|

市場調查報告書

商品編碼

1636157

歐洲冷藏貨櫃運輸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Refrigerated Container Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

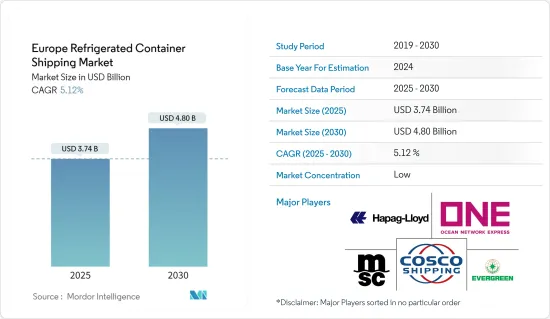

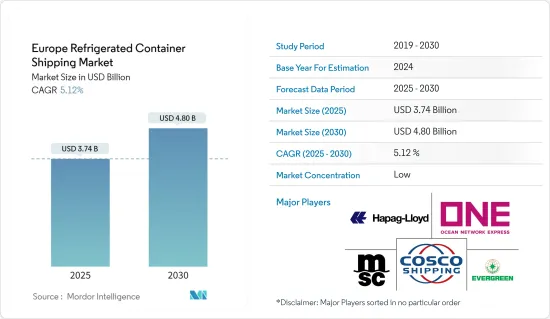

歐洲冷藏貨櫃運輸市場規模預計到2025年為37.4億美元,預計到2030年將達到48億美元,預測期內(2025-2030年)複合年成長率為5.12%。

主要亮點

- 製藥業需求的增加正在推動市場。此外,冷藏運輸中先進技術的使用正在推動市場發展。

- 歐盟委員會活性化制定法律和政策的力度,刺激了歐洲製藥業冷藏貨櫃的興起。歐盟 (EU) 透過旨在改善歐洲公司貿易前景的特殊政策來管理貿易和投資關係。這刺激了對用於藥品運輸的冷藏集裝箱的強勁需求。德國 MECOTEC 集團於 2021 年 11 月提供了 8 個冷藏貨櫃來冷凍COVID-19 疫苗。 2022 年 4 月,康德樂獲得了一份價值 5780 萬美元的契約,負責存儲和交付 80,000 托盤個人防護工具(PPE),以支持國家戰略儲備 (SNS)。它是美國衛生與公眾服務部 (HHS) 負責準備和回應的助理部長辦公室的一部分。

- 最近的一項研究顯示,基於對15條冷藏貿易航線的分析,乾貨貨櫃運價在2021年成長了四倍多,其中2021年第三季成長了50%。此外,根據該公司的Dalreftrans子公司擴大策略,2022年7月,FESCO運輸集團計劃在2022年夏末將持有擴大到4,000個。因此,藥品運輸和物流需求的不斷成長正在推動冷藏貨櫃的使用。

- 藥品供應鏈中使用的技術正在不斷擴展,以提供將醫療用品安全運送到目的地的新方法。控制塔技術、包裝自動化、人工智慧等技術在藥品低溫運輸設施中大量應用。低溫運輸敏感藥物的最新發展,包括治療罕見和慢性疾病的生物療法、治療 COVID-19 和其他感染疾病的疫苗、新的腫瘤治療以及細胞和基因 (CGT) 療法,都取得了更複雜的進展。鏈要求。 2022 年 8 月,馬士基公司 (MCI) 宣布計劃在南卡羅來納州里奇維爾建造一座新的溫控貨物倉儲設施,將於 2023 年第一季投入營運。

- 冷藏貨櫃的不斷進步有助於提高製藥業使用的貨櫃的效率和可靠性。關鍵發展之一是大多數運輸公司擴大使用物聯網(物聯網連接)設備。海事流程可擷取並通訊大量資料,這些數據可用於提供關鍵見解並診斷困難、防止停機並最佳化程序,最終提高航運業的業務效率。 2022年2月,CMA CGM推出了SMART Reefer Container,這是一種用於冷藏貨物的互聯貨櫃。使用智慧冷凍貨櫃追蹤冷藏物品的位置和狀態。此外,2022年3月,全球物聯網解決方案供應商ORBCOMM Inc.宣布推出CT 3500物聯網遠端資訊處理設備。它具有冷藏集裝箱智慧管理的新發展。

