|

市場調查報告書

商品編碼

1636139

德國快遞:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Express Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

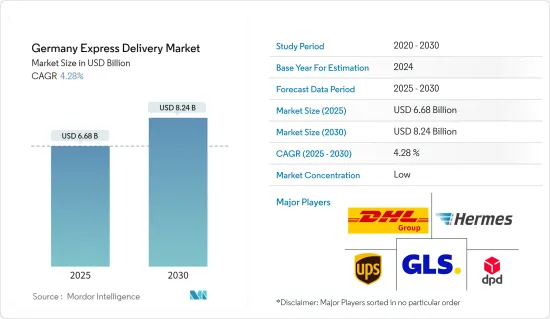

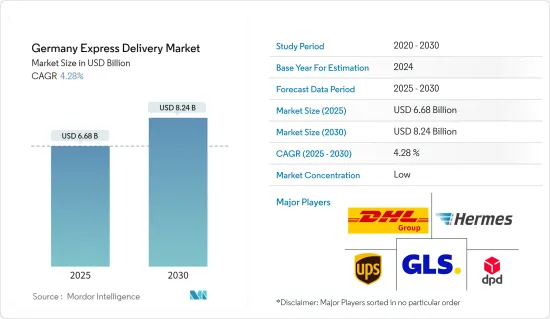

德國快遞市場規模預估至2025年為66.8億美元,預估至2030年將達82.4億美元,預測期間(2025-2030年)複合年成長率為4.28%。

主要亮點

- 德國的快遞市場主要受到國際貿易活動激增和當日送達需求不斷成長的推動。

- 推動快遞產業成長的關鍵因素之一是跨境/國際商業航線的擴展,特別是在新興國家,這正在提高國際貿易和B2C運輸的接受度。此外,消費者對透過各種電子商務入口網站進行網路購物的偏好不斷增加,也推動了市場的成長。為了跨境分銷產品,電子商務商店與宅配合作。

- 2019年,網路商店實現淨出口銷售額24億美元,大幅超過市場出口GMV僅4.18億美元。 2023年,出口市場GMV升至11億美元。 157% 的成長率令人印象深刻,儘管仍低於網路商店的銷售額。

- 技術進步,例如透過群眾外包分銷模式使用數位技術,也有助於積極的市場前景。其他因素,如快速都市化、消費者支出能力的上升以及製造業的顯著成長,預計也將在預測期內進一步提振市場。提供自動化包裹和貨物運輸解決方案,以提高零售商整體運輸業務的效率。在不久的將來,零售商將能夠將電子提交海關文件等管理任務委託給交付合作夥伴,並享受更快的清關速度,從而減少與相關文書工作相關的時間和成本。

- 此外,隨著政府和貿易集團就區域和貿易協定進行談判,進入新市場對中小企業變得更具吸引力。城市年輕人口的成長得益於跨境電商的快速成長。

- 隨著當日送達成為線上購物客戶更受歡迎的送貨選擇,對當日送達的需求不斷成長。技術創新在當日達服務業正在取得進展。當日送達服務領域的主要競爭對手正在專注於為其服務開發創新技術,以滿足不斷成長的需求。

德國快遞市場趨勢

國際市場經歷顯著成長

- 在德國的國際市場上,網路商店的出口表現優於市場。相反,對於進口商品,市場的 GMV 超過商店的淨銷售額。德國主要的電子商務出口夥伴全部是歐洲人。同時,我們的進口夥伴也多種多樣,包括瑞士、美國、土耳其和印度。雖然時尚品迄今是德國電子商務的主要進口品類,但出口品類以愛好和休閒為主導,緊隨其後的是電子產品。

- 2019年,網路商店出口淨銷售額達24億美元,超過市場出口GMV僅4.18億美元。到2023年,出口市場GMV飆升至11億美元。儘管仍低於網路商店的銷售額,但 157% 的成長率還是引人注目的。

- 目前,該市場在進口中佔據主導地位,這表明國際市場(而不是外國網路商店)在德國創造了更高的 GMV。這與2019年海外網路商店表現優於市場的情況相比發生了重大變化。

- 2019年,海外網路商店淨進口銷售額為4.14億美元。儘管這僅佔當年出口銷售額的一小部分,但仍超過了市場上進口的GMV。然而,到2023年,國際市場不僅進口GMV將突破10億美元大關,網路商店的進口銷售額也將突破10億美元大關。德國網路商店在出口方面表現出色,這得益於鄰國強大的客戶關係和品牌信任。

