|

市場調查報告書

商品編碼

1635431

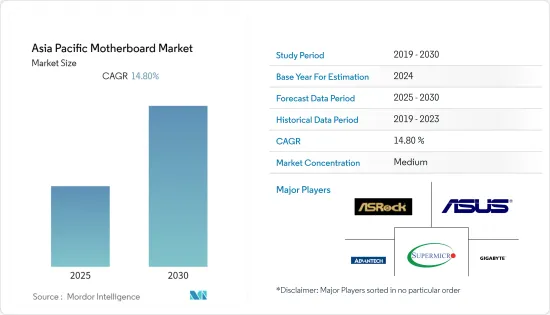

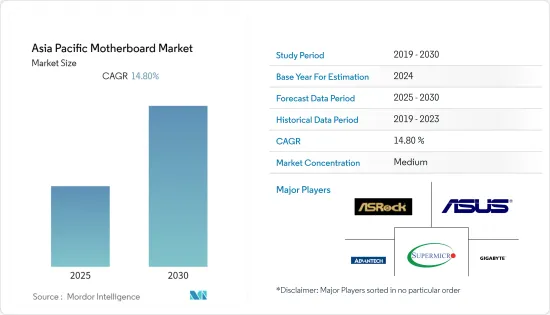

亞太主機板市場:佔有率分析、產業趨勢、成長預測(2025-2030)Asia Pacific Motherboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

亞太主機板市場預計在預測期內複合年成長率為 14.8%

主要亮點

- 預計亞太地區市場在預測期內將顯著成長。智慧型手機普及率的提高使亞太地區成為全球最大的行動市場之一。這是由於人口成長和都市化進程加快。據 GSM 協會稱,到 2025 年,超過五分之四的連接可能是智慧型手機。這一趨勢預計將增加該地區主機板的使用量。

- 由於其快速成長,物聯網技術在各行業的採用不斷增加,促使主機板製造商進行創新並引入多種變革來滿足客戶需求。從智慧型手機和健身追蹤器到智慧型工廠設備,行動裝置的空間管理至關重要。該地區的製造商正在專注於小型化,以便在有限的空間中安裝更多的硬體。

- 此外,印度等國家正成為電子製造的熱點,政府的各種舉措導致主機板市場顯著成長。根據行動裝置產業機構 ICEA 的最新報告,2021 年至 2026 年間,印度可能出口價值高達 1,090 億美元的主機板(技術上稱為印刷基板組件 (PCBA))。此外,根據IT硬體製造商協會MAIT於2021年2月發布的最新報告,預計到2025-26年,印度國內對電子主機板的需求將成長六倍以上,達到815億美元。

- 然而,半導體短缺正在對主機板生產產生負面影響。由於技術先進,主機板的成本也在上漲。因此,所研究的市場具有高度的投入分化。

- 此外,COVID-19 大流行的蔓延使製造流程變得複雜,因為許多製造商必須適應敏感工作流程中產品組裝、原型開發和風險評估的變化。然而,醫療用電子設備、國防/政府電子和航太電子等產業受到的影響較小,因為它們對中國主機板供應的依賴程度較低。總體而言,預計市場在預測期內將顯著成長。

亞太主機板市場趨勢

中國可望獲得較大市場佔有率

中國是亞太主機板市場的主要國家之一,佔總市佔率的一半以上。智慧型手機設備市場的擴張是推動所研究市場成長的最重要因素之一。根據 GSMA 2021 報告,到 2025 年,中國 47% 的連線可能是 5G,到 2020 年將有 12.2 億人訂閱行動服務。此外,根據GSMA預測,到2025年,中國5G連線數預計將達到4.6億。

- 此外,工業 4.0 預計也將推動該地區研究市場的成長。該國在工業4.0方面正在取得進展。營運工廠、倉庫、港口和城市交通的5G網路可以將生產力提高10倍以上。僅通訊巨頭華為一家就正在為約 2,000 家中國製造企業和 5,300 家中國礦業公司建立 5G 應用程式。所有這些預計將推動該主機板在該國的採用。

