|

市場調查報告書

商品編碼

1636127

中東和非洲的空氣品質監測:市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

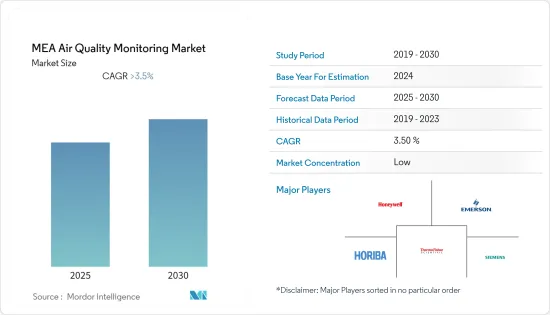

預計中東和非洲空氣品質監測市場在預測期內複合年成長率將超過 3.5%。

從中期來看,工業化和都市化的不斷發展將導致空氣品質惡化,從而推動對空氣品質監測和淨化的需求,特別是在開發中國家。

同時,為支持政府的淨零碳排放措施而滲透的可再生和環保能源預計將在預測期內阻礙市場。

空氣品質監測系統的技術進步為設備及其應用的技術發展提供了重大機會。

沙烏地阿拉伯預計將主導中東和非洲的空氣品質監測市場,因為它佔初級能源消費量的大部分。

中東和非洲空氣品質監測市場趨勢

戶外顯示器市場預計成長最快

室外空氣品質監控系統可測量污染物、空氣顆粒物、濕度和室外空氣溫度的濃度等級。檢測 CO2、O3、NO2、SO2、甲醛 (HCHO) 和總揮發性有機化合物 (TVOC) 等污染物的含量。

乍得2021年PM2.5平均濃度為75.9微克每立方公尺(μg/m3),使其成為世界上污染最嚴重的國家之一。這比阿拉伯聯合大公國的平均 PM2.5 濃度高出近 40μg/m3。

空氣品質監測系統主要由政府在特定州和國家的城市和公共場所部署。這些設備防風雨,必須滿足特定的環境測試和模擬才能獲得建築認證。

室外監測儀又分為可攜式室外監測儀、固定式室外監測儀、灰塵和顆粒物監測儀以及AQM站。可攜式戶外監視器因其操作優勢和易於部署而在全球範圍內得到最廣泛的部署。

隨著都市化進程的加速和越來越多的人遷移到都市區,都市區的空氣污染水平不斷增加。預計到2050年,居住在都市區的人口將增加25億。由於人口密度高以及工業設施、城市廢棄物產生和交通堵塞等多種污染源的存在,迫切需要改善空氣品質監測和應變系統。

2023 年 5 月,阿拉伯聯合大公國氣候變遷與環境部 (MOCCAE) 更新了 64 個空氣品質監測站的分類,作為永續性年舉措的一部分,以促進當地社區的健康和福祉。根據該部 2022 年發布的指令,這種重新分類對於維持最高的環境和氣候保護標準是必要的。

因此,這些新興市場的發展預計將在預測期內推動戶外監視器市場的發展。

沙烏地阿拉伯主導市場

沙烏地阿拉伯佔中東和非洲石油和天然氣生產和消費的大部分,在預測期內正在推動空氣品質監測市場,特別是隨著工業化程度的提高而導致化學污染物的增加。

此外,發電業是空氣品質監測系統的最大消費者。由於氣候變遷相關問題,發電業擴大從燃煤發電廠轉向燃氣電廠和可再生發電。

2021年,沙烏地阿拉伯佔中東初級能源消費量總量的28.6%,為10.82艾焦耳。 2021年,石油、天然氣、煤炭等石化燃料佔該地區初級能源消耗總量的較大比例。

2021年中東地區的監測人數增加了86%,主要是由於沙烏地阿拉伯和以色列的監測人數大幅增加,佔全部區域的73%。

因此,鑑於上述幾點,預計沙烏地阿拉伯在預測期內將出現顯著成長。

中東和非洲空氣品質監測產業概況

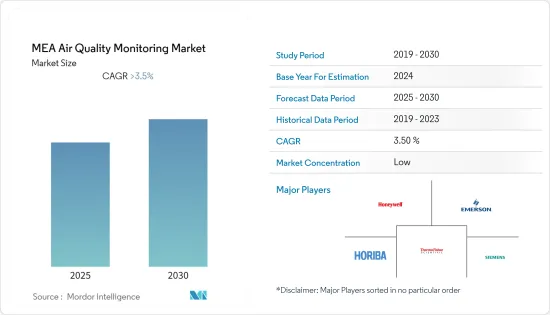

中東和非洲空氣品質監測市場是細分的。主要企業(排名不分先後)包括西門子公司、賽默飛世爾科技公司、Horiba Ltd、艾默生電氣公司和霍尼韋爾國際公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 產品類型

- 室內監視器

- 室外監視器

- 取樣方式

- 連續的

- 手動的

- 間歇性的

- 污染物類型

- 化學污染物

- 物理污染物

- 生物污染物

- 最終用戶

- 住宅及商業設施

- 發電

- 石化

- 其他

- 地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- Honeywell International Inc.