- 然而,進口市場正在興起。隨著德國消費者擴大跨境購物,他們被市場上具有競爭力的價格和強大的物流支援所吸引。德國快速成長的市場趨勢反映了向全球市場主導地位的轉變,並凸顯了該市場在國際電子商務中的關鍵作用。

- 2023年,Otto以5.73億美元的跨境出口GMV位居榜首。然而,儘管位居榜首,Otto 的出口 GMV 僅為 Amazon.de 出口銷售額(16 億美元)的三分之一。奧託的主要產品線是時裝,其次是電子產品。跨境貿易僅限奧地利和荷蘭,2023年分別貢獻總GMV的4%和3.8%。

- 進口方面,Galaxus 成為領跑者,在德國的進口 GMV 達到 3.27 億美元。這一數字是主要網路商店Amazon.com 1.18 億美元進口銷售額的兩倍多。 Galaxus主要是瑞士跨國市場,預計德國將在2023年成為其第二大市場,佔總GMV的近20%。隨著國際銷售的激增,同一市場對快遞的需求也將隨之增加。

由於個人支出限制,2023年德國電子商務面臨低迷

- 2023年,德國電商大幅下滑,主因是消費者支出下降。商品總銷售額下降 11.8%,至 797 億歐元(834.8 億美元),低於 2022 年的 904 億歐元(946.9 億美元)。電子商務佔零售總額(不包括食品,但包括藥品銷售)的佔有率從 2022 年的 11.8% 下降至 10.2%。

- 旅行預訂、演唱會門票銷售等數位服務出現復甦跡象,但動能減弱。這些服務成長了 12.7%,達到 127 億歐元(133 億美元),而前一年成長了 39.9%,達到 112.5 億歐元(117.8 億美元)。結果,電子商務領域(商品和服務)的總合銷售額自 2020 年以來首次跌破 1,000 億歐元(1,047.4 億美元)大關。 2023年,網路交易總銷售額達936億歐元(980.4億美元),其中包括透過電話、傳真和其他方式進行的交易。

- 零售商可能會記得 2023 年是重大轉型的一年。直接面對消費者 (D2C) 零售商的收入在 2022 年下降了 11.1%,但已經建立了更穩定的長期成長軌跡,銷售額比 2019 年大流行前高出 62%。市場和網路零售業分別下降 8.5% 和 14.7%,但均比新冠疫情前的水準高出 19.0% 和 7.0%。多通路交易收益下降幅度最大,達 18.1%,這與店內顧客的明顯復甦一致。

- 2023年,網路購物活動進一步下降。經常網路購物的顧客比例下降至 34.3%,較 2019 年 40% 的平均水準大幅下降,也低於四年平均值。隨著電商持續下滑,快遞服務的需求也悄悄下降。

德國快遞行業概況

德國快遞市場由許多本地、區域和全球參與企業細分。主要參與企業包括 DHL 團體、Hermes Europe GmbH、Dynamic Parcel Distribution (DPD)、General Logistics Systems BV (GLS) 和 United Parcel Services (UPS)。

為了更好地服務客戶,該公司正在將尖端技術進步納入其供應鏈。 2024年6月,全球領先的國際快遞服務供應商DHL Express升級了人工智慧平台「我的全球貿易服務」(MyGTS),並推出了新的「貿易通道比較」功能。這項附加功能允許各種規模的企業存取和參考出口和進口國家或地區之間當前的貿易通道法規和要求。因此,希望擴大市場的公司可以使用此工具做出明智的決策、提高效率並確保競爭。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 當日送達需求快速成長推動市場

- 可支配所得的增加推動市場

- 市場限制因素

- 與傳統運輸方式相比,高成本阻礙了市場發展

- 影響市場的監管限制

- 市場機會

- 技術進步驅動市場

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 政府法規和舉措

- 工業技術趨勢

- 電商產業洞察(國內電商、跨境電商)

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按業務

- B2B

- B2C

- 按目的地

- 國內的

- 國外

- 按最終用戶

- 服務(BFSI(銀行、金融服務、保險))

- 批發/零售(電子商務)

- 製造業、建設業、公共產業

- 一級產業(農業、其他天然資源)

第6章 競爭狀況

- 公司簡介

- DHL Group

- Hermes Europe Gmbh

- Dynamic Parcel Distribution(DPD)

- General Logistics Systems BV(GLS)

- United Parcel Services(UPS)

- FedEx Express

- DB Schenker

- Go Express

- Atlantic International Express

- Nippon Express*

- 其他公司

第7章 市場的未來

第8章附錄

- 宏觀經濟指標(GDP分佈、活動、運輸和倉儲業對經濟的貢獻)

- 對外貿易統計-出口與進口(分產品)

- 深入了解主要出口目的地和進口原產國

The Germany Express Delivery Market size is estimated at USD 6.68 billion in 2025, and is expected to reach USD 8.24 billion by 2030, at a CAGR of 4.28% during the forecast period (2025-2030).

