|

市場調查報告書

商品編碼

1635394

歐洲閥門:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

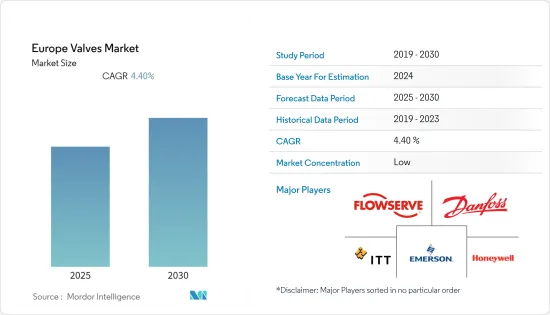

歐洲閥門市場預計在預測期內複合年成長率為 4.4%。

主要亮點

- 工業閥門在日益複雜的工業和工作領域中發揮著重要作用。幾乎每個工業領域都需要管道和軟管,包括原油和天然氣生產、醫療和水處理、引擎、機械和設備工程以及氣體、液體和可流動固體的運輸。

- 技術的進步形成了創新的解決方案,可以透過簡化操作來提高加工廠的效率。隨著行業需求的發展和變化,閥門供應商預計將繼續開發產品和流程來應對這些新挑戰。

- 該地區各國政府正在採取各種舉措並選擇不同的策略來增加對閥門的需求。例如,2022年6月,歐盟委員會發布的新的歐盟太陽能策略指出,屋頂太陽能光電(PV)可以幫助關閉燃氣閥門。

- 此外,公司定期推出新的創新以滿足市場需求。例如,2021年2月,PE管製造商COSMOIND推出了BF管件、EF管件、球閥等新產品。公司還擁有ISO 9001、ISO 14001、CE、GB、TUV、NSF、KS、KC、KFI和G-Pass認證。

- 此外,COVID-19 的爆發也引發了全球經濟危機。疫情對油氣產業造成嚴重影響,油價貶值。重要的石油生產商所開採的石油的儲存空間即將耗盡,從而減少了需求。根據BP《2021年世界能源統計回顧》,由於道路流化措施,汽油需求減少了約13%(3.1 Mb/d)。此外,由於個人防護裝備等醫療和衛生相關用品的需求增加,與石化行業密切相關的產品(乙烷、石腦油、液化石油氣)的銷售幾乎保持不變。

歐洲閥門市場趨勢

控制閥佔較大市場佔有率

- 控制閥操縱流動的流體,例如氣體、蒸氣、水或化合物,以補償負載擾動並使調節的製程變數盡可能接近所需的設定點。控制閥是製程控制迴路中最關鍵的部分,對於製程的整體性能至關重要,特別是當可靠性和生產率是關鍵目標時。

- 控制閥市場的成長是由諸如對無線基礎設施監控各種工廠設備的需求不斷增加、對自動化的日益關注以及製程工業中設施數量的增加等因素所推動的。

- 此外,該公司正在探索各種收購和聯盟,以提高其在市場上的影響力。例如,2021 年 6 月,Helios Technologies 簽訂了收購 NEM srl 的最終協議。 NEM 生產插裝閥、閥體內零件和方向控制閥。

- 2021 年 8 月,Burkert 流體控制系統推出耐用且免維護的產品,適用於高達 25 bar 的介質壓力和高達 230 °C 的溫度,用於製程和食品產業中氣體、液體和蒸氣的切換和控制。提供更少的開/關和控制閥。 200度C時壽命超過100萬次。

石油和天然氣產業預計將顯著成長

- 為了持續高效營運,歐洲地區主要國家都在專注於維修和擴大現有煉油廠,以滿足日益成長的原油需求。這種情況預計將增加管道和基礎設施開發的投資,從而增加預測期內的閥門需求。

- 2022年6月,奈及利亞國家石油公司奈及利亞國家石油公司(NNPC)獲得奈及利亞政府許可,簽署建設從摩洛哥至歐洲的5,660公里天然氣管道的合約。這些努力將進一步推動研究目標市場的發展。

