|

市場調查報告書

商品編碼

1635419

美國壁紙:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)United States Wall Coverings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

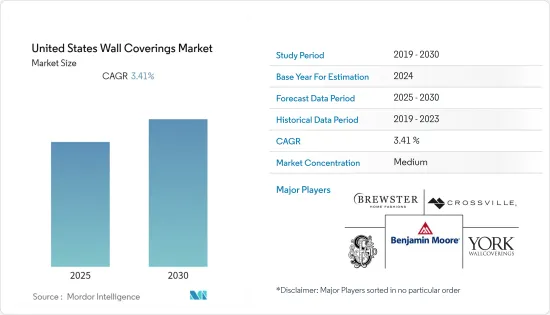

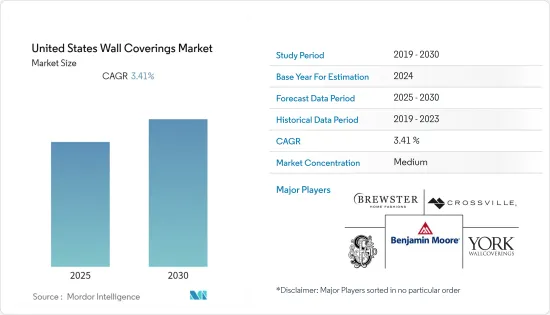

預計美國壁紙市場在預測期內的複合年成長率為 3.41%。

主要亮點

- 生活水準的提高、對奢華生活方式的渴望以及可支配收入增加推動的家居客製化推動了牆面裝飾市場的擴張。此外,技術創新的進步和更高品質的產品,例如採用噴墨列印技術列印的客製化 3D 牆,正在吸引高所得消費者購買壁材。

- 大多數牆布產品易於維護且持久,預計將增加客戶需求。由於人口成長和都市化,基礎設施活動的投資預計將在整個預測期內推動牆面覆蓋物市場的成長。

- 對於某些應用,油漆被認為是壁紙的更好替代品。此外,去除現有壁紙是一項繁瑣的任務,需要正確的工具才能有效地完成。可以使用化學物質或去除工具去除壁紙,但如果不小心,可能會損壞牆壁。

- 根據 Dodge Construction Network 的數據,從 2020 年到 2021 年,美國前 20 大都會區的商業和多用戶住宅量將增加 18%。在全國範圍內,2021 年商業和多戶住宅建築增加了 16%。 2021 年,上半區(前 10 個大都會區)的商業和多戶住宅量增加了 18%,而華盛頓特區和加州洛杉磯這兩個大都會區則出現下降。

- 兩個大都會區的開工量正在下降:華盛頓特區和加州洛杉磯。例如,根據 BEA 的數據,美國建築業是世界上最大的,僱用了約 800 萬人,私人支出每年都在持續增加。到 2023 年,新建設預計將達到 14,490 億美元。

- 疫情期間,由於提供許可證的政府機構關閉以及建築材料供應鏈中斷,新住宅開發進一步受到阻礙,這也影響了美國牆布市場。

- 儘管出現了新冠疫情,2021 年租賃住宅還是有一些好消息:RentCafe 最近的一項研究發現,租賃房產建設與前四年的活躍公寓建設速度持平。預計 2021 年美國將連續第五年開放超過 33 萬套新租賃住宅。

美國壁紙市場趨勢

美國住宅建設活動復甦提振市場

- 住宅建築佔據牆面裝飾市場的大部分,預計將繼續大幅成長。就業機會和人口成長是新住宅需求增加的主要驅動力,因為美國人口的持續成長正在增加對包括公寓在內的所有類型住宅的需求。

- 美國人口普查局和美國住房與城市發展部聯合發布了 2022 年 4 月住宅建設統計數據:181.9 萬份建築許可,172.4 萬套住宅開工,129 萬套住宅竣工(5,000 套)。

- 根據美國人口普查局統計,美國新建商業建築價值在2008年經濟大衰退期間大幅下降,現已反彈至經濟衰退前水平,2021年將達到910.3億美元。到 2022 年,美國開工將達到 1,350 億美元。此外,在美國開始的最常見的商業建築類型是私人辦公室。私人辦公室、倉庫以及購物和零售設施在未來幾年可能仍然具有吸引力。

壁紙產品的技術創新推動市場成長

- 市場上的壁紙行業正在不斷創新,例如用不織布背襯取代 Osnerberg 並減輕重量。此外,其他特性的結合,如消除黴菌限制的透氣織物,正在顯著推動商業和住宅領域壁紙市場的成長。

- 此外,壁紙技術的進步可能會使這些材料更容易塗抹和去除,從而增加銷售機會。因此,到 2022 年,隨著建築工程和住宅維修的可能性在住宅和非住宅市場變得更具吸引力,對壁紙的需求可能會增加。

