|

市場調查報告書

商品編碼

1635374

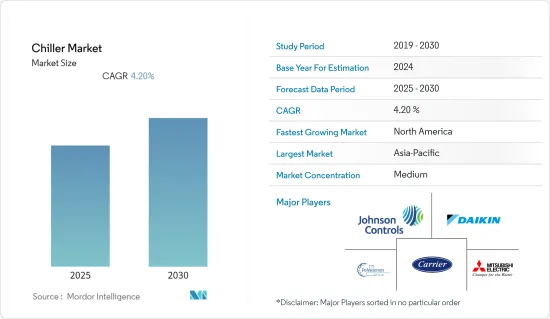

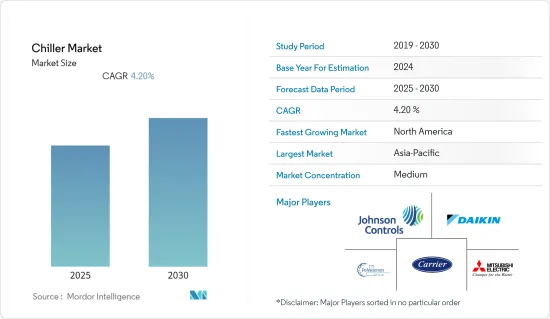

冷凍-市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Chiller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內冷凍市場複合年成長率為 4.2%

主要亮點

- 據印度品牌股權基金會稱,到2025年,印度化工和石化行業的總投資預計將達到8兆印度盧比(1,073.8億美元)。 2021年12月,印度化工產品產量為903,002噸,石化產品產量為1,877,907噸。 2021 年 12 月高含量化學品包括:堿灰(257,199 公噸)、苛性鈉(277,638 公噸)、液態氯(190,492 公噸)、甲醛(22,794 公噸)以及殺蟲劑和殺蟲劑(22,110 公噸)。

- 此外,HFC(氫氟碳化物)的逐步淘汰迫在眉睫,對環保冷卻解決方案的需求正在促使冷凍機組製造商進行創新。作為回應,2022 年 2 月,位於華盛頓州的飲料加工和工業市場冷凍製造商和供應商 Pro-Refrigeration, Inc. 提出了二氧化碳冷凍的想法。 CO2是一種天然冷媒,全球暖化潛勢(GWP)為1,因此對全球暖化的影響為零。它還可以100%回收冷凍系統排放的熱量並產生高達200°F的熱水。飲料廠和酪農使用大量天然氣和丙烷來加熱水以進行消毒和清洗,因此熱回收是 Pro 冷凍的重要產品功能。

- 隨著對環保和永續產品的需求不斷增加,各個製造商正在努力開發永續產品和解決方案。例如,2021年3月,羅斯推出了MiDIpack-I Eco,這是一個採用變頻渦捲式壓縮機和R32生態氣體的新系列風冷式冷凍和可逆熱泵產品。此產品系列針對注重生態永續性的公司。

- 另一方面,對全球暖化和臭氧層消耗等環境問題的擔憂導致了全球和區域法規的製定,這對冷媒的應用產生了重大影響。購買、設計、安裝和維修空調和冷凍設備的製造商和最終用戶應參考現行國家法規、規範和標準來選擇適合其預期用途的冷媒。

- 聯合國環境規劃署技術、工業和經濟部 (UNEP DTIE) 臭氧行動司正在審查《關於蒙特婁議定書》下的承諾,特別是與逐步淘汰氟烴塑膠(HCFC) 相關的承諾。正在協助各國遵守規定。 HCFC 的替代品包括氨、碳氫化合物和二氧化碳等天然冷媒,以及全球暖化潛值 (GWP) 較低的氣候和臭氧友善 HFC,包括飽和和不飽和 HFC (HFO)。這些因素對目前的市場生態系統提出了挑戰。但它也為採用先進技術、促進創新和提高效率的公司提供了重大機會。

冷凍市場趨勢

食品和飲料領域將顯著推動市場成長

- 食品加工冷凍是食品和飲料製造商和經銷商最常用的冷卻系統之一。食品加工和食品包裝應用需要可靠的間接冷卻設備來保持準確和一致的溫度控制。食品加工冷凍使用熱交換器來冷卻產生熱量的製程元件。它用於各種食品加工應用,包括起司、肉類、醬汁、優格、冰淇淋、巧克力和烘焙點心。

