|

市場調查報告書

商品編碼

1635514

東南亞海上地震探勘:市場佔有率分析、產業趨勢與成長預測(2025-2030)Southeast Asia Offshore Seismic Survey - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

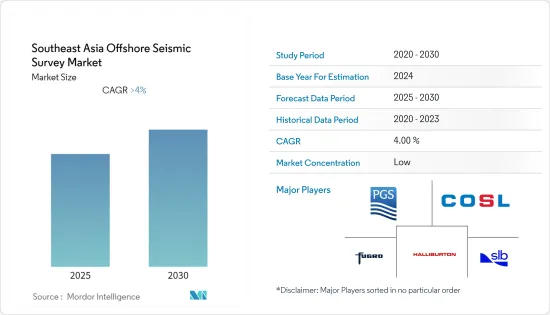

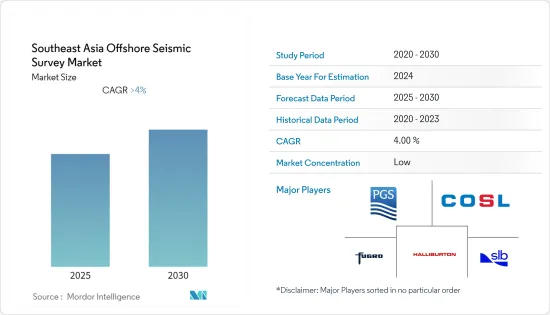

東南亞海上地震探勘市場預計在預測期內將維持4%以上的複合年成長率。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,探勘技術在石油和天然氣探勘中的日益使用以及離岸風力發電投資的增加預計將推動市場成長。

- 另一方面,與地震探勘相關的高成本預計將阻礙預測期內的市場成長。

- 地震探勘技術的不斷進步可能為東南亞海上地震探勘市場提供利潤豐厚的成長機會。

- 預計馬來西亞在預測期內將出現顯著成長和最高的複合年成長率。這一成長得益於投資的增加以及政府的支持措施。

東南亞海上地震探勘市場趨勢

主導市場的資料收集

- 探勘資料收集的目的是取得地球內部沉積盆地的影像。這有助於探勘公司創建模型,以做出更明智的探勘和鑽井決策。

- 2021年,印尼是東南亞最大的石油生產國,日產量為58.5萬桶。同年,馬來西亞成為該地區第二大石油生產國,日產量約508,000桶。

- 資料獲取是透過多客戶調查或獨家調查來完成的。物理探勘公司為擁有資料且通常覆蓋有限英畝的客戶開發專有調查。

- 2022年7月,PGS獲得了兩份3D探勘和4D採集契約,總合宣傳活動約為5個月。特別是,它與一家未透露姓名的石油公司簽署了第一份印尼近海 3D探勘合約。

- 探勘資料可以以 2D 或 3D 形式取得。在2D地震探勘中,震央和接收器沿著地球表面的一條線放置,輸出是地下的線圖表示。當收集大資料區域或 3D探勘在經濟上不可行時,可使用 2D 地震探勘。

- 總體而言,主要來自東南亞離岸風力發電和石油和天然氣行業的海上地震探勘服務需求的增加可能會在預測期內增加海上地震探勘市場。

馬來西亞正在經歷顯著的成長

- 馬來西亞的石油和天然氣產業對該國經濟至關重要,截至 2020 年佔 GDP 的 20%。該國擁有東南亞第二大蘊藏量,也是世界第四大出口國,2021年出口液化天然氣(LNG)351億立方公尺。

- 2021年馬來西亞天然氣產量約630.3億立方公尺。天然氣產量與前一年同期比較增加6.6%。

- 馬來西亞大部分的石油和天然氣產量來自三個產區的海上油田。馬來西亞半島(馬來盆地)、砂勞越和沙巴。此外,為了抵消成熟油田產量的下降,政府計劃透過增加現有油田的產量以及在砂拉越和沙巴近海深水區開發新區塊來開闢新的投資機會。因此,該國對海上地震探勘服務的需求不斷增加。

- 2022 年 3 月,馬來西亞國家石油公司為位於沙巴和砂拉越海上的五個海上區塊簽署了四份新的生產共享合約(PSC)。此外,2021年2月,馬來西亞國家石油公司簽署了五個海上探勘區塊的產品分成合約:位於沙巴海岸的SB412、2W和X,以及位於砂拉越海岸的SK439/SK440。

- 2021 年7 月,TGS ASA、PGS ASA 和斯倫貝謝的WesternGeco 獲得了預資助,用於6,400 平方公里的多客戶端3D 勘測,該勘測將於2021 年10 月在馬來西亞海岸附近的沙撈越盆地開始。該研究是馬來西亞國家石油公司 Petronas 於 2020 年授予的多年期合約的第一階段,該合約將在五年內獲取和處理砂拉越盆地多達 105,000 平方公里的多客戶端 3D資料。

- 總體而言,由於海上石油和天然氣以及離岸風力發電的投資增加,預計馬來西亞對海上探勘服務的需求將中度至高速成長。

東南亞海上地震探勘產業概況

東南亞海上地震探勘市場本質上是適度整合的。該市場的主要企業包括(排名不分先後)哈里伯頓公司、斯倫貝謝有限公司、Fugro NV、PGS ASA 和中海油田服務有限公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按服務

- 資料採集

- 資料處理和解釋

- 按行業分類

- 石油和天然氣

- 風力

- 按地區

- 泰國

- 新加坡

- 印尼

- 馬來西亞

- 其他東南亞地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Halliburton Company

- BGP Inc.

