|

市場調查報告書

商品編碼

1636229

石油和天然氣固定和旋轉設備:市場佔有率分析、行業趨勢、成長預測(2025-2030)Oil & Gas Static And Rotating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

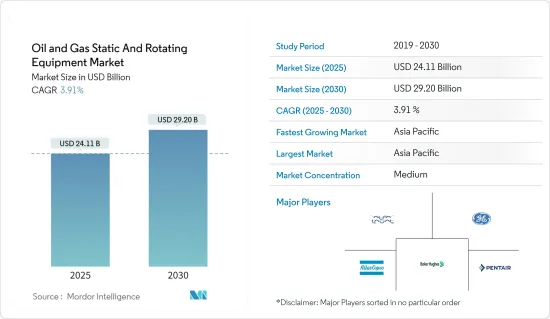

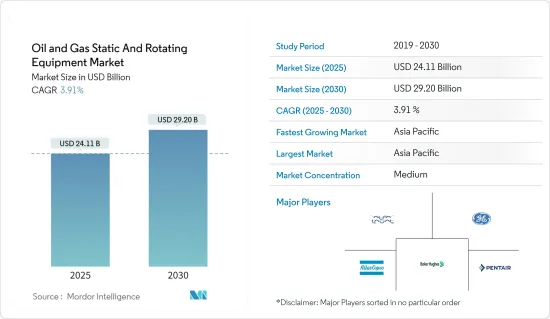

預計2025年石油和天然氣固定和旋轉設備市場規模為241.1億美元,預測期內(2025-2030年)複合年成長率為3.91%,預計到2030年將達到292億美元。

主要亮點

- 由於全球能源需求增加以及海洋探勘活動活性化對固定旋轉設備的需求,預計石油和天然氣固定和旋轉設備市場在預測期內將成長。

- 另一方面,擴大採用可再生能源和清潔能源來源預計將阻礙未來的市場成長。

- 然而,由於在預測期內提高設備效率的技術進步,市場存在顯著成長的機會。

- 預計亞太地區市場在預測期內將顯著成長。

石油和天然氣固定和旋轉設備市場趨勢

預計旋轉設備領域需求量大

- 旋轉設備在石油和天然氣產業中發揮重要作用。此設備的旋轉部件由引擎、壓縮機、渦輪機、工業閥門等組成。旋轉設備通常用於將材料從一個位置運輸到另一個位置,或迫使材料旋轉,例如旋轉螺旋槳。

- 旋轉設備應用於上游、下游、下游等產業。泵浦和壓縮機是旋轉設備的例子,在石油和天然氣生產和儲存中有多種用途。

- 一些石油和天然氣計劃與其他公司簽訂了安裝旋轉設備的協議和合約。例如,2024 年 5 月,Larsen & Toubro (L&T)、L&T Energy Hydrocarbon (LTEH) 從 ONGC 獲得了在 ONGC 孟買 High 和 Tapti 海上基地設計、採購和建造的新型製程氣體壓縮機 (PGC) 模組。安裝和試運行訂單。

- 此外,天然氣產量的增加預計將增加對壓縮機和泵浦等旋轉設備的需求。根據世界能源數據統計,2023年全球天然氣產量為4,0592億立方公尺。自2010年以來天然氣產量持續成長,2020年將略為下降。

- 此外,企業正在加大研發投入,努力提高旋轉設備的效率,這將為旋轉設備未來創造商機。

- 例如,2024年5月,全球旋轉設備解決方案和能源轉換技術領導者約翰·克蘭(John Crane)在加拿大亞伯達獲得了為期五年的合約。該合約描述了大型綜合體的工業密封支援服務。作為合約的一部分,約翰克蘭正在實施管理可靠性計劃 (MRP),以延長現場關鍵資產的使用壽命。這包括旋轉設備,例如離心式幫浦和工業密封件。此類計劃預計將提高旋轉設備的效率並推動未來的需求。

