|

市場調查報告書

商品編碼

1635501

南美洲太陽能逆變器:市場佔有率分析、產業趨勢、成長預測(2025-2030)South America Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

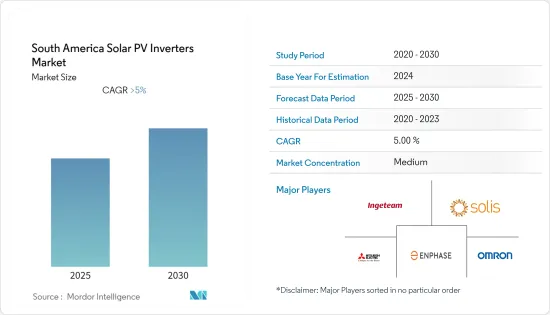

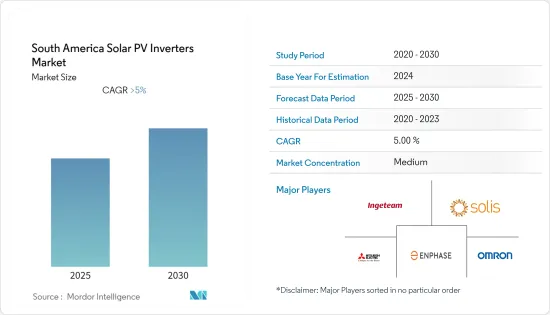

南美洲太陽能逆變器市場預計在預測期內維持5%以上的複合年成長率

2020 年市場受到 COVID-19 的負面影響。目前已達到疫情前水準。

主要亮點

- 從長遠來看,太陽能發電需求的增加預計將刺激太陽能逆變器市場的成長。此外,不斷增加的投資和雄心勃勃的太陽能目標預計將推動所研究市場的成長。

- 另一方面,組串式逆變器的技術缺陷預計將阻礙太陽能逆變器在預測期內的成長。

- 太陽能逆變器的產品創新和最新技術的採用可能會創造利潤豐厚的成長機會。

- 預計巴西將主導市場並在預測期內實現最高的複合年成長率。這一成長是由國家投資增加和政府支持措施推動的。

南美洲太陽能逆變器市場趨勢

公用事業規模領域主導市場

- 隨著南美洲公用事業規模計劃的迅速增加,選擇合適的逆變器對於太陽能發電工程高效產生大量能源變得越來越重要。常用的公用事業規模逆變器包括集中式逆變器和電網規模逆變器。

- 此外,幾十年來,公用事業規模的太陽能一直以穩定的燃料價格生產可靠、綠能。發展公用事業規模的太陽能是減少碳排放最快的方法之一,也是大規模太陽能發電裝置和逆變器的關鍵驅動力之一。

- 根據IRENA預測,南美洲太陽能發電裝置容量將從2020年的1,275萬千瓦增加到2021年的154萬千瓦。

- 智利是該地區最大的太陽能市場之一。巨大的太陽能潛力、容易獲得的土地、強力的政府獎勵和監管以及穩定的政治和經濟商業環境確保了資產和投資的安全,許多外國公司已經進入該國的太陽能產業。

- 2022 年 6 月,希臘工業集團 Mytilineos SA 與智利電力公司 Enel Generacion Chile SA 簽署了一份為期 10 年的購電協議。該公司通過位於阿里卡和帕里納科塔(109兆瓦)、安託法加斯塔(228兆瓦)、阿塔卡馬(165兆瓦)和科金博(86兆瓦)的四家太陽能發電廠(累積容量為588兆瓦)發電,並提供Enel Generacion每年提供高達1.1TWh的太陽能。一個計劃已開始建設,另外三個項目正處於開發後期階段。

- 在其他南美國家中,阿根廷擁有最大的太陽能市場。在官民合作關係(PPP)立法等政府措施以及監管和鼓勵私人投資該國經濟關鍵領域的努力的推動下,該國太陽能產業正在溫和成長。預計將有30多個太陽能發電工程以PPP模式實施,主要涉及能源、交通等重大基礎設施和社會領域計劃。

- 因此,預計該國太陽能市場將由大型公用事業規模發電工程主導,從而在預測期內推動對大型中央逆變器解決方案的需求。 2021年12月,阿根廷電力生產商Genneia SA開始建造80MW Sierras de Ullum太陽能發電廠,價值6,000萬美元。

