|

市場調查報告書

商品編碼

1635392

開關穩壓器電源管理 IC:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Switching Regulators Power Management IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

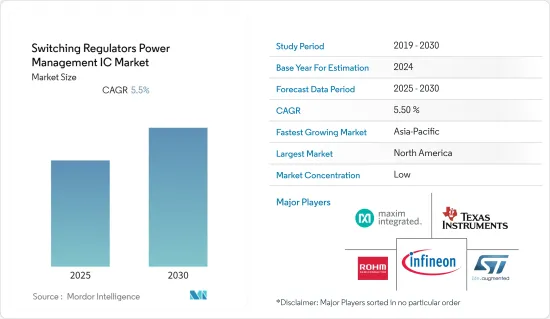

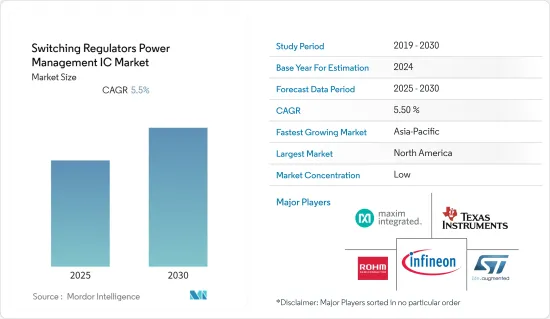

開關穩壓器電源管理 IC 市場預計在預測期內複合年成長率為 5.5%。

主要亮點

- 開關穩壓器有更複雜的設計支持,可以處理更多的功率並從各種輸入電壓產生穩定的輸出電壓。因此,開關穩壓器和 IC 近年來越來越受歡迎,為使用者提供了高效率和靈活性。

- 例如,2022 年 6 月,ROHM 發布了一款新型汽車 LDO 穩壓器 IC,可在奈米級輸出電容下正常運作。 Nanocap技術解決了電容器問題,並為更高穩定性開闢了新前景。 BD9xxN1系列(BD950N1G-C、BD933N1G-C、BD900N1G-C、BD950N1WG-C、BD933N1WG-C、BD900N1WG-C)是一次(12V直接連接)能源,適用於動力傳動系統、車身娛樂系統 ADAS 和汽車資訊的供應最佳化。

- 近年來,消費性電子市場也大幅成長。例如,根據美國人口普查局和 CTA 的數據,2021 年美國智慧型手機銷量預計將增加至 747 億美元。開關穩壓器電源管理 IC (PMIC) 用於數位相機、攝影機、無線設備、串流媒體盒和加密狗、智慧型手機、機器人和個人電腦設備等產品,但需求預計會增加。

- 此外,電池充電站和基礎設施預計將在全球範圍內成長。此外,各行業自動化程度的提高顯著增加了電池需求,並支持了市場成長。此外,技術創新以及可攜式電池和行動電源的日益普及也對市場做出了重大貢獻。

- 例如,2021年10月,Power World宣布未來兩三年內將在印度投資2,500萬美元,建立鋰離子電池製造設備和電池替代基礎設施。此外,該公司還在北方邦大諾伊達建造了一座1GW的電池工廠。印度計劃將約 8,000 輛現有三輪車改裝為電動車。

開關穩壓器電源管理IC市場趨勢

消費性電子產業佔據主要市場佔有率

- 可支配收入的增加、生活水準的提高和技術的普及正在增加對消費性電子產品的需求,特別是智慧電視、智慧型手錶和智慧型手機等智慧設備,這支撐了對開關穩壓器電源管理IC的需求。

- 例如,2021年1月,私募股權公司Warburg Pincus向耳機和智慧穿戴裝置製造商boAt投資1億美元。印度蜂窩與電子協會也宣布計劃在印度創建智慧型手機設計、研發和應用開發生態系統。

- 此外,根據消費者技術協會的數據,2018 年至 2021 年美國消費性電子 (CE) 市場的零售收益穩定成長。根據零售額預測,2021年美國消費性電子零售額預計將達4,420億美元,推動未來市場成長。此外,智慧型手機在消費性電子領域的零售額中佔據最大佔有率。根據消費者科技協會的數據,2021 年 1 月智慧型手機銷售額為 730 億美元。

- 2022年4月,一加在美國推出了OnePlus Nord N20 5G,擴展了其Nord系列智慧型手機。這款智慧型手機搭載高通 Snapdragon 處理器,並配有 AMOLED 顯示器。這款智慧型手機配備4500mAh電池,運行Android 11作業系統。此類家電的發展將進一步激發科學研究市場的活力。

