|

市場調查報告書

商品編碼

1635451

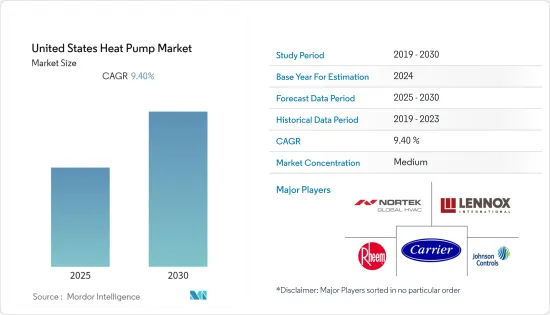

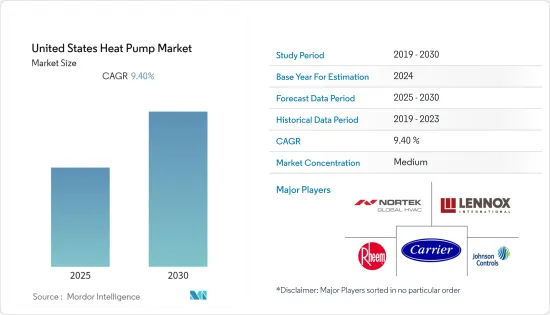

美國熱泵:市場佔有率分析、產業趨勢與成長預測(2025-2030)United States Heat Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

美國熱泵市場預計在預測期內複合年成長率為 9.4%

主要亮點

- 在美國,新的政府法規預計將提高暖通空調設備的能源效率。從 2023 年開始,在美國銷售的所有新住宅中央源熱泵系統預計將滿足新的最低能源效率法規和標準。這些設備類型的最新能源效率最低標準於 2015 年生效。新法規要求所有空氣源熱泵提高其加熱效率。

- 此外,美國環保署 (EPA) 報告稱,透過利用地熱能,住宅可節省高達 70% 的供暖成本和高達 50% 的製冷成本。此類案例預計將支持市場成長。

- 根據國際能源總署(IEA)統計,地源熱泵的年銷量約為40萬台,雖然全球廣泛使用的地源熱泵數量較少,但其中一半以上安裝在美國。量和安裝量增加了一倍多,部分歸功於2018 年至2021 年30% 的聯邦稅額扣抵。

- 此外,熱泵由於其能源效率而受到該地區政府的監管。例如,能源部 (DOE) 發布了風扇能源評級 (FER),為住宅爐風扇設定了最低氣流效率標準。

- 結合FER的新標準,美國能源部表示,到2030年,核心風機新標準將節省約3.99quad的能源,減少碳污染3400萬噸,並美國公民節省超過90億美元的電費。是可能的。根據一項新的州法律,緬因市正在招募安裝人員,以實現未來五年安裝 10 萬台熱泵的目標。

美國熱泵市場趨勢

空氣源熱泵預計將佔據較大市場佔有率

- 空氣源熱泵(ASHP)輸入電力,從周圍空氣中提取熱量,並提供高達 90 攝氏度的熱水。它從周圍空氣中吸收熱量,使周圍區域變得涼爽。因此,對熱水和冷空氣的需求正在推動空氣源熱泵的成長。

- ASHP 有兩種主要類型:空對水和空對空。空氣-水熱泵透過吸收外部空氣的熱量並將其透過風扇系統直接泵入您的家中來加熱房間。同時,空氣源熱泵從室外空氣中吸收熱量,並透過中央暖氣供應系統向室內空間提供熱水加熱、散熱器和地板(或全部三者)。因此,選擇ASHP類型決定了所需的供熱系統類型。

- 這些泵浦已在美國幾乎每個地區使用多年。直到最近,它們還沒有在長期處於零下氣溫的地區使用。然而,近年來,空氣源熱泵技術已經發展到現在可以在寒冷地區提供合法的空間加熱選擇。

- 例如,根據美國能源局和東北部能源效率夥伴關係的數據,如果在東北部和大西洋中部地區更換整個機組,使用空氣源熱泵與電阻加熱器相比,每年可節省結果發現,其能耗約為3,000 千瓦時(或459 美元),而石油系統的能耗為6,200 千瓦時(或948 美元)。如果更換石油(II 仍然存在,但運行頻率較低),平均每年節省電量將接近 3,000 千瓦時(約 300 美元)。此類案例預計將進一步促進市場成長。

- 此外,對空調的需求正在下降,為熱泵供應商創造了機會。例如,根據空調、暖氣與冷氣研究所的數據,2022 年 4 月美國空調出貨量下降 1.6%,至 592,889 台,低於 2021 年 4 月的 602,723 台。

住宅領域預計將佔據很大佔有率

- 對於沒有管道的住宅,還有無管道空氣源熱泵,稱為迷你分離式熱泵。此外,一種特殊類型的空氣源熱泵(稱為逆循環冷卻器)可用於暖氣模式下的輻射地板暖氣系統,因為它產生冷熱水而不是空氣。

