|

市場調查報告書

商品編碼

1636258

電動車電池負極:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

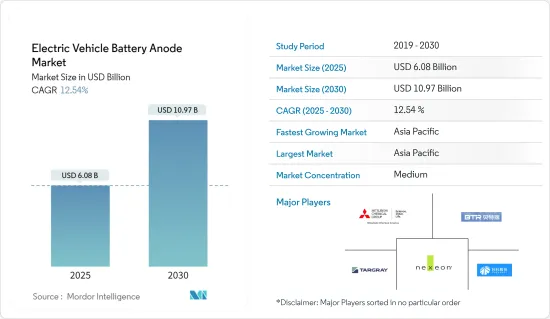

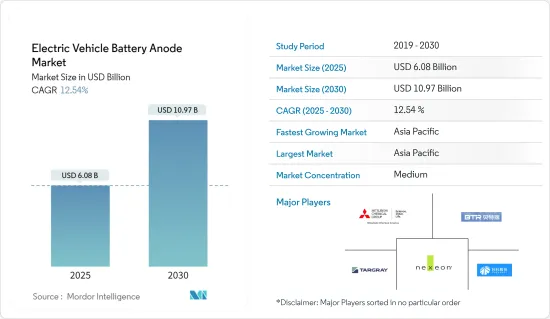

電動車電池負極市場規模預計到2025年為60.8億美元,預計到2030年將達到109.7億美元,預測期內(2025-2030年)複合年成長率為12.54%。

主要亮點

- 從中期來看,電動車需求增加和政府支持措施等因素預計將在預測期內推動市場發展。

- 另一方面,與石墨等負極材料相關的技術挑戰預計將阻礙預測期內的市場成長。

- 然而,技術創新和永續材料的開發預計將在未來幾年為市場帶來重大機會。

- 由於電動車在該地區各國的滲透率不斷提高,預計亞太地區將主導市場。

電動車電池負極市場趨勢

鋰離子電池領域佔市場主導地位

- 鋰離子電池領域在電動車的性能和效率方面發揮著重要作用。隨著電動車需求持續飆升,對高性能鋰離子電池的需求日益明顯。鋰離子電池以其高能量密度、長循環壽命和相對較低的自放電率而聞名,是電動車生態系統的重要組成部分,特別是在負極設計方面。

- 影響鋰離子電池領域的主要趨勢之一是鋰離子電池價格的下降,使電動車更容易被更廣泛的消費者所接受。截至2023年,鋰離子電池的平均價格將在每千瓦時139美元左右,較2013年下降超過82%。

- 預計成本將持續下降,預計到 2025 年成本可能降至 113 美元/度以下,到 2030 年達到 80 美元/度。電池價格的下降將使電動車變得更便宜,並鼓勵製造商投資先進的陽極材料和技術來提高電池性能。

- 鋰離子電池負極主要由石墨製成,石墨因其優異的導電性和嵌入鋰離子的能力而受到青睞。然而,對替代材料(例如矽和矽基複合材料)的研究正在進行中,這些材料可以顯著提高能源儲存容量。這種新材料方法的部分原因是對電動車電池更高性能和效率的需求。

- 世界主要開發中國家政府正在支持電動車的廣泛採用,並提高電池製造的獨立性,進一步增加對電池和電池陽極的需求。

- 例如,印度政府的目標是到2030年將100%的二輪車和三輪車轉變為電動車,並力爭實現汽車銷售的30%為電動車。

- 隨著越來越多的消費者和政府尋求更清潔的交通選擇,電動車產量正在迅速增加。產量激增將直接增加對電動車電池及其零件(包括負極)的需求。

- 此外,一些國家也鼓勵國內外企業投資電動車電池生產。例如,2023年5月,瑞典電池製造商Northvolt宣布計劃投資數十億歐元在德國建造電動車電池工廠。該公司計劃對該工廠投資約88億美元,德國政府列出的補貼約5億歐元。

- 總體而言,由於技術進步、電池價格下降以