- 此外,為了應對日益激烈的競爭,中國主機板廠商正在採取各種策略。除了加強行銷之外,我們也透過通路體系採取捆綁策略。最常見的方法是捆綁顯示卡,有的廠商同時捆綁顯示卡和記憶體。

- 此外,台灣也是一些最著名的主機板製造商在市場上推出新產品的所在地。例如,2021年10月,華擎推出了搭載Intel Z690晶片組的新系列主機板。這是全新的LGA1700插槽平台,支援最新的第12代英特爾酷睿處理器,為PCI Express 5.0和DDR5高速記憶體開啟無限可能。

- 此外,總部位於台灣的精英電腦系統公司等公司每月擁有生產超過 250 萬塊主機板的製造能力。這些因素使得台灣成為主機板市場的熱點。

亞太地區圖形外掛板市場動態

- 由於線上遊戲/i-game的日益普及以及對筆記型電腦和平板電腦作為遊戲平台的需求激增,預計市場在預測期內將出現溫和成長。

- 由於圖形附加板 (AIB) 在超級電腦、遠端工作站和模擬器中的使用,對圖形附加板 (AIB) 的需求不斷增加。超級電腦和遠端工作站用於國防、航太以及研發等科技應用。隨著許多國家增加對科學研究的投資,圖形 AIB 市場在預測期內可能會呈指數級成長。根據Top500的數據,2021年工業和研究超級電腦的滲透率分別為53%和20.4%,而2020年則為57.6%和19%。

- 此外,市場是由執行 3D 渲染和視訊編輯等複雜任務的用戶驅動的。 AutoCAD 和 Adobe Premiere Pro 等高階用途可使用圖形 AIB 來加快處理速度,從而實現更快、更有效率的工作流程。此外,個人電腦對記憶體顯示卡的需求不斷增加,以及對高解析度平板電腦的需求激增,進一步推動了市場的成長。

- 智慧型手機、平板電腦和筆記型電腦正在取代個人電腦市場。因此,智慧型手機、平板電腦和筆記型電腦上遊戲服務的需求不斷增加。因此,對個人電腦等基於顯示器的設備上的遊戲服務的需求預計將下降。因此,對主要用於桌上型電腦的圖形 AIB 的需求預計將減少。因此,所有因素預計都將推動市場上主機板供應商的成長機會。

亞太主機板產業概況

由於華碩電腦公司、技嘉科技公司和華擎公司等主要廠商的存在,主機板市場競爭對手之間的競爭並不激烈。這些公司由於能夠不斷創新其服務產品而在市場上獲得競爭優勢。透過研發活動和併購,這些公司正在擴大其市場佔有率。

- 2021年10月,華碩IoT發表了新產品N51051I-IM-A,主要針對Intel Celeron N5105四核心處理器設計。該產品在緊湊的電路板上提供大量 I/O 連接埠、先進的連接性和靈活的客製化功能,使其成為空間受限安裝的良好選擇。

- 2022 年 5 月:MSI 宣布推出專為 AMD Ryzen 7,000 處理器設計的 AM5 主機板。不過,即將商用的是商務導向的MEG X670E Ace和Pro X670-P WIFI主機板。這種市場發展為受調查的交易廠商帶來了各種商機。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章 市場促進因素

- 人們越來越關注電子產品的小型化

- 連網型設備、智慧型設備和其他電子產品在亞太地區的滲透率不斷擴大

第6章 市場問題

- 導致替代產品形成的技術進步與發展

第7章圖形外掛板市場趨勢亞太地區圖形外掛板市場動態(以金額為準、基於數量)

第8章市場區隔

- 依外形規格(有定性分析)

- ATX

- 微型ATX

- 迷你ITX

- 按模型類型(計劃提供定性和定量分析)

- 工業的

- 商業的

- 按地區

- 中國

- 印度

- 日本

- 其他亞太地區

第9章 亞太市場各類主機板價格分析

第 10 章 亞太地區為 AIB 合作夥伴供貨的離散 GPU 供應商的市場佔有率

第11章 亞太地區主機板廠商市場佔有率

第12章競爭格局

- 公司簡介

- ASUSTeK Computer Inc.