歐洲冷藏貨櫃運輸市場趨勢

醫藥產業的成長帶動市場

- 歐洲製藥協會聯合會 (EFPIA) 每年都會出版概況,強調製藥業在非洲大陸的戰略重要性。當跨大西洋的平衡繼續從歐洲轉向美國時,中國正在成為一個新的力量。多年來,隨著國內研發力道的加大,國內醫藥市場以兩位數的成長率成長。許多對全球健康影響最大的藥物都是由歐洲生物製藥公司發現或開發的,這與它們豐富的歷史一致。在績效的推動下,藥物開發公司增加了研發投資,以創造未來的藥物。

- 醫藥供應鏈產業過去曾經歷困難時期。公司必須適應新技術,以繼續支援醫院交付服務、大流行期間的患者運輸、緊急應變以及家庭和醫院醫療用品的交付。事實證明,在關鍵時刻利用各種數位技術支援調度、供應鏈管理和供應鏈最佳化工作流程可以提高藥品的可及性、品質和可負擔性。歐洲製藥公司不斷與政府、非政府組織和物流提供者合作,擴大其低溫運輸物流基礎設施。這將確保向世界各地的人們提供救命藥物。

- 他們傾向於依靠實體資產來支援所有開發、製造和中斷業務,並且許多情況需要重複使用舊資產。正在引入多種技術來幫助預測和維護製藥設備。這將有助於進一步減少計劃外設備中斷和潛在的供應中斷。除了這些趨勢之外,北美公司還應該為歐洲停機或中斷期間外包的可能性做好規劃。近幾個月來,越來越多的歐洲製藥公司轉向藥品外包策略,以確保全球藥品供應的連續性。儘管歐洲製藥業在這一領域取得了一些進展,但重要的工作仍然存在,包括培養對文化差異和危機管理的理解和容忍。

冷藏運輸需求的增加推動了市場

- 全球市場主要由食品和飲料行業的顯著成長所推動。一般消費者對新鮮產品不斷成長的需求有助於維持這一趨勢。此外,透過使用智慧型手機進行網路購物和宅配的需求日益成長,是推動冷藏運輸需求的主要因素。此外,基於行動應用程式的訂購平台的出現以及對生鮮食品的需求不斷增加,特別是需要頻繁物流服務的快餐店(QSR)預計將有助於市場。

- 歐洲是世界冷藏運輸領域的第三大地區。由於該全部區域對生鮮產品的需求不斷增加,市場主要受到蓬勃發展的食品和飲料行業的推動。除此之外,歐洲擁有高度發展的冷藏運輸業。這意味著配備先進冷凍系統的高方拖車的需求量很大。此外,該地區的主要企業正在實施可最大限度減少污染的節能技術。最近的技術進步增加了對運送食品和原料的冷藏車的需求。此外,海洋運輸車輛因其成本低廉而變得越來越受歡迎,推動了產業的發展。

歐洲冷藏貨櫃運輸業概況

歐洲冷藏貨櫃運輸市場高度分散,擁有大量區域、本地和全球參與者。主要參與者包括地中海航運公司-MSC、中遠海運集運、赫伯羅特、長榮海運和 Ocean Network Express (ONE)。嚴格的國際政府法規和需求的周期性也正在影響產業結構。航運公司正在對新資產進行審慎投資,以確保客戶的可靠性和效率,同時實現更高的投資收益。海上運輸自動化的預測趨勢和不斷提高的海上安全標準也有望在未來幾年為市場參與企業提供者機。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態

- 目前的市場狀況

- 市場概況

- 市場動態

- 促進因素

- 與航空貿易相比,人們越來越偏好海上貿易

- 對智慧冷凍貨櫃的需求增加

- 抑制因素

- 冷藏貨櫃營運和財務挑戰可能會阻礙市場成長

- 機會

- 低溫運輸產業的發展提供了市場開放機會,也提供了潛在的市場成長機會。

- 促進因素

- 價值鏈/供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 行業法規政策

- 物流領域技術發展

- 政府措施和監管方面

- COVID-19大流行對市場的影響

第5章市場區隔

- 按尺寸

- 小貨櫃(20英尺)