- 在全球範圍內,由於便利、可支配收入增加和忙碌的生活方式等多種因素,冷凍和加工食品的消費量正在增加。例如,根據 Deutsches Tiefkuhlinstitut 的數據,德國人均冷凍食品消費量從 202 年的 44.8 公斤增加到 2021 年的 46.1 公斤。此外,經濟合作暨發展組織(OECD)預測,歐盟(EU27)的乳酪產量將從2018年的993.8萬噸增加到2030年的1,154.3萬噸。

- 為了滿足不斷成長的消費者群體不斷變化的需求,市場上的多家公司正在創新先進和全面的產品。例如,阿特拉斯科普柯於 2021 年 3 月推出了 TCX 4-90A冷凍系列,將其工業產品組合擴展到製程冷卻設備。 TCX冷凍適用於各種工業流程和冷卻應用中的水冷卻,包括食品和飲料、製藥、醫療、印刷和塑膠。

- 此外,開利於 2022 年 3 月推出了採用 PureTec 冷媒的 AquaForce Vision 30KAV,這是一款採用超低 GWP(全球暖化潛勢)冷媒 R-1234ze 的新型高性能、緊湊型製程冷凍冷水機系列。該冷凍系列針對食品製造、塑膠、製藥、化學和金屬行業以及需要超可靠冷卻至 -12°C 的工業流程進行了最佳化。

- 此外,2022 年 5 月,Kaltra 宣布將於 2022 年第三季擴大其高效風冷冷凍組合,包括基於 2019 年首次推出的 Versa 平台的 R290(丙烷)型號。新型 Lightstream Screw II冷凍的核心是基於 Bitzer 緊湊型螺桿設計元件的丙烷壓縮機,針對 R290 等易燃冷媒的設計、操作和維護制定了特殊的安全法規。這些冷凍適用於食品和飲料、化學、製藥、製造應用、空調市場等領域的中低溫冷凍。

- 啤酒廠和釀酒廠對乙二醇冷凍的需求正在迅速增加。乙二醇冷凍用於消除研磨、研磨、晾架和煮沸過程中添加的熱量。模組化和包裝冷凍由於易於使用和安裝,在飲料行業也越來越受歡迎。

北美實現顯著成長

- 美國和加拿大構成了北美冷凍市場的其他子群體。持續的經濟成長和不斷發展的都市化導致醫院、辦公室、大型零售店和劇院的建設不斷擴大。北美各國政府正在支持機場基礎設施的發展和智慧城市的創建。因此,旅遊業、智慧城市計劃和建設活動的增加正在推動該地區住宅、商業和工業領域對冷凍的需求。美國能源局(DOE) 正在全國範圍內進行重大投資,以提高能源效率標準。美國能源部的目標是透過開發突破性的研究和技術解決方案來解決美國面臨的環境、能源和核能挑戰。

- 為了滿足客戶的各種需求並佔領廣泛的市場,公司不斷向市場推出新產品。例如,2022 年 3 月,美國江森自控旗下的弗里克工業冷凍公司 (Frick Industrial Refrigeration) 宣佈為北美市場推出一款新型低充電直列式包裝氨/NH3 (R717)冷凍。根據 Forry 介紹,新型 Frick North America 內聯成套氨製冷機 (IPAC-S) 具有“極低的充電量”,通常使用 1 磅/TR (0.13 kg/kW)。 IPAC-S是隨著Frick的氨螺桿壓縮機誕生的。它有 IPAC-24 至 IPAC-222 12 種尺寸,冷凍製冷量範圍從 30TR 至 390TR(105.5 至 1,371.6kW)。

- 此外,2021年5月,商務用食品服務設備製造商Wellbilt將在美國和加拿大銷售來自專門生產高品質鼓風冷凍的義大利Nuovair公司的所有捲入式鼓風冷凍。 Nuoair 技術解決了營運商遇到的四大問題。首先,憑藉業界最大的風量(9立方米/小時)和電子膨脹閥,您可以透過突然停止烹飪過程在幾秒鐘內挽救煮過頭的食物,以保持風味和品質。

- 資料中心產生過多的熱量,造成經濟和環境挑戰。此外,資料中心的二氧化碳排放達到歷史最高水平,對環境產生重大影響。這些高排放、對高效冷卻的需求以及資料中心新興市場的發展正在推動資料中心 HVAC 系統對高效能冷凍的需求,並促進市場成長。

- 例如,Facebook的母公司Meta將於2022年4月在密蘇裡州和德克薩斯州啟動兩個新的資料中心計劃,使美國資料中心建設和營運的總投資達到約160億美元。位於德克薩斯州坦普爾的耗資 8 億美元的設施總面積約為 90 萬平方英尺,位於密蘇裡州堪薩斯城的耗資 8 億美元的設施總面積約為 100 萬平方英尺。資料中心建設的增加預計將顯著推動市場。

