|

市場調查報告書

商品編碼

1635385

美國空調設備:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)United States Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

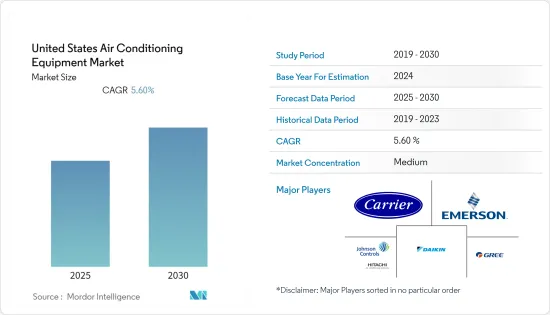

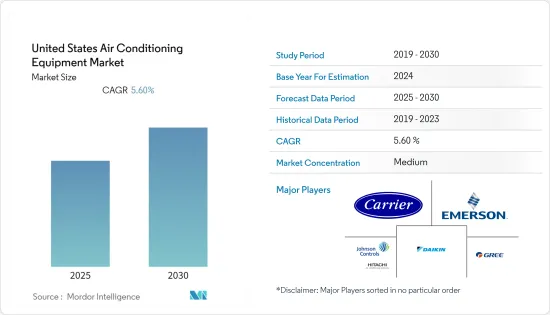

預計美國空調設備市場在預測期內的複合年成長率為 5.6%。

主要亮點

- 經濟的快速擴張正在增加人們的可支配收入並增加對住宅和商業住宅的需求。工業應用也推動了空調產業的發展。根據國際貨幣基金組織的數據,2021年美國人均國內生產總值達到約69,231.4美元。如此龐大的人均國民生產毛額是研究資本的驅動力。

- 旅遊業的快速擴張也將刺激市場,各地的飯店和商用車都在考慮可攜式空調和其他空調系統。可攜式空調市場將由尋求行動冷卻設備和節能冷卻系統的消費者推動。此外,全部區域政府關注節能空調,公共部門預計將成為該市場的主要驅動力。

- 空氣調節機可以去除危險的空氣污染物,這些污染物可能導致各種疾病和呼吸系統疾病,包括肺癌、缺血性心臟疾病、氣喘和慢性阻塞性肺病。此外,多項技術發展正在對市場擴張產生積極影響,例如經濟實惠的 3D 列印設備的開發以及將感測器整合到 AHU 設備中以實現運動啟動空調。大量基礎設施的開發和智慧城市的建設,特別是在新興經濟體,預計將是推動市場成長的進一步因素。

- 隨著 COVID-19 的爆發,工業公司對他們購買的服務和產品對環境的影響表示擔憂,並且願意比其他公司支付更多的錢來購買環保和健康的選擇。預計智慧空調系統的需求將會很大。從自我控制到整合感測器、遠端溫度調節和能源控制,技術為最終用戶提供了更多控制權。空調系統對負載條件做出反應,負載條件根據不規則出勤導致的建築物運轉率而變化。需要合理化每位員工的佔地面積並發展辦公空間的使用模式。

- 對與全球暖化和臭氧層消耗相關的環境問題的擔憂導致了全球和區域法規的製定,這些法規對冷媒應用產生了重大影響。購買、設計、安裝和維修空調設備的製造商和最終用戶應參考現行國家法規、規範和標準,以選擇適合其預期用途的冷媒。

美國空調設備市場趨勢

商業領域是推動市場的因素之一

- 根據美國能源資訊署的數據,商業建築占美國能源消費量的近20%和溫室氣體排放的12%。智慧建築透過減少浪費和節約能源全球整體的社區提供服務。

- 透過減少建築物的能源使用,建築物業主可以節省更多的營運成本。透過將建築物的機械和電氣系統連接到雲端,它們可以自動打開和關閉,從而消除浪費。

- 在美國,商業建築有大量投資。根據Construct Connect和牛津經濟研究院的數據,2022年零售建設將達到196.4億美元,飯店為149.6億美元,政府建築為120.5億美元,體育場館為96.6億美元。對商業計劃的大量投資正在創造對交流設備的需求。

- 公司正在透過在該地區建立新辦事處來擴大其影響力,從而促進市場的成長。例如,2022年5月,作為擴大策略的一部分,克拉克建築集團宣佈在美國維吉尼亞麥克萊恩開設一個佔地128,000平方英尺的新辦公室。克拉克建築集團的基礎設施、建築和資產解決方案部門將在這個新辦公室設立一個現代化的協作中心。此外,Clark 將在貝塞斯達保留約 29,000 平方英尺的辦公空間,並將巴爾的摩市中心體育場廣場的辦公空間增加一倍。