- 這些發展凸顯了南美洲對公用事業規模太陽能光電解決方案的需求正在迅速成長,預計在預測期內對公用事業規模發電工程的大型中央逆變器的需求也將成長。

巴西主導市場

- 巴西是南美洲最大的太陽能發電市場,也是最大的太陽能逆變器市場之一。據IRENA稱,巴西太陽能發電容量將從2020年的787萬千瓦增加到2021年的1305萬千瓦,幾乎翻倍。 2021年,巴西45%的電力將由再生能源生產,而太陽能發電僅佔總發電量的1.7%。

- 巴西的太陽能產業受到其他再生能源競爭的限制。生質能源、水力發電和風電等替代可再生能源的成長預計將在預測期內嚴重限制太陽能和光伏逆變器的需求。

- 儘管如此,巴西的最新計畫PDEE(Plano Decenal de Expansao de Energia)2027預計到2027年將非水力可再生能源佔發電量的比例提高到28%。此外,由於公用事業發電工程和分散式太陽能發電工程預計將在各種競標中開發,因此在預測期內,對大型中央逆變器的需求預計將保持在較高水準。

- 2022年4月,陽光電源宣布與Comerc Energia集團成員Mercury Renew簽署500MWac光伏逆變器解決方案供應協議。根據該契約,陽光電源將為米納斯吉拉斯州650兆瓦Helio Vargas光伏電站的建設提供500兆瓦容量的SG3125HV-30中央逆變器解決方案。

- 太陽能產業也得到了淨計量等政府措施的支持,該措施允許將多餘的電力賣回電網並從您的帳單中扣除。因此,住宅領域正在快速成長,預計在預測期內,小型太陽能逆變器(包括離網太陽能逆變器)的需求將會很大。預計2020年逆變器出貨量將超過480萬千瓦,大幅超過2019年終的裝置容量(約350萬千瓦)。這主要是由小型分散式發電的成長所推動的。預計這將導致該國住宅領域的需求激增,從而帶動對小型微型逆變器和組串逆變器的需求。

- 巴西也有國內公司參與製造逆變器等太陽能設備。隨著該國建立自己的供應鏈,預計價格將進一步下降,需求將成長。預計國內太陽能製造業的發展將在預測期內及以後為市場提供重大成長機會。

南美洲太陽能逆變器產業概況

南美洲太陽能逆變器市場是細分的。該市場的主要企業包括(排名不分先後)Ingeteam、Ginlong (Solis) Technologies、三菱電機公司、Enphase Energy Inc.和歐姆龍。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 市場促進因素

- 市場限制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按逆變器類型

- 中央逆變器

- 組串式逆變器

- 微型逆變器

- 按用途

- 住宅

- 商業和工業

- 實用規模

- 按地區

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Ingeteam

- Ginlong(Solis)Technologies

- Mitsubishi Electric Corporation

- Enphase Energy Inc.

- Omron Corporation

- Sungrow Power Supply Co. Ltd

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Growatt New Energy Co. Ltd

- Siemens AG

第7章市場機會與未來趨勢

簡介目錄

Product Code: 92907

The South America Solar PV Inverters Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand for solar power is expected to stimulate the growth of the solar PV inverters market. Furthermore, increasing investments and ambitious solar energy targets are expected to drive the growth of the market studied.

- On the other hand, technical drawbacks of string inverters are expected to hamper the growth of solar PV inverters during the forecast period.

- Nevertheless, product innovation and adaptation of the latest technologies in solar PV inverters are likely to create lucrative growth opportunities.

- Brazil is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies in the country.

South America Solar PV Inverters Market Trends

Utility-scale Segment to Dominate the Market

- The number of utility-scale projects across South America is increasing rapidly, and choosing the best inverter is increasingly important to generate a massive amount of energy efficiently for the solar PV project. Some of the commonly used utility-scale inverters are central inverters and grid-scale inverters.

- Furthermore, utility-scale solar has been generating reliable, clean electricity with a stable fuel price for decades. Developing utility-scale solar power is one of the fastest ways to reduce carbon emissions, which is one of the significant drivers for large-scale PV installation and inverters.

- According to IRENA, South America's solar PV capacity increased from 12.75 GW in 2020 to 1.54 GW in 2021.

- Chile is one of the largest solar Energy markets in the region. Due to its high solar photovoltaic potential, easy land availability coupled with extremely supportive government incentives and regulations, and a politically and economically stable business environment allowing asset and investment security has attracted many foreign companies to the country's solar energy sector.

- In June 2022, Greek industrial conglomerate Mytilineos SA signed a 10-year PPA with Chilean utility Enel Generacion Chile SA. The company will generate the power through four of its solar farms located in Arica y Parinacota (109 MW), Antofagasta (228 MW), Atacama (165 MW), and Coquimbo (86 MW), with a cumulative capacity of 588 MWp, and will supply Enel Generacion with up to 1.1 TWh of solar per year. One project has started construction, while the other three are in the advanced stages of development.

- Among the other South American nations, Argentina has the largest solar market. The country's solar sector has been growing at a moderate pace, bolstered by government policies such as the Public-Private Partnership (PPP) law and efforts to regulate and encourage private investments in the critical sectors of the country's economy. More than 30 solar projects, primarily across major infrastructure and social sectors, including energy and transport projects, are expected to be implemented under the PPP model.

- Due to this, the country's solar market is expected to be dominated by larger, utility-scale solar projects, boosting the demand for large central inverter solutions during the forecast period. In December 2021, Argentine power producer Genneia SA started the construction of the 80 MW Sierras de Ullum solar farm worth USD 60 million.

- Such developments highlight the fact that the demand for utility-scale solar PV solutions is growing rapidly in South America, which is expected to be complemented by a similar growth in the demand for larger central inverters for utility-scale solar PV projects during the forecast period.

Brazil to Dominate the Market

- Brazil is the largest solar energy market in the South American region and is also one of the largest solar PV inverter markets. According to IRENA, Brazil's solar PV capacity nearly doubled from 7.87 GW in 2020 to 13.05 GW in 2021. Though 45% of Brazil's electricity was produced from renewables in 2021, solar PV only accounted for 1.7% of the total production.

- The solar sector in the country has been restrained by competition from other renewables. The growth of alternate renewable energy sources such as bioenergy, hydro, and wind is expected to significantly restrain the demand for solar energy and solar PV inverters during the forecast period.

- Despite this, under its latest plan, Plano Decenal de Expansao de Energia (PDEE) 2027, Brazil is expected to increase its non-hydro renewable energy to 28% of its electricity generation mix by 2027. Moreover, utility-scale solar projects and distributed solar generation projects are expected to be rolled out under various auctions, and the demand for large central inverters is expected to remain high during the forecast period.

- In April 2022, Sungrow announced that it had secured a 500 MWac PV inverter solution supply contract with Mercury Renew, part of the Comerc Energia Group. Under the contract, Sungrow is expected to supply 500 MWac capacity SG3125HV-30 central inverter solutions for the construction of the 650 MW Helio Valgas PV plant in Minas Gerais.

- The solar sector has also been bolstered by government initiatives, like net metering, to allow customers to get credits on the bills by selling excess electricity produced to the grid. Due to this, the residential segment has grown rapidly, and smaller solar inverters, including off-grid solar inverters, are expected to see significant demand during the forecast period. It is estimated that inverter shipments in 2020 crossed ~4.8 GW, which is significantly higher than the installed capacity at the end of 2019 (~3.5 GW). This has been primarily driven by the growth in smaller, decentralized power generation. Due to this, the country is expected to see a rapid rise in demand from the residential sector, which is expected to be translated into demand for smaller micro and string inverters.

- Brazil also has domestic companies involved in the manufacture of solar equipment, such as inverters. As the country builds its own supply chain, the price is expected to fall further, and demand is expected to grow. The development of an indigenous solar PV manufacturing industry is expected to be a significant growth opportunity for the market beyond the forecast period.

South America Solar PV Inverters Industry Overview

The South American solar PV inverters market is fragmented. Some of the major players in the market (in no particular order) include Ingeteam, Ginlong (Solis) Technologies, Mitsubishi Electric Corporation, Enphase Energy Inc., and Omron Corporation, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-Scale

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ingeteam

- 6.3.2 Ginlong (Solis) Technologies

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 Enphase Energy Inc.

- 6.3.5 Omron Corporation

- 6.3.6 Sungrow Power Supply Co. Ltd

- 6.3.7 SMA Solar Technology AG

- 6.3.8 SolarEdge Technologies Inc.

- 6.3.9 Growatt New Energy Co. Ltd

- 6.3.10 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219