|

市場調查報告書

商品編碼

1636130

亞太地區儲槽保護:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Asia Pacific Tank Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

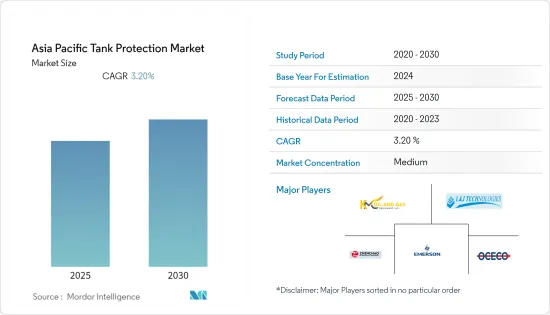

預計亞太地區儲槽保護市場在預測期內複合年成長率為 3.2%

主要亮點

- 下游產業投資的增加和海上石油探勘活動的活性化是推動市場成長的關鍵因素。

- 同時,原料價格波動和擴大採用更清潔的替代品是市場的主要限制因素。

- 控制流程自動化需求的不斷成長預計將為預測期內的市場參與企業提供巨大的機會。

- 中國是儲槽保護市場成長最快的地區,並且在預測期內可能呈現最高的複合年成長率。

亞太地區儲槽保護市場趨勢

石油探勘投資增加帶動市場

- 石油儲存槽在精製和加工過程中儲存原油和其他原料。它也用於存儲成品。不銹鋼、碳鋼、鋼筋混凝土和工業塑膠都是用來製造儲存槽的材料。各國設定增加產量目標以滿足各領域的石油需求是預期擴大亞太儲槽保護市場的關鍵因素。

- 例如,2022年6月,ONGC宣布,在西部和東部近海有新發現後,印度天然氣產量預計增加25%,原油產量將增加11%。該公司計劃2022年至2025年投資3,100億盧比用於探勘,並從2024年至2025年每年新增約10萬平方公里的新探勘區域。

- 印度政府已採取策略性舉措來提高化學工業在國內生產毛額中的佔有率。據化學和石化部稱,2020年印度化工產業價值為1,780億美元,目標是到2025年增至3,000億美元。這將推動與化學和石化生產相關的基礎設施的發展,並預計將在預測期內增加對儲罐保護系統的需求。

- 2020年至2024年間,中國總合9家煉油廠計畫投產。其中五個是計劃中的煉油廠,四個是已宣布的煉油廠。揭陽煉油廠很可能成為中國下一個精製能力為400mbd的大型煉油廠。計劃於 2022 年開始營運。這些計劃可能會增加國內石油和天然氣產業的投資。

- 根據BP統計,2021年亞太地區精製能力為2,958.7萬桶/日,高於2015年的2,685.5萬桶/日。這表明政府對石油和天然氣行業的投資,預計將在預測期內推動儲罐保護市場。

- 因此,鑑於上述幾點,石油和天然氣行業投資的增加將在預測期內推動市場。

中國坦克防護市場快速成長

- 2022年3月,中國石油化學股份有限公司宣布2022年投資1,980億元人民幣,較2020年成長18%。其中,我們計劃投資815億元用於上游開發。這將導致石油和天然氣領域的投資增加。

- 2021年,中國將成為世界主要國家之一,導致液化天然氣需求增加。 2020年液化天然氣進口量約1,200萬噸,2021年將增加至7,900萬噸。需求激增使中國超越日本成為全球最大的液化天然氣進口國。隨著中國液化天然氣買家簽署每年超過2000萬噸的長期契約,需求增加。

- 此外,2021年,中國煉油產能達到16.69Mb/d的歷史新高。隨著石油需求成長由燃油主導轉向石化原料主導,煉油產業正在轉型升級。

- 2022年1月,中海油宣布2023年預計淨生產量目標為6.4-6.5億桶,2024年目標為680-6.9億桶。

- 因此,隨著煉油和石化業務的擴張以及即將開展的計劃,預計該國儲罐保護市場的需求將會增加。

亞太地區儲槽保護產業概況

亞太地區儲槽保護市場區隔:市場的主要企業(排名不分先後)包括艾默生電氣公司、L&J Technologies Inc.、浙江振超石油化工裝備公司、石油節約工程公司(OCECO)和KMC油氣裝備公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 加大下游產業投資力度

- 海上石油探勘活動增加

- 抑制因素

- 更多採用更清潔的替代燃料

- 機會

- 控制過程中對自動化的需求不斷增加

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 石油和天然氣產業

- 上游

- 下游

- 中產階級

- 目的

- 新計畫(新訂單)

- 現有計劃(替代項目)

- 裝置

- 閥門

- 發洩

- 阻火器

- 地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- Korean Steel Power Corp.

- Emerson Electric Co.

- Zhejiang Zhenchao Petroleum And Chemical Equipment Co., Ltd

- Valcrom Global DWC LLC

- Motherwell Tank Protection

- NEOTECH Co.,Ltd.

- Oil Conservation Engineering Company(OCECO)

- KMC Oil and Gas Equipment

- L&J Technologies Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 5000227

The Asia Pacific Tank Protection Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- Increasing investment in the downstream sector and rising offshore Oil exploration activities are major factors expected to drive the market's growth.

