|

市場調查報告書

商品編碼

1635383

亞太地區閥門:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)APAC Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

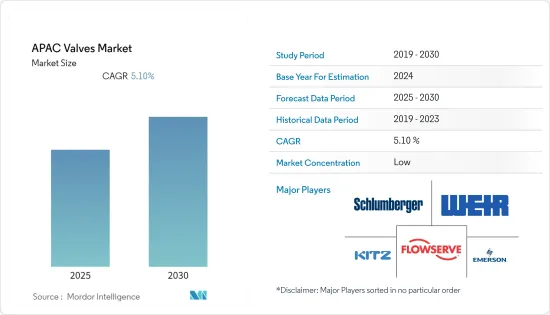

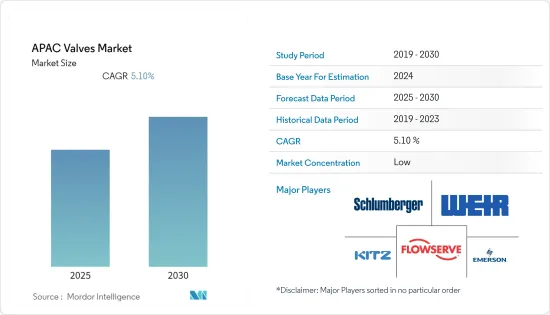

亞太閥門市場預計在預測期間內複合年成長率為5.1%

主要亮點

- 閥門市場預計將成長,主要得益於對石油和天然氣行業以及製藥基礎設施的投資。例如,印度正在大力投資石油和天然氣探勘以及建造天然氣基礎設施,以滿足其能源需求。例如,2021年7月,印度石油公司(IOC)宣佈在其馬圖拉煉油廠建立印度首個綠氫工廠,將綠氫調節和計劃引入該國石油和天然氣產業。

- 此外,該地區各國政府正在投資市政水處理基礎設施,以保護自然水體免受污染並促進水的再利用。這導致該地區蝶閥的銷量增加。總理莫迪最近也宣布,新成立的 Jal Jeevan Mission 將在未來五年內斥資 3.5 億印度盧比,到 2024 年為每個農村家庭提供自來水(「Har Ghar Jal」)。

- 隨著燃料需求的增加,預計該地區各國將啟動新的石油和天然氣探勘計劃,增加對先進閥門技術的需求。同樣,各種水處理廠也在建設中,以滿足日益成長的淡水需求。因此,未來幾年閥門市場將迅速擴大。

- 例如,2021年9月,印度政府核准了印度東北部的石油和天然氣計劃。這些計劃計劃於 2025 年完成。

- 此外,根據經濟合作暨發展組織(OECD)的數據,疫情嚴重影響了印度、澳洲、中國和日本等多個國家。這些國家的生產因疫情初期為限制 COVID-19 傳播而實施的政府限制而受到干擾,從而限制了疫情期間的勞動力供應。此外,中國實施了嚴格的封鎖和社會隔離,停止了探勘並減少了該國對石油和其他電力商品的需求。受此影響,中國天然氣儲運活動大幅減少,導致球閥和蝶閥需求下降。

亞太閥門市場趨勢

石油和天然氣產業預計將佔據主要市場佔有率

- 在預測期內,石油和天然氣領域對閥門的需求不斷增加將推動亞太閥門市場的成長。預計該地區海上石油和天然氣計劃的增加將推動預測期內閥門市場的成長。

- 政府的重點是透過改善分配製度來提高國家的製造和生產能力,並為人民提供基本的生活設施。全部區域正在建造新的石油和天然氣發行系統。

- 例如,印度石油公司宣布將在 2022年終前投資 700 億盧比用於新的天然氣發行計劃。

- 此外,2021 年 11 月,印度石油公司、巴拉特石油有限公司和印度斯坦石油有限公司宣布推出示範零售店計畫和 Darpan Petrol Pump 數位客戶回饋計畫。這三大石油分銷商聯合開設零售樣品店,以提高服務標準和設施,每天為超過6000萬消費者提供服務。

- 2021 年 7 月,政府實施了多項措施來應對不斷成長的需求。允許天然氣、石油產品和煉油廠等許多領域 100% 的外國直接投資 (FDI)。此外,印度正在吸引國內外投資,信實工業有限公司 (RIL) 和凱恩印度公司的存在證明了這一點。

印度預計將出現顯著成長

- 印度是製造業和機械工業快速成長的國家之一,對閥門的需求不斷增加。政府為公司設立製造單位提供便利。我們也正在採取各種措施來支持製造業。例如,印度於2021年8月敲定了一項計劃,以實現其1兆美元的製造業出口目標。

- 不斷成長的電力需求也為印度市場的閥門供應商帶來了成長機會。根據CEA第19次電力調查,預計到27財政年度結束印度發電總裝置容量將達到619GW。預計2022會計年度尖峰電力需求為226GW,2027會計年度為299GW。

- 鑑於其快速的工業化和不斷成長的收入,印度這個擁有超過 10 億人口的國家製定了積極的清潔能源目標,以滿足不斷成長的電力需求、減少污染和應對氣候變遷。總理莫迪在格拉斯哥舉行的聯合國氣候變遷會議上宣布,該國將在 2022 年引入 175 吉瓦的可再生能源,高於目前的100 吉瓦,到2030 年引入500 吉瓦的非化石電力。

- 此外,由於對污水再利用的日益重視,預計全國對閥門的需求將會增加。例如,巴特那已安裝了四個污水處理廠(STP),從而為處理家庭產生的廢液提供了長期解決方案。此外,2022 年 7 月,古吉拉突邦政府宣布原則上核准在古吉拉突邦九個市建設價值 11.812 億印度盧比、容量為 73.98 MLD 的 STP 工程。

- 因此,預計該國各領域投資的增加將推動各種閥門的需求,並在預測期內提振整體市場需求。

亞太閥門產業概況

亞太閥門市場競爭激烈。主要市場參與企業包括艾默生電氣公司、威爾集團 PLC、福斯公司、斯倫貝謝有限公司、斯派莎克工程公司、IMI PLC、克瑞公司。許多其他公司也不斷升級其產品系列,並採取各種有機和無機策略,例如合併、聯盟、新產品發布、合作和收購。

- 2022 年 5 月 - 艾默生宣布其配備 AES Profinet 和乙太網路/IP 的 Aventics 系列高級閥門 (AV) 閥門系統是首款也是唯一一款預裝開放平台通訊統一架構 (OPC UA) 功能的閥門系統。 AES 使用戶能夠克服互通性挑戰並使資料更易於訪問,同時透過整合數位雙胞胎來提高生產力和效率。

- 2021 年 6 月 - Neles Corporation 宣布推出全新多功能蝶閥系列,採用 Neldisc 金屬閥座和圓片球軟閥座,具有卓越的性能和較低的環境影響。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 石油和天然氣行業擴大使用閥門

- 增加球閥和蝶閥的使用

- 市場問題

- 更長的使用壽命和腐蝕風險

第6章 市場細分

- 按類型

- 球

- 蝴蝶

- 門/手套/檢查

- 插頭

- 控制

- 其他

- 按最終用戶產業

- 石油和天然氣

- 發電

- 化學

- 用水和污水

- 礦業

- 其他

- 按國家/地區

- 中國

- 印度

- 韓國

- 日本

- 澳洲/紐西蘭

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Flowserve Corporation

- Schlumberger Limited

- The Weir Group plc

- KITZ Corporation

- Samson Controls Inc.

- Forbes Marshall

- Alfa Laval Corporate AB

- Avcon Controls Pvt Ltd

- XHVAL

- ZECO VALVE GROUP

- DomBor Valve

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 91611

The APAC Valves Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The valve market is expected to grow primarily due to investments in the oil and gas industry and pharmaceutical infrastructure. For instance, India has heavily invested in oil and gas exploration and is building natural gas infrastructure to meet its energy needs. For instance, in July 2021, the Indian Oil Corporation (IOC) announced to establish India's first green hydrogen plant at Mathura refinery to introduce green hydrogen conditioning and projects in the oil and gas sector in the country.

- Furthermore, governments in the region are investing in municipal water treatment infrastructure to protect natural water bodies from contamination and promote water reuse. This is increasing sales of butterfly valves in the area. Also recently, Prime Minister Narendra Modi ji announced that the newly formed Jal Jeevan Mission will spend INR 3.5 lakh crore over the next five years to provide piped water ('Har Ghar Jal') to all rural households by 2024.

- As demand for fuel rises, various countries in the region begin new oil and gas exploration projects that are expected to increase demand for advanced valve technology. Similarly, different water treatment plants are being built to meet the rising demand for freshwater. As a result, the valve market will expand rapidly in the coming years.

- For instance, In September 2021, the Indian administration approved oil and gas projects in Northeast India worth INR 1 lakh crore (USD 13.46 billion). These projects will be completed by 2025.

- Further, the pandemic has severely impacted several countries, including India, Australia, China, and Japan, according to the Organization for Economic Cooperation and Development (OECD). Government limitations imposed to control the spread of COVID-19 in these countries during the initial period of the outbreak have hampered production due to the limited availability of the workforce during the pandemic period. Furthermore, China has imposed strict lockdown and social isolation, which halted exploration and reduced the country's demand for oil and other power commodities. As a result, China's natural gas storage and transportation activities have decreased significantly, resulting in low demand for ball and butterfly valves.