- 因此,由於石油和天然氣行業對旋轉設備的使用和需求,預計該領域在預測期內將有大量需求。

亞太地區市場預計將顯著成長

- 亞太地區擁有全球一半以上的人口,有可能對世界能源的未來產生重大影響。該地區包括印度、中國和日本等正在經歷快速都市化和工業化的新興國家。

- 因此,該地區的能源需求不斷增加,需要石油和天然氣產業的生產和探勘活動。未來的石油和天然氣計劃預計將增加該地區對固定和旋轉設備的需求。

- 例如,2022 年 10 月,SENEX Energy 宣布將在昆士蘭州西南部的 Atlas計劃附近建造一座新的天然氣壓縮設施。該天然氣廠將使用生產許可證 PL209 進行建造。隨著石油和天然氣產量的增加,預計在預測期內對該設備的需求將會增加。

- 根據世界能源數據統計,2023年亞太地區天然氣總產量為6,918億立方米,與前一年同期比較增0.6%。

- 此外,下游計劃的開發預計將推動該地區的市場。石化工業使用固定式和旋轉式設備進行精製。 2023年3月,印度石油公司宣布將投資7.42億美元在奧裡薩邦帕拉迪普興建石化聯合企業。此類新計畫預計將增加設備需求並推動市場。

- 該地區天然氣生產需求的增加預計將大幅增加對石油和天然氣啟動和旋轉設備的需求。例如,根據天然氣出口國論壇的數據,到 2050 年,天然氣預計將佔東南亞發電總量的 36%。綜上所述,亞太地區天然氣需求預計將大幅成長,到2050年將達到710 bcm。

- 由於石油和天然氣行業的發展以及能源需求的增加,預計亞太地區將顯著成長。

石油和天然氣固定和旋轉設備產業概述

石油和天然氣固定和旋轉設備市場已減少一半。市場上的主要企業包括(排名不分先後)阿法拉伐公司、阿特拉斯·科普柯公司、通用電氣公司、貝克休斯公司和濱特爾公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 能源需求增加

- 活性化海洋探勘活動

- 抑制因素

- 更多採用可再生和清潔能源來源

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 目的

- 上游

- 中產階級

- 下游

- 類型

- 固定式

- 旋轉式

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 俄羅斯

- 北歐的

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 卡達

- 奈及利亞

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Alfa Laval AB

- Atlas Copco AB

- General Electric Co

- Baker Hughes Co.

- Pentair PLC

- Siemens AG

- Sulzer Limited

- FMC Technologies Inc.

- Flowserve Corporation

- Mitsubishi heavy Industries Ltd

- Doosan Group

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 提高效率的技術進步

簡介目錄

Product Code: 50003497

The Oil & Gas Static And Rotating Equipment Market size is estimated at USD 24.11 billion in 2025, and is expected to reach USD 29.20 billion by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

Key Highlights

- The oil and gas static and rotating equipment market is expected to grow during the forecast period due to increasing global energy demand and the need for static rotating equipment from increased offshore exploration activities.

- On the other hand, the rising adoption of renewable and cleaner energy sources is expected to hamper the market growth in the future.

- However, there is an opportunity for significant market growth through technological advancements to improve equipment efficiency during the forecast period.

- Asia-Pacific is expected to witness significant growth in the market during the forecast period.

Oil & Gas Static And Rotating Equipment Market Trends

The Rotating Equipment Segment is Expected to Have a Significant Demand

- Rotating equipment plays a significant role in the oil and gas industry. The rotating components of this equipment may consist of engines, compressors, turbines, and industrial valves. Most of the rotating equipment is used to transport substances from one area to another, or it may be used to force materials to rotate, such as by making a propeller turn.

- Rotating equipment is used in industries, including upstream, downstream, and downstream. Pumps and compressors are examples of rotating equipment that have several uses in the production and storage of oil and gas.

- In several oil and gas projects, agreements and contracts are made with other companies to install rotating equipment. For example, in May 2024, Larsen & Toubro (L&T), L&T Energy Hydrocarbon (LTEH), got a contract from ONGC for the engineering, procurement, construction, installation, and commissioning of new process gas compressor (PGC) modules at ONGC's Mumbai High and Tapti offshore locations.