- 大貨櫃(40英尺)

- 高立方容器

- 按國家/地區

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Mediterranean Shipping Company-MSC

- COSCO Shipping Lines

- Hapag-Lloyd

- Evergreen Marine Line

- Ocean Network Express(ONE)

- Smith Europe

- CMA CGM Group

- Hyundai Merchant Marine(HMM)

- Yang Ming Transport Corporation

- ZIM Integrated Shipping Services

- Unifeeder*

第7章 市場的未來

第8章附錄

The Europe Refrigerated Container Shipping Market size is estimated at USD 3.74 billion in 2025, and is expected to reach USD 4.80 billion by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

Key Highlights

- The increasing demand from the pharmaceutical industry drives the market. Furthermore, the market is driven by the use of advanced technology in reefer transportation.

- The European Commission's increased initiatives for creating laws and policies fuel the rise of the reefer container for the pharmaceutical sector in Europe. The European Union administers its trade and investment relations through a special policy that strives to improve trading prospects for European enterprises. It adds to the strong demand for reefer containers for pharmaceutical product transportation. MECOTEC Group, Germany, provided 8 containers for deep-freeze storage of COVID-19 vaccines in November 2021. Cardinal Health was awarded a USD 57.8 million contract in April 2022 for the storage and delivery of 80,000 pallets of personal protective equipment (PPE) to support the Strategic National Stockpile (SNS). It is a part of the Office of the Assistant Secretary for Preparedness and Response within the US Department of Health and Human Services (HHS).

- According to recent studies, there was a 50% increase in the third quarter of 2021 based on an analysis of 15 reefer trade routes, while dry container freight charges more than quadrupled in 2021. In addition, under the company's Dalreftrans subsidiary expansion strategy, FESCO Transportation Group planned to extend its fleet of reefer containers to 4,000 units by the end of summer 2022 in July 2022. Thus, an increase in the demand for pharmaceutical product transportation and logistics is driving the use of reefer containers.

- Technologies utilized in pharmaceutical supply chains are expanding to provide new approaches to secure the safe transportation of medical items to their intended destinations. Control tower technology, packing automation, artificial intelligence, and other technologies are heavily used in pharmaceutical cold chain facilities. Recent advancements in the distribution of temperature-sensitive pharmaceutical products, ranging from biological therapies to treat rare and chronic diseases, vaccines to treat COVID-19 and other infectious diseases, novel oncology treatments, and cell and gene (CGT) therapies, presented more complex cold-chain requirements. In August 2022, Maersk Company (MCI) announced a new cold storage facility planned for Ridgeville, South Carolina, to serve temperature-controlled goods, which began its operations in the first quarter of 2023.

- Continuous advancements in reefer containers are helping to improve the efficiency and dependability of containers used in the pharmaceutical business. One of the critical developments is the rising use of Internet of Things (IoT-connected) devices by most transport companies. During the shipping process, a large amount of data is captured and communicated, used to draw significant insights and diagnose difficulties, prevent downtime, and optimize procedures, ultimately enhancing operating efficiencies in the maritime industry. CMA CGM unveiled their SMART reefer container, a connected container for refrigerated goods, in February 2022. The position and status of refrigerated goods can be tracked using SMART reefer containers. Furthermore, in March 2022, ORBCOMM Inc., a global provider of IoT solutions, announced the launch of its CT 3500 IoT telematics device. It features the next evolution in the smart management of refrigerated containers.

Europe Refrigerated Container Shipping Market Trends

Growth in Pharmaceutical industry driving the market

- Every year, the European Federation of Pharmaceutical Industries and Associations (EFPIA) releases an annual factbook to highlight the pharmaceutical industry's enormous strategic importance to the continent. While the trans-Atlantic balance continues to shift away from Europe and towards the United States, China is emerging as a new powerhouse. For many years, the domestic pharma market grew at a double-digit rate, accompanied by intensive domestic R&D efforts. Many of the drugs that had the greatest influence on global health were discovered or developed by European biopharmaceutical companies in keeping with their rich past. Drug developers increased R&D investment to generate the medicines of the future, buoyed by achievements.

