|

市場調查報告書

商品編碼

1635441

世界鍋爐 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Global Boiler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

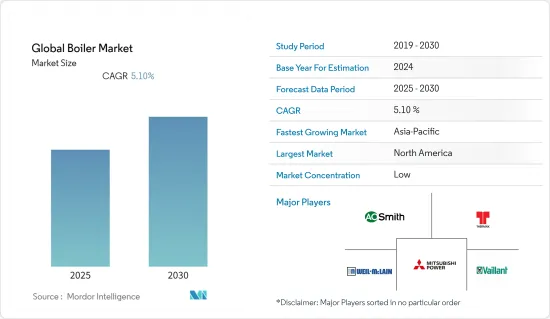

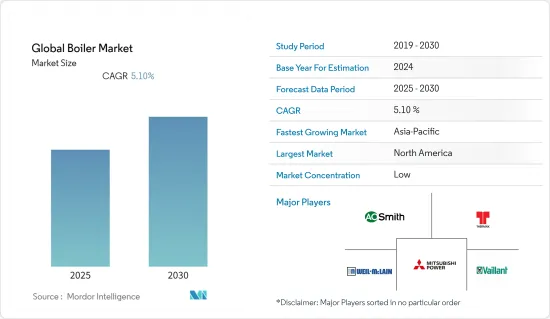

預計全球鍋爐市場在預測期內複合年成長率為 5.1%

主要亮點

- 食品加工業的擴張將提振鍋爐市場。多項政府措施也支持每個地區的市場擴張。例如,印度政府向中小型食品加工企業提供稅收優惠,鼓勵其創辦和擴展業務。

- 中國、印度等新興國家正加大對石化等各產業的投資,拉動鍋爐需求。據化學和石化工業協會稱,對節能系統的需求不斷增加預計將進一步擴大市場並補充業務成長。截至 2021 年,印度石油公司位於奧裡薩邦 Paradeep 的石化計劃投資額接近 270 萬美元。

- COVID-19 的疫情對全球鍋爐市場產生了負面影響。這是由於製造業活動暫停、住宅建設和維護活動暫停、物流服務暫停以及消費者更換舊暖氣系統支出減少。工業和商業業務的急劇下滑正在對全球鍋爐市場的成長產生負面影響

- 阻礙鍋爐市場成長的因素之一是政府機構實施的嚴格排放法規。此外,原物料價格波動和鍋爐安裝成本高似乎也成為市場的限制因素。例如,在印度,根據空氣品質管理委員會 (CAQM) 的規定,工業鍋爐中生質能燃料的使用量不得超過 80mg/Nm3,排放必須限制在 50mg/Nm3。政府機構的此類監管預計將阻礙市場成長。

鍋爐市場趨勢

住宅鍋爐需求佔較大市場佔有率

- 美國、德國、印度和中國房地產行業的強勁成長需求預計將推動住宅領域對鍋爐的需求,而印度、中國和巴西等新興國家的都市化加快和人口快速成長預計將推動住宅領域對鍋爐的需求住宅領域對鍋爐的需求預計將推動鍋爐市場。例如,根據美國人口普查局的數據,美國住宅單元數量將從2017年的1.3657億增加到2021年的1.4195億,預計將帶動鍋爐的需求。

- 對鍋爐產生的熱量和污染的日益擔憂促使一些國家的政府實施嚴格的計劃,以促進綠色建築的建設以及使用綠色住宅鍋爐作為永續供暖推出。

- 例如,英國政府推出了鍋爐升級計畫(BUS)。該計劃使業主能夠經濟有效地擺脫對石化燃料系統的依賴,並轉向更清潔、更有效率的暖氣系統。 BUS 為農村家庭購買和安裝生質能鍋爐提供 5,000 英鎊的折扣。

- 為了生產節能鍋爐,領先的製造商正在專注於開發新的鍋爐塗層技術,這些技術具有快速加熱和耐腐蝕等優點。 AO Smith 是一家著名的水處理和鍋爐製造商,不斷完善其藍鑽玻璃塗層技術,以對抗鍋爐水箱表面沉積物、水垢和殘留物的堆積。這些原因正在刺激全球住宅鍋爐市場的擴張。

- 2020年,美國能源局在規範熱水器製造商和製造商的節能法規方面做得很好。美國能源部表示,住宅鍋爐應作為重要的節能設備進行標準化。從技術上和經濟上來說,所有客戶都應該能夠購買和使用這些鍋爐。美國能源部正在為製造商開發節省能源和成本的創新鍋爐提供額外幫助。

預計亞太地區將佔據主要市場佔有率

- 由於都市化進程加快和可支配收入增加,預計亞太地區將出現強勁成長。永續建築計劃的持續擴張和零排放建築目標的實現將擴大該地區的鍋爐市場。

- 截至 2021 年,火力發電廠和煉油廠數量最多的亞太地區將主導市場。由於該地區的人口成長和都市化,預計預測期內能源和電力需求將會增加。

- 根據BP統計,不包括發電廠,該地區煉油能力佔全球精製能力的近37.3%,預計在預測期內精製能力將持續增加。中國是該地區的大國,2021年將貢獻全球精製能力的18.3%。此外,預計到2023年,該國將佔該地區原油精製能力的44%。預計這將推動所研究市場的需求。

- 根據世界銀行2021年報告,由於電力需求增加以及天然氣、煤炭和碳價格上漲,亞洲能源價格不斷上漲,這是人們更加關注能源管理的關鍵原因。增加輸電和發電容量有助於實現高效率的能源管理。節能工業鍋爐是高效能能源管理的一個很好的例子。

- 大摩拉島煉油石化聯合體年產能1,400萬噸,計畫於2022年運作。此外,揭陽煉油廠也是一座在建煉油廠,很可能在預測期內開始試運行,預計這將增加蒸氣鍋爐的需求。即將到來的電力、石油和氣體純化領域計劃有幾個計劃,預計亞太地區將在預測期內主導市場。

鍋爐業概況

全球鍋爐市場由頂級製造商主導,集中度較高。隨著技術的進步,工業公司尋求透過開發新產品和改進現有產品來增加市場佔有率。

- 2021 年 8 月 - BDR Thermea 集團旗下的 Baxi 在英國第一座氫氣屋展示氫氣鍋爐。蓋茨黑德附近洛索恩利的兩棟住宅將展示動力來源設備的實際使用。八喜邀請住宅提供者親自來看鍋爐。八喜供熱承諾到2025年只開發低碳能源相容產品,這意味著燃氣鍋爐將成為“氫能”,並且可以簡單地轉換為使用氫氣工作。

- 2021年7月 - 川崎熱力工程(KTE)向國際市場推出高效直流式鍋爐「IF系列」和「WILLHEAT系列」。 IF系列」和「WILLHEAT」實現了99%的高效率,實現了顯著的節能效果。 IF系列採用新型高性能節熱器結構,鍋爐效率達99%。 「WILLHEAT」是一種加熱面積在10m2以下的蒸氣鍋爐,也實現了99%的高鍋爐效率,並且現已推出等效蒸發量2,500kg/h和3,000kg/h的新型號。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 預計電力需求將快速成長,推動市場成長

- 市場限制因素

- 對熱泵取代鍋爐的需求不斷成長

第6章 市場細分

- 依鍋爐類型

- 熱水鍋爐

- 燃氣鍋爐

- 蒸氣鍋爐

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Daikin Industries, Ltd.

- AO Smith Corporation

- Mitsubishi Power, Ltd.

- Weil-McLain

- Valliant Group

- Forbes Marshall

- General Electric

- Thermax Limited

- Ariston Thermo SpA

- BDR Thermea Group

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 91838

The Global Boiler Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The expansion of the food processing industry pushes the boiler market forward. Several government initiatives are also driving market expansion in their respective regions. For instance, the Government of India offers tax benefits to small and medium-sized food processing companies to encourage them to establish and grow their operations.

- Rising investments in various industries, such as petrochemical, in developing countries such as China and India drive up demand for boilers. The market is predicted to expand further due to increased demand for energy-efficient systems, which will complement the business growth, According to the Chemicals & Petrochemicals Manufacturers Association. The petrochemical project of Indian Oil Corporation Limited in Paradeep, Odisha, accounted for an investment of nearly USD 2.7 million as of 2021.

- The COVID-19 outbreak has impacted negatively the global boiler market. This is attributed to the halting of manufacturing activities, residential construction & maintenance activities, halt in logistics services, and decreased consumer spending on the replacement of old heating systems and. The sharp decline in the industrial and commercial business is negatively impacting the growth of the global boiler market

- One of the reasons impeding the growth of the boiler market is the rigorous regulation imposed by government agencies on emission limits. Furthermore, fluctuating raw material prices and high installation cost for the boiler appears to be a market restraint. For example, In India According to Commission for Air Quality Management (CAQM), industries cannot use bio-mass fuel over 80mg/Nm3 in boilers, and they should limit emissions to 50mg/Nm3. Such regulation imposed by government agencies will hinder market growth.

Boiler Market Trends

Demand for Residential Boilers to Hold a Major Market Share

- The strong growth demand from the real estate sector in the United States, Germany, India, and China is expected to drive demand for boilers in the residential segment, and Rising urbanization and a rapidly growing population in emerging nations like India, China, and Brazil are expected to drive global boiler market. For instance, According to US Census Bureau, the number of housing units in the united stated increased from 136.57 million in 2017 to 141.95 million in 2021, which is expected to drive demand for boilers

- Rising worries about the heat and pollution produced by boilers have driven governments in several countries to launch severe programs to promote the construction of green buildings and the use of eco-friendly residential boilers as a sustainable heating technology.

- For instance, UK government has launched Boiler Upgrade Scheme (BUS), The plan enables property owners to transition away from their dependency on fossil fuel systems and towards a cleaner, more efficient heating system in a cost-effective manner. The BUS provides GBP 5,000 off the cost and installation of a biomass boiler for rural households.

- To produce energy-efficient boilers, major manufacturers are focused on the development of new technologies for boiler coating that will bring benefits such as rapid heating and corrosion resistance. A.O. Smith, prominent water treatment and boiler manufacturer, is continually improving its blue diamond glass coating technique to combat sediment, scale, and residue buildup on the surface of the boiler tank. These reasons are fueling the expansion of the residential global boiler market.

- The US Department of Energy took a fantastic initiative in 2020 to regulate energy conservation rules and regulations for water heater makers and manufacturers. Residential boilers, according to DOE, should be standardized as important energy-saving devices. Every customer should be able to afford and use these boilers, both technologically and financially. The DOE has provided additional assistance to manufacturers in developing innovative boilers that will save energy and money.

Asia-Pacific Expected to Hold a Major Market Share

- The Asia Pacific is predicted to have significant growth due to growing urbanization and rising disposable income. The continued expansion of sustainable building projects and achieving zero-emission building targets will increase the boiler market in this region.

- Asia-Pacific dominated the market with the highest thermal power plants and refineries as of 2021. With the region's growing population and urbanization, the demand for energy and power is expected to rise during the forecast period.

- Apart from power plants, according to BP Statistics, the region contributes to nearly 37.3% of the global refining capacity and is expected to add to its refining capacity during the forecast period. China is the major country in the region that will contribute 18.3% of the world's oil refining capacity in 2021. Moreover, the country is planning to make up 44% of the crude oil refining capacity in the region in 2023. This is expected to drive the demand for the market studied.

- According to The World Bank report 2021, the increase in electricity demand and the rise in gas, coal, and carbon prices have resulted in climbing energy prices in Asia, which is a primary reason for the growing interest in energy management. Adding extra power transmission or generation capacity might help to achieve efficient energy management. Energy-efficient industrial boilers are a good illustration of efficient energy management.

- Pulau Muara Besar Refinery & Petrochemical Complex with a capacity of 14 million tons per annum is expected to be commissioned in 2022. Furthermore, the Jieyang refinery is another refinery that is under construction and is likely to be commissioned during the forecast period and is expected to increase the demand for steam boilers. With several projects upcoming in power, oil, and gas refining sector, Asia-Pacific is expected to dominate the market in the forecast period.

Boiler Industry Overview

Top manufacturers dominate the Global boiler market, which is highly concentrated. Due to technological improvements, industry players seek to enhance their market share by developing new products and improving existing product lines.

- August 2021 - Baxi, part of the BDR Thermea Group, showcases its hydrogen boiler in the UK's first hydrogen house. Two homes in Low Thornley, near Gateshead, demonstrated the usage of hydrogen-powered equipment in a real-world situation. Baxi has invited housing providers to see their boiler in action. Baxi Heating has vowed to develop exclusively low-carbon energy-compatible products by 2025, which implies that gas boilers will be 'hydrogen-ready' and simply convertible to function with hydrogen.

- July 2021 - Kawasaki Thermal Engineering (KTE) launched high-efficiency type of once-through boilers from the "IF" and "WILLHEAT" series for the international market. The "IF series" and "WILLHEAT" boilers have a 99 percent efficiency rating and significant energy savings. The "IF series" reaches 99 percent boiler efficiency thanks to a newly constructed high-performance economizer. "WILLHEAT," a steam boiler with a heated surface of less than 10m2, also achieves a high boiler efficiency of 99 percent, and models with equivalent evaporation of 2,500 kg/h and 3,000 kg/h are newly offered.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Electricity Demand is Expected to Surge, Fueling the Market Growth.

- 5.2 Market Restraints

- 5.2.1 Growing demand for Heat Pumps as a suitable alternative to Boilers .

6 MARKET SEGMENTATION

- 6.1 By Boiler Type

- 6.1.1 Hot Water Boilers

- 6.1.2 Gas Boiler

- 6.1.3 Steam Water Boilers

- 6.2 End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries, Ltd.

- 7.1.2 A. O. Smith Corporation

- 7.1.3 Mitsubishi Power, Ltd.

- 7.1.4 Weil-McLain

- 7.1.5 Valliant Group

- 7.1.6 Forbes Marshall

- 7.1.7 General Electric

- 7.1.8 Thermax Limited

- 7.1.9 Ariston Thermo SpA

- 7.1.10 BDR Thermea Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219