|

市場調查報告書

商品編碼

1636234

功率因數校正裝置的全球市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Power Factor Correction Units - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

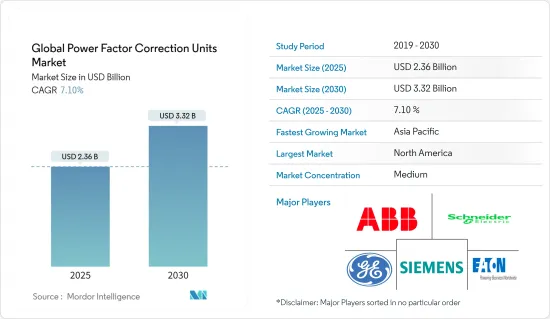

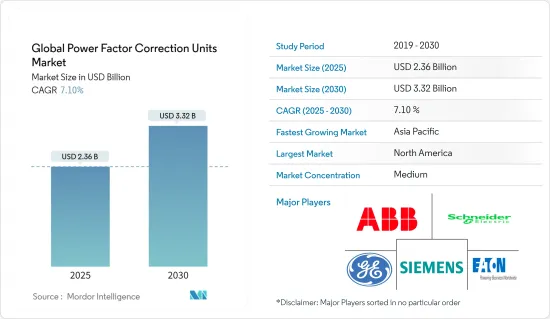

功率因數校正裝置的全球市場規模預計到 2025 年為 23.6 億美元,預計到 2030 年將達到 33.2 億美元,預測期內(2025-2030 年)複合年成長率為 7.1%。

主要亮點

- 從中期來看,快速工業化、收緊法規和能源效率標準等因素預計將成為預測期內全球功率因數校正裝置市場的最大驅動力之一。

- 這些裝置涉及複雜的維護和技術挑戰,這對預測期內的功率因數校正裝置的全球市場構成威脅。

- 然而,人們正在努力部署需要高效電力管理的智慧電網。預計這一因素將在未來為市場創造一些機會。

- 預計亞太地區在預測期內將顯著成長,並實現最高的年成長率。這是由於該地區製造業的不斷發展和對風能裝置的關注。

全球功率因數改善裝置市場趨勢

工業領域推動成長

- 近年來,由於技術進步、自動化程度提高以及對效率和生產力的日益重視等因素的綜合作用,全球工業格局經歷了巨大的成長和擴張。這種工業成長對壓縮空氣管道市場產生積極影響,增強其需求並推動其成長軌跡。

- 聯合國工業發展組織發布的資料顯示,由於印度、中國、馬來西亞和南非等新興經濟體更加重視增加製造業,2022年起全球工業產出將持續成長。因此,2023年第一季至第四季成長了1.4%,顯示全球製造業產出正在成長。

- 工業部門由能源密集型產業組成,例如鋼鐵製造、石化、水泥製造以及紙漿和造紙廠。這些行業運作具有大量無功功率需求的大型設備,使其成為功率因數校正技術的良好候選者。

- 透過安裝功率因數校正裝置,這些設施可以顯著降低電費。此外,提高功率因數可以提高電壓穩定性,減少對電力基礎設施的壓力,延長昂貴的工業設備的使用壽命,並最大限度地減少電力問題造成的停機時間。

- 對技術創新的日益重視,開啟了製造業自動化和數位化的新時代。自動化系統和機器人技術變得越來越流行,可以實現更快的生產速度和更高的業務效率。這種複雜性往往會導致功率因數劣化,促使製造商投資於全面的電能品質解決方案。

- 例如,2023年6月,ABB印度公司獲得了一份契約,為安賽樂米塔爾新日鐵印度公司位於古吉拉突邦拉的先進鋼鐵軋延廠(CRM)提供電氣化和自動化系統。本計劃包括供應ABBbility System 800xA分散式控制系統(DCS)及相關設備及消耗品。

- 隨著工業流程在工業 4.0 範式下日益數位化和自動化,對先進功率因數校正解決方案的需求不斷增加。現代工業設施正在將智慧功率因數校正單元與即時監控、自適應補償以及與更廣泛的能源管理系統的無縫整合相整合。

- 因此,如上所述,工業領域預計在預測期內將大幅成長。

亞太地區主導市場

- 亞太地區是全球功率因數校正設備市場的重要市場。該地區的特點是快速工業化、快速成長的能源需求以及對能源效率的日益關注。這個廣闊而多樣化的地區涵蓋了各種快速發展的經濟體,為功率因數校正行業提供了有利的市場前景。