- 同樣,2021年4月,蘋果宣布加速在美國投資,計劃未來五年承諾超過4300億美元的新投資,並在全美新增2萬個就業崗位,而這一數字在美國將繼續成長。成為未來幾年市場成長的驅動力。

亞太地區預計將出現顯著成長

- 由於亞太地區主要智慧型手機製造商和筆記型電腦製造商增加投資以提高其智慧型手機市場佔有率,預計亞太地區將在預測期內為直流到直流開關穩壓器市場提供重大成長機會。對電子設備的需求不斷成長影響了對 DC/DC開關穩壓器的需求。

- 例如,2022年7月,OPPO宣布將在未來五年內在印度投資6000萬美元,作為其“Vihaan”計劃的一部分,通過增強中小企業和中小微企業的能力來加強製造生態系統。

- 此外,中國正在增加對汽車產業的投資,以鞏固其市場領導者的地位。例如,2021年12月,中國政府取消了對外國投資的一些限制,以促進國內汽車製造。

- 隨著亞洲各地區政府增加對各行業的投資,所研究的市場預計將會成長。例如,據 IBEF 稱,到 2025 年,印度的家用電器和消費電子產業預計將成長一倍以上,達到 1.48 兆印度盧比。此外,2000年4月至2021年12月期間,印度電子產品產業共吸收FDI流入31.9億美元。

- 此外,印度政府高度重視電子硬體製造,這是印度製造、數位印度和新創印度計畫的關鍵組成部分。由於政府採取多項促進國內製造業的舉措,印度行動電話和其他消費性電子產品的生產和組裝活動已出現初步成長。

開關穩壓器電源管理IC產業概述

全球開關穩壓器電源管理 IC 市場與許多地區和國際參與者競爭激烈。主要企業包括 ROHM、Infineon Technologies AG、Maxim 整合式和 NXP Semiconductors。該市場的主要企業正在推出創新的新產品並建立夥伴關係和協作,以獲得競爭優勢。

- 2022 年 3 月 - ROHM Semiconductor 發布了一種新的電源技術 QuiCur,該技術可改善 DC/DC 轉換器 IC(開關穩壓器)的負載瞬態響應特性(包括響應速度和後級電壓穩定性的響應性能)。

- 2021 年 5 月 - 向全球提供先進半導體技術的三星電子宣布推出業界首款整合電源管理 IC (PMIC) S2FPD01、S2FPD02,用於第 5 代 DDR5 雙列直插記憶體模組 (DIMM)。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 消費性電子產品需求增加

- 綠色汽車生產

- 市場限制因素

- 開關穩壓器在製程中會產生噪音

第6章 市場細分

- 按最終用戶產業

- 車

- 家電

- 產業

- 通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Infineon Technologies AG

- Maxim Integrated

- ROHM Co., Ltd.

- Texas Instruments Incorporated

- STMicroelectronics

- Renesas Electronics Corporation

- Maxlinear

- On Semiconductor

- NXP Semiconductors

- Microchip Technology Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91641

The Switching Regulators Power Management IC Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- Switching regulators receive support from a more complex design, which allows them to handle more power and produce a stable output voltage from varying input voltages. As a result, switching voltage regulators and ICs have grown in popularity in recent years, providing greater efficiency and flexibility to the user.

- For instance, in June 2022, ROHM introduced new automotive LDO regulator ICs with proper operation at nanoscale output capacitance. Nano Cap technology solves capacitor problems, opening new prospects for greater stability. The BD9xxN1 series (BD950N1G-C, BD933N1G-C, BD900N1G-C, BD950N1WG-C, BD933N1WG-C, BD900N1WG-C) is optimized for primary (direct connection to 12V) energy supplies in a wide range of applications, including powertrain, body, ADAS, and car infotainment.

- The consumer electronics market has also grown significantly in recent years. For instance, the value of smartphone sales in the United States is expected to increase to USD 74.7 billion in 2021, according to the US Census Bureau and CTA. Although switching regulator Power Management ICs (PMIC) are used in products like digital cameras, video camcorders, wireless devices, streaming media boxes and dongles, smartphones, robots, and personal computer devices, demand is expected to rise.

- Furthermore, battery charging stations and infrastructure are expected to grow worldwide. Also, with increased automation in various industries, demand for batteries has increased significantly, supporting market growth. Furthermore, innovation and rising penetration of portable batteries and power banks contribute significantly to the market.

- For instance, in October 2021, Power Global announced a USD 25 million investment in India over the next two to three years to establish a lithium-ion battery manufacturing unit and battery swapping infrastructure. Furthermore, the company constructed a one-gigawatt battery plant in Greater Noida, Uttar Pradesh. It plans to retrofit around 8 lakh existing three-wheelers in India for conversion to electric versions.