- 此外,2022年5月,義大利Snam公司和西班牙Enagas公司考慮興建一條天然氣管道。提案的西班牙-義大利管道預計年輸送能力高達300億立方公尺。在此背景下,俄羅斯入侵烏克蘭後,歐洲尋求能源供應來源多元化,減少對俄羅斯天然氣的依賴。

- 此外,2022年6月,荷蘭和德國宣布將在北海聯合開發和開發新的天然氣田,以確保歐洲尋求擺脫俄羅斯石化燃料的天然氣供應。該許可證是由於烏克蘭戰爭而獲得的,該油田預計將於 2024年終開始生產。

歐洲閥門產業概況

歐洲閥門市場企業之間的競爭日益激烈。該市場由 ITT Inc.、艾默生電氣公司和通用電氣等主要公司組成。從市場佔有率來看,目前這些大公司佔據市場主導地位。然而,隨著技術創新的不斷增加,許多公司正在透過贏得新契約和開發新市場來擴大其市場佔有率。

- 2021 年 10 月 - 阿姆斯壯國際公司完成了對 Leslie Controls 的收購,該公司是一家控制系統、工業泵、熱水器和蒸氣調節器的製造商。此次收購包括 Leslie 的各種控制閥和蒸氣熱水器。

- 2021 年 9 月 - 收購 Genesis Systems,這是一家控制閥、調節器以及閥門自動化產品和系統的分銷商。 Genesis Systems 服務於各種商業和工業市場,包括發電、半導體、石化、 OEM、製藥、建築自動化以及食品和飲料行業。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 新興市場越來越重視電力、水和用水和污水

- 最終用戶關注環境問題和維修老化基礎設施以保持競爭力

- 市場挑戰

- 競爭加劇給製造商帶來價格壓力

第6章 市場細分

- 按類型

- 球

- 蝴蝶

- 門/手套/檢查

- 插頭

- 控制

- 其他類型

- 按最終用戶產業

- 石油和天然氣

- 化學

- 用水和污水

- 發電

- 礦業

- 其他最終用戶產業

- 按國家/地區

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Danfoss A/S

- Flowserve Corporation

- Emerson Electric Co.

- ITT INC.

- Honeywell International Inc.

- KITZ Corporation

- Hitachi Ltd

- Pentair PLC

- Schlumberger Limited

- The Weir Group PLC

- Xylem Inc.

- AVK Holding A/S

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91644

The Europe Valves Market is expected to register a CAGR of 4.4% during the forecast period.

Key Highlights

- Industrial valves play a vital role in the increasingly complex industrial and working world. Pipelines and hose pipes are necessary everywhere, in crude oil and natural gas production and in nearly all areas of industry, including medicine and water treatment, as well as in engines, machinery, and plant engineering, the conveyance of gas, fluids, and free-flowing solids.

- Advancements in technology have shaped innovative solutions that can improve process plants to become increasingly efficient by streamlining their operations. As industry requirements evolve and change, valve suppliers are expected to continue developing products and processes that address these new challenges.

- The Government in the region is taking various initiatives and opting for different strategies to boost the demand for valves. For instance, in June 2022, the new EU solar strategy published by the European Commission stated that the rooftop solar photovoltaic(PV) would help in turning the gas valves off.

- Moreover, companies are regulalry coming up with new innovations to keep up with the market demand. For instance, in Feb 2021, COSMOIND Co. Ltd, a PE pipe manufacturer has launched new products of BF fitting, EF fitting and ball valves. The company is also fully certified to ISO 9001, ISO 14001, CE, GB, TUV, NSF, KS, KC, KFI and G-Pass.

- Further, the outbreak of COVID-19 has resulted in an economic crisis across the world. The pandemic severely affected the oil and gas industry, with oil prices slashed. Significant oil producers are running out of storage space for extracted oil, and the demand is declining. According to BP's Statistical Review of World Energy 2021, gasoline demand decreased by around 13% (3.1 Mb/d) due to road mobility measures. Moreover, products closely related to the petrochemicals sector (ethane, naphtha, and LPG) were largely flat, supported partly by increasing demand for medical and hygiene-related supplies such as PPE.