- 住宅、商業建築和工業建築中的多餘熱量透過冷凍去除並用於空調。為了從冷凝器和蒸發器中去除熱量,這些設備使用冷媒。住房研究聯合中心預測,未來十年,嬰兒潮世代將推動美國的建築和改建需求。該國供暖和製冷設備市場的擴大預計將受到建設計劃增加的積極影響。例如,根據美國人口普查局的數據,截至 2021 年 5 月,以季節性已調整的年率計算,5 月發放的建築許可證為 1,681,000 套私人住宅。這比 2020 年 5 月的值高出 34.9%。住宅單元數量的增加為冷凍市場提供了成長機會。

冷凍產業概況

全球冷凍市場競爭激烈,主要競爭者包括 Carrier Global Corporation、Mitsubishi Electric Corporation 和 Polyscience Inc.。公司不斷投資於策略聯盟和產品開發,以獲得顯著的市場佔有率。我們將介紹一些最近的市場發展趨勢。

- 2022 年 2 月 - 空調設計師 Fujinetsu 和冷凍製造商 Meiwa 在 HVAC&R Japan 2022展覽會上展示了共同開發的空調用丙烷 (R290)冷凍的新原型。據兩家公司的代表稱,該原型機已成功通過冷卻能力測試。兩家公司計劃進行一年的控制檢查,再進行一年的現場檢查。目標是在 2024 年 4 月推出該產品。有 5 種類型,冷凍能力為 3.6 至 5.6kW(12,283.20 至 19,107.20BTU/h),暖氣能力為 4.0 至 6.3kW。

- 2021 年 6 月 - 江森自控將 QWC4 水冷式螺旋式冷凍機加入其冷凍產品組合中。採用R-134a冷媒,無臭氧層破壞潛勢。根據該公司介紹,與傳統冷凍相比,此冷凍採用變速驅動技術,可降低能源成本和碳排放。此冷凍適用於熱回收方法,例如開放式冷卻塔、乾式冷卻器、絕熱冷卻器、熱回收和熱泵。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈分析

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 冷凍和加工食品的消費增加

- 工業發展(半導體、造紙、水泥等)

- 市場限制因素

- 初始成本高

- 日益嚴重的環境問題

第6章 市場細分

- 透過排熱方式或冷卻方式

- 水冷

- 風冷

- 按壓縮機類型

- 螺旋式冷凍機

- 渦卷式冷凍機

- 往復式冷凍

- 離心式冷凍

- 吸收式冷凍

- 按最終用戶產業

- 化工/石化

- 飲食

- 醫療保健

- 塑膠

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- DAIKIN INDUSTRIES LTD

- DIMPLEX THERMAL SOLUTIONS

- LG Electronics

- JOHNSON CONTROLS INTERNATIONAL PLC

- Polyscience Inc.

- SMARDT CHILLER GROUP INC.

- THERMAX LTD.

- TRANE Technologies Plc

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91572

The Chiller Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- According Indian Brand Equity Foundation, by 2025, it is anticipated that investments in the Indian chemicals and petrochemicals sector will total INR 8 lakh crore (USD 107.38 billion). In December 2021, in India, the chemical output totaled 903,002 MT, while petrochemical production totaled 1,877,907 MT. The following chemicals were produced at a high level in December 2021: soda ash (257,199 MT), caustic soda (277,638 MT), liquid chlorine (190,492 MT), formaldehyde (22,794 MT), and pesticides and insecticides (22,110 MT).

- Additionally, with the approaching HFC (hydrofluorocarbon) phasedown, the demand for environmentally friendly cooling solutions is driving chiller manufacturers to innovate. To cater to this, in February 2022, Washington-based Pro-Refrigeration, Inc., a manufacturer and supplier of chillers for beverage processing and industrial markets, developed the idea of a CO2 chiller. Since CO2 is a natural refrigerant with a global warming potential (GWP) rating of 1, it has zero impact on global warming. It also allows refrigeration systems to recover 100% of the heat rejected from their systems, generating hot water at up to 200°F. Heat recovery capability is an essential product feature for Pro-Refrigeration, as beverage plants, dairy farms, use a high amount of natural gas or propane to heat water for sanitizing and wash-down.

- The increasing need for environment friendly and sustainable products is leading various manufacturers to develop sustainable products and solutions. For instance, in March 2021, Rhoss launched MiDIpack-I Eco, a new range of air-cooled water chillers and reversible heat pump products range with inverter scroll compressors and R32 ecological gas. The range was aimed at the companies that opt for eco-sustainability.

