|

市場調查報告書

商品編碼

1635379

全球保險閥市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Pressure Relief Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

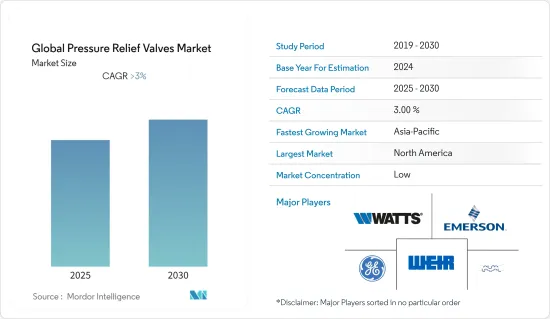

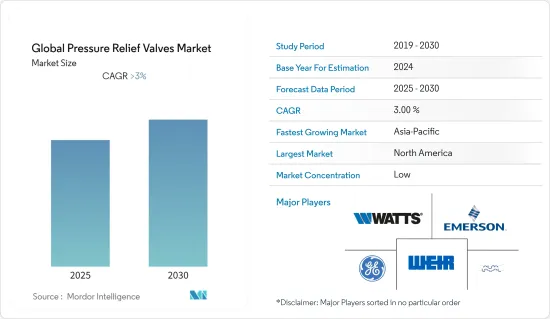

預計全球保險閥市場在預測期內將維持3%以上的複合年成長率。

由於全球封鎖,COVID-19 大流行已經停止了保險閥行業各種產品的生產。這阻礙了保險閥市場的成長。 COVID-19 影響了 2021 年第一季的洩壓保險閥銷售,預計將在 2022 年全年實現市場成長。雖然保險閥的銷量在大流行的早期階段大幅下降,但隨著全球製造業務恢復到基準值,市場預計將在接下來的幾年中大幅復甦。

然而,石油和天然氣產業在2021年全年強勁復甦,油價達到六年來的最高水準。石油和天然氣產業的前景光明且利潤豐厚,因為目前對石化燃料能源的依賴過於嚴重,無法適應向可再生能源的自然過渡。發電 世界各地的電網都致力於實現無碳發電。煤炭正在被天然氣取代,氣動系統中需要閥門來調節氣體流量。這些行業的成長將帶動保險閥市場的成長。

美國是世界領先的化學品生產國,其次是德國、俄羅斯和中國。美國也是最大的石化產品生產國和消費國,佔2021年石油總產量的20%,其次是沙烏地阿拉伯(11%)、俄羅斯(11%)和加拿大(6%)。中國是領先的電力生產國,其次是美國、印度和俄羅斯。 2020年中國發電量將達7,779.1兆瓦時。這些是閥門的主要市場,因為它們是石油和天然氣、電力和石化產品的最大生產國,也是洩壓保險閥的最終用戶,洩壓保險閥市場預計在預測期內將大幅成長。

保險閥市場趨勢

石油和天然氣需求的增加推動市場成長

預計2021年全球原油產量為9,557萬桶/日,2022年將達到9,989萬桶/日。 2020年,全球原油需求達到9,100萬桶/日。這是自 2012 年以來的最低需求,但隨著 COVID-19 大流行導致的封鎖開始解除,需求在 2021-2022 年迅速成長。 2021年,全球發現了相當於47億桶的原油和天然氣。美國每天消耗17,178,000桶石油。因此,就石油消費量而言,美國處於領先地位,其次是中國(1422.5萬桶/日)和印度(466.9萬桶/日)。

2021年,全球石油消費量為9,739萬桶/日。預計2022年全球消費量將達到9,961萬桶/日,2023年將達到1,0155萬桶/日。原油到煉油廠以及汽油、煤油、噴射機燃料和暖氣油等精製產品從煉油廠到市場都是透過石油管線運輸的。過高的壓力水平可能導致管道破裂,甚至導致最具彈性的閥門故障。為此,石油管線上安裝了保險閥。隨著全球石油和天然氣需求的增加,保險閥市場預計將穩定成長。

