|

市場調查報告書

商品編碼

1635498

亞太地區石油與天然氣儲存槽:市場佔有率分析、產業趨勢、統計、成長趨勢預測(2025-2030)Asia-Pacific Oil and Gas Storage Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

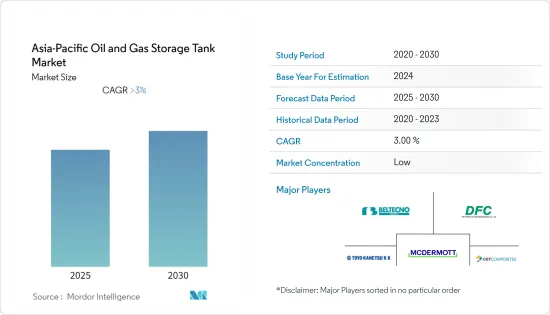

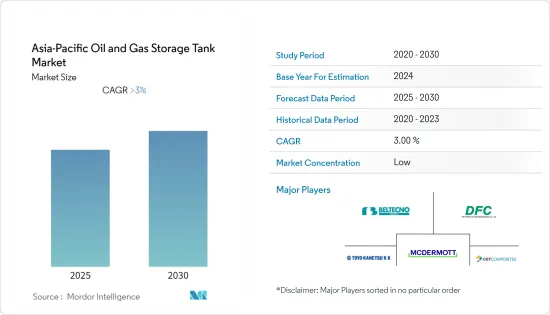

預計亞太地區油氣儲存槽市場在預測期內的複合年成長率將超過3%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,石油產品消費增加和液化天然氣產量增加等因素預計將推動亞太地區油氣儲存槽市場的成長。

- 另一方面,與石油和天然氣儲存槽相關的環境和安全問題可能會在不久的將來阻礙市場的成長。

- 亞洲新興國家住宅和工業發展導致能源需求增加等因素為市場成長提供了許多機會。

- 由於儲存槽製造設施的擴張和液化天然氣的開發,澳洲預計將在石油和天然氣儲存槽市場超過其他亞洲國家。

亞太地區石油和天然氣儲存槽市場趨勢

液化天然氣預計將大幅成長

- 液化天然氣(LNG)是在加工廠液化精製天然氣而獲得的產品。在亞太地區,有六個國家參與液化天然氣出口貿易:澳洲、汶萊、印尼、馬來西亞、巴布亞紐幾內亞和越南。然而,隨著其他亞洲國家也即將推出液化天然氣計劃,該名單預計在未來幾年將擴大。

- 過去十年澳洲液化天然氣出口平均成長15%。根據澳洲氣候、能源、環境和水務部的數據,2021 年液化天然氣出口量為 4,314 PJ。該國預計,隨著即將推出的液化天然氣出口設施計劃,未來幾年液化天然氣產量將達到更高水準。

- 例如,2022年8月,Woodside Energy和Bechtel公司開始建造位於西澳大利亞的Pulte-LNG Train 2計劃。柏克德公司作為該計劃的EPC服務供應商。投產後,液化天然氣年產能可達500萬噸。

- 此外,2021年12月,越南計畫興建液化天然氣出口終端,以增加國內液化天然氣供應。該計劃包括興建一座5萬立方公尺的儲存槽,每年可處理約65萬噸液化天然氣。 JAPEX和ITECO JSC正在參與該計劃的開發計劃,並且有更多的投資者正在加入計劃。

- 隨著這些新興市場的發展,液化天然氣燃料儲存槽市場預計在未來幾年將經歷快速成長。

澳洲可望主導市場

- 澳洲能源領域最近取得了發展,包括天然氣產量的增加和新設備製造設施的建設。該國也預計汽油和柴油等燃料的能源消耗將增加。

- 2021年液化天然氣出口量為1,069.91億立方米,較2016年的394.99億立方米大幅增加。由於該國新提交的液化天然氣計劃,預計這一趨勢將在未來幾年持續下去。

- 2022年4月,澳洲政府宣布計劃在北領地達爾文建造新的液化天然氣出口終端。該計劃已簽署,計劃在該國投資11億美元。除了液化天然氣出口外,該接收站還將擁有氫氣出口設施。

- 該國也正在規劃其他氣體的儲存槽製造設施。 2022 年,總部位於雪梨的 CST Composites 宣布計劃與 Optimum Composite Technologies 合資在澳洲建立新的氫氣儲存槽製造工廠。

- 預計此類發展將使該國在石油和天然氣儲存槽市場上取代其他亞洲國家。

亞太地區油氣儲存槽產業概況

亞太地區油氣儲存槽市場細分為:市場上的主要企業包括(排名不分先後)Mcdermott International Ltd、DFCPressure VesselsManufacturer、CST Composites、Toyo Kanetsu KK 和 Beltecno Corporation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 產品

- 原油

- 液化天然氣(LNG)

- 柴油引擎

- 汽油

- 煤油

- 液化石油氣(LPG)

- 其他

- 材料

- 鋼

- 碳鋼

- 玻璃鋼

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mcdermott International Ltd.

