|

市場調查報告書

商品編碼

1635401

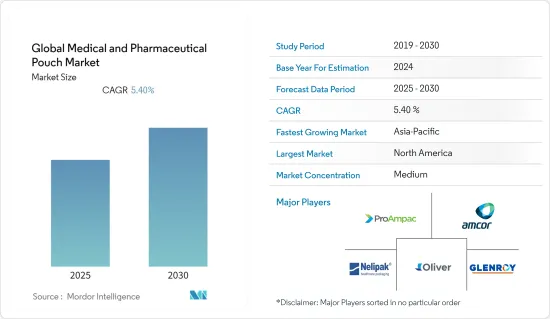

醫療和藥品袋:全球市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)Global Medical & Pharmaceutical Pouch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計全球醫療和藥品袋市場在預測期內的複合年成長率為 5.4%。

主要亮點

- 製藥領域的技術進步正在迅速改變藥物傳輸機制和化學成分。需要更先進和現代化的包裝來確保新藥物輸送技術的正確運作和保護。

- 此外,藥袋是一種廣泛應用於現代藥物輸送系統的包裝類型。除了阻隔性之外,藥袋還具有專為兒童和老年人使用而設計的形狀和機制。

- 袋子是用於銷售中小型、軟性或半軟性無菌醫療產品的常用容器,在運輸或儲存過程中不太可能損壞。應用包括靜脈導管、靜脈注射裝置、透析斷開帽、傷口敷料、小型手術器械、診斷測試包、縫合線、牙科用品等。

- 製藥業正在市場中發揮重要作用,從生產學名藥轉向開發新藥。 「健康中國2030」戰略強調了這一轉變。因此,醫藥行業的成長預計將創造機會並積極推動醫療和藥品袋市場的成長。

醫療和藥品袋市場的趨勢

醫療保健和藥品領域的擴大成長推動了市場成長

- 聚乙烯市場呈現成長趨勢。這是由於對包括塑膠袋在內的聚乙烯物品的需求增加。聚乙烯,俗稱聚烷或聚乙烯,是由長乙烯單體鏈組成的聚烯樹脂。屬於聚烯樹脂。聚乙烯的高衝擊強度、強耐化學性、高延展性和輕質等優點預計將推動該行業向前發展。

- 由於對環境問題的日益擔憂和政府監管的收緊,可生物分解聚乙烯的快速成長可能會在預測期內為聚乙烯市場提供新的成長前景。使用再生塑膠的創新方法的出現有效地促進了聚乙烯市場的成長。

- 此外,美國食品藥物管理局(FDA) 根據 CFR 標題 21 880.6850 監管用於醫療用途的無菌包裝,並將其歸類為 II 類醫療設備。製造商必須提交 A 510(k) 總結驗證測試和結果才能銷售其產品。合規趨勢往往會顯著增加美國包裝袋市場的需求。

- 由於藥袋具有許多優點,預計將在業界越來越受歡迎。這些袋子受到製藥公司的青睞,因為它們可以保護藥品免受有害射線和環境的影響,並且可以印上處方箋。

亞太地區預計將獲得主要市場佔有率

- 預計亞太地區醫藥市場將在預測期內快速成長。藥品包裝是由全球製藥業不斷發展所推動的。印度和中國等人口稠密地區的藥品包裝需求量大。這些國家藥品產量的增加進一步刺激了需求。

- 該地區由中國和印度等製藥行業的主要參與者組成,它們是製藥行業的重要供應商。根據《2021 年印度經濟調查》,未來 10 年印度國內市場預計將成長兩倍。預計2021年印度國內醫藥市場規模將成長至420億美元,2024年將成長至650億美元,2030年將成長至120至1300億美元。

- 永續包裝、耐用性和可回收性等因素,以及醫院和製藥製造商等各種最終用戶的上升趨勢,預計將在預測期內推動袋子的使用。供應鏈中斷預計將導致基本醫藥原料的價格上漲,並增加各種產品類型的成本。

- 由於引入嚴格的法律來提高該國製造的藥品的品質和完整性,玻璃在藥品包裝解決方案中的使用正在增加。此外,預計該行業對無菌醫療包裝產品的需求不斷成長,將進一步推動該地區預測期內的市場成長。

醫療和藥品袋行業概況

全球醫療和藥品袋市場競爭激烈,有大量區域和全球參與者。主要參與者包括 ProAmpac.、Glenroy, Inc.、Nelipak Corporation、Oliver 和 Amcor Plc.。

- 2022 年 6 月 - 在醫療技術創新博覽會上,Oliver Healthcare Packaging 作為袋子、蓋子、捲材、乾淨切割襯墊等產品的領先供應商,展示了其創新產品。該公司的包裝在滅菌、運輸和儲存作業過程中保護醫療設備和藥品。

- 2021 年 6 月 - Amcor 推出了歐洲首款用於藥品和醫療設備組合物品的多室袋,並已榮獲軟包裝協會頒發的 2021 年創新和材料結構獎。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 消費者對輕量袋子的需求不斷成長

- 增加醫療保健和藥品支出以推動市場成長

- 市場挑戰

- 原料成本上漲

第6章 市場細分

- 按材質

- 聚乙烯

- 聚氯乙烯

- 聚丙烯

- 聚對苯二甲酸乙二酯

- 其他材料

- 依產品類型

- 透氣袋

- 防拆封袋

- 防剝落袋

- 高阻隔袋

- 按用途

- 錠劑/膠囊

- 粉末

- 藥物輸送系統

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ProAmpac.

- GFR Pharma Ltd

- Glenroy, Inc.