- Gigabyte Technology Co.

- ASRock Inc.

- Super Micro Computer Inc.

- Advantech Co. Ltd

- Biostar Inc.

- MSI Computer Corporation

第13章投資分析

第14章市場機會與未來趨勢

The Asia Pacific Motherboard Market is expected to register a CAGR of 14.8% during the forecast period.

Key Highlights

- The Asia-Pacific region is expected to exhibit significant growth in the market during the forecast period. The increasing smartphone adoption rates have made Asia-Pacific one of the largest mobile markets globally. This is due to increasing population growth and urbanization. As per the GSM Association, more than four out of five connections may be smartphones by 2025. This trend is expected to increase motherboard usage in this region.

- The deployment of IoT technologies across various industries is increasing because of their rapid growth and encouraging motherboard manufacturers to innovate and introduce multiple changes to meet their clients' demands. From smartphones and fitness trackers to smart factory equipment, managing space on mobile devices is of high importance. Manufacturers in the region are focusing on miniaturization to place more hardware within limited space.

- Moreover, countries such as India are becoming a hotspot for electronics device manufacturing with the various initiative from the government paving significant growth for the motherboard market. According to the latest report by mobile devices industry body ICEA, India can export motherboards, technically called printed circuit board assembly(PCBA), worth up to USD 109 billion between 2021-26. Additionally, according to the latest report released on February 2021 by IT hardware makers body MAIT, domestic demand for electronic motherboards is expected to grow by over six-fold to USD 81.5 billion by 2025-26 in India.

- However, the shortage of semiconductors has negatively impacted the production of motherboards. In addition, the cost of a motherboard is also increasing with advanced technologies. Therefore the degree of input differentiation is witnessed to be high in the market studied.

- Further, the spread of COVID-19 pandemic complicated the manufacturing process as many of the manufacturers had to adapt to changes for product assembly, prototype development, and risk assessment in sensitive workflows. However, industries like medical electronics, defense/government electronics, and aerospace electronics were less affected as the industries were hardly dependent on china for the supply of motherboards. Overall the market is set to witness huge growth dusring the forecast period.

APAC Motherboard Market Trends

China is expected to acquire a significant market share

China is one of the prominent countries in the Asian-Pacific region for the motherboard market, accounting for more than half of the total market share. The increasing market for smartphone devices is one of the most significant factors driving the studied market's growth. According to GSMA 2021 report, 47% of connections in China may be in 5G by 2025, and 1.22 billion people subscribed to mobile services in 2020. In addition, according to GSMA the number of forecasted connections in China for 5G is expected to reach 460 million by 2025.

- Furthermore, industry 4.0 is also expected to drive the studied market growth in the region. The country is making advanced strides in industry 4.0. 5G networks that run factories, warehouses, ports, and urban transportation can increase productivity tenfold or more. Telecom giant Huawei alone builds 5G applications for almost 2,000 Chinese manufacturing firms and 5,300 Chinese miners. All these are expected to drive motherboard adoption in the country.

- Moreover, in order to meet intensifying competition, motherboard makers in China have adopted various strategies. In addition to bolstering marketing, they have been using bundling strategies through their channel systems. The most prevalent method is to bundle graphics cards, while some players have bundled both graphics cards and memory.

- Furthermore, Taiwan is home to some of the most prominent motherboard manufacturers launching new products in the market. For instance, in October 2021, ASRock launched a new range of motherboards featuring Intel Z690 chipset, a brand new LGA1700 socket platform to pair with the latest 12th Generation Intel Core Processors, opening endless possibilities with PCI Express 5.0 and DDR5 high-speed memory.

- Moreover, the company such as Elitegroup computer systems Co. Ltd, headquartered in Taiwan, has a manufacturing capacity to produce over 2.5 million motherboards every month. All these make the country a hotspot for the motherboard market.

