|

市場調查報告書

商品編碼

1636116

歐洲智慧清管:市場佔有率分析、產業趨勢與成長預測(2025-2030)Europe Intelligent Pigging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

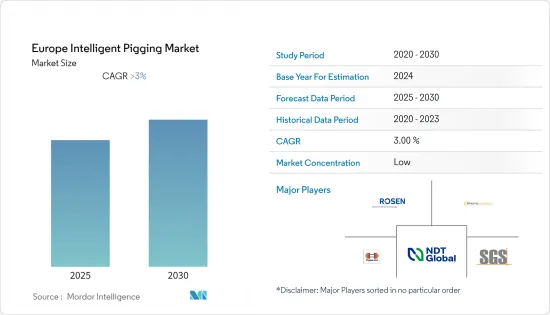

歐洲智慧清管市場預計在預測期內複合年成長率將超過3%

主要亮點

- 2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。短期內,由於管道清管服務需求的增加以及該地區石油和天然氣產量的高速成長,歐洲智慧清管市場預計將顯著成長。

- 另一方面,智慧清管無法應用於沒有清管器的管道,這阻礙了市場的成長。該地區(尤其是新興國家)能源消耗的增加是由都市化進程加快推動的。

- 由於俄羅斯專注於新管道的開發和建設,預計在預測期內將成為歐洲智慧清管市場成長最快的國家。

歐洲智慧清管市場趨勢

卡鉗清管作為重要的智慧清管過程

- Caliper Pigging 提供有關管道的有用且詳細的資訊,包括橢圓形、凹口、閥門位置、環焊縫和 T 形件。除此之外,卡尺清管設備還可用於液體和氣體管路、大角度1.5維彎管和遠距輸管。

- 此外,新的管道,特別是天然氣管道,配備了先進的設備,例如複雜且數量眾多的閥門以及流體流量和壓力感測器。這些設施是為了更好地控制產量。然而,由於管道結構複雜,獲取詳細資料非常重要。卡鉗清管器是最適合此類工作的清管器類型。因此受到天然氣管道營運商的青睞。

- 此外,卡尺清管器可以透過使用獨立吊掛的彈簧加載測量臂來識別管道中的微小變化,以確定管道的內部截面。這些臂與管道的內表面持續接觸。因此,可以識別管道直徑的微小變化。由於這些優勢,油氣管道公司對卡尺清管器的需求量很大。

- 由於市場油氣供應、生產和需求,歐洲管道清管業的成長需要在該地區主要國家擴建新的油氣管道計劃。

- 由於歐洲是世界上最大的天然氣進口國之一,因此對該地區內高效運輸天然氣的管道基礎設施有著巨大的需求。過去十年,由於該地區初級能源需求大幅增加。 2021年,歐洲天然氣消費量為5,711億立方米,佔全球總消費量的14.1%。

- 2022 年 8 月,Equinor 和 Wintershall Dea 兩家能源公司合作建造一條 900 公里長的管道,到 2032 年將德國北部的二氧化碳捕獲設施與挪威的倉儲設施連接起來。該管道每年可捕獲 2,000 萬至 4,000 萬噸二氧化碳,相當於德國每年工業排放的 20% 左右。這種聯盟/合作關係可能會在預測期內對智慧清管市場產生積極的需求。

- 因此,隨著技術的進步,對卡鉗清管器的需求預計將呈現顯著成長,進而帶動智慧清管器市場的需求。

俄羅斯主導市場

- 截至 2022 年 1 月,俄羅斯已探明石油蘊藏量排名第六,產量為 1,130 萬桶/日,而美國和沙烏地阿拉伯的日產量為1,760 萬桶,產量為1,200 mb/日,是第三大石油國。儘管俄羅斯的探明蘊藏量比沙烏地阿拉伯低近70%,但截至2021年的產量大致相當。

- 但該國大部分石油來自西西伯利亞西部的棕地,這些棕地已經運作了數十年。這主要是由於新技術的發展提高了生產力。該國石油和天然氣產量的增加導致對該國中游基礎設施的巨大需求。

- 俄羅斯擁有龐大的管道網路,用於向歐洲和中國等國外出口石油和天然氣。截至2021年,俄羅斯天然氣工業股份公司控制大部分管道,管道總長約176,800公里,包括國內和國際管道。 2021年俄羅斯天然氣消費量為4,746億立方公尺。