- On the flip side, environmental concerns regarding global warming and ozone depletion have led over time to the development of evolving global and regional regulations, which have had significant implications for refrigerants across applications. Manufacturers and end-users who purchase, design, install, and service air conditioning and refrigeration equipment should consult their specific country's current regulations, codes, and standards to aid with refrigerant selection for each intended use.

- The United Nations Environment Program - Division of Technology, Industry, and Economics (UNEP DTIE) OzonAction Branch assists countries in complying with their commitments under the Montreal Protocol on Substances that Deplete the Ozone Layer, especially those related to the phase-out of hydrochlorofluorocarbons (HCFCs). The substitutes to HCFCs include the climate and ozone-friendly alternatives such as natural refrigerants - ammonia, hydrocarbons, and carbon dioxide; and lower global warming potential (GWP) HFCs, both saturated HFCs and unsaturated HFCs (HFOs). These factors pose a challenge to the current market ecosystem. However, they also double as significant opportunity providers for several companies to adopt advanced technologies, nurture innovations and promote efficiency.

Chillers Market Trends

The Food & Beverage Segment will Significantly Drive the Market's Growth

- Water chillers for food processing are among the most utilized chilling systems for food and beverage producers and distributors. Food processing and food packaging applications need reliable indirect cooling equipment to maintain precise and consistent temperature control. Food processing chillers use a heat exchanger to help cool heat-producing process elements. They are used for a variety of food processing applications like cheese, meat, sauce, yogurt, ice cream, chocolate, baked items, etc.

- Globally, there has been an increase in the consumption of frozen and processed food due to several factors like convenience, increase in disposable income, busy lifestyles, etc. For instance, according to Deutsches Tiefkuhlinstitut, the per capita consumption of deep-frozen food in Germany increased from 44.8 kilograms in 202 to 46.1 kilograms in 2021. Further, the Organization for Economic Co-operation and Development (OECD), estimates that the volume of cheese produced in the European Union (EU 27) would witness an uptrend from 9,938 thousand tonnes n 2018 to 11,543 thousand tonnes in 2030.

- To cater to the evolving needs of the increasing consumer base, several companies in the market are innovating advanced and comprehensive products. For instance, in March 2021, Atlas Copco extended its industrial portfolio to include process cooling equipment with the launch of the TCX 4-90A chiller range. The TCX chillers are intended for cooling water for a wide range of industrial processes and cooling applications, including Food & beverage, pharma, medical, printing, and plastics.

- Further, in March 2022, Carrier introduced the AquaForce Vision 30KAV with PUREtec refrigerant, a new line of high-performance, compact process cooling chillers with ultra-low global warming potential (GWP) refrigerant R-1234ze. The chiller line is optimized for industrial processing like food manufacturing, plastics, pharmaceuticals, chemicals, metal industries, and applications requiring ultra-reliable cooling up to -12degC.

- Additionally, in May 2022, Kaltra announced that its portfolio of high-efficient air-cooled chillers would be extended in Q3 2022, with R290 (propane) models based on the Versa platform initially launched in 2019. The heart of new Lightstream Screw II chillers is propane compressors-based design elements of Bitzer compact screws, with special safety regulations applied to the design, operation, and maintenance of flammable refrigerants like R290. These chillers target medium-low temperature refrigeration, including food & beverage, chemical, pharmaceutical, manufacturing applications, and air conditioning markets.

- Glycol chillers are witnessing an upsurge in demand in breweries and wineries. They are employed to remove the heat added during the milling, mashing, lautering, and boiling process. Modular and packed chillers are also growing in popularity in the beverage industry as they are convenient to use and easy to install.

North America to Witness Significant Growth

- The US and Canada make up the other subgroups of the North American chiller market. The construction of hospitals, offices, huge retail stores, and theatres has expanded as a result of continued economic growth and growing urbanization. The governments of North American nations support the growth of airport infrastructure and the creation of smart cities. Thus, increased tourism, smart city projects, and construction activities are driving the demand for chillers in the region's residential, commercial, and industrial sectors. The US Department of Energy (DOE) is making significant investments nationwide to raise energy efficiency standards. The goal of the DOE is to address the environmental, energy, and nuclear concerns facing the US by developing game-changing research and technology solutions.

- To meet the various demands of the customers and capture a wide market range, the companies are introducing new products in the market. For instance, in March 2022, a new low-charge inline packaged ammonia/NH3 (R717) chiller was introduced for the North American market by Frick Industrial Refrigeration, a division of Johnson Controls in the United States. A "extremely low-charge" chiller, the new Frick North America Inline Packaged Ammonia Chiller (IPAC-S) typically uses 1lb/TR, or 0.13kg/kW, according to Forry. With Frick ammonia screw compressors, the IPAC-S was created. There are 12 sizes available for these, ranging from IPAC-24 to IPAC-222, and they have chiller cooling capacities ranging from 30TR to 390TR (105.5 to 1,371.6kW).