- CGG SA

- Fugro NV

- ION Geophysical Corporation

- PGS ASA

- China Oilfield Services Limited

- SAExploration Holdings Inc.

- Schlumberger Ltd

- TGS NOPEC GEOPHYSICAL COMPANY ASA(TGS ASA)

- Shearwater GeoServices AS

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92952

The Southeast Asia Offshore Seismic Survey Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing use of seismic technology for oil and gas exploration and increasing investments in offshore wind are expected to drive the market's growth.

- On the other hand, the high costs associated with the seismic survey are expected to hamper the market's growth during the forecast period.

- Nevertheless, increasing seismic survey technology advancements will likely create lucrative growth opportunities for the Southeast Asia offshore seismic survey market.

- Malaysia is expected to witness significant growth and the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies, in the country.

Southeast Asia Offshore Seismic Survey Market Trends

Data Acquisition to Dominate the Market

- Seismic data acquisition aims to obtain an image of the sedimentary basins in the earth's interior. It helps create models that facilitate exploration companies to make better-informed exploration and drilling decisions.

- In 2021, Indonesia was the largest oil producer in Southeast Asia, producing 585,000 barrels per day. In the same year, Malaysia produced around 508,000 barrels daily, making it the second-largest oil producer in the region.

- Data is acquired through multi-client surveys or on a proprietary basis. A geophysical company develops proprietary surveys for a client who owns the data and usually covers limited acreage.

- In July 2022, PGS won two contracts for 3D exploration and 4D acquisition, totaling a roughly five-month campaign. In particular, the business signed its first contract for a 3D exploration acquisition offshore Indonesia with an unnamed oil company.

- Seismic data could be acquired for either 2D or 3D imaging. In the 2D seismic acquisition, sources and receivers are deployed along a line on the surface, and the output is a line graphical representation of the subsurface. 2D seismic acquisition is used when collecting large data areas and when a 3D survey is not economically viable.

- Overall, the increasing demand for offshore seismic services from the offshore wind and oil and gas sectors, mainly in Southeast Asia, will likely increase the offshore seismic survey market during the forecast period.

Malaysia to Witness Significant Growth

- Malaysia's oil and gas sector is vital to its economy as it contributes 20% to the GDP as of 2020. The country has the second largest proven reserves in Southeast Asia and is the world's fourth-largest exporter of liquified natural gas (LNG), totaling 35.1 billion cubic meters in 2021, and is strategically located amid important routes for seaborne energy trade.

- In 2021, Malaysia's natural gas production was approximately 63.03 billion cubic meters. Natural gas production has witnessed 6.6% growth compared to the previous year.

- Most of Malaysia's oil and gas production comes from offshore fields in three producing regions: Peninsular Malaysia (Malay Basin), Sarawak, and Sabah. Further, to offset the production declines from mature fields, the government focuses on opening new investment opportunities by enhancing output from existing fields and developing new areas in deepwater offshore Sarawak and Sabah. This has increased the demand for offshore seismic services in the country.

- In March 2022, Petronas signed four new Production Sharing Contracts (PSCs) for five offshore blocks located off the coast of Sabah and Sarawak. Additionally, in February 2021, Petronas signed PSCs for five offshore exploration blocks, SB412, 2W, and X, located off the coast of Sabah, and SK439/SK440, located off the coast of Sarawak.

- In July 2021, TGS ASA, PGS ASA, and Schlumberger's WesternGeco secured pre-funding for a 6,400 square kilometer multi-client 3D survey starting in October 2021 in the Sarawak Basin, offshore Malaysia. The survey is the first phase of a multi-year contract awarded by the Malaysian national oil firm Petronas in 2020 to acquire and process up to 105,000 square kilometers of multi-client 3D data over five years in the Sarawak Basin.

- Overall, Malaysia is expected to witness moderate to high growth in the demand for offshore seismic services, driven by increasing investments in offshore oil and gas and offshore wind power.

Southeast Asia Offshore Seismic Survey Industry Overview

The Southeast Asia offshore seismic survey market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Halliburton Company, Schlumberger Ltd, Fugro NV, PGS ASA, and China Oilfield Services Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 By Sector

- 5.2.1 Oil and Gas

- 5.2.2 Wind

- 5.3 By Geography

- 5.3.1 Thailand

- 5.3.2 Singapore

- 5.3.3 Indonesia

- 5.3.4 Malaysia

- 5.3.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 BGP Inc.

- 6.3.3 CGG SA

- 6.3.4 Fugro NV

- 6.3.5 ION Geophysical Corporation

- 6.3.6 PGS ASA

- 6.3.7 China Oilfield Services Limited

- 6.3.8 SAExploration Holdings Inc.

- 6.3.9 Schlumberger Ltd

- 6.3.10 TGS NOPEC GEOPHYSICAL COMPANY ASA (TGS ASA )

- 6.3.11 Shearwater GeoServices AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219