- 工業化一直是亞太地區採用功率因數校正裝置的主要動力。該地區是世界製造業強國,涵蓋汽車、電子、紡織和重工業,需要先進的電源管理解決方案。隨著這些國家工業部門的快速成長,功率因數校正裝置的需求預計將大幅增加。

- 例如,印度23會計年度製造業出口創歷史新高,達4,474.6億美元,比上年度(22會計年度)的4,220億美元成長6.03%。製造業佔印度GDP的17%,僱用了超過2,730萬名工人,對國家經濟至關重要。印度政府的目標是透過各種措施和措施,到2025年將製造業的市場佔有率提高到25%。

- 這些能源密集產業擴大採用功率因數校正技術來最佳化電氣系統、降低營運成本並遵守嚴格的能源效率法規。工業升級的推動和先進製造技術的採用進一步增加了對可靠功率因數校正解決方案的需求。

- 亞太地區的都市化和基礎設施發展極大地促進了功率因數校正裝置不斷成長的需求。城市的快速擴張以及工業和經濟特區的建立給現有電力基礎設施帶來了前所未有的壓力。這導致人們越來越重視提高電能品質和電網穩定性,而功率因數校正在減少傳輸損耗和提高整個電力系統的效率方面發揮著重要作用。

- 例如,2023年10月,馬來西亞政府宣布計劃進行重大投資,在霹靂州建立四個新工業。其中最突出的是位於丹絨馬林的汽車高科技谷(AHTV),它是振興馬來西亞汽車產業的關鍵舉措。據預測,未來10年該合資企業預計將吸引高達67億美元的投資。該舉措不僅旨在創造數千個就業機會,還將馬來西亞定位為尖端汽車生產的地區領導者。

- 此外,在亞太地區日益普及的智慧城市概念正在整合先進的電力管理系統,包括智慧功率因數校正裝置,作為城市電力基礎設施的組成部分。

- 因此,如前所述,亞太地區預計將在預測期內主導市場。

全球功率因數改善裝置產業概況

全球功率因數校正裝置市場已減少一半。該市場的主要企業(排名不分先後)包括 ABB 有限公司、西門子公司、通用電氣公司、施耐德電氣公司和伊頓公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 工業快速成長

- 嚴格的監管標準

- 抑制因素

- 維護和技術挑戰

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 類型

- 主動功率因數校正單元

- 被動功率因數改善裝置

- 混合功率因數校正單元

- 最終用戶

- 住宅

- 商業的

- 工業的

- 2029 年之前的市場規模和需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- ABB Ltd

- Schneider Electric SE

- Eaton Corporation

- Siemens AG

- General Electric Company

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Toshiba Electronic Devices & Storage Corporation

- Crompton Greaves Limited

- L&T Electrical & Automation

- 其他知名公司名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 智慧電網發展

簡介目錄

Product Code: 50003502

The Global Power Factor Correction Units Market size is estimated at USD 2.36 billion in 2025, and is expected to reach USD 3.32 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rapid industrialization, growing stringent regulations, and standards over energy efficiency are expected to be among the most significant drivers for the global power factor correction units market during the forecast period.

- Complicated maintenance and technical challenges are associated with these units, posing a threat to the global power factor correction units market during the forecast period.

- However, continued efforts are being made toward smart grid deployments, which require efficient power management. This factor is expected to create several opportunities for the market in the future.

- Asia-Pacific is expected to witness significant growth and register the highest annual growth rate during the forecast period. This is due to the region's growing manufacturing industry and focus on wind energy installations.

Global Power Factor Correction Units Market Trends

The Industrial Segment to Witness Growth

- The global industrial landscape has experienced massive growth and expansion in recent years due to the confluence of factors such as technological advancements, increasing automation, and a growing emphasis on efficiency and productivity. This industrial growth has a positive impact on the compressed air pipe market, strengthening its demand and driving its growth trajectory.

- According to the data released by the United Nations Industrial Development Organization, the global manufacturing output has observed consistent growth since 2022 owing to the growing emphasis on increasing the manufacturing industry in developing economies like India, China, Malaysia, South Africa, and various others. This has led to an increase of 1.4% between the first and fourth quarters of 2023, signifying the growing manufacturing output globally.

- The industrial segment comprises energy-intensive industries such as steel manufacturing, petrochemicals, cement production, and pulp and paper mills. These industries operate large-scale equipment with significant reactive power demands, making them prime candidates for power factor improvement technologies.

- By installing power factor correction units, these facilities can substantially reduce their electricity bills, as many utility companies impose penalties for low power factors. Moreover, improved power factor leads to enhanced voltage stability and reduced stress on electrical infrastructure, potentially extending the lifespan of expensive industrial equipment and minimizing downtime due to electrical issues.