- 根據世界能源監測機構統計,截至2022年6月,俄羅斯石油管線長度約為2,051.2公里(規劃+正在建造)和40,91.9公里(運作中)。俄羅斯正在積極開發新的管道,以支持現有基礎設施,並進一步發展天然氣出口能力和能力。例如,全長1,230公里的北溪2號天然氣管道,從俄羅斯經波羅的海延伸至德國,已於2021年9月竣工(但由於正在等待德國和歐盟的認證,因此尚未開通)。該管道的規劃和建設捲入了政治爭議,人們擔心俄羅斯會利用它來維持與歐洲和烏克蘭的地緣政治優勢。

- TurkStream是另一個管道計劃,將把俄羅斯最大的天然氣蘊藏量直接連接到土耳其的天然氣輸送網路,為土耳其、歐洲南部和東南部提供可靠的能源。該管道將從俄羅斯海岸開始,橫跨黑海,全長超過 930 公里,最終到達土耳其色雷斯地區。此系統的近海部分由黑海中兩條相互平行的線路組成。該管道將進入俄羅斯海岸附近海域,並停靠在土耳其海岸色雷斯地區。此外,該計劃還將確保土耳其和歐洲能源供應的可靠性,並透過專門用於管道建設和營運的資源為土耳其的經濟發展做出貢獻。

- 這些好處可能會在預測期內對智慧清管市場產生積極的需求。

歐洲智慧清管產業概況

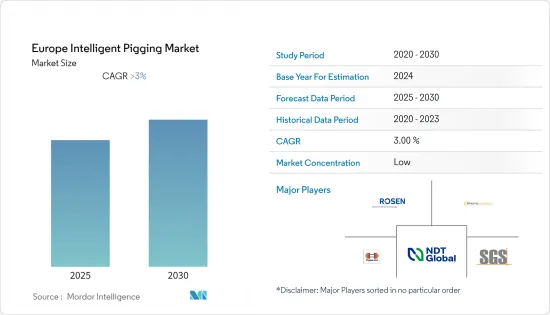

歐洲智慧清管市場區隔:主要參與企業包括(排名不分先後)Rosen Group、PipeSurvey International、SGS SA、NDT Global Services Ltd 和 Pigtek Ltd。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 漏磁 (MFL) 清管

- 超音波檢測清管

- 卡鉗清管

- 目的

- 裂痕和洩漏檢測

- 金屬損失/腐蝕檢測

- 形態和彎曲檢測

- 其他

- 管路流體類型

- 油

- 氣體

- 地區

- 歐洲

- 德國

- 英國

- 俄羅斯

- 義大利

- 荷蘭

- 歐洲其他地區

- 歐洲

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- PipeSurvey International

- Rosen Group

- TD Williamson Inc.

- Baker Hughes Company

- NDT Global Services Ltd

- SGS SA

- Penspen Limited

- Pigtek Ltd

第7章市場機會與未來趨勢

簡介目錄

Product Code: 5000064

The Europe Intelligent Pigging Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels. Over the short term, the Europe intelligent pigging market is expected to register significant growth due to the increasing demand for pipeline pigging services in the region and the high growth of oil and gas production.

- On the other hand, intelligent pigging is not applicable to unpigged pipelines, which impedes market growth. Nevertheless, the growing energy consumption in the region, distinctly in developing countries, is propelled by the advancing steps of urbanization.

- Russia is expected to witness the fastest growth in the Europe Intelligent Pigging Market during the forecast period as it focuses on the development and construction of new pipelines.

Europe Intelligent Pigging Market Trends

Caliper Pigging as a Significant Intelligent Pigging Process

- Caliper pigging gives useful and detailed information on the pipeline, such as ovalities, dents, valve locations, and girth welds and t pieces. Aside from that, caliper-pigging equipment can be employed in liquid and gas pipelines, high-angle 1.5D bends, and long-distance pipelines.

- In addition, the new pipelines, particularly gas pipelines, are equipped with sophisticated equipment, such as an advanced and large number of valves and fluid flow and pressure sensors. The equipment is intended to attain better control over production. But with a complicated pipeline structure, it is important to acquire detailed data. Caliper pigging is the most suitable type of pigging for these kinds of operations. Hence, they are preferred by gas pipeline operators.

- Furthermore, the caliper pigs could identify minute changes in pipelines by using the independently suspended spring-loaded measuring arms to determine the internal cross-section of the pipeline. These arms are in continuous contact with the inner surface of the pipeline. Thus, it could identify the slight change in pipe diameter. Due to these advantages, the oil and gas pipeline companies have a high demand for caliper pigs.

- Due to the market's supply, production, and demand for oil and gas, the expansion of new oil and gas pipeline projects in the region's key countries was necessary for the pipeline-pigging industry to grow in Europe.