Market Dynamics for Graphic Add-in-Board Market in Asia-Pacific Region

- With the growing popularity of online gaming/i-gaming and spur in demand for laptops and tablet PCs, as a gaming platform, the market is expected to witness moderate growth during the forecast period.

- The demand for graphic add-in boards (AIB) has risen because of their use in supercomputers, remote workstations, and simulators. Supercomputers and remote workstations are used in scientific and technical applications such as defense, aerospace, and research and development. As many countries increase their investment in scientific research, the market for graphic AIB is likely to expand exponentially during the forecast period. According to Top500 the distribution of supercomputers in 2021 for industry and research accounted to 53% and 20.4% compared to 57.6% and 19% respectively in 2020.

- Moreover, the market is driven by users who perform complex tasks like 3D rendering and video editing. High-end applications like AutoCAD and Adobe Premiere Pro can use Graphics AIB to speed up processing and make for faster and more efficient workflows. Moreover, the growing demand for memory graphics cards in PCs and spur in demand for high-resolution tablets further boost the market growth.

- Smartphones, tablets, and laptops are increasingly replacing the market for personal computers. Hence, gaming service in smartphones, tablets, and laptops is in growing demand. This is expected to reduce the demand for gaming services in monitor-based devices such as personal computers. Hence, this is expected to reduce the demand for graphics AIB, mostly used in desktop computers. thus all the factors is expected to drive growth opportunites for the Motherboard vendors in the market.

APAC Motherboard Industry Overview

The competitive rivalry in the motherboard market is moderate owing to the presence of some major players such as ASUSTeKComputer Inc., Gigabyte Technology Co.,ASRock Inc., others. Their ability to continually innovate their offerings has enabled them to gain a competitive advantage over other players in the market. Through research & development activities, mergers & acquisitions these players have been able to expand their market footprint.

- October 2021: ASUS IoT announced its new product, N51051I-IM-A, a mini-ITX industrial motherboard primarily designed for the Intel Celeron N5105 quad-core processor. The product offers numerous I/O ports, advanced connectivity, and flexible customization in a compact board, becoming a well-suited choice for space-restricted installations

- May 2022: MSI announced AM5 motherboards designed for AMD's Ryzen 7000 processors that are expected to also launch in 2022. However, the one commercialized is MEG X670E Ace and Pro X670-P WIFI motherboards that are business oriented. Such developments in the market are driving various opportunities for the vendors studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 Market Drivers

- 5.1 Increasing Focus on Miniaturization of Electronics

- 5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region

6 Market Challenges

- 6.1 Advancements and Developments in Technologies Leading to Formation of Substitutes

7 Market Dynamics for Graphic Add-in-Board Market in Asia-Pacific Region ( in Value and Volume)

8 MARKET SEGMENTATION

- 8.1 By Form Factor (Qualitative Analysis to be provided)

- 8.1.1 ATX

- 8.1.2 Micro-ATX

- 8.1.3 Mini ITX

- 8.2 By Type of Model ( Both Qualitative and Quantitative Analysis to be provided)

- 8.2.1 Industrial

- 8.2.2 Commercial

- 8.3 Geography

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Rest of Asia-Pacific

9 PRICING ANALYSIS of different MOTHERBOARD offered in Asia-Pacific MARKET

10 Vendor market shares of Discrete GPU vendors supplying to AIB partners in Asia-Pacific region

11 Vendor market shares of Motherboard Manufacturer in Asia-Pacific region

12 COMPETITIVE LANDSCAPE

- 12.1 Company Profiles

- 12.1.1 ASUSTeK Computer Inc.

- 12.1.2 Gigabyte Technology Co.

- 12.1.3 ASRock Inc.

- 12.1.4 Super Micro Computer Inc.

- 12.1.5 Advantech Co. Ltd

- 12.1.6 Biostar Inc.

- 12.1.7 MSI Computer Corporation