- Nelipak Corporation

- Oliver

- Amcor Plc

- Terrapack

- American FlexPack

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91658

The Global Medical & Pharmaceutical Pouch Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Pharmaceutical sector technological advancements are rapidly changing the drug delivery mechanism and chemical ingredients. A higher and more modern packaging is required to ensure the appropriate working and protection of the new medication delivery technology.

- Further, Pharmaceutical pouches are one type of packaging widely utilized in modern medication delivery systems. Pharmaceutical pouches are available in child-resistant and senior citizen-friendly forms and mechanisms, in addition to barrier qualities against the external environment.

- Pouches are commonly used containers for small-to-medium-sized soft, semi-soft sterile medical goods sold and are not vulnerable to damage during shipment and storage. The applications include intravenous (IV) catheters, IV administration sets, dialysis disconnect caps, wound dressings, small surgical instruments, diagnostic test packs, sutures, and dental supplies

- The pharmaceutical sector plays a vital role in the market, moving from manufacturing generics to new drug development. The Healthy China 2030 initiative underlines this shift. Hence, the growth of the pharmaceutical industry is expected to create opportunities, thereby driving the medical & pharmaceutical pouch market's growth positively.

Medical & Pharmaceutical Pouch Market Trends

Increasing Growth of Healthcare & Pharmaceutical To Augment The Market Growth

- The polyethylene market witnessed to show an increasing trend. This is due to an increase in demand for polyethylene items including plastic pouches. Polyethylene, commonly known as polythene or polyethylene, is a polyolefin resin made up of long ethylene monomer chains. It belongs to the polyolefin resins family. Polyethylene's advantages, such as higher impact strength, strong chemical resistance, high ductility, and low weight, are projected to propel the industry forward.

- A surge in bio-degradable polyethylene may provide new growth prospects for the polyethylene market throughout the forecast period, owing to increased environmental concerns and stricter government restrictions. The emergence of innovative methods for using recycled plastic effectively boosts the polyethylene market's growth.

- Further, the US food and drug administration (FDA) regulates sterilization packaging intended for use in health care under Cfr title 21 880.6850 and classifies it as A class II medical device. Manufacturers must submit A 510(k) outlining the validation testing and results in order to market products. With the adhering to compliance, the market demand for pouches significantly tends to rise in the united states.

- Pharmaceutical pouches are predicted to grow in popularity in the industry due to their numerous advantages. These pouches are preferred by pharmaceutical businesses because they can protect drugs from harmful rays or the environment, and they can be engraved with a prescription.

Asia Pacific Expected to Witness Significant Market Share

- The Asia Pacific Pharmaceutical Market is expected to grow rapidly during the forecasted period. Pharma packaging has been boosted by the constantly developing pharmaceutical industry worldwide. Pharmaceutical packaging is in high demand in densely populated areas such as India and China. Increased pharmaceutical output in these countries has boosted demand even further.

- The region comprises of pharma giants such as China and India, which are prominent providers in the pharmaceutical industry. The home market is predicted to rise thrice in the next decade, according to the Indian Economic Survey 2021. In 2021, India's domestic pharmaceutical market is expected to be worth USD 42 billion, rising to USD 65 billion by 2024 and USD 120-130 billion by 2030.

- During the forecast period, factors such as sustainable packaging, durability, and recyclables, as well as the growing propensity of various end-users such as hospitals and medicine manufacturers, are likely to promote the use of pouches. Due to supply chain interruptions, the prices of essential pharmaceutical ingredients have risen, which is projected to raise the costs of various product types.

- The introduction of stringent laws to enhance the quality and integrity of domestically manufactured drugs has led to an increase in the usage of glass for pharmaceutical packaging solutions. Also, the rising demand for sterile medical packaging products from the industry would further drive the market's growth over the forecast period in the region.

Medical & Pharmaceutical Pouch Industry Overview

The Global Medical & Pharmaceutical Pouch Market is moderately competitive, with a considerable number of regional and global players. Key players include ProAmpac., Glenroy, Inc., Nelipak Corporation, Oliver and Amcor Plc

- June 2022 - At the Med-tech Innovation Expo, Oliver Healthcare Packaging, a leading supplier of pouches, lidding, roll stock, and cleancut mounting cards, demonstrated innovative products. During the sterilization, transportation, and storage operations, their packaging safeguards medical devices and pharmaceutical products.

- June 2021 - Amcor introduced a multi-chamber pouch for drug-device combination items offered for the first time in Europe and has already received a 2021 Award from the Flexible Packaging Association for technological innovation and material structure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Lightweight Pouches by Consumers

- 5.1.2 Increasing Spending on Healthcare & Pharmaceutical to Augment the Market Growth

- 5.2 Market Challenges

- 5.2.1 Increasing Raw Material Costs

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Polyethylene

- 6.1.2 Polyvinyl Chloride

- 6.1.3 Polypropylene

- 6.1.4 Polyethylene Terephthalate

- 6.1.5 Other Materials

- 6.2 By Product Type

- 6.2.1 Breathable Pouch

- 6.2.2 Tamper Evident Pouch

- 6.2.3 Non-Peelable Pouch

- 6.2.4 High Barrier Pouch

- 6.3 By Application

- 6.3.1 Tablet/Capsule

- 6.3.2 Powder

- 6.3.3 Drug Delivery System

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ProAmpac.

- 7.1.2 GFR Pharma Ltd

- 7.1.3 Glenroy, Inc.

- 7.1.4 Nelipak Corporation

- 7.1.5 Oliver

- 7.1.6 Amcor Plc

- 7.1.7 Terrapack

- 7.1.8 American FlexPack

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219