- 2021 年 2 月,大金應用材料公司將與 Elita Air 合作,利用全球現有的零件經銷商和分銷商。作為大金集團的成員,Elitire 將成為大金應用材料公司的官方服務和技術提供商,為客戶提供商務用供暖和製冷設備的整個生命週期的支援。這些夥伴關係關係有望擴大大金客自訂空氣處理器在每個地區商務用領域的使用。

冷媒用量波動是推動市場的因素之一

- 大多數商業機構都使用 VRF 系統,從小型商店和咖啡館到大型辦公大樓和公共區域。透過 VRF 分區,能源僅在辦公室運作中用於冷卻或加熱。 VRF 系統具有安靜的室內機和保持精確溫度控制的能力,可確保最舒適和高效的職場環境。

- VRF 系統提供同步加熱和冷卻服務、精確的溫度控制和高能源效率。這些優勢提供了相對於傳統方法的競爭優勢,並且是產業擴張的主要驅動力。建設產業的擴張、房地產和建築業的放鬆管制、巨大的節能潛力、對 VRF 系統低且易於維護的需求等是推動 VRF 系統市場的主要因素。

- 為了滿足客戶需求,該地區的公司正在提供各種產品以增加其市場佔有率。例如,Bosch VRF 空調系統不僅在一個中央系統中提供高達 270kW 的大容量範圍,而且還採用模組化設計,具有節省空間的室外單元、時尚的室內單元和複雜的控制設備方法。此高效產品系列適用於飯店、企業、醫院、餐廳、別墅、學校等空調設備。 VRF 系統的優點包括與建築管理系統的連接、每個房間的控制和集中控制。

- COVID-19 的疫情對 VRF 系統業務以及其他行業產生了重大負面影響。一方面,VRF 系統製造商必須處理所有問題,例如採購生產 VRF 系統所需的原料和組件、交付成品以及吸引偏遠地區的工人。然而,各種製造組織自動化程度的提高以及用於調度和警報的建築自動化系統 (BAS) 的整合正在對市場成長產生積極影響。

- VRF 通常與能源回收通氣結合使用。各種通風增加和 VRF 提供最佳的室內環境舒適度 (IEC) 和室內空氣品質 (IAQ)。為了實現這一目標,需要使用標準能源回收通風或特殊的室外空氣系統 (DOAS)。透過在不同位置安裝多個 VRF 室內機,可以實現多個過濾點。由於這些小調節點,空氣可以更頻繁地循環和過濾。

美國空調設備產業概況

美國空調設備市場適度整合,擁有多家大公司。公司不斷投資於策略聯盟和產品開發,以佔領更多的市場佔有率。近期市場趨勢如下:

- 2022 年 5 月 - 江森自控 - 日立有限公司宣布推出一款壁掛式室內迷你分體裝置,作為其高效單區商務用迷你分離式系統 PRIMAIRY P300 系列的最新成員。這種無管道供暖和製冷系統的開發是為了滿足零售店、餐廳和教育設施等中小型空間的獨特要求。新的壁掛式裝置更小、更輕,日立的全系列 PRIMAIRY 迷你分離式系統具有多種安裝選項,使承包商的安裝更加容易。長管道長度提供更大的佈局自由度,大容量範圍確保為每種應用提供精確尺寸的系統。滿足客戶需求和應用

- 2021 年 12 月 - 減少零售對環境的影響變得越來越重要,主要目標之一是建築基礎設施的脫碳。大金的新型壁掛式室內機將先進技術與優雅設計融為一體,極具吸引力。易於安裝、操作且經濟實惠的節能熱泵技術現在可以取代所有商店中的傳統鍋爐系統。透過與SkyAir α系列室外機結合,此室外機最大管路長度為85m,工作範圍低至-20度C,安裝人員和設計師可以最大限度地提高設計和安裝位置的自由度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 更換現有設備並提高性能

- 政府支持法規,包括透過稅額扣抵計劃激勵節能

- 市場限制(持續戰爭對供應鏈和原料的影響)

- 取決於宏觀經濟經濟狀況

第6章 市場細分

- 按設備

- 空調/通風設備

- 類型

- 單分體/多分體

- VRF

- 空氣調節機

- 冷卻器

- 風機盤管

- 室內包和屋頂包

- 其他類型

- 空調/通風設備

- 按銷售管道

- 專賣店

- 線上

- 多品牌商店

- 按最終用戶

- 住宅

- 商業的

- 產業

第7章 競爭格局

- 公司簡介

- Daikin Industries, Ltd.

