|

市場調查報告書

商品編碼

1636199

郵輪物流:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cruise Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

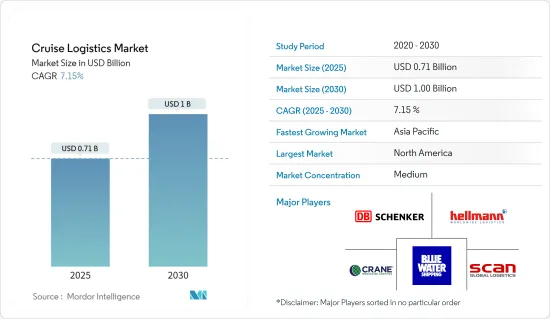

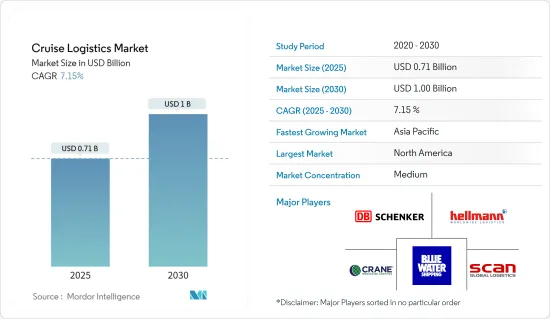

郵輪物流市場規模預計2025年將達到7.1億美元,預計2030年將達10億美元,預測期間(2025-2030年)複合年成長率為7.15%。

隨著向綠色郵輪營運的轉變,以綠色供應和永續燃料選擇為特色,物流提供者必須適應新的環境法規和標準。在瑞典,郵輪市場越來越注重永續性,公司優先考慮環保選擇並促進負責任的旅遊業。

從2023年初開始,斯德哥爾摩港將其工作車輛改用生物柴油(HVO100)取代Mk1柴油,每年減少化石二氧化碳排放約200噸。目標是到 2030 年使斯德哥爾摩港的業務不再使用石化燃料。此外,從 2024 年 7 月起,將鼓勵郵輪公司對至少三種類型的廢棄物進行分類:塑膠、紙張和金屬。

人們正在做出各種努力來盡量減少郵輪上廢棄物的產生。例如,Costa Crociere 的 4GOODFOOD 計畫旨在將船上的食物廢棄物減少一半,符合聯合國永續發展議程到 2030 年將食物廢棄物減少 50% 的目標。

有效減少郵輪上的食物浪費需要精確的物流管理、先進的低溫運輸物流和更好的包裝,以確保食物品質並最大限度地減少運輸和儲存過程中的腐敗。時間表。這種向永續性的轉變解決了生態問題,並在郵輪物流行業培育了更具彈性和前瞻性的方法。

郵輪物流市場趨勢

郵輪物流整合與增強的趨勢

2023年郵輪客運市場將大幅成長55%,重要的物流公司正在加強服務。 Radiant 物流就是這樣一家公司,以其技術主導的全球營運而聞名,於 2024 年 2 月採取了一項策略性舉措。我們收購了兩家私人公司: Select 物流和 Select Cartage,這兩家公司均位於佛羅裡達州多拉爾。自 2007 年收購以來,這些公司一直是 Radiant 的 Adcom Worldwide 品牌的一部分,並已整合到 Radiant 不斷擴大的郵輪物流產品組合中。 Radiant的交易結構符合業界標準,將部分付款與被收購公司的未來業績掛鉤。

Radiant的收購策略是基於成長和加強其在郵輪物流的地位。透過將這些營業單位整合到 Adcom Worldwide 品牌中,Radiant 旨在加強其服務套件,特別是運輸、倉儲和其他對郵輪營運至關重要的關鍵物流功能。

這些全產業趨勢凸顯了郵輪產業向物流端到端物流解決方案的轉變。透過收購,Radiant 物流等公司準備提供全面的物流支持,涵蓋供應、倉儲、清關和港口業務。將收購成本與未來業績聯繫起來的重點凸顯了該行業對成長和卓越營運的承諾,並符合日益複雜的郵輪物流的需求。

綠色措施正在改變歐洲的郵輪物流

2023年6月,世界上第一艘環保郵輪從比利時安特衛普港啟航,展開為期10天的北海環球航行。這艘 300m 長的遊輪是同類中的第一艘遊輪,旨在迎合具有環保意識的旅行者,提供奢華的體驗,同時最大限度地減少對環境的影響。