- Furthermore, in May 2021, Welbilt, Inc., a producer of commercial foodservice equipment, is the sole distributor of roll-in blast chillers from Nuovair, the Italian company that specializes in high-quality blast chillers in the United States and Canada. Four major issues that operators experience are addressed by Nuovair technology. First off, overcooked food can be saved in a matter of seconds by abruptly stopping the cooking process to preserve flavor and quality due to the industry's greatest air-flow rate (9m3/hr) and an electronic expansion valve, which delivers up to 25% faster cooling than a manual valve.

- The data centers produce excessive heat, which presents an economic and environmental challenge. The carbon dioxide emissions from data centers are also at an all-time high which largely impacts the environment. Such heavy emissions, the need for efficient cooling, and the increasing development of data centers have driven the demand for efficient chillers in HVAC systems in data centers and have attributed to the market's growth.

- For instance, in April 2022, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in U.S. data center construction and operations to almost USD16 billion. A USD 800 million facility in Temple, Texas, will total approximately 900,000 square feet, while another USD 800 million facility in Kansas City, Missouri, will total nearly 1 million square feet. The growing increase in the construction of data centers will significantly drive the market.

- Residential, commercial, and industrial buildings' excess heat is removed using chillers to provide air conditioning. To remove heat from the condenser and evaporators, these devices use refrigerants. The Joint Center for Housing Studies predicts that during the next ten years, baby boomers will be the main driver of construction and remodeling demand in the United States. The expansion of the country's chillers market is anticipated to be positively impacted by the nation's increasing number of construction projects. For instance, according to the United States Census Bureau, as of May 2021, the private housing authorized by building permits in May was at a seasonally adjusted annual rate of 1,681,000. The value was 34.9% above the May 2020 rate. The increase in residential units creates growth opportunities for the chiller market.

Chillers Industry Overview

The global chiller market is competitive with the presence of a few major companies like Carrier Global Corporation, Mitsubishi Electric Corporation, Polyscience Inc., etc. The companies are continuously investing in making strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

- February 2022 - Air-conditioning designer Fujinetsu and chiller manufacturer Meiwa, exhibited a new jointly developed prototype of a propane (R290) chiller for air-conditioning applications at the HVAC&R Japan 2022 trade show. According to the representatives of the companies, the prototype successfully completed cooling-capacity tests. The companies plan to conduct controls testing for one year and field testing for another. Their goal is to launch the product on the market in April of 2024. The unit would be available in 5 types with a cooling capacity ranging from 3.6-5.6kW (12,283.20-19,107.20BTU/h) and a heating capacity ranging from 4.0-6.3kW.

- June 2021 - Johnson Controls added the Quantech QWC4 water-cooled screw chiller to its chiller portfolio. It employs R-134a refrigerant, which has no ozone-depletion potential. As per the company, the chiller utilizes variable-speed drive technology to reduce energy costs and carbon emissions compared to traditional chillers. The chiller is intended for use with heat-rejection methods like an open cooling tower, dry cooler, adiabatic cooler, heat recovery, or heat pump.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Frozen and Processed Food

- 5.1.2 Industrial Development (Semicounductors, Paper, Cement, etc.)

- 5.2 Market Restraints

- 5.2.1 High Initial Costs

- 5.2.2 Growing Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Heat Rejection Method or Type of Cooling

- 6.1.1 Water Cooled

- 6.1.2 Air Cooled

- 6.2 By Compressor Type

- 6.2.1 Screw Chillers

- 6.2.2 Scroll Chillers

- 6.2.3 Reciprocating Chillers

- 6.2.4 Centrifugal Chillers

- 6.2.5 Absorption Chillers

- 6.3 By End-User Industry

- 6.3.1 Chemicals & Petrochemicals

- 6.3.2 Food & Beverage

- 6.3.3 Medical

- 6.3.4 Plastics

- 6.3.5 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdm

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Carrier Global Corporation

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 DAIKIN INDUSTRIES LTD

- 7.1.4 DIMPLEX THERMAL SOLUTIONS

- 7.1.5 LG Electronics

- 7.1.6 JOHNSON CONTROLS INTERNATIONAL PLC

- 7.1.7 Polyscience Inc.

- 7.1.8 SMARDT CHILLER GROUP INC.

- 7.1.9 THERMAX LTD.

- 7.1.10 TRANE Technologies Plc

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219