- Europe is among one of the biggest importers of natural gas in the world, leading to significant demand for pipeline infrastructure in the region for the efficient transport of natural across the region. In the last decade, the demand for energy has grown significantly in the region due to the growing demand for primary energy in the region. In 2021, Europe's natural gas consumption was 571.1 billion cubic meters, contributing 14.1 % of total world consumption.

- In August 2022, two energy firms, namely Equinor and Wintershall Dea, partnered to build a 900 km (560 miles) pipeline connecting a CO2 collection facility in Northern Germany with storage sites in Norway by 2032. The pipeline is likely to have a capacity of 20 million to 40 million tonnes of CO2 per year, equivalent to around 20% of all annual German industrial emissions. Such partnerships/collaborations are likely to create positive demand for the intelligent pigging market during the forecast period.

- Therefore, due to technological advancements, the demand for caliper pigging is expected to witness significant growth, which, in turn, drives the demand for the intelligent pigging market.

Russia to dominate the market

- As of January 2022, Russia ranked sixth in terms of proven oil reserves, but it was still the third-largest producer of oil across the globe with a production volume of 11.3 million barrels per day (mb/d), only behind the United States and Saudi Arabia with a production of 17.6 mb/d and 12 mb/d, in January 2022. Despite Russia's proven reserves being almost 70% less than Saudi Arabia's, it is almost at par when it comes to production as of 2021.

- However, most of the country's oil is being produced from brownfields in Western Siberia that have been in operation for decades. This is primarily due to the development of new technologies to increase production rates. The increase in the production of oil & gas in the country has led to significant demand for midstream infrastructure in the country.

- Russia has a huge network of pipelines for exporting oil and gas to Europe and other foreign countries, including China. As of 2021, Gazprom holds control of most of the pipelines and has about 176,800 kilometers of pipeline, including domestic and international. In 2021, Russia's natural gas consumption was 474.6 billion cubic meters.

- According to the Global Energy Monitor Statistics, as of June 2022, Russia had an oil pipeline length of around 2,051.2 km (proposed + construction) and 40,091.9 km (operational). The country is actively developing new pipelines to support its existing infrastructure and further develop its gas exporting capacity and capability. For instance, the Nord Stream 2 gas pipeline, with a length of 1,230 km from Russia to Germany running through the Baltic Sea, was completed in September 2021 (but has not yet entered service due to the pending certification by Germany and the European Union). Planning and construction of the pipeline were mired in political controversy over fears that Russia would use it for geopolitical advantage with Europe and Ukraine.

- TurkStream, another pipeline project that directly connects the largest gas reserves in Russia to the Turkish gas transportation network, providing reliable energy to Turkey, South and Southeast Europe. This pipeline starts on the Russian coast, runs over 930 km through the Black Sea, and comes ashore in the Thrace region of Turkey. The offshore component of the system consists of two parallel lines running through the Black Sea. The pipelines enter the water on the Russian coast and come ashore on the Turkish coast in the Thrace region. Additionally, this project helps ensure the reliability of energy supplies to Turkey and Europe and contributes to Turkey's economic development through the resources it has allocated for the construction and operation of the pipeline.

- Such benefits are likely to create positive demand for the intelligent pigging market during the forecast period.

Europe Intelligent Pigging Industry Overview

The Europe intelligent pigging market is fragmented. The key players include (not in particular order) Rosen Group, PipeSurvey International, SGS SA, NDT Global Services Ltd, and Pigtek Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Magnetic Flux Leakage (MFL) Pigging

- 5.1.2 Ultrasonic Test Pigging

- 5.1.3 Caliper Pigging

- 5.2 Application

- 5.2.1 Crack and Leakage Detection

- 5.2.2 Metal Loss/Corrosion Detection

- 5.2.3 Geometry Measurement and Bend Detection

- 5.2.4 Other Applications

- 5.3 Pipeline Fluid Type

- 5.3.1 Oil

- 5.3.2 Gas

- 5.4 Geography

- 5.4.1 Europe

- 5.4.1.1 Germany

- 5.4.1.2 United Kindgom

- 5.4.1.3 Russia

- 5.4.1.4 Italy

- 5.4.1.5 Netherlands

- 5.4.1.6 Rest of Europe

- 5.4.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 PipeSurvey International

- 6.3.2 Rosen Group

- 6.3.3 T.D. Williamson Inc.

- 6.3.4 Baker Hughes Company

- 6.3.5 NDT Global Services Ltd

- 6.3.6 SGS SA

- 6.3.7 Penspen Limited

- 6.3.8 Pigtek Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219