- Gree Electrical Appliances Inc.

- Emerson Electric Company

- Hitachi-Johnson Controls Air Conditioning Inc.

- Carrier

- LG Electronics Inc.

- Panasonic Corporation

- Toshiba Corporation

- Haier Group Corporation

- Electrolux

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91614

The United States Air Conditioning Equipment Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- Rapid economic expansion assists in raising people's disposable incomes and driving up demand for housing for both residential and commercial uses. Industrial uses also fuel the air conditioner industry. According to International Monetory fund, In 2021, the gross domestic product per capita in the United States amounted to around USD 69,231.4 . Such huge per capital will drive the studied capital.

- The market will also be fueled by the tourism sector's rapid expansion, as hotels and commercial vehicles around the region will soon consider a range of portable and other AC systems. The portable air conditioner market will be driven by consumers seeking on-the-go cooling devices and energy-efficient cooling systems. Additionally, the public sector will be a key driver in this market as governments throughout the region focus on energy-efficient air conditioning.

- The Air Handling Units can remove hazardous air pollutants that can lead to various illnesses and respiratory conditions, such as lung cancer, ischemic heart disease, asthma, and chronic obstructive pulmonary disease. Additionally, several technological developments, like the creation of affordable 3D printed units and the integration of sensors in AHU units for movement-activated air conditioning, are favorably affecting the market's expansion. The development of vast infrastructure and the creation of smart cities, particularly in emerging economies, are further drivers that are anticipated to fuel market growth.

- With the outbreak of COVID-19, industrial companies are expressing concerns about the environmental impact of the services and products they buy and are willing to pay more for more environmentally and health-friendly options than others. Smart Air Conditioner systems are expected to have significant demand. Technology gives end-users more control, from self-regulation to sensors to remote temperature adjustment to integrating energy controls. The Air Conditioner systems deal with varied load conditions depending on the occupancy rate in the buildings due to irregular attendance. Rationalizing square foot occupancy per employee and evolving office space usage patterns will be necessary.

- Environmental concerns regarding global warming and ozone depletion have led to the development of evolving global and regional regulations, which have had significant implications for refrigerants across applications. Manufacturers and end-users who purchase, design, install, and service air conditioning equipment should consult their country's current regulations, codes, and standards to aid refrigerant selection for each intended use.

US Air Conditioning Equipment Market Trends

Commercial Segment is one of the Factor Driving the Market

- According to the United States Energy Information Administration, Nearly 20% of the country's energy consumption and 12% of its greenhouse gas emissions are attributed to commercial buildings. Smart buildings serve the entire world community by lowering waste and preserving energy.

- Reducing energy use in buildings can save building owners to save more on their operational costs. By connecting mechanical and electrical systems in buildings to the cloud, they can automatically switch on and off, reducing waste.

- The investments in commercial buildings are massive in the United States. According to Construct Connect and Oxford Economics, in 2022, the value of commercial construction by retail will account for USD 19.64 billion, USD 14.96 billion for hotels, USD 12.05 billion for government, and USD 9.66 billion for sports stadiums. The robust investments directed toward commercial projects create a need AC equipment.

- The companies are expanidng thier presence by constructing new offices in the region which will enable the market to grow. For instance, May 2022, As part of its expansion strategy, Clark Construction Group has announced the inauguration of a new 128,000ft2 office in McLean, Virginia, US. The organization's infrastructure, construction, and asset solutions departments will have a modern, collaborative hub in this new office space. Additionally, Clark is maintaining almost 29,000ft2 of its office space in Bethesda and increasing its office space at Stadium Square in downtown Baltimore by a factor of two.

- In February 2021, Daikin Applied collaborated with ElitAire, to utilize its existing parts distributor and sales representative globally. ElitAire, which is now part of the Daikin Group, is likely to be Daikin Applied's authorized service and technology provider, supporting customers throughout the lifecycle of their commercial heating and cooling equipment. Such partnerships are poised to increase the usage of custom air handlers of Daikin in the commercial sector of that respective region.

Variable Refrigerant Volume is one of the Factor Driving the Market

- Most commercial structures, from little stores and cafes to big office complexes and public areas, use VRF systems. VRF zoning ensures that energy is only used to cool or heat occupied offices. Due to their quiet indoor units and ability to maintain precise temperature control, VRF systems guarantee the most comfortable and productive work environment.

