|

市場調查報告書

商品編碼

1636170

印度家具金屬製品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Furniture Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

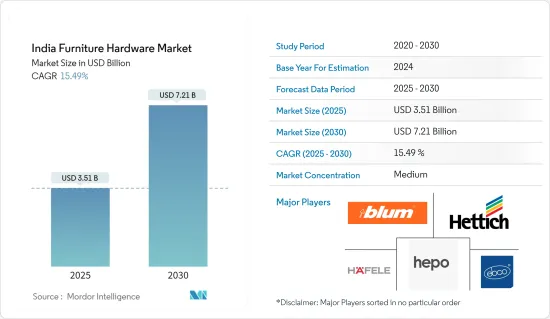

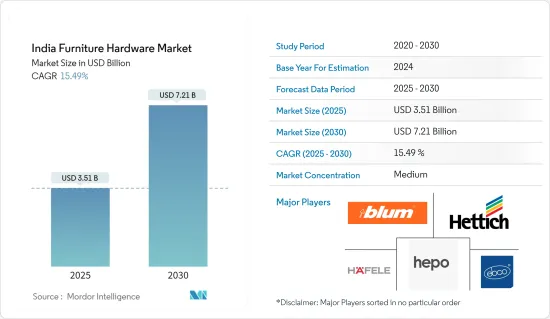

印度家具金屬製品市場規模預計到2025年為35.1億美元,預計到2030年將達到72.1億美元,預測期內(2025-2030年)複合年成長率為15.49%。

在快速都市化、收入增加、對融合美觀和功能的建築金屬製品解決方案的需求不斷增加以及對模組化和組裝家具日益成長的興趣的推動下,印度的家具金屬製品市場正在快速成長。這個市場包括家具製造所必需的各種產品,從鉸鍊和把手到螺絲和抽屜滑軌。此外,家居裝修需求的不斷成長以及客戶對室內設計的意識和知識的不斷提高也推動了市場的發展。印度最近採取了一系列舉措,以增強對外國投資者的吸引力,並將自己定位為首要投資中心。值得注意的是,專注於印度的離岸基金的表現優於新興市場基金,並吸引了全球投資者的興趣。

高力新報告顯示,2019年至2023年,印度房地產領域的機構投資將有77%為外資流入,年均達40億美元。 2024 會計年度迄今為止,外國證券投資 (FPI) 已為印度市場注入了 416 億美元。

印度家具金屬製品市場趨勢

住宅家具和金屬製品的增加提振了市場

隨著建設計劃的增加和重建的持續進行,印度對硬體產品的需求預計將激增。印度對木材和木製家具的需求正在迅速成長,尤其是在班加羅爾、德里和孟買等大城市。在住宅和商業房地產美化趨勢的推動下,技術創新和快速都市化正在推動印度家具和金屬製品製造業的激增。儘管原料成本上漲和外匯波動帶來挑戰,但隨著人們對經濟適用住宅的日益關注,市場正在看到新的機會。住宅領域在印度家具和金屬製品市場中佔據最大的市場佔有率。家具金屬製品市場的成長得益於對裝修計劃不斷成長的需求和越來越多精通設計的客戶的支持。這種需求的增加不僅限於金屬製品,還引起了整個建築市場的共鳴。

線籃家具金屬製品盤活市場

金屬絲籃在印度很受歡迎,尤其是在模組化和現代家具中。這些籃子現在已成為咖啡桌、邊桌和儲物單元等家具的標準配置,既時尚又方便。您可以存放書籍、雜誌、毛毯和電器產品等所有物品,讓物品井然有序且易於取用。此外,這款金屬絲籃為您的家具注入現代工業風格,迎合精緻實用設計愛好者的需求。不銹鋼貨運系列具有 10 年防銹保證。這些產品在海蒂詩位於印度巴羅達的工廠生產,符合嚴格的國際品質標準。

印度家具金屬製品產業概況

印度家具金屬製品市場競爭激烈,玩家眾多。市場多樣化的產品範圍進一步促進了這種競爭,吸引了許多國際品牌。 Hafele India、Blum India 和 Ebco 等主要企業正在積極採取產品發布、活動參與和業務擴張等策略舉措,以提高市場佔有率並增加收益。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 城市擴張刺激了住宅建設,進而刺激了對家具和建築金屬製品的需求。

- 辦公室和酒店等商業空間的成長推動了對家具和金屬製品的需求

- 市場限制因素

- 市場對價格的敏感度影響優質金屬製品解決方案的採用

- 確保不同產品和供應商的品質一致是一項挑戰,會影響客戶滿意度和品牌忠誠度

- 市場機會

- 協作和策略夥伴關係

- 利用印度具有成本效益的製造能力並進入全球市場創造利潤豐厚的收益流

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察最新市場趨勢、最新市場發展與創新

- 深入了解市場主要企業採取的關鍵策略(新產品發布、合作夥伴關係、業務擴張等)

- 印度家具金屬製品本地生產與進口的見解

- COVID-19 對市場的影響

第5章市場區隔

- 依產品類型

- 鉸鏈

- 流道系統

- 電梯系統

- 盒子系統

- 鐵絲籃

- 橫拉門系統

- 把手、把手、旋鈕

- 緊固件(螺絲、螺栓、螺帽等)

- 其他產品

- 按最終用戶

- 住宅

- 商業的

- 按分銷管道

- B2B/計劃(房地產開發、建築公司等)

- B2C/零售

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Blum India Pvt. Ltd

- Hettich India Pvt. Ltd

- Hafele India Private Limited

- Ebco Private Limited

- Hepo India Pvt. Ltd

- FGV(Hindware Home Innovation Limited)

- Godrej & Boyce Manufacturing Company Limited

- Dorset Industries Pvt. Ltd

- Ozone Overseas Pvt. Ltd

- Salice India Pvt. Ltd

- ASSA ABLOY

- KAFF

- GRASS(an Austrian Manufacturer)

- Denz Enterprise

- Hexa Wood Pvt. Ltd

- Kich Architectural Products Pvt. Ltd*

第7章 未來市場趨勢

第 8 章 免責聲明與出版商訊息

The India Furniture Hardware Market size is estimated at USD 3.51 billion in 2025, and is expected to reach USD 7.21 billion by 2030, at a CAGR of 15.49% during the forecast period (2025-2030).