Switching Regulators Power Management IC Market Trends

Consumer Electronics Sector to Hold Significant Market Share

- The increase in disposable income, rising living standards, and technological penetration have increased demand for consumer electronics, particularly smart devices such as smart TVs, smartwatches, smartphones, and others, which supports industry demand for Switching Regulator power management ICs.

- For instance, in January 2021, Warburg Pincus, a private equity firm, invested USD 100 million in boAt, a manufacturer of earphones and smart wearables. In addition, the India Cellular & Electronics Association announced plans to establish an ecosystem for smartphone design, R&D, and application development in India.

- Furthermore, according to the Consumer Technology Association, retail earnings in the consumer electronics (CE) market in the United States increased steadily from 2018 to 2021. According to projected retail sales, consumer electronics retail sales in the United States reached USD 442 billion in 2021, which is expected to drive market growth in the future. Moreover, Smartphones accounted for the most retail revenue in the consumer electronics sector. According to the consumer technology association, in January 2021, Smartphones accounted for USD 73 billion in revenue 2021.

- In April 2022, OnePlus expanded its Nord series of smartphones with the release of the OnePlus Nord N20 5G in the United States. The smartphone is powered by a Qualcomm Snapdragon processor and has an AMOLED display. The smartphone has a 4500mAh battery and runs the Android 11 operating system. These developments in consumer electronics further boost the studied market.

- Similarly, in April 2021, Apple announced an acceleration of its US investments, with plans to make new contributions of more than USD 430 billion and add 20,000 new jobs across the country over the next five years, which will drive market growth in the future.

Asia-Pacific is Expected to Witness Significant Growth

- Asia Pacific is expected to offer a significant growth opportunity for DC to DC switching regulators market during the forecast duration due to increasing investment by major smartphone and laptop manufacturers in the Asia Pacific region to improve their smartphone market share. The increasing demand for electronic devices impacts the need for DC to DC switching regulators.

- For instance, in July 2022, Oppo announced a USD 60 million investment in India over the next five years as part of its 'Vihaan' project to strengthen the manufacturing ecosystem by empowering small and medium enterprises and micro, small, and medium enterprises.

- Moreover, China is increasing its investment in the automotive sector to strengthen its position as the market leader. For instance, in December 2021, the Chinese government removed several limits on foreign investment to boost automotive manufacturing in the country.

- The studied market is expected to grow as various Asian regional governments increase their investments in various sectors. For example, the Indian appliances and consumer electronics industry is expected to more than double to INR 1.48 lakh crore by 2025, according to IBEF. Furthermore, between April 2000 and December 2021, the electronic goods sector in India attracted USD 3.19 billion in FDI inflows.

- Moreover, the Government of India places a high value on electronics hardware manufacturing as it is a key component of the Make in India, Digital India, and Start-up India programs. With various government initiatives to boost domestic manufacturing, India has already seen initial growth in production and assembly activities for products such as mobile phones and other consumer electronics.

Switching Regulators Power Management IC Industry Overview

The global switching regulators power management IC market is highly competitive, with many regional and international players. Such as ROHM Co., Ltd., Infineon Technologies AG, Maxim Integrated, and NXP Semiconductors are among the key players. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- March 2022 - ROHM Semiconductor introduced QuiCur, a new power supply technology that improves the load transient response characteristics (response performance involving response speed and voltage stability of subsequent stage) of DC/DC converter ICs (switching regulators).

- May 2021 - Samsung Electronics, a global provider of advanced semiconductor technology, announced the industry's first integrated power management ICs (PMICs) - S2FPD01, S2FPD02, and S2FPC01, for the fifth-generation DDR5 dual in-line memory module (DIMM).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Consumer Electronic Devices

- 5.1.2 Production of Green Automobiles

- 5.2 Market Restraints

- 5.2.1 Switching Regulators Generate Noise During the Process.

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive

- 6.1.2 Consumer Electronics

- 6.1.3 Industrial

- 6.1.4 Communication

- 6.1.5 Other End-users Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Italy

- 6.2.2.4 France

- 6.2.2.5 Rest of the Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Australia & New Zealand

- 6.2.3.6 Rest of the Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Maxim Integrated

- 7.1.3 ROHM Co., Ltd.

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 STMicroelectronics

- 7.1.6 Renesas Electronics Corporation

- 7.1.7 Maxlinear

- 7.1.8 On Semiconductor

- 7.1.9 NXP Semiconductors

- 7.1.10 Microchip Technology Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219