|

市場調查報告書

商品編碼

1635518

南美洲的電池管理系統:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

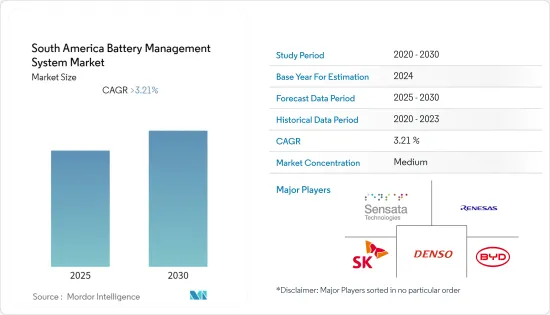

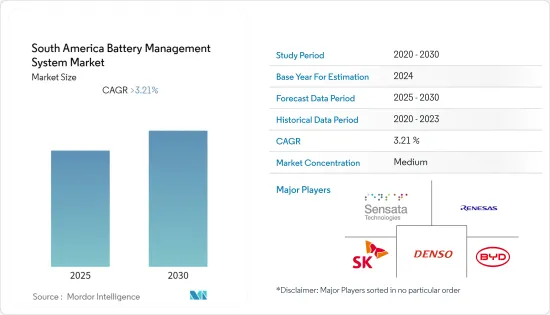

南美洲電池管理系統市場預計在預測期內複合年成長率將超過3.21%。

市場受到 COVID-19 大流行的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,電動車的日益普及、對強大充電基礎設施的需求以及對提高電池能源效率的關注預計將推動所研究市場的成長。

- 另一方面,現成或標準電池管理系統的技術限制是市場的主要限制因素之一。

- 電池管理系統的技術進步具有降低複雜性、提高效率和提高可靠性等優點,預計將在預測期內提供成長機會。

- 巴西在市場上佔據主導地位,並且在預測期內也可能實現最高的複合年成長率。這一成長是由電動車銷量的快速成長和可再生能源發電需求的增加所推動的。

南美洲電池管理系統市場趨勢

交通運輸領域預計將主導市場

- 此前,僅使用內燃機車輛(ICE)。然而,由於人們對環境問題的日益關注,科技正在轉向電動車(EV)。 ICE 領域沒有電池管理系統市場。

- 鋰離子電池由於具有高能量密度、低自放電、重量輕和低維護成本而主要用於電動車。鉛基電池廣泛應用於內燃機汽車,預計在可預見的未來仍將是唯一可大規模生產的電池系統。作為 SLI 應用的鉛酸電池的可大規模生產的替代品,鋰離子電池需要進一步降低成本。

- 鋰離子電池系統為插電混合動力汽車汽車和電動車提供動力。由於鋰離子電池具有高能量密度、快速充電能力和高放電功率,是唯一能夠滿足OEM對車輛續航里程和充電時間要求的可用技術。鉛基動力電池比能量低且重量大,使其在混合動力汽車和電動車中不具競爭力。

- 在拉丁美洲,2021年登記了118,145輛混合動力汽車和電動車,比2020年的57,078輛增加了107.1%。成長最快的細分市場是混合動力汽車,包括插電式混合動力汽車(PHEV)和非插電式混合動力汽車混合動力汽車(HEV),成長110.1%,以及純電動車(BEV),成長57.3%。

- 根據美國國家永續交通協會 (ANDEMOS) 的數據,2021 年哥倫比亞註冊了 17,702 輛電動和混合動力汽車。此外,哥倫比亞政府制定了到 2030 年擁有 60 萬輛電動車的目標,預計該國對電池以及電池管理系統 (BMS) 的需求將會增加。

- 電池管理系統安裝在各種電動車、摩托車、乘用車、輕型商用車、重型商用車上。運輸業以其溫室氣體和二氧化碳排放聞名。此外,燃燒石化燃料對環境的淨影響歷來是汽車製造商的弱點。此外,各國政府也實施了嚴格的法規來減少內燃機造成的污染。因此,幾家主要汽車製造商都專注於開發和製造電動車。

- 因此,由於上述因素,交通運輸領域很可能在預測期內主導電池管理系統市場。

巴西可望主導市場

- 巴西是世界第12大經濟體,2021年規模約1.62兆美元,也是南美洲最大的經濟體。

- 巴西的經濟發展帶動了商業基礎設施的廣泛發展。隨著國家經濟活動的蓬勃發展,資料中心的成長機會也大幅增加,這有望為電池管理系統創造商機。資料中心的電源對於確保連續運作至關重要,這導致在資料中心站點引入電池管理系統。

- 例如,2021年12月,Ascenty在巴西里約熱內盧和霍爾特蘭迪亞開設了兩個新資料中心。該公司最近宣布計劃籌集 9.25 億美元債務,並在該國再建五個資料中心。五個資料中心中的兩個預計將於 2022 年竣工,兩個於 2023 年竣工,一個於 2024 年竣工。因此,即將到來的資料中心可能會在預測期內增加市場研究。

- 此外,電動車銷量的增加也導致對鋰離子電池的需求增加。在預測期內,隨著單位銷售量預計將以更快的速度成長,對電池(尤其是鋰離子電池)的需求預計將增加。

- 根據巴西電動車協會(ABVE)統計,2021年巴西電動車註冊量達34,839輛,與前一年同期比較成長77%。

- Rota 2030計畫旨在提高交通部門的能源效率,對巴西電動車市場產生重大推動作用。電動車採用率的快速成長預計將極大推動預測期內巴西市場的發展。

南美洲電池管理系統產業概況

南美洲電池管理系統市場適度細分。該市場的主要企業包括(排名不分先後)森薩塔科技公司、瑞薩電子公司、SK Innovation、電裝公司和比亞迪。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按用途

- 固定式

- 可攜式的

- 用於運輸

- 按地區

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sensata Technologies Inc.