- On the other hand, Volatile raw material prices and the rising adoption of cleaner alternatives are the major restraints for the market.

- Nevertheless, the growing demand for automation in the control process is expected to create an excellent opportunity for the market players in the forecast period, as these projects are paving the way for the line pipe industry to grow more.

- China fastest growing region in the Tank protection market and is also likely to witness the highest CAGR during the forecast period.

Asia Pacific Tank Protection Market Trends

Increase investment in the oilfield exploration will drive the market

- Oil storage tanks hold crude oil and other raw materials during the refining and processing processes. They are also used to keep finished products. Stainless steel, carbon steel, reinforced concrete, and industrial plastic are among the materials used to make oil storage tanks. The targets set by countries to increase production to meet oil demand in various sectors is the major factor that is expected to increase the Asia Pacific tank protection market.

- For instance, in June 2022, ONGC announced that the company expects to increase 25% natural gas and 11 % in crude oil production in India after newer discoveries in western and eastern offshore. The company will spend Rs 31,000 crore from 2022 to 2025 on the exploration and add approx 1,00,000 square kilometers of new exploration area annually up to 2024-25.

- In India, the government has taken a strategic initiative to increase the share of the chemical sector in the country's GDP. According to the Department of Chemicals and Petrochemicals, the chemical sector in India was valued at USD 178 billion in 2020, which is targeted to increase to USD 300 billion by 2025. This is likely to promulgate the development of infrastructure associated with chemical and petrochemical production, which is expected to drive the demand for tank protection systems during the forecast period.

- In China, a total of 9 upcoming refineries are expected to start operations between 2020 and 2024. Among these, five are planned refineries, and four are announced refineries. The Jieyang refinery is likely to be the major upcoming refinery in China, with a refining capacity of 400 mbd. It is expected to start operations in 2022. These projects are likely to increase an investment in the oil and gas sector in the country.

- According to BP statistical review, in 2021, oil refinery throughput was 29,587 thousand barrels per day in Asia pacific and saw an increase from 26,855 thousand barrels per day in 2015. This shows that the government is investing in the oil and gas sectors, which will drive the market of tank protection during the forecast period.

- Hence, owing to the above points, increasing investment in the oil and gas sector will drive the market during the forecast period.

China fastest growing region in the Tank protection market

- In March 2022, China Petroleum & Chemical Corp announced it to spend CNY 198 billion in 2022, more than 18% from 2020, which was higher than that of the 2013 investment record of CNY 181.7 billion. Out of this, the company plans to invest CNY 81.5 billion in upstream exploitation. This will lead to increase investment in the oil and gas sector.

- In 2021, China will be one of the major countries in the world, which will lead to growth in LNG demand. In 2020, about 12 million tons of LNG were imported; in 2021, there were 79 million tons. Due to this surge in demand, China surpassed Japan to take the top spot among LNG importers worldwide. Demand has increased due to Chinese LNG buyers signing long-term contracts for more than 20 million tons annually.

- Additionally, in 2021, China's refinery capacity reached an all-time high of 16.69 Mb/d. As the oil demand growth shifted from fuel-driven to petrochemical feedstock-driven, the country is transforming and upgrading the refinery industry.

- In January 2022, CNOOC announced net production estimated targets for 2023 are 640 million to 650 million barrels and for 2024 is 680 million to 690 million barrels of oil.

- Hence, with the expansion of the refinery and petrochemical business and the upcoming project, the country is expected to witness an increase in the demand for tank protection markets.

Asia Pacific Tank Protection Industry Overview

The Asia Pacific Tank protection market is fragmented. Some of the key players in this market (in no particular order) include Emerson Electric Co., L&J Technologies Inc., Zhejiang Zhenchao Petroleum And Chemical Equipment Co., Ltd, Oil Conservation Engineering Company (OCECO), and KMC Oil and Gas Equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing investment in the downstream sector

- 4.5.1.2 Rising offshore Oil exploration activities

- 4.5.2 Restraints

- 4.5.2.1 Rising adoption of cleaner alternatives

- 4.5.3 Oppurtunities

- 4.5.3.1 Growing demand for automation in the control process

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Oil & Gas - Sector

- 5.1.1 Upstream

- 5.1.2 Downstream

- 5.1.3 Midstream

- 5.2 Application

- 5.2.1 New Project (New Orders)

- 5.2.2 Existing Project (Replacement Orders)

- 5.3 Equipment

- 5.3.1 Valves

- 5.3.2 Vents

- 5.3.3 Flame Arrestors

- 5.4 Geography

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 Australia

- 5.4.5 South Korea

- 5.4.6 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Korean Steel Power Corp.

- 6.3.2 Emerson Electric Co.

- 6.3.3 Zhejiang Zhenchao Petroleum And Chemical Equipment Co., Ltd

- 6.3.4 Valcrom Global DWC LLC

- 6.3.5 Motherwell Tank Protection

- 6.3.6 NEOTECH Co.,Ltd.

- 6.3.7 Oil Conservation Engineering Company (OCECO)

- 6.3.8 KMC Oil and Gas Equipment

- 6.3.9 L&J Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219