- 生活水準的提高、可支配收入的增加導致人們渴望擁有更好的生活和工作空間,而實現這一目標的一部分就是讓大腦更積極地思考。

- 美國許多公司正在投資生產環保且有吸引力的壁紙。此外,許多公司正在利用併購等新方式來維持和擴大市場佔有率。例如,2021年5月,塗料公司F.Backdrop被Schumacher & Company收購。此次收購將使該公司能夠透過在其產品線中添加優質壁材來擴大市場佔有率。

美國壁材產業概況

美國壁紙市場競爭適中,由多家大公司組成。從市場佔有率來看,目前少數大公司佔據市場主導地位。憑藉主導的市場佔有率,這些領先公司正專注於擴大不同國家的基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。此外,在這個市場上營運的公司正在收購從事牆面覆層技術的新興企業,以增強其產品能力。

- 2022 年 6 月 - Crossbill 推出 Classic Groove陶瓷瓷磚系列,具有漩渦表面和柔和、精緻的光澤。最終產品是一系列美觀增強的暖色和冷色中性瓷磚,並帶有各種裝飾元素。

- 2021 年 8 月 - 位於南達科他州蘇福爾斯的 Furniture Mart USA 破土動工,擴建其公司總部和分銷地點,面積達 300,000 平方英尺。這座佔地650,000 平方英尺的工廠將容納1,200 名員工,並將成為北達科他州、南達科他州、明尼蘇達州、威斯康辛州、伊利諾伊州和愛荷華州的Furniture Mart、Ashley HomeStore 和Unclaimed 商店的所在地。,為貨運家具商店提供產品。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 住宅建設活動復甦

- 由於意識增強,牆板銷售復甦

- 對數位印刷解決方案的需求增加

- 不織布和紙質壁紙的成長

- 市場限制因素

- 與塗料領域競爭激烈

- 近期宏觀環境變化預計將影響消費者消費

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 壁紙及壁紙進出口分析

- 美國壁紙和其他主要替代品的客戶消費趨勢

- COVID-19 對壁紙產業的影響

- 主要產品創新

- 生態友善壁紙

- 木板印刷

- 數位印刷的進步

- 吸光壁紙

第5章市場區隔

- 按類型

- 牆板

- 瓦

- 金屬牆

- 壁紙

- 乙烯基塑膠

- 不織布壁紙

- 紙壁紙

- 布藝壁紙

- 其他壁紙

- 按用途

- 住宅

- 商業的

- 按最終用戶

- 專賣店

- 家居中心

- 家具店

- 量販店

- 電子商務

- 其他最終用戶

第6章 競爭狀況

- 公司簡介

- Brewster Home Fashion

- Benjamin Moore & Co.

- York Wall Coverings

- F. Schumacher

- Crossville Inc.

- Georgia-Pacific

- Mohawk Industries Inc.

- Ahlstrom-Munksjo Oyj

- Johns Manville Corporation

- Rust-Oleum Coproration

- Sherwin-Williams Company

- The Valspar Company

- Koroseal Wall Protection

- Len-Tex Corporation

- Wallquest Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The United States Wall Coverings Market is expected to register a CAGR of 3.41% during the forecast period.

Key Highlights

- The expansion of the wall coverings market is driven by rising standards of living, the desire for a luxurious existence, and household customization due to increased disposable income. Furthermore, advancements in innovation and better-quality items, such as bespoke 3D walls printed with ink-jet printing technology, have enticed high-income consumers to purchase wall coverings.

- Most wall covering products are simple to maintain and long-lasting, projected to increase customer demand. As a result of the expanding population and urbanization, investments in infrastructure activities are likely to promote the growth of the wall coverings market throughout the forecast period.

- Paint is considered a better alternative, as compared to wall coverings in specific uses. Furthermore, removing existing wallpaper can be a tiresome task that needs the right tools to be efficient. Stripping wallpaper can be achieved with chemicals or stripping tools, but care must be taken, or the wall can be damage.

- According to Dodge Construction Network, the value of commercial and multifamily construction starts in the top 20 metropolitan regions of the United States climbed 18% from 2020 to 2021. Nationally, commercial and multifamily construction in the United States rose by 16% in 2021. Commercial and multifamily starts increased 18% in the top half (the top ten metro areas) in 2021, with two metro areas, Washington, DC, and Los Angeles, CA, reporting declines.

- The New constructions in this region increase an opportunity for the Wall coverings market suppliers. For instance, According to BEA, The construction sector in the United States is one of the world's largest, with private spending continuing to rise year after year and around 8 million people employed. By 2023, new construction is estimated to be worth USD 1,449 billion.

- During the Pandemic, new home development was further hampered by the closure of government agencies that provided permits and disruptions in the supply chain for construction supplies. which also affected the Wall Coverings Market in the United States.

- Despite the Pandemic, there is some good news for renters in 2021: According to a recent survey from RentCafe, rental property construction has stayed at almost the same rate as in the preceding four active years of apartment construction. For the fifth year in a row, over 330,000 new rental units are scheduled to open across the United States in 2021.

US Wall Coverings Market Trends

Rebounding Residential Construction Activity in the United States is Boosting the Market

- Residential constructions account for a significant portion of the wallcovering market and are expected to increase considerably. Employment opportunities and population expansion are substantial drivers of the rising demand for new housing since sustained population growth in the United States has raised the demand for all types of housing, including apartments.