核能發電的不斷成長預計將成為市場成長的驅動力

根據世界核能協會統計,全球約10%的電力是由約440個核子反應爐產生的。大約還有 55 座核子反應爐正在興建中,約佔現有發電能力的 15%。 2020年,核能發電廠提供了2,553太瓦時的電力,低於2019年的2,657太瓦時。 2020年之前,核能發電量已連續七年成長。 2020年,13個國家超過四分之一的電力來自核能發電。法國約四分之三的電力來自核能發電,斯洛伐克和烏克蘭一半以上的電力來自核能發電,匈牙利、核能發電、斯洛維尼亞、保加利亞、芬蘭和捷克共和國三分之一以上的電力來自核電。韓國通常30%以上的電力來自核能發電,美國、英國、西班牙、羅馬尼亞和俄羅斯約有五分之一的電力來自核能發電。

世界各地都需要新的發電能力來取代舊的石化燃料發電能力,特別是碳排放燃煤發電能力,並滿足許多國家不斷成長的電力需求。世界核能協會提出了一個名為「和諧計畫」的雄心勃勃的設想,該計畫將在 2050 年之前增加 1,000 GWe 的新核能發電裝置容量為1,250 GWe(考慮到退役情況) ,提案供應 25 GWe。

核能發電的快速成長預計將為洩壓保險閥產業參與者帶來新的商機。因為保險閥對於保護渦輪機、過熱器和鍋爐以及允許發電廠在指定壓力下運行非常重要。

保險閥行業概況

洩壓保險閥市場高度分散。該市場的主要企業包括通用電氣、艾默生電氣公司、瓦茨、威爾集團和阿法拉伐。市場參與企業競相爭取市場佔有率。主要企業採用併購和技術創新等多種策略,為客戶提供廣泛的閥門產品組合,以提高製程性能和可靠性。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態

- 市場概況

- 市場動態

- 促進因素

- 抑制因素

- 價值鏈/供應鏈分析

- 行業法規政策

- 該領域的技術發展

- 產業吸引力-波特五力分析

- COVID-19 對市場的影響

第5章市場區隔

- 依產品類型

- 先導型

- 彈簧式

- 自重式

- 其他

- 透過設定壓力

- 高壓

- 中壓

- 低壓

- 按最終用戶

- 石油和天然氣

- 化學處理

- 發電

- 紙/紙漿

- 飲食

- 製藥

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 伊朗

- 其他中東/非洲

- 其他

- 北美洲

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- General Electric

- Emerson Electric Co.

- Watts Water Technologies, Inc

- Weir Group Plc.

- Alfa Laval Corporate AB

- Curtis-Wright Corp

- AGF Manufacturing, Inc.

- Mercury Manufacturing Company

- IMI Plc

- Goetze KG Armaturen*

第7章 市場機會及未來趨勢

第8章 免責聲明

The Global Pressure Relief Valves Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 pandemic halted the production of various products in the pressure relief valves industry, which is attributed to the global lockdown. This hampered the growth of the pressure relief valve market. COVID-19 affected the sales of pressure relief valves in the first quarter of 2021 and is anticipated to hurt the market growth throughout 2022. Though sales of pressure relief valves plummeted during the initial stages of the pandemic, with global manufacturing sector operations reviving toward threshold rates, the market is expected to recover sharply over subsequent years.

However, the oil and gas industry has rebounded strongly throughout 2021, with oil prices reaching their highest levels in six years. The future is bright and hugely profitable for the oil and gas industry because the current dependence on energy from fossil fuels is too heavy to accommodate the spontaneous migration to renewable energy. The Power Generation Electric grids worldwide have a goal of carbon-free power generation. Coal is being replaced by gas which requires valves to regulate the flow of gas in a pneumatic system. The growth in these industries will drive the growth of the pressure relief valves market.

The United States of America is the world's leading country in the production of chemical products followed by Germany, Russia, and China. The United States is also the largest producer and consumer of petrochemicals with a 20% share of total oil production in 2021, followed by Saudi Arabia (11%), Russia (11%), and Canada (6%). China is the leading power-producing country followed by the United States, India, and Russia. China produced 7779.1 terawatt hours of electricity in 2020. As these are the top countries producing oil & gas, power, and petrochemicals - the end-users for pressure relief valves - they are the major markets for the valves and will see significant growth in the pressure relief valves market during the forecast period.