The Indian furniture hardware market is witnessing a surge, propelled by rapid urbanization, rising incomes, increasing demand for architectural hardware solutions that blend aesthetics with functionality, and a growing affinity for modular and ready-to-assemble furniture. This market encompasses a spectrum of products, from hinges and handles to screws and drawer slides, all pivotal in furniture manufacturing. The market is further driven by rising demand for renovation projects and customers' growing awareness and knowledge about interior design. India has recently implemented a series of initiatives to bolster its appeal to foreign investors, positioning itself as a prime investment hub. Notably, India-focused offshore funds have outperformed their counterparts in emerging markets, piquing the interest of global investors.

Colliers' recent report highlights that from 2019 to 2023, foreign inflows dominated institutional investments in India's real estate sector, accounting for 77% and averaging a substantial USD 4 billion annually. Moving into FY 2024, foreign portfolio investments (FPIs) injected a noteworthy USD 41.6 billion into the Indian market.

India Furniture Hardware Market Trends

Increase in Residential Furniture Hardware is Fuelling the Market

With an uptick in construction projects and ongoing renovations, the country is poised to witness a surge in hardware product demand. The demand for wood and wooden furniture in India has surged, especially in metro cities such as Bangalore, Delhi, and Mumbai. Technological innovations and rapid urbanization are fueling a surge in the manufacturing of furniture hardware in India, driven by the trend of beautifying residential and commercial buildings. Rising raw material costs and currency fluctuations pose challenges, but the market finds new opportunities due to a growing emphasis on affordable housing. In India's furniture hardware landscape, the residential segment notably commands the largest market share. The growth in the furniture hardware market is underpinned by a rising demand for renovation projects and a more design-savvy customer base. This heightened demand is not confined to hardware but resonates across the broader construction market.

Wire Baskets Furniture Hardware is Fuelling the Market

Wire baskets are popular in India, particularly in modular and contemporary furniture. These baskets are now standard in furniture like coffee tables, side tables, and storage units, offering both style and convenience. They boast versatility, storing various items, from books and magazines to blankets and electronics, while maintaining an organized and accessible setup. Moreover, these wire baskets infuse furniture with a modern, industrial flair, catering to sleek, functional design fans. Crafted from stainless steel, the Cargo Series boasts a 10-year replacement warranty against rust, a testament to its impeccable plating finish. These products are proudly manufactured at Hettich's Vadodara Plant in India, adhering to rigorous international quality standards.

India Furniture Hardware Industry Overview

The Indian furniture hardware market is fiercely competitive, boasting a multitude of players. This competition is further fueled by the market's diverse product range, which attracts a host of international brands. Key players like Hafele India, Blum India, Ebco, and others actively engage in strategic moves, including product launches, event participation, and expansions, to bolster their market presence and boost revenues.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Expansion is Fueling Residential Construction, Spurring the Need for Furniture and Architectural Hardware

- 4.2.2 The Growth of Commercial Spaces like Offices and Hotels Bolsters the Demand for Furniture Hardware

- 4.3 Market Restraints

- 4.3.1 The Market's High Sensitivity to Prices is Impacting the Adoption of Premium Hardware Solutions

- 4.3.2 Ensuring Consistent Quality Across Diverse Products and Suppliers Poses Challenges, Impacting Customer Satisfaction and Brand Loyalty

- 4.4 Market Opportunities

- 4.4.1 Collaboration and Strategic Partnerships

- 4.4.2 Harnessing India's Cost-efficient Manufacturing Prowess to Access Global Markets Promises Lucrative Revenue Streams

- 4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into the Latest Trends, Recent Developments, and Innovations in the Market

- 4.7 Insights on Key Strategies (New Product Launches, Collaborations, Expansions, etc.) Adopted by Leading Players in the Market

- 4.8 Insights on Local Production Versus Import of Furniture Hardware in India

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hinges

- 5.1.2 Runner Systems

- 5.1.3 Lift Systems

- 5.1.4 Box Systems

- 5.1.5 Wire Baskets

- 5.1.6 Sliding Door Systems

- 5.1.7 Handles, Pulls, and Knobs

- 5.1.8 Fasteners (Screw, Bolts, Nuts, etc.)

- 5.1.9 Other Products

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 B2B/Projects (Real Estate Developers, Contractors, Etc.)

- 5.3.2 B2C/Retail

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Blum India Pvt. Ltd

- 6.2.2 Hettich India Pvt. Ltd

- 6.2.3 Hafele India Private Limited

- 6.2.4 Ebco Private Limited

- 6.2.5 Hepo India Pvt. Ltd

- 6.2.6 FGV (Hindware Home Innovation Limited)

- 6.2.7 Godrej & Boyce Manufacturing Company Limited

- 6.2.8 Dorset Industries Pvt. Ltd

- 6.2.9 Ozone Overseas Pvt. Ltd

- 6.2.10 Salice India Pvt. Ltd

- 6.2.11 ASSA ABLOY

- 6.2.12 KAFF

- 6.2.13 GRASS (an Austrian Manufacturer)

- 6.2.14 Denz Enterprise

- 6.2.15 Hexa Wood Pvt. Ltd

- 6.2.16 Kich Architectural Products Pvt. Ltd*