- Renesas Electronics Corporation

- SK Innovation Co. Ltd

- DENSO Corporation

- BYD Co. Ltd

- Panasonic Corporation

- Bosch Corporation

- Continental Engineering Services

- Intel Corporation

- Saft

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92957

The South America Battery Management System Market is expected to register a CAGR of greater than 3.21% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles, the need for robust charging infrastructure, and the focus on increasing the energy efficiency of batteries are expected to drive the growth of the market studied.

- On the other hand, technological limitations on off-the-shelf battery management systems or standard battery management systems are one of the major restraints for the market.

- Nevertheless, technological advancements in battery management systems with advantages, such as reduced complexity, better efficiency, and improved reliability, among others, are expected to provide growth opportunities in the forecast period.

- Brazil dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in sales of electric vehicles and the growing demand for renewable power generation.

South America Battery Management System Market Trends

Transportation Segment is Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) due to growing environmental concerns. Battery management systems do not have any market in the ICE sector.

- Lithium-ion batteries are primarily used in EVs as they provide high energy density, low self-discharge, less weight, and low maintenance. For ICE vehicles, the lead-based battery is widely used and is expected to continue to be the only viable mass-market battery system for the foreseeable future. Lithium-ion batteries still require higher cost reductions for use in SLI applications to be considered a viable mass-market alternative to lead-based batteries.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Owing to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology capable of meeting OEM requirements for the vehicle's driving range and charging time. The lead-based traction batteries are not competitive for use in total hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- In Latin America, 118,145 hybrid and electric vehicles were registered in 2021, an increase of 107.1% over 2020, when 57,078 units were registered. The fastest-growing segment was hybrid vehicles, including plug-in hybrids (PHEV) and non-plug-in hybrids (HEV), with 110.1% growth, while fully electric vehicles (BEV) grew by 57.3%.

- According to the National Association of Sustainable Mobility (ANDEMOS), in 2021, 17,702 electric cars and hybrid vehicles were registered in Colombia. The Colombian government has also set a target of getting 600,000 EVs on the road by 2030, which is expected to lead to an increase in the demand for batteries in the country and, in turn, increase the demand for battery management systems (BMS).

- The battery management systems are deployed in various electric vehicles, two-wheelers, passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The transportation industry is known for its greenhouse gas and carbon emissions. Furthermore, the net environmental impact of burning fossil fuels has historically been the weak spot for manufacturers of motor vehicles. Moreover, governments implemented stringent regulations to reduce the pollution caused by internal combustion engines. As a result, several large automotive manufacturers focus on moving toward electric vehicle development and manufacturing.

- Hence, based on the factors mentioned above, the transportation segment is likely to dominate the battery management system market during the forecast period.

Brazil is Expected to Dominate the Market

- Brazil is the world's twelfth-largest economy, with a size of about USD 1.62 trillion in 2021, and is the largest economy in South America.

- The economic development in Brazil is leading to the widespread development of commercial infrastructure. As the country's economic activity is booming, it is witnessing a considerable increase in the growth of data centers, which is expected to create opportunities for battery management systems. The electricity supply at data centers is of paramount importance to ensure continuous operations, which leads to the deployment of battery management systems at data center sites.

- For instance, in December 2021, Ascenty opened two new data centers in Rio de Janeiro and Hortolandia, Brazil. The company recently raised USD 925 million in credit and announced its plans to build five more data centers in the country. Two of the five data centers are expected to be completed in 2022, two in 2023, and one in 2024. Thus, such upcoming data centers are likely to increase the market studied during the forecast period.

- Furthermore, the increase in sales of electric vehicles has also helped in the increasing demand for lithium-ion batteries. With the sales expected to increase at a much faster rate during the forecast period, the demand for batteries, specifically lithium-ion batteries, is expected to increase.

- According to the Brazilian Association of Electric Vehicles (ABVE), EV registrations in Brazil reached 34,839 in 2021, a 77% increase year over year.

- The Rota 2030 program is aimed at improving energy efficiency in the transportation sector, which is a big boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to provide a significant impetus to the Brazilian segment of the market studied during the forecast period.

South America Battery Management System Industry Overview

The South American battery management system market is moderately fragmented. Some of the major players in the market (in no particular order) include Sensata Technologies Inc., Renesas Electronics Corporation, SK Innovation Co. Ltd, DENSO Corporation, and BYD Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 By Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Chile

- 5.2.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sensata Technologies Inc.

- 6.3.2 Renesas Electronics Corporation

- 6.3.3 SK Innovation Co. Ltd

- 6.3.4 DENSO Corporation

- 6.3.5 BYD Co. Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Bosch Corporation

- 6.3.8 Continental Engineering Services

- 6.3.9 Intel Corporation

- 6.3.10 Saft

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219