- The United States Census Bureau and the United States Department of Housing and Urban Development jointly released the following new residential building statistics for April 2022: 1,819,000 building permits issued, 1,724,000 housing starts, and 1,295,000 housing completions.

- According to US Census Bureau, after a considerable decline during the 2008 Great recession, the value of the new commercial building in the United States has recovered to pre-recession levels, hitting 91.03 billion USD in 2021. In 2022, the value of construction starts in the United States reached USD 135 billion. Moreover, the most popular forms of commercial construction started in the United States were private offices. Private offices, warehouses, and shopping/retail facilities will maintain their attractiveness in the coming years.

Incremental Innovation in Wallpaper Products Drives Market Growth

- The wallpaper segment of the market is seeing a constant innovation, such as the replacement of Osnaburg with non-woven backing and lightweight. Besides, the incorporation of other characteristics, like breathable fabrics that eliminates the limitations of molds, is considerably promoting the growth of the wall-coverings market in both commercial and residential sectors.

- Furthermore, advancements in wallpaper technology will improve sales opportunities by making these materials easier to apply and remove. Therefore, through 2022, the more attractive possibilities for building construction in residential & non-residential markets and home improvements will enhance wallpaper demand.

- Rising standard of living, Increased disposable income lead to a desire for a better outlook on living and working spaces, and part of achieving that is conditioning one's brain to think more positively, which they may do the surrounding themselves with the wallpapers that make them happy.

- Many companies in the United States are investing in producing environmentally friendly and attractive wallpapers. In addition, numerous corporations are using additional techniques to retain or expand market shares, such as mergers and acquisitions. In May 2021, for instance, F. The Backdrop paint company was purchased by Schumacher & Co. This acquisition allows the company to increase its market share by adding Premium wall coverings to its product line.

US Wall Coverings Industry Overview

The United States Wall Covering Market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players, with a prominent share in the market, are focusing on expanding their customer base across different countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups working on Wall Covering technologies to strengthen their product capabilities.

- June 2022 - Crossville launches the classic grooves porcelain tile collection with swirling surface glints and glows with a soft, sophisticated sheen. The ultimate product is a collection of aesthetically improved warm and cool neutral tiles accented by various decorative elements.

- August 2021 - The Furniture Mart USA from Sioux Falls, South Dakota, broke ground on a 300,000-square-foot expansion of its headquarters and distribution hub. The 650,000-square-foot plant will serve as a hub for the company's 1,200 employees and offer the product for its Furniture Mart, Ashley HomeStore, and Unclaimed Freight Furniture stores in North Dakota, South Dakota, Minnesota, Wisconsin, Illinois, and Iowa after it is done.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rebounding Residential Construction Activity

- 4.3.2 Recovery in Wall Panel Sales Aided by Higher Awareness

- 4.3.3 Increasing Demand for Digitally Printed Solutions

- 4.3.4 Growth in Non-woven and Paper-based Wallpapers

- 4.4 Market Restraints

- 4.4.1 Strong Competition from the Paints Segment

- 4.4.2 Recent Changes in Macro-environment Expected to Impact Customer Spending

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Import-Export Analysis for Wallcoverings and Wallpapers

- 4.8 Customer Spending Trends on Wallcoverings and Other Key Alternatives in the United States

- 4.9 Impact of COVID-19 on the Wallcoverings Industry

- 4.10 Key Product Innovations

- 4.10.1 Eco-Friendly Wallcoverings

- 4.10.2 Plank Prints

- 4.10.3 Digital Printing advancements

- 4.10.4 Light Absorbing Wallcoverings

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wall Panel

- 5.1.2 Tiles

- 5.1.3 Metal Wall

- 5.1.4 Wallpaper

- 5.1.4.1 Vinyl

- 5.1.4.2 Non-woven Wallpaper

- 5.1.4.3 Paper-based Wallpaper

- 5.1.4.4 Fabric Wallpapers

- 5.1.4.5 Other Wallpaper Types

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By End User

- 5.3.1 Specialty Store

- 5.3.2 Home Center

- 5.3.3 Furniture Store

- 5.3.4 Mass Merchandizer

- 5.3.5 E-commerce

- 5.3.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Brewster Home Fashion

- 6.1.2 Benjamin Moore & Co.

- 6.1.3 York Wall Coverings

- 6.1.4 F. Schumacher

- 6.1.5 Crossville Inc.

- 6.1.6 Georgia-Pacific

- 6.1.7 Mohawk Industries Inc.

- 6.1.8 Ahlstrom-Munksjo Oyj

- 6.1.9 Johns Manville Corporation

- 6.1.10 Rust-Oleum Coproration

- 6.1.11 Sherwin-Williams Company

- 6.1.12 The Valspar Company

- 6.1.13 Koroseal Wall Protection

- 6.1.14 Len-Tex Corporation

- 6.1.15 Wallquest Inc.