- Further, increasing gas production is expected to create demand for rotating equipment like compressors and pumps. According to the Statistical Review of World Energy Data, in 2023, global gas production accounted for 4059.2 billion cubic meters. Gas production has increased continuously since 2010, with a slight drop in 2020.

- Moreover, companies are making efforts to improve the efficiency of rotating equipment by investing more and more in research and development, which, in turn, will create opportunities for these equipment in the future.

- For instance, in May 2024, John Crane, a global leader in rotating equipment solutions and energy transition technologies, secured a five-year contract in Alberta, Canada. The contract involves providing industrial seal support services for a major complex. As part of this agreement, John Crane is implementing a managed reliability program (MRP) to enhance the longevity of critical site assets. This includes rotating equipment like centrifugal pumps and industrial seals. Such programs are expected to improve rotating equipment efficiency, driving future demand.

- Thus, owing to the use and demand for rotating equipment in the oil and gas industry, the segment is expected to have a significant demand during the forecast period.

Asia-Pacific is Expected to Have a Significant Growth in the Market

- Asia-Pacific is home to over half of the world's population, giving it the potential to influence the future of global energy significantly. The region includes developing countries like India, China, and Japan, which are experiencing rapid urbanization and industrialization.

- Thus, the region's energy demand is increasing continuously, which, in turn, demands production and exploration activities in the oil and gas industry. With the upcoming oil and gas projects, the demand for static and rotating equipment is expected to grow in the region.

- For example, in October 2022, SENEX Energy announced the construction of a new gas compression facility adjacent to its Atlas project in southwest Queensland. The gas plant will be constructed using production license PL209. With increasing oil and gas production, demand for this equipment is expected to grow during the forecast period.

- According to Statistical Review of World Energy Data, in 2023, Asia-Pacific total gas production accounted for 691.8 billion cubic meters, an annual growth rate of 0.6% compared to the previous year.

- Further, the development of downstream projects is expected to drive the market in the region. In the petrochemical industry, static and rotating equipment are used in refining. In March 2023, Indian Oil Corporation Ltd announced it would invest USD 742 million in building a petrochemical complex at Paradip in Odisha. Such new projects are expected to increase the demand for equipment, thereby driving the market.

- The increasing demand for natural gas production in the region is expected to surge the need for oil and gas starting and rotating equipment. For instance, according to the Gas Exporting Countries Forum, natural gas is projected to account for 36% of Southeast Asia's total generation mix by 2050. In summary, Asia-Pacific's demand for natural gas is expected to grow significantly, with estimates reaching 710 bcm by 2050.

- Due to the development of the oil and gas industry and the increasing energy demand, Asia-Pacific is expected to grow significantly.

Oil & Gas Static And Rotating Equipment Industry Overview

The oil and gas static and rotating equipment market is semi-fragmented. The key players in the market (in no particular order) include Alfa Laval AB, Atlas Copco AB, General Electric Co, Baker Hughes Co., and Pentair PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Energy Demand

- 4.5.1.2 More Offshore Exploration Activities

- 4.5.2 Restraints

- 4.5.2.1 Rising Adoption of Renewable and Cleaner Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Type

- 5.2.1 Static

- 5.2.2 Rotating

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 NORDIC

- 5.3.2.7 Italy

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Egypt

- 5.3.4.4 Qatar

- 5.3.4.5 Nigeria

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Atlas Copco AB

- 6.3.3 General Electric Co

- 6.3.4 Baker Hughes Co.

- 6.3.5 Pentair PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer Limited

- 6.3.8 FMC Technologies Inc.

- 6.3.9 Flowserve Corporation

- 6.3.10 Mitsubishi heavy Industries Ltd

- 6.3.11 Doosan Group

- 6.4 List of Other Prominent Companies

- 6.5 Market RankingAnalysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement to Increase the Efficiency

02-2729-4219

+886-2-2729-4219