT Data

- ATOS SE

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91562

The Global Application Outsourcing Market is expected to register a CAGR of 5.32% during the forecast period.

Key Highlights

- IT companies provide application outsourcing services to other companies to outsource their business operations. These services involve testing, designing, and production of business applications. The assistance includes application re-engineering, application maintenance, support, web portal development, and data migration.

- Third-party companies take care of the businesses by monitoring business functions to avoid the burden of doing that work. Moreover, cloud computing has made the job easier, as it is cost-effective. Various end-users like banking, retail, and others are already using these services, driving the growth of the application outsourcing market.

- Various companies are looking for strategic partnerships to enhance their products and services. For instance, in May 2022, IBM signed a strategic collaboration agreement with Amazon Web Services to deliver IBM Software-as-a-Service on AWS. The partnership between IBM and AWS will provide clients with quick and easy access to IBM Software that spans automation, AI and data, security and sustainability capabilities, is built on Red Hat OpenShift Service on AWS (ROSA), and runs cloud-native on AWS.

- Furthermore, companies globally are looking to enhance and innovate their products to provide services to a broader customer base. For instance, in May 2022, IBM enhanced its Global Data Platform to address the challenges related to AI adoption. As per the Global AI Adoption Index 2021, data complexity and data silos are the top barriers to AI adoption.

- The Covid - 19 pandemic has moderately impacted the application outsourcing market. Lockdown and adoption of work from home by many companies have affected the adoption of application outsourcing and workflow of enterprises.

Application Outsourcing Market Trends

BFSI to have a significant share

- The growing base of new-age customers is compelling the banking, Financial Services, and Industrial Industry (BFSI) to redirect their efforts to provide a better customer experience. A minimal switching cost coupled with multiple players in the industry has made it easier for the customers to change their service providers easily. For higher customer retention and better profitability, the BFSI sector must offer its customers an engaging user experience and convenience. Technology-enabled solutions help companies deliver more accurate and personalized services and a superior customer experience.

- Fintechs may utilize big data to build thorough user-profiles and precise client segmentation strategies, allowing them to customize their services to their consumers' demands. Personalized services can be provided using advanced modeling approaches that take into account a person's risk perception, age, gender, financial circumstances, location, and, in some instances, relationship status.

- As per Crisil, the IT Industry will post a strong recovery with revenue growth of 11% in FY 2022. The recovery will be led by increasing outsourcing and accelerating digital transformation services, mainly in banking, financial assistance, insurance, retail, and healthcare. BFSI, which accounts for 28% of IT service revenue, will grow 13-14% in FY 2022.

- Major companies in the market are looking for strategic mergers and acquisitions to expand their global footprints. For instance, in January 2021, Tech Mahindra acquired Payments Technology Services for USD 9 million to expand its footprints in the BFSI sector. Payments Technology Services provides banking and payments solutions to financial services firms in Asia.

- Many players in the market are coming up with various product development and innovations to stronghold their market presence. For instance, in April 2022, IBM announced its IBM z16, a real-time AI for transaction processing at scale and the industry's first quantum-safe system. IBM z16 is specifically designed to help protect against near-future threats that might be used to crack today's encryption technologies.

- In May 2022, TCS announced its BaNCS Cloud product suite would enable financial services firms with cloud-native capabilities to accelerate digitization and drive their growth and transformation.

Asia-Pacific is expected to show a significant growth

- The increasing demand for BFSI and the move toward digital transformation are expected to drive market growth in the region. The governments in the area are rigorously investing in digital transformation. For instance, the Ministry of Electronics and Information Technology (MeitY) has announced a budget outlay of INR 10,676.18 crore for the Digital India program, INR 6,388 crore in the last year's budget.

- The rising need for healthcare outsourcing results from increased spending on healthcare services, and the expense of government healthcare programs has shifted to healthcare sources. Numerous new multi-strength hospital projects have come up in the region, boosting the requirement for outsourcing.

- Also, Hospitals have begun to utilize third-party services to understand imaging results or records of doctor's case notes which are set to create a booming effect in the healthcare outsourcing market. As per the Ministry of Finance of the People's Republic of China, In 2021, total public expenditure on health care and hygiene in China amounted to about 1.92 trillion yuan.

Application Outsourcing Industry Overview

The application outsourcing market is highly competitive, with several local and international players active. International participants operate in the countries through partnerships with local players. With the Market expected to broaden and yield more opportunities, more players will enter the market soon. Key players operating in the market include Wipro, IBM, and Accenture, among others. The recent developments in the market are -

- April 2022 - Tata Consultancy Services will combine its experience as a leading transformation partner for BFSI clients with its Microsoft Cloud for Financial Services solutions and its large talent pool of Microsoft-certified consultants to enable clients to innovate and reimagine their businesses to meet the evolving market, customer and regulatory needs.

- April 2022 - TCS has entered into a strategic partnership with payments Canada to transform its operations and help implement the Real-Time Rail (RTR). This new real-time payments system will allow Canadians to initiate payments and receive irrevocable funds in seconds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased demand from BFSI

- 5.1.2 Growing emphasis on customer retention & engagement

- 5.1.3 Move towards digital transformation

- 5.2 Market Restraints

- 5.2.1 Security & Privacy-related concerns

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 BFSI

- 6.1.2 Healthcare and Lifesciences

- 6.1.3 Media and Entertainment

- 6.1.4 Logistics & Transportation

- 6.1.5 Other Categories

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 China

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 India

- 6.2.3.2 China

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of APAC

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture

- 7.1.2 Wipro

- 7.1.3 TCS

- 7.1.4 Capgemini

- 7.1.5 CSC

- 7.1.6 HCL

- 7.1.7 IBM Global Services

- 7.1.8 Infosys

- 7.1.9 NTT Data

- 7.1.10 ATOS SE

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219