為了凸顯環保洗腦遊輪體驗日益成長的趨勢,歐洲運輸與環境聯合會發起了一場宣傳「100%綠色遊輪」的模擬宣傳活動,口號是「讓不永續的事情變得永續」。總部位於瑞士的地中海郵輪 (MSC Cruises) 等公司正在宣傳液化天然氣 (LNG) 作為石油的綠色替代品,但液化天然氣存在環境缺陷。液化天然氣燃燒時會排放二氧化碳並洩漏甲烷,就全球暖化潛力而言,甲烷是比二氧化碳更強大的污染物。

綠色郵輪的推動正在創造對環保物流解決方案的需求。這包括有機食品和環保產品等材料的永續採購和運輸,以及在燃料管理和廢棄物處理方面採用環保做法。隨著越來越多的旅客優先考慮永續性以及法規的收緊,物流公司可能需要透過綠色物流認證和定期環境影響審核來遵守這些新標準。

郵輪物流行業概況

郵輪物流市場的競爭格局受到多種因素的影響,包括技術進步、監管障礙和郵輪港口的擴張。領先的公司利用即時追蹤、自動化和先進的庫存管理來提高業務效率和透明度。 DB Schenker、Hellmann Worldwide 物流和 Klein Worldwide 物流等公司憑藉其廣闊的全球影響力和多樣化的服務組合而脫穎而出。

儘管面臨嚴峻的營運成本和嚴格的法規,這些市場領導仍在加倍投入專門的基礎設施,特別是溫控儲存和運輸,強調了他們對安全和品質的承諾。此外,市場正在見證永續性措施的激增以及對亞太和南美洲快速成長市場的策略性進入。鑑於該行業的活力,該公司正在巧妙地應對從自然災害到地緣政治變化再到流行病的供應鏈中斷,並確保無縫交付,支持蓬勃發展的郵輪業。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 洞察供應鏈/價值鏈分析

- 產業監管洞察

- 洞察產業技術進步

第5章市場動態

- 市場促進因素

- 世界各地郵輪港口的擴建

- 郵輪假期越來越受歡迎

- 市場限制因素

- 與維持高標準相關的成本

- 市場機會

- 越來越重視永續性和環境課責

- 將郵輪業擴展到新興市場

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 依物流服務類型

- 港口業務

- 供應鏈管理

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東/非洲

- 南美洲

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- DB Schenker

- Hellmann Worldwide Logistics

- Crane Worldwide Logistics

- Blue Water Shipping

- Scan Global Logistics

- Southampton Freight Services

- CNS Logistics

- TEFRA Cruise Logistics

- SAS Cruise Logistics

- ATPI*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

The Cruise Logistics Market size is estimated at USD 0.71 billion in 2025, and is expected to reach USD 1.00 billion by 2030, at a CAGR of 7.15% during the forecast period (2025-2030).

The shift toward greener cruise operations, featuring eco-friendly supplies and sustainable fuel options, requires logistics providers to adapt to new environmental regulations and standards. In Sweden, the cruise market increasingly emphasizes sustainability, with companies prioritizing eco-friendly choices and promoting responsible tourism.

Since the beginning of 2023, Ports of Stockholm has transitioned its work vehicles to biodiesel (HVO100) instead of Mk1 diesel, reducing fossil carbon dioxide emissions by approximately 200 tonnes annually. The aim is to make Ports of Stockholm's operations fossil-free by 2030. Additionally, starting in July 2024, cruise lines are encouraged to segregate and manage at least three types of waste: plastics, paper, and metal.

Various initiatives are in place to minimize waste production on cruise ships. For instance, Costa Crociere's 4GOODFOOD program targets halving food waste on its ships in line with the UN's Sustainable Development Agenda goal of reducing food waste by 50% by 2030, now implemented across eight EU destinations.

Effective food waste reduction on cruise ships requires precise logistics management, advanced cold chain logistics, better packaging solutions, and optimized delivery schedules to ensure food quality and minimize spoilage during transport and storage. This shift toward sustainability addresses ecological concerns and fosters a more resilient and forward-thinking approach within the cruise logistics industry.