- The pharmaceutical supply chain sector had a difficult time in the past. Companies had to adapt to new technology to provide ongoing assistance for hospital distribution services, patient transportation during the pandemic, emergency response circumstances, and pharmaceutical home and hospital deliveries. It is demonstrated that using various digital technologies to support scheduling, supply chain management, and supply chain optimization workflows at key periods improves drug accessibility, quality, and price. European pharmaceutical companies are constantly collaborating with governments, non-governmental organizations, and logistics providers to expand cold-chain logistics infrastructure. It will ensure the delivery of life-saving medications to the worldwide population.

- There is a tendency to rely on physical assets to support all development, manufacturing, and disruption operations, and old assets will need to be repurposed in many circumstances. Several technologies are being implemented to aid in the prediction and maintenance of pharmaceutical equipment. It will help to mitigate unplanned equipment shutdowns and potential supply disruptions even further. In addition to this tendency, North American firms should plan for prospective outsourcing opportunities during European downtimes and disruptions. More pharmaceutical businesses in Europe used the pharmaceutical outsourcing strategy in the last few months to secure global medicine supply continuity. The European pharmaceutical sector made some headway in this area, but there are still some critical activities like understanding and developing tolerance towards cultural differences and crisis management.

Increasing demand for reefer transportation driving the market

- The global market is primarily driven by significant growth in the food and beverage industry. The increased demand for fresh commodities among the general public can help to sustain this. In addition, the growing desire for online shopping and home delivery as a result of smartphone use is a major driver driving demand for refrigerated transport. Furthermore, the advent of mobile app-based ordering platforms as a result of rising demand for fresh food goods, particularly from quick service restaurants (QSRs) that require frequent logistic services, is considered to help the market.

- In the global refrigerated transport sector, Europe is the third largest region. Due to an increase in demand for fresh items across the region, the market is primarily driven by the thriving food and beverage industry. Aside from that, Europe includes a highly developed refrigerated transport industry. It means that high-cube trailers with advanced refrigeration systems are in high demand. Furthermore, the region's major players are introducing fuel-efficient technology that assists in minimizing pollution. Recent technological advancements increased the demand for refrigerated vehicles for delivering food and raw materials. Furthermore, the growing popularity of maritime transport vehicles due to their low cost is propelling the industry forward.

Europe Refrigerated Container Shipping Industry Overview

The Europe Refrigerated Container Shipping Market is highly fragmented, with a lot of local, regional, and global players. Some of the major players include Mediterranean Shipping Company - MSC, COSCO Shipping Lines, Hapag-Lloyd, Evergreen Marine Line, Ocean Network Express (ONE), and many more. Stringent international government restrictions and demand cyclicality also influence the industry structure. Shipping companies are making prudent investments in new assets to ensure customer dependability and efficiency while earning higher returns on investment. The predicted trend of automation in marine transportation, as well as the rise in marine safety standards, are also expected to generate opportunities for market participants in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Rising Preference for Maritime Trade over Airborne Trade

- 4.3.1.2 Smart reefer containers gain demand

- 4.3.2 Restraints

- 4.3.2.1 Operational and Financial Challenges Associated with Reefer Containers may hamper the growth of the market

- 4.3.3 Opportunities

- 4.3.3.1 Developments in cold chain sector present lucrative opportunities holds potential opportunity for growth of the market

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Policies and Regulations

- 4.7 Technological Developments in the Logistics Sector

- 4.8 Government Initiatives and Regulatory Aspects

- 4.9 Impact of the COVID-19 Pandemic on the Market

5 5. MARKET SEGMENTATION

- 5.1 By Size

- 5.1.1 Small Container (20 Feet)

- 5.1.2 Large Container (40 Feet)

- 5.1.3 High Cube Container

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Italy

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mediterranean Shipping Company - MSC

- 6.2.2 COSCO Shipping Lines

- 6.2.3 Hapag - Lloyd

- 6.2.4 Evergreen Marine Line

- 6.2.5 Ocean Network Express (ONE)

- 6.2.6 Smith Europe

- 6.2.7 CMA CGM Group

- 6.2.8 Hyundai Merchant Marine (HMM)

- 6.2.9 Yang Ming Transport Corporation

- 6.2.10 ZIM Integrated Shipping Services

- 6.2.11 Unifeeder*