Pressure Relief Valves Market Trends

Increasing Oil & Gas Demand Driving the Growth of the Market

Each day, the world produced 95.57 million barrels of oil in 2021, and in 2022, it's estimated that this will reach 99.89 million barrels per day. In 2020, the world's crude oil demand reached 91 million barrels per day. This was the lowest amount of demand since 2012, but it quickly increased as COVID-19 pandemic lockdowns began to lift during 2021 and into 2022. In 2021, the world discovered the equivalent of 4.7 billion barrels of oil in crude oil and natural gas. The U.S. consumes 17.178 million barrels of oil per day. This makes the U.S. the leading country as far as oil consumption goes, followed by China, which consumes 14.225 million barrels per day, and India, which consumes 4.669 million barrels per day.

In 2021, the world consumed 97.39 million barrels of oil a day. In 2022, it's estimated that the world will consume 99.61 million barrels per day, and by 2023, it's estimated that consumption will reach 101.55 million barrels per day. The crude oil to the refineries and refined products such as gasoline, kerosene, jet fuel, and heating oil from refineries to the market are carried through oil pipelines. Overly high-pressure levels could result in pipeline bursts or cause even the most resilient valves to malfunction. Due to this, pressure relief valves are installed in an oil pipeline. The growing oil & gas across the world will surely drive the pressure relief valves market.

Increasing Need for Nuclear Power Expected to Drive the Growth of the Market

According to World Nuclear Association, around 10% of the world's electricity is generated by about 440 nuclear power reactors. About 55 more reactors are under construction, equivalent to approximately 15% of the existing capacity. In 2020 nuclear plants supplied 2553 TWh of electricity, down from 2657 TWh in 2019. Prior to 2020, electricity generation from nuclear energy had increased for seven consecutive years. Thirteen countries in 2020 produced at least one-quarter of their electricity from nuclear. France gets around three-quarters of its electricity from nuclear energy, Slovakia and Ukraine get more than half from nuclear, whilst Hungary, Belgium, Slovenia, Bulgaria, Finland, and the Czech Republic get one-third or more. South Korea normally gets more than 30% of its electricity from nuclear, while in the USA, UK, Spain, Romania, and Russia about one-fifth of electricity is from nuclear.

There is a need for new generating capacity around the world, both to replace old fossil fuel units, especially coal-fired ones, which emit a lot of carbon dioxide, and to meet the increased demand for electricity in many countries. The World Nuclear Association has put forward an ambitious scenario called the Harmony programme which proposes the addition of 1000 GWe of new nuclear capacity by 2050, to provide 25% of electricity then (about 10,000 TWh) from 1250 GWe of capacity (after allowing for retirements).

Surge in need for nuclear power generation is expected to open up new opportunities for pressure relief valves industry participants. As pressure relief valves are critical for safeguarding turbines, super heaters, and boilers and allowing station to operate at a predetermined pressure.

Pressure Relief Valves Industry Overview

The pressure relief valve market is fairly fragmented. Some of the key players in the market are General Electric, Emerson Electric Co., Watts, The Weir Group PLC, and Alfa Laval. The market players undergo competition to capture the market share. Major companies apply many strategies like mergers and acquisitions, and technological innovations to provide their customers with the broadest portfolio of valves to improve process performance and reliability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Policies and Regulations

- 4.5 Technological Developments in the Sector

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Pilot Operated

- 5.1.2 Spring Loaded

- 5.1.3 Dead Weight

- 5.1.4 Others

- 5.2 By Set Pressure

- 5.2.1 High Pressure

- 5.2.2 Medium Pressure

- 5.2.3 Low Pressure

- 5.3 By End User

- 5.3.1 Oil & Gas

- 5.3.2 Chemical Processing

- 5.3.3 Power Generation

- 5.3.4 Paper & Pulp

- 5.3.5 Food & Beverages

- 5.3.6 Pharmaceuticals

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South-Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 UAE

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 Iran

- 5.4.4.4 Rest of the Middle East and Africa

- 5.4.5 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 General Electric

- 6.2.2 Emerson Electric Co.

- 6.2.3 Watts Water Technologies, Inc

- 6.2.4 Weir Group Plc.

- 6.2.5 Alfa Laval Corporate AB

- 6.2.6 Curtis-Wright Corp

- 6.2.7 AGF Manufacturing, Inc.

- 6.2.8 Mercury Manufacturing Company

- 6.2.9 IMI Plc

- 6.2.10 Goetze KG Armaturen*