Cruise Logistics Market Trends

Trend Toward Consolidation and Enhanced Capabilities in Cruise Logistics

The cruise passenger market witnessed a remarkable 55% growth in 2023, prompting significant logistics firms to bolster their services. One such player, Radiant Logistics Inc., known for its tech-driven global operations, made a strategic move in February 2024. It acquired two privately held companies, Select Logistics Inc. and Select Cartage Inc., based in Doral, Florida. These firms, part of Radiant's Adcom Worldwide brand since an earlier acquisition in 2007, were integrated into Radiant's expanding cruise logistics portfolio. Radiant's deal structure, aligning with industry norms, tied a portion of the payment to the acquired firms' future performance.

Radiant's acquisition strategy is about growth and consolidating and elevating its position in cruise logistics. By integrating these entities into its Adcom Worldwide brand, Radiant aims to strengthen its suite of services, particularly transportation, warehousing, and other critical logistics functions essential for cruise operations.

This industry-wide trend underscores a shift toward tailored, end-to-end logistics solutions for the cruise sector. Through acquisitions, companies like Radiant Logistics are poised to provide comprehensive logistical support, covering provisioning, warehousing, customs brokerage, and port operations. The emphasis on tying acquisition costs to future performance highlights the industry's commitment to growth and operational excellence, aligning with the increasingly complex demands of cruise logistics.

Eco-friendly Initiatives Transforming European Cruise Logistics

In June 2023, the world's first green cruise ship embarked on its maiden voyage from the Port of Antwerp, Belgium, for a 10-day tour of the North Sea. This 300-m-long vessel is the first of its kind, offering a luxury experience with minimal environmental impact, catering to eco-conscious travelers.

To highlight the increasing trend of greenwashed cruise experiences, the European Federation for Transport and Environment launched a mock campaign promoting a '100% green cruise' with the slogan 'sustain the unsustainable.' While companies like MSC Cruises, based in Switzerland, advocate for liquefied natural gas (LNG) as a greener alternative to oil, LNG has its environmental drawbacks. It emits CO2 when burned and leaks methane, a pollutant far more potent than CO2 in terms of global warming potential.

This push for green cruising is creating a demand for eco-friendly logistics solutions. This includes sourcing and transporting sustainable supplies such as organic food and environmentally friendly products and adopting greener practices in fuel management and waste disposal. With more travelers prioritizing sustainability and regulations becoming stricter, logistics companies must comply with these new standards, potentially through certifications for green logistics and regular environmental impact audits.

Cruise Logistics Industry Overview

The competitive landscape in the cruise logistics market is influenced by several factors, notably technological advancements, regulatory hurdles, and the widening scope of cruise destinations. Leading players capitalize on real-time tracking, automation, and advanced inventory management to boost operational efficiency and transparency. Companies like DB Schenker, Hellmann Worldwide Logistics, and Crane Worldwide Logistics stand out, leveraging their expansive global reach and diverse service portfolios.

Despite facing steep operational costs and stringent regulations, these market leaders are doubling on specialized infrastructure investments, particularly in temperature-controlled storage and transportation, underscoring their commitment to safety and quality. Moreover, the market is witnessing a surge in sustainability initiatives and a strategic push into burgeoning markets in Asia-Pacific and South America. Given the sector's dynamism, companies are adeptly navigating supply chain disruptions, from natural calamities to geopolitical shifts or pandemics, ensuring seamless delivery to bolster the thriving cruise industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion of Global Cruise Ports

- 5.1.2 The Rising Popularity of Cruise Vacations

- 5.2 Market Restraints

- 5.2.1 Costs Associated With Maintaining High Standards

- 5.3 Market Opportunities

- 5.3.1 Growing Emphasis on Sustainability and Environmental Accountability

- 5.3.2 The Cruise Industry's Expansion into Emerging Markets

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type of Logistics Services

- 6.1.1 Port Operations

- 6.1.2 Supply Chain Management

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.5 South America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DB Schenker

- 7.2.2 Hellmann Worldwide Logistics

- 7.2.3 Crane Worldwide Logistics

- 7.2.4 Blue Water Shipping

- 7.2.5 Scan Global Logistics

- 7.2.6 Southampton Freight Services

- 7.2.7 CNS Logistics

- 7.2.8 TEFRA Cruise Logistics

- 7.2.9 SAS Cruise Logistics

- 7.2.10 ATPI*

- 7.3 Other Companies