- 地源熱泵透過在住宅和地面或附近水源之間轉移熱量來實現更高的效率。儘管地源熱泵的安裝成本較高,但由於地源熱泵利用相對恆定的地面溫度和水溫,因此營業成本較低。其他好處包括減少 30% 至 60% 的能源消耗、控制濕度、堅固可靠以及與各種住宅相容。

- 此外,新型住宅熱泵在國內逐漸流行。這是吸收式熱泵,也稱為燃氣熱泵。吸收式熱泵利用熱作為能源來源,可以由多種熱源提供動力。此外,住宅吸收式熱泵利用氨水吸收循環提供暖氣。

- 此外,美國人口普查局和美國住房與城市發展部聯合宣布,住宅建設正在成長。例如,2022年5月竣工的私人住宅單位數量按年計算為1,465,000套,比4月份修訂後的預測1,343,000套增加9.1%(成長22.6%)。這為市場上的供應商提供了機會。

美國熱泵產業概況

由於 Lennox、大金和開利等主要參與者的存在,熱泵市場競爭對手之間的競爭並不激烈。這些公司由於能夠不斷創新其服務產品而在市場上獲得競爭優勢。透過研發活動和併購,這些公司正在擴大其市場佔有率。

- 2021 年 8 月 - Gradient 透過使用氣候友善製冷劑(可能使用丙烷 (R290))提供全年供暖和製冷,與傳統系統相比,溫室氣體排放量排放75%,宣布開發出家用窗式熱泵,可減少溫室氣體排放

- 2021 年 10 月 - 三菱電機特靈 HVAC 美國推出適用於商業和工業應用的 CO2 (R744) 熱泵熱水器 Heat2O。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

- 產業價值鏈

- 效率技術簡介(僅限受聯邦標準監管的相關設備)

- 低(HSPF:8.0-8.99)

- 高(HSPF:9 或更高)

第5章市場動態

- 市場促進因素

- 更換現有設備,提高性能並恢復熱泵減稅

- 政府加大力度減少碳排放

- 市場問題

- 冷媒使用缺乏監管的前景會給行業參與者帶來不確定性

- 熱泵安裝成本高

第6章 市場細分

- 按類型

- 空氣熱源

- 水熱源

- 地下熱源

- 按最終用戶

- 住宅

- 商業的

- 工業的

第7章 競爭格局

- 公司簡介

- DAIKIN INDUSTRIES LTD

- Carrier GLOBAL corporation(UNITED TECHNOLOGIES corporation)

- RHEEM MANUFACTURING COMPANY

- Trane technologies plc(ingersol-rand plc)

- Johnson Controls International plc

- Nortek AIR MANAGEMENT(Melrose industries plc)

- LENNOX INTERNATONAL INC.

- ROBERT BOSCH GMBH

- EMERSON ELECTRIC CO.

- GE APPLIANCES

- STIEBEL ELTRON GmbH & Co. KG(DE)

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91862

The United States Heat Pump Market is expected to register a CAGR of 9.4% during the forecast period.

Key Highlights

- The introduction of new government regulations, in the United States, is expected to result in increased energy efficiency of HVAC equipment. Starting from 2023, all new residential central air-source heat pump systems sold in the United States are expected to meet new minimum energy efficiency regulations and standards. The latest minimum energy efficiency standards for these equipment types went into effect in 2015. The new regulations require an increase in the heating efficiency of all air-source heat pumps.

- Moreover, the US Environmental Protection Agency (EPA) reported that homeowners could save up to 70% on heating costs and 50% on cooling costs with geothermal. Such instances are likely to boost the market growth.

- According to the International Energy Agency (IEA), these pumps are less common worldwide, as they have an annual sales of around 400,000, in which more than half of the installations are in the United States, where shipments and installations have more than doubled since 2010, partly owing to a 30% federal tax credit available during 2018-21.

- Furthermore, the heat pumps have been regulated by the governments in the region for their energy efficiency. For instance, the Department of Energy (DOE) announced Fan Energy Rating (FER) that sets a minimum airflow efficiency standard for residential furnace fans.

- With the new FER standards, the US DOE predicts that the new standard for furnace fans might save about 3.99 quads of energy, reduce carbon pollution by 34 million metric tons, and save the American citizens more than USD 9 billion electric bills through 2030. According to new state law, the city of Maine seeks installers to help meet the goal of 100,000 heat pumps over the next five years.

US Heat Pump Market Trends

Air Source Heat Pumps are Expected to Hold a Major Market Share

- The air source heat pump (ASHP) takes the electricity input, extracts the heat from ambient air, and gives hot water up to 90 degrees Celsius. Due to the extraction of heat from the ambient air, the ambient gets cooler. Thus, the requirement for both hot water and cold air is driving the growth of air-source heat pumps.