- 3M Co.

- Teledyne Technologies Inc.

- TSI Inc.

- Agilent Technologies Inc.

第7章 市場機會及未來趨勢

The MEA Air Quality Monitoring Market is expected to register a CAGR of greater than 3.5% during the forecast period.

Over the medium period, increasing industrialization and urbanization are leading to a deterioration in air quality, driving the demand for air quality monitoring and purification, especially in developing countries.

On the other hand, the penetration of renewable and greener energy to support the government's net zero carbon emission policy is expected to hinder the market in the forecast period.

The technological advancements in air quality monitoring systems create enormous opportunities for the techno-development of devices and their applications.

Saudi Arabia is expected to dominate the Middle East and Africa Air Quality Monitoring market as the country holds the majority share in primary energy consumption.

MEA Air Quality Monitoring Market Trends

The Outdoor Monitor Segment is Expected to be the Fastest growing Segment

The outdoor air quality monitoring systems measure the concentration levels of pollutants, suspended particles, humidity, and temperature outside air, i.e., in open spaces. They detect the levels of pollutants like CO2, O3, NO2, SO2, formaldehyde (HCHO), total volatile organic compounds (TVOC), etc.

Chad had an average PM2.5 concentration of 75.9 micrograms per cubic meter of air (µg/m3) in 2021, making it one of the most polluted countries in the world. This was almost 40 µg/m3 more than the average PM2.5 concentrations in the United Arab Emirates.

Air quality monitoring systems are majorly deployed by governments in cities and public spaces of a particular state or country. These devices are weather-resistant and must meet certain environmental tests and simulations to be confided by some building certifications.

The outdoor monitors are further segmented into portable outdoor monitors, fixed outdoor monitors, dust and particulate monitors, and AQM stations. Portable outdoor monitors are the most widely deployed globally due to their operational advantage and easy deployment.

With the increasing urbanization and more people moving to urban areas, the air pollution levels in urban areas have increased. It is estimated that by 2050, 2.5 billion more people will live in urban areas. The high population density and diverse pollution sources like industrial facilities, municipal waste generation, and transport congestion lead to an urge for better air quality monitoring and address systems.

In May 2023, The United Arab Emirates' Ministry of Climate Change and Environment (MOCCAE) updated the classification of 64 air quality monitoring stations as part of the Year of Sustainability initiative to promote community health and welfare. According to the ministry's directive issued in 2022, this reclassification was mandatory to maintain the highest environmental and climate protection standards.

Therefore, such developments are expected to give a thrust to the outdoor monitor segment of the market during the forecast period.

Saudi Arabia to dominate the market.

Saudi Arabia has the majority of the production and consumption of oil and gas in the Middle East and Africa region, particularly due to growing industrialization, which has increased chemical pollutants, thereby driving the air quality monitoring market in the forecast period.

Moreover, the power generation sector is the biggest consumer of air quality monitoring systems. The power production sector is increasingly switching from coal-fired power plants to gas-fired power plants and renewable power generation due to the problems associated with climate change.

In 2021, Saudi Arabia accounted for 28.6% of the total primary energy consumed across the Middle East, with 10.82 exajoules. Fossil fuels, such as oil, natural gas, and coal, accounted for a significant share of the total primary energy consumed in the region in 2021.

The number of monitors in the Middle East region climbed by 86% in 2021, mostly due to a significant increase in the number of monitors in Saudi Arabia and Israel, whose monitors comprised 73% of all in the region.

Therefore, owing to the above points, Saudi Arabia is expected to witness significant growth during the forecast period.

MEA Air Quality Monitoring Industry Overview

The Middle East and Africa Air Quality Monitoring Market is fragmented. Some of the major players (not in the particular order) include Siemens AG, Thermo Fisher Scientific Inc., Horiba Ltd, Emerson Electric Co., and Honeywell International Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Indoor Monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 Pollutant Type

- 5.3.1 Chemical Pollutants

- 5.3.2 Physical Pollutants

- 5.3.3 Biological Pollutants

- 5.4 End User

- 5.4.1 Residential and Commercial

- 5.4.2 Power Generation

- 5.4.3 Petrochemicals

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 Honeywell International Inc.

- 6.3.6 3M Co.

- 6.3.7 Teledyne Technologies Inc.

- 6.3.8 TSI Inc.

- 6.3.9 Agilent Technologies Inc.