- VRF systems offer simultaneous heating and cooling services, accurate temperature control, and high energy efficiency. These benefits give these systems a competitive edge over conventional methods and are the main drivers of industry expansion. The expanding construction industry, loosening regulations in the real estate and construction sectors, significant potential for energy savings, and low and simple maintenance needs of VRF systems are all major factors propelling the market for VRF systems.

- To meet the demands of the customers the firms in the region are providing different products to enhance their market share. For example, In addition to providing a large capacity range of up to 270 kW in a single central system, Bosch VRF Air Conditioning Systems also employs a modular design approach with space-saving outside units, fashionable indoor units, and sophisticated controls. This high-efficiency product line is appropriate for air-conditioning facilities, including hotels, businesses, hospitals, restaurants, villas, and schools. The advantages of a VRF system include connecting to building management systems and providing individual room control and centralized control.

- The COVID-19 epidemic significantly negatively impacted the VRF systems business, just like in any other industry. On the one hand, procuring the raw materials and components needed to produce VRF Systems, delivering finished goods, and luring workers out of quarantines were all issues that VRF system makers had to deal with. However, the market growth has been positively impacted by increasing automation in various manufacturing organizations and integrating the Building Automation System (BAS) for schedules and alarms.

- VRF is frequently used in combination with energy recovery ventilation. A variety of increased ventilation and VRF provides the best indoor environmental comfort (IEC) and indoor air quality (IAQ). Standard energy recovery ventilators or specialized outdoor air systems are used to achieve this (DOAS). Multiple filtration points are possible with numerous indoor VRF units placed in various locations. The air can circulate and filter more often thanks to these tiny conditioning points.

US Air Conditioning Equipment Industry Overview

The United States Air Conditioning Equipment market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2022 - Johnson Controls-Hitachi has introduced a new Wall Mount indoor mini-split unit as the latest addition to its PRIMAIRY P300 line of high-efficiency, single-zone commercial mini-split systems. This ductless heating and cooling system are developed to address the particular requirements of small to medium-sized spaces, such as retail establishments, dining establishments, and educational facilities. The new Wall Mount unit is small and light, and the entire series of Hitachi PRIMAIRY mini-split systems have several mounting possibilities, making installation for contractors easier. Long pipe adds to the layout freedom, and a large capacity range ensures a system that is precisely the right size for any application. To satisfy client needs and application

- December 2021 - Reducing the environmental impact of the retail industry is becoming increasingly crucial, with one of the main objectives being the decarbonization of building infrastructure. The new wall-mounted indoor unit from Daikin delivers an enticing combination of advanced technology and elegant design. All retail establishments can now use energy-saving heat pump technology to replace conventional boiler systems since it is simple to install, operate, and affordable. When coupled with the Sky Air Alpha-series outdoor unit, which has lengthy piping lengths up to 85 meters and a wide operation range down to -20°C, the new model offers installers and designers the most flexibility in design and location.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment Of The Impact Of Covid-19 On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement Of Existing Equipment With Better Performing Ones

- 5.1.2 Supportive Government Regulations Including Incentives For Saving Energy Through Tax Credit Programs

- 5.2 Market Restraint (impact Of Ongoing War On Supply Chain And Raw Material)

- 5.2.1 Dependence On Macro-economic Conditions

6 MARKET SEGMENTATION

- 6.1 Equipment

- 6.1.1 Air Conditioning/Ventilation Equipment

- 6.1.1.1 Type

- 6.1.1.1.1 Single Splits/Multi-Splits

- 6.1.1.1.2 VRF

- 6.1.1.1.3 Air Handling Units

- 6.1.1.1.4 Chillers

- 6.1.1.1.5 Fans Coils

- 6.1.1.1.6 Indoor Packaged And Roof Tops

- 6.1.1.1.7 Other Types

- 6.1.1 Air Conditioning/Ventilation Equipment

- 6.2 Distribution Channel

- 6.2.1 Exclusive Stores

- 6.2.2 Online

- 6.2.3 Multi Brand Stores

- 6.3 End User

- 6.3.1 Residential

- 6.3.2 Commercial

- 6.3.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries, Ltd.

- 7.1.2 Gree Electrical Appliances Inc.

- 7.1.3 Emerson Electric Company

- 7.1.4 Hitachi-Johnson Controls Air Conditioning Inc.

- 7.1.5 Carrier

- 7.1.6 LG Electronics Inc.

- 7.1.7 Panasonic Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Haier Group Corporation

- 7.1.10 Electrolux

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219