- There are two main types of ASHP, which are air-to-water and air-to-air. An air-to-air heat pump absorbs heat from the outside air and then transfers it directly into houses via a fan system to heat a room. At the same time, air-to-water heat pumps absorb heat from the outside air and then transfer it via the central heating system to provide hot water heating, radiator, or underfloor heating in an indoor space (or all three). Thus, choosing the type of ASHP determines the type of heat distribution system one needs.

- These pumps have been used for many years in nearly all parts of the United States. Until recently, they have not been used in areas that experienced extended periods of subfreezing temperatures. However, in recent years, air-source heat pump technology has advanced to offer a legitimate space heating alternative in colder regions.

- For instance, according to the US Department of Energy, when entire units were replaced in the Northeast and Mid-Atlantic regions, the Northeast Energy Efficiency Partnerships found that the annual savings when using an air-source heat pump were around 3,000 kWh (or USD 459) when compared to electric resistance heaters and 6,200 kWh (or USD 948) when compared to oil systems. When displacing oil (i.e., the oil system remains but operates less frequently), the average annual savings are near 3,000 kWh (or about USD 300). Such instances are likely to augment the market growth further.

- Further, the demand for air conditioners are reducing that is increasing opportuinties for the heat pump vendors. for instance according to Air-conditioning,heating and refrigeration institute the US shipments of air conditioners decreased 1.6% in April 2022 and accounted for 592,889 units, down from 602,723 units shipped in April 2021.

Residential sector is expected to have significant share

- For homes without ducts, air-source heat pumps are also available in a ductless version called a mini-split heat pump. Also, a particular type of air-source heat pump called a reverse cycle chiller generates hot and cold water rather than air, allowing it to be used with radiant floor heating systems in heating mode.

- Geothermal heat pumps achieve higher efficiencies by transferring heat between the house and the ground or a nearby water source. The geothermal heat pump cost more to install, but geothermal heat pumps have low operating costs because they take advantage of relatively constant ground or water temperatures. Moreover, it offers benefits such as it can reduce energy use by 30%-60%, control humidity, are sturdy and reliable, and fit in a wide variety of homes.

- Furthermore, a new heat pump for residential systems is witnessing gradual growth in the country, which is an absorption heat pump, also called a gas-fired heat pump. It uses heat as its energy source and can be driven by a large variety of heat sources. In addition, residential absorption heat pumps use an ammonia-water absorption cycle to provide heating.

- Further, The US Census Bureau and the U.S. Department of Housing and Urban Development jointly announced that the residential building construction is increasing, for instance, in May 2022, privatelyowned housing completions were at the annual rate of 1,465,000 which was 9.1 percent (+-22.6 percent) above the revised April estimate of 1,343,000. Thus driving opportunites for the vendors in the market.

US Heat Pump Industry Overview

The competitive rivalry in the heat pump market is moderately high owing to the presence of some major players such as Lennox, Daikin, Carrier amongst others. Their ability to continually innovate their offerings has enabled them to gain a competitive advantage over other players in the market. Through research & development activities, mergers & acquisitions these players have been able to expand their market footprint.

- August 2021 - Gradient announced to devlop home window heat pump that will be designed toprovide heating and coolin throught the year by making use of climate-friendly refrigerant that can possibly propane (R290) and help reduce greenhouse gas emissions by 75% compared to conventional systems.

- October 2021 - Mitsubishi Electric Trane HVAC US launched CO2 (R744) heat pump water heater, the Heat2O, for commercial and industrial applications as emphasis on decarbonization increased in the country and continious efforts to replace fossil fuel heaters prevails in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain

- 4.5 Thecnology Snapshot on Efficiency (only for relevant equipment which are regulated by Federal Standards)

- 4.5.1 Low (HSPF: 8.0-8.99)

- 4.5.2 High (HSPF: 9 and Above)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement of Existing Equipment with Better Performing Ones and Reinstating of Tax Credits for Heat Pumps

- 5.1.2 Increasing Government Initiatives To Curb Carbon Emission

- 5.2 Market Challenges

- 5.2.1 Lack Of Regulations Related To Refrigerant Usage Is Expected To Create Uncertainties For Industry Participants

- 5.2.2 High Installation Cost Of Heat Pumps

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Air-source

- 6.1.2 Water-source

- 6.1.3 Geothermal (ground) Source

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIKIN INDUSTRIES LTD

- 7.1.2 Carrier GLOBAL corporation (UNITED TECHNOLOGIES corporation)

- 7.1.3 RHEEM MANUFACTURING COMPANY

- 7.1.4 Trane technologies plc (ingersol-rand plc)

- 7.1.5 Johnson Controls International plc

- 7.1.6 Nortek AIR MANAGEMENT (Melrose industries plc) -

- 7.1.7 LENNOX INTERNATONAL INC.

- 7.1.8 ROBERT BOSCH GMBH

- 7.1.9 EMERSON ELECTRIC CO.

- 7.1.10 GE APPLIANCES

- 7.1.11 STIEBEL ELTRON GmbH & Co. KG (DE)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219