Europe Valves Market Trends

Control Valves to Hold a Significant Market Share

- The control valve manipulates the flowing fluid, such as gas, steam, water, or chemical compounds, to compensate for the load disturbance and keeps the regulated process variable as close as possible to the desired set point. Control valves are the most important part of any process control loop, as they are critical to the overall performance of the process, especially when reliability and productivity are the primary goals.

- The growth of the control valve market is driven by factors such as the increasing need for wireless infrastructure to monitor equipment in various plants, augmented focus on automation, and expanding number of process industry establishments.

- Further, companies are looking for various acquisitions and partnerships in order to stronghold their market presence. For instance, in June 2021, Helios Technologies signed a definitive agreement to acquire NEM s.r.l. NEM produces cartridge, parts-in-body and directional control valves.

- In August 2021, Burkert Fluid Control Systems announced to offer durable and low maintenance on/off and control valves for switching and controlling gases, liquids, and steam in the process and food industries, suitable for media pressures up to 25 bar and temperatures up to 230°C. The service life at 200°C is more than one million switching cycles.

Oil & Gas Segment is Expected to Register Significant Growth

- To ensure the continuation of efficient operations, significant countries in the European region have increased focus on renovating existing refineries and expanding their oil refineries to meet the growing demand for crude oil. This scenario is expected to increase investments toward the pipeline and infrastructural development, augmenting the demand for valves over the forecast period.

- In June 2022, Nigerian state oil firm Nigerian National Petroleum Corporation (NNPC) received permission from the Nigerian Government to sign an agreement on constructing a 5,660-km gas pipeline from Morocco to Europe. These initiatives further boost the studied market.

- Moreover, in May 2022, Italy's Snam and Spain's Enagas explored the construction of a gas pipeline. The proposed pipeline between Spain and Italy is expected to have an annual capacity of up to 30 billion cubic meters. This comes after Europe's efforts to diversify its energy supply mix and cut its reliance on Russian gas in the wake of Russia's invasion of Ukraine.

- Further, in June 2022, Netherlands and Germany announced jointly developing and exploiting a new gas field in the North Sea to help secure gas supply as Europe tries to wean itself from Russian fossil fuels. The permit was granted due to the war in Ukraine, and the production at the field is expected to start by the end of 2024.

Europe Valves Industry Overview

The Europe valves market is witnessing a rise in competitiveness among companies. The market consists of major players, such as ITT Inc., Emerson Electric Co, and General Electric. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- October 2021 - Armstrong International completed the acquisition of Leslie Controls, a manufacturer of control systems, industrial pumps, water heaters, and steam regulators. The acquisition included Leslie's broad range of control valves and steam water heaters.

- September 2021 - FloWorks acquired Genesis Systems, a control valve, regulator, and valve automation products and systems distributor. Genesis Systems serves a range of commercial and industrial markets, including power generation, semiconductor, petrochemical, OEM, pharma, building automation, and food and beverage industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing emphasis on Power and Water & Wastewater in Emerging Markets

- 5.1.2 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.2 Market Challenges

- 5.2.1 High Levels of Competition Leading To Price Pressures For Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Water & Wastewater

- 6.2.4 Power Generation

- 6.2.5 Mining

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest of the Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Danfoss A/S

- 7.1.2 Flowserve Corporation

- 7.1.3 Emerson Electric Co.

- 7.1.4 ITT INC.

- 7.1.5 Honeywell International Inc.

- 7.1.6 KITZ Corporation

- 7.1.7 Hitachi Ltd

- 7.1.8 Pentair PLC

- 7.1.9 Schlumberger Limited

- 7.1.10 The Weir Group PLC

- 7.1.11 Xylem Inc.

- 7.1.12 AVK Holding A/S

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219