- DFC Pressure Vessel Manufacturer Co Ltd.

- CST Composites

- Toyo Kanetsu KK

- Beltecno Corporation

- Wenzhou Ace Machinery Co Ltd.

- Jiangsu Honggang Industries Co Ltd.

- Yachiyo Industries Co Ltd.

- Ness India Engineers

- Fuelco Australia

第7章 市場機會及未來趨勢

The Asia-Pacific Oil and Gas Storage Tank Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the factors like growing consumption of petroleum products and increased LNG production are expected to facilitate the growth of the oil and gas storage tank market in the Asia-Pacific region.

- On the other hand, the environmental and safety issues associated with the oil and gas storage tanks can hamper the market growth in the near future.

- Nevertheless, factors like growing energy needs with the residential and industrial development in the Asian developing countries place many opportunities for market growth.

- Australia is projected to take over other Asian countries in the oil and gas storage tank market due to the expansion in the storage tank manufacturing facilities and LNG developments.

APAC Oil & Gas Storage Tank Market Trends

LNG Expected to Witness Significant Growth

- Liquefied Natural Gas (LNG) is the product formed by the liquefaction of natural gas that comes after getting processed for purification at the processing plant. The Asia-Pacific region has around six countries involved in the LNG export trade, which includes Australia, Brunei, Indonesia, Malaysia, Papua New Guinea, and Vietnam. But the list is predicted to be stretched in the coming years due to the upcoming LNG projects in other Asian countries.

- In Australia, LNG exports have witnessed an increase of 15% on an average basis in the last decade. In 2021, the country exported around 4314PJ of LNG, as per the Australian Department of Climate, Energy, Environment, and Water. The country is anticipating higher levels of LNG production in the coming years due to the upcoming LNG export facility projects.

- For example, in August 2022, Woodside Energy and Bechtel Corporation kickstarted the construction of the Pluto-LNG train 2 project located in Western Australia. Bechtel was contracted as the EPC services provider for the project. Once operational, the plant may have an LNG production capacity of 5 million tonnes per annum.

- Furthermore, in December 2021, Vietnam planned an LNG export terminal to increase the LNG supply in the country. The project includes the construction of a 50,000 cubic meters storage tank capable of handling around 650,000 metric tonnes of LNG annually. JAPEX and ITECO JSC joined the project development plan, and more investors are yet to be added to the project.

- Owing to such developments, the LNG fuel storage tank market is projected to witness fast-paced growth in the coming years.

Australia Expected to Dominate the Market

- Australia has recently witnessed progressive developments in the energy sector, with an upsurge in the natural gas production levels and new equipment manufacturing facilities. The country has also envisaged an increase in energy consumption of the fuels like gasoline, diesel, etc.

- The LNG export volume in 2021 was recorded as 106,991 million cubic meters, a sharp escalation from 39,499 million cubic meters in 2016. The trend is also anticipated to continue in the coming years due to the country's newly tabled LNG plans.

- In April 2022, the Australian government planned a new LNG export terminal at Darwin, Northern Territory. The project was signed with a planned investment of USD 1.1 billion in the country. Along with LNG export, the terminal is also expected to be equipped with hydrogen export facilities.

- Furthermore, the country plans more storage tank manufacturing facilities for other gases. In 2022, Sydney-based CST Composites announced plans to establish a new hydrogen gas storage tank manufacturing facility in Australia in a joint venture with Optimum Composite Technologies.

- Such developments are predicted to make the country take over other Asian countries in the oil and gas storage tank market.

APAC Oil & Gas Storage Tank Industry Overview

The Asia-Pacific oil and gas storage tank market is fragmented. Some of the key players in the market (in no particular order) include Mcdermott International Ltd, DFC Pressure Vessels Manufacturer Co Ltd, CST Composites, Toyo Kanetsu K.K, and Beltecno Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Crude Oil

- 5.1.2 Liquefied Natural Gas (LNG)

- 5.1.3 Diesel

- 5.1.4 Gasoline

- 5.1.5 Kerosene

- 5.1.6 Liquefied Petroleum Gas (LPG)

- 5.1.7 Other Products

- 5.2 Material

- 5.2.1 Steel

- 5.2.2 Carbon Steel

- 5.2.3 Fiberglass-Reinforced Plastic

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mcdermott International Ltd.

- 6.3.2 DFC Pressure Vessel Manufacturer Co Ltd.

- 6.3.3 CST Composites

- 6.3.4 Toyo Kanetsu K.K

- 6.3.5 Beltecno Corporation

- 6.3.6 Wenzhou Ace Machinery Co Ltd.

- 6.3.7 Jiangsu Honggang Industries Co Ltd.

- 6.3.8 Yachiyo Industries Co Ltd.

- 6.3.9 Ness India Engineers

- 6.3.10 Fuelco Australia