APAC Valves Market Trends

Oil & Gas Industry Expected to Hold a Significant Market Share

- Over the forecast period, growing demand for valves in the oil & gas sector will drive growth in the Asia-Pacific valves market. Rising offshore oil and gas projects across the region are expected to drive growth in the valve market over the forecast period.

- The government is focusing hard on increasing the country's manufacturing and production capacity and providing basic life facilities to its citizens through improved distribution systems. Across the region, new oil and gas distribution systems have been constructed.

- For instance, the Indian Oil Corporation has announced that it will invest INR 7000 crore in new gas distribution projects by the end of 2022.

- Furthermore, in November 2021, Indian Oil, Bharat Petroleum Corporation Limited, and Hindustan Petroleum Corporation Limited announced the Model Retail Outlet Scheme launch and the Darpan petrol pump digital customer feedback program. These three oil PSUs have collaborated to open model retail outlets to improve service standards and amenities across their networks, serving over six crore consumers daily. which will further drive the market growth.

- In July 2021, the government implemented several policies to meet rising demand. It has permitted 100 % Foreign Direct Investment (FDI) in many sectors, including natural gas, petroleum products, and refineries. Furthermore, as evidenced by the presence of Reliance Industries Ltd (RIL) and Cairn India, it attracts both domestic and foreign investment.

India is Expected to Register a Significant Growth

- India is one of the fastest-growing countries in terms of manufacturing sectors and machinery, giving rise to the need for valves. The government provides benefits to companies setting up manufacturing units. It also outlines various policies to boost the manufacturing sector. For instance, India outlined a plan in August 2021 to reach its goal of USD 1 trillion in manufactured goods exports.

- The growing power demand also generates growth opportunities for valve vendors in the Indian market. According to the CEA's 19th Electric Power Survey, India's total installed power generation capacity is expected to reach 619 GW by the end of FY27. Peak electricity demand has been estimated to be 226 GW in FY22 and 299 GW in FY27.

- In light of rapid industrialization and rising incomes, India, which has over one billion people, has established aggressive clean-energy targets to reduce pollution and combat climate change while meeting rising electricity demand. Prime Minister Narendra Modi announced at the United Nations Climate Change Conference in Glasgow that India would install 175 gigatonnes (GW) of renewable energy by 2022, up from 100 GW now, and 500 GW of non-fossil power by 2030.

- Further, the increasing emphasis on recycling wastewater is also expected to generate demand for valves across the country. For instance, four sewage treatment plants (STPs) have been set up in Patna, and As a result, it provides a long-term solution for the disposal of waste liquid generated by households. Moreover, in July 2022, the Gujarat government announced to give in-principle approval for works worth INR 118.12 crore for STPs of 73.98 MLD capacity in nine municipalities of Gujarat.

- Hence, the growing investments across various sectors in the country are expected to drive the demand for various valves, thereby boosting the overall market demand over the forecast period.

APAC Valves Industry Overview

The Asia-Pacific valve market is significantly competitive. Key market players such as Emerson Electric Co, The Weir Group PLC, Flowserve Corporation, Schlumberger Limited, Spirax-Sarco Engineering plc, IMI PLC, Crane Co, and many others are constantly upgrading their product portfolios and undertaking various organic and inorganic strategies such as mergers, partnerships, new product launches, collaborations, and acquisitions.

- May 2022 - Emerson announced that its Aventics Series Advanced Valve (AV) valve system with AES Profinet and Ethernet/IP is the first and only valve system with preinstalled Open Platform Communications Unified Architecture (OPC UA) functionality. The AES enables users to overcome interoperability challenges and gain easier access to data while integrating the digital twin can boost productivity and efficiency.

- June 2021 - Neles Corporation has announced the release of a new line of versatile butterfly valves with Neldisc metal seats and Wafer-Sphere soft seats for superior performance with a low environmental footprint.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Valve Use in the Oil and Gas Industry

- 5.1.2 Increased Utilization of Ball Valves and Butterfly Valves

- 5.2 Market Challenges

- 5.2.1 Service Extending Life and Corrosion Risk

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water & Wastewater

- 6.2.5 Mining

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 South Korea

- 6.3.4 Japan

- 6.3.5 Australia and New Zealand

- 6.3.6 Rest of the Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Flowserve Corporation

- 7.1.3 Schlumberger Limited

- 7.1.4 The Weir Group plc

- 7.1.5 KITZ Corporation

- 7.1.6 Samson Controls Inc.

- 7.1.7 Forbes Marshall

- 7.1.8 Alfa Laval Corporate AB

- 7.1.9 Avcon Controls Pvt Ltd

- 7.1.10 XHVAL

- 7.1.11 ZECO VALVE GROUP

- 7.1.12 DomBor Valve

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219