- The growing emphasis on innovation has ushered in a new era of automation and digitalization in the manufacturing industry. Automated systems and robotic technologies have become increasingly prevalent, enabling higher production rates and enhanced operational efficiency. This complexity often results in power factor degradation, prompting manufacturers to invest in comprehensive power quality solutions.

- For instance, in June 2023, ABB India secured a contract to provide electrification and automation systems for ArcelorMittal Nippon Steel India's advanced steel cold rolling mill (CRM) in Hazira, Gujarat. The project includes supplying the ABB Ability System 800xA distributed control system (DCS) and associated machinery and supplies.

- As industrial processes become increasingly digitized and automated under the paradigm of Industry 4.0, the demand for sophisticated power factor correction solutions has grown. Modern industrial facilities are integrating smart power factor correction units with real-time monitoring, adaptive correction, and seamless integration with broader energy management systems.

- Therefore, as mentioned above, the industrial segment is expected to grow significantly during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is a pivotal market in the global landscape for power factor correction units. It is characterized by rapid industrialization, burgeoning energy demands, and an increasing focus on energy efficiency. This vast and diverse region, encompassing various rapidly evolving economies, presents a favorable market scenario for the power factor correction industry.

- Industrialization is the primary driver for adopting power factor correction units across Asia-Pacific. The region's position as a global manufacturing powerhouse, spanning automotive, electronics, textiles, and heavy industries, necessitates sophisticated power management solutions. With these countries' rapidly rising industrial segment, the demand for power correction factor units is expected to increase significantly.

- For instance, in the financial year 2023, India's manufacturing exports hit a record high, reaching USD 447.46 billion, marking a 6.03% growth from the previous year's (FY22) USD 422 billion. The manufacturing industry, contributing to 17% of India's GDP and employing over 27.3 million workers, is pivotal in the nation's economy. With various initiatives and policies, the Indian government aims to elevate manufacturing's market share to 25% by 2025.

- With their substantial reactive power demands, these energy-intensive industries are increasingly turning to power factor correction technologies to optimize their electrical systems, reduce operational costs, and comply with stringent energy efficiency regulations. The push for industrial upgrades and the adoption of advanced manufacturing technologies further accentuate the need for reliable power factor correction solutions.

- Urbanization and infrastructure development across Asia-Pacific have significantly contributed to the growing demand for power factor correction units. Rapid city expansion and the establishment of industrial parks and special economic zones have placed unprecedented strain on existing power infrastructures. This has led to a heightened focus on power quality improvement and grid stability, with power factor correction playing a crucial role in mitigating transmission losses and enhancing overall electrical system efficiency.

- For instance, in October 2023, the Malaysian government unveiled plans to invest substantially in the establishment of four new industrial parks in Perak. A standout among these is the Automotive High-Tech Valley (AHTV) in Tanjung Malim, designed as a pivotal move to rejuvenate Malaysia's automotive industry. Forecasts suggest this venture will draw in a staggering USD 6.7 billion in investments over the coming decade. Not only will this initiative create thousands of job opportunities, but it also aims to position Malaysia as a leader in the regional production of state-of-the-art vehicles.

- Moreover, the concept of smart cities, gaining traction across the region, incorporates advanced power management systems, including intelligent power factor correction units, as integral components of urban electrical infrastructure.

- Therefore, as mentioned above, Asia-Pacific is expected to dominate the market during the forecast period.

Global Power Factor Correction Units Industry Overview

The global power factor correction units market is semi-fragmented. Some of the key players in this market (in no particular order) are ABB Ltd, Siemens AG, General Electric Company, Schneider Electric SE, and Eaton Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rapid Industrial Growth

- 4.5.1.2 Stringent Regulatory Standards

- 4.5.2 Restraints

- 4.5.2.1 Maintenance abd Technical Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Active Power Factor Correction Unit

- 5.1.2 Passive Power Factor Correction Unit

- 5.1.3 Hybrid Power Factor Correction Unit

- 5.2 End Users

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Schneider Electric SE

- 6.3.3 Eaton Corporation

- 6.3.4 Siemens AG

- 6.3.5 General Electric Company

- 6.3.6 Emerson Electric Co.

- 6.3.7 Mitsubishi Electric Corporation

- 6.3.8 Toshiba Electronic Devices & Storage Corporation

- 6.3.9 Crompton Greaves Limited

- 6.3.10 L&T Electrical & Automation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Smart Grid Development

02-2729-4219

+886-2-2729-4219