Key Highlights

- German express delivery market is primarily fueled by surging international trade activities and a growing demand for same-day delivery.

- One of the primary drivers driving the growth of the express delivery industry is the expansion of cross-border/international commercial routes, particularly in developing countries, which has increased the acceptance of international trade and B2C shipping. Furthermore, the growing consumer preference for shopping online via various e-commerce portals is boosting market growth. To distribute their products across domestic and international borders, e-commerce stores collaborate with courier service providers.

- In 2019, online stores achieved export net sales of USD 2.4 billion, far surpassing the marketplace export GMV, which was only USD 418 million. By 2023, the export marketplace GMV climbed to USD 1.1 billion. Although it still lags behind online store net sales, this 157% growth rate is impressive.

- Technological improvements, such as the use of digital technology with crowd-sourced distribution models, are also contributing to the market's favourable outlook. Other factors, such as rapid urbanization, rising consumer expenditure capacities, and significant growth in the manufacturing sector, are expected to propel the market even higher during the forecast period. There are automated package and freight shipping solutions available to improve the efficiency of retail merchants' overall shipping operation. Retailers will soon be able to delegate paperwork to shipping partners, such as electronically transmitting customs documentation, and enjoy a fast customs clearing procedure, reducing the time and expense associated with the associated paperwork.

- Furthermore, as more regional and trade agreements are negotiated between governments and trading blocs, it has become more appealing for SMEs to enter new markets. The increase of a young, urban population is attributed to the rapid growth of cross-border e-commerce.

- The demand for same-day delivery is growing as it becomes a more popular shipping option for customers purchasing online. Technological innovations are gaining traction in the industry for same-day delivery services. The major competitors in the same-day delivery services sector are focusing on creating technology breakthroughs in their services to meet the growing demand.

Germany Express Delivery Market Trends

International segment experiencing substantial growth in the market

- In Germany's international landscape, online stores outpace marketplaces in exports. Conversely, for imports, the GMV from marketplaces surpasses the net sales from stores. Germany's primary eCommerce export partners are exclusively European. In contrast, its import partners span a broader spectrum, including Switzerland, the U.S., Turkey, and India. Fashion dominates as the leading imported category in German eCommerce, while exports are spearheaded by hobby & leisure, trailed by electronics.

- In 2019, online stores boasted export net sales of USD 2.4 billion, overshadowing the marketplace export GMV, which stood at a mere USD 418 million. Fast forward to 2023, and the export marketplace GMV surged to USD 1.1 billion. While still trailing behind online store net sales, this growth rate of 157% is noteworthy.

- Marketplaces now dominate imports, indicating that international marketplaces, rather than foreign online stores, are generating a higher GMV in Germany. This marks a significant shift from 2019 when foreign online stores outperformed marketplaces.

- In 2019, foreign online stores recorded import net sales of USD 414 million. While this was a mere fraction of that year's export sales, it still eclipsed the GMV from marketplace imports. By 2023, however, international marketplaces not only crossed the USD 1 billion mark in import GMV but also outpaced the import sales of online stores.German online stores excel in exports, bolstered by robust customer relationships and brand trust in neighboring nations.

- In the realm of imports, however, marketplaces are gaining ground. As German consumers increasingly shop beyond their borders, they are drawn to marketplaces for their competitive pricing and robust logistical support. This burgeoning marketplace trend in Germany mirrors the global shift towards marketplace dominance, underscoring their pivotal role in international eCommerce.

- In 2023, Otto led the pack with a cross-border export GMV of USD 573 million. Yet, despite its top position, Otto's export GMV is only about one-third of Amazon.de's leading export net sales, which stand at a hefty USD 1.6 billion. Otto's primary offerings are fashion, trailed by electronics, and its cross-border dealings are limited to Austria and the Netherlands, contributing 4% and 3.8% to its total GMV in 2023.

- On the import front, Galaxus emerged as the frontrunner, amassing an import GMV of USD 327 million in Germany. This figure more than doubles the import net sales of the leading online store, Amazon.com, which stands at USD 118 million. Galaxus, primarily a Swiss multinational marketplace, sees Germany as its second-largest market, accounting for nearly 20% of its total GMV in 2023. As international sales surge, the demand for express delivery in the market rises in tandem.

German e-commerce grappled with a downturn in 2023, as consumer spending curtailed

- In 2023, German e-commerce experienced a significant downturn, primarily driven by reduced consumer spending. Gross goods turnover plummeted by 11.8%, settling at EUR 79.7 billion (USD 83.48 billion), down from EUR 90.4 billion (USD 94.69 billion) in 2022 The e-commerce share of total retail (excluding food but including pharmacy revenues) dipped to 10.2%, a drop from 11.8% in 2022.

- While digital services like vacation bookings and concert ticket sales saw a recovery, the momentum weakened. These services grew by 12.7% to EUR 12.7 billion (USD 13.30 billion), a stark contrast to the previous year's 39.9% surge to EUR 11.25 billion (USD 11.78 billion). Consequently, the combined turnover for the e-commerce sector (goods and services) fell below the EUR 100 billion (USD 104.74 billion) mark for the first time since 2020. Total revenues from online trade in 2023, including those generated via telephone, fax, or other means, reached EUR 93.6 billion (USD 98.04 billion).

- Retailers will remember 2023 as a year of significant shifts. Direct-to-consumer (D2C) retailers, despite an 11.1% revenue drop in 2022, have established a more stable long-term growth trajectory, boasting figures 62% above their pre-pandemic 2019 values. Marketplaces and online retailers saw declines of 8.5% and 14.7% respectively, yet both stand 19.0% and 7.0% above their pre-COVID values. Multichannel trading faced the steepest revenue drop at 18.1%, coinciding with a noted resurgence of customers at physical points of sale.

- Online shopping activity waned further in 2023. The proportion of regularly active online customers making purchases in the dipped to 34.3%, a notable decline from the 40% average in 2019 and below the four-year average. As the e-commerce landscape continues to wane, demand for express delivery services has seen a subtle dip.

Germany Express Delivery Industry Overview

The German express delivery market is fragmented with a lot of local, regional, and global players. Major players include DHL Group, Hermes Europe Gmbh, Dynamic Parcel Distribution (DPD), General Logistics Systems B.V. (GLS), United Parcel Services (UPS), etc.

To better serve their customers, companies are integrating cutting-edge technological advancements into their supply chains. In June 2024, DHL Express, the world's foremost international express service provider, upgraded its AI-driven platform, "My Global Trade Services" (MyGTS), introducing a new "trade lane comparison" feature. This addition allows businesses, regardless of size, to access and reference current trade lane regulations and requirements between exporting and importing nations or territories. Consequently, firms eyeing market expansion can utilize this tool for informed decision-making, enhancing efficiency and securing a competitive edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for same day delivery driving the market

- 4.2.2 Increased disposable income driving the market

- 4.3 Market Restraints

- 4.3.1 High cost compared to traditional delivery methods hindering the market

- 4.3.2 Regulatory constraints affecting the market

- 4.4 Market Opportunities

- 4.4.1 Technological advancements driving the market

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends in Industry

- 4.9 Insights on the E-commerce Industry (Domestic and Cross-border E-commerce)

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Business

- 5.1.1 B2B (Business-to-Business)

- 5.1.2 B2C (Business-to-Consumer)

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By End User

- 5.3.1 Services (BFSI (Banking, Financial Services and Insurance))

- 5.3.2 Wholesale and Retail Trade (E-commerce)

- 5.3.3 Manufacturing, Construction, and Utilities

- 5.3.4 Primary Industries (Agriculture, and Other Natural Resources)

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 DHL Group

- 6.2.2 Hermes Europe Gmbh

- 6.2.3 Dynamic Parcel Distribution (DPD)

- 6.2.4 General Logistics Systems B.V. (GLS)

- 6.2.5 United Parcel Services (UPS)

- 6.2.6 FedEx Express

- 6.2.7 DB Schenker

- 6.2.8 Go Express

- 6.2.9 Atlantic International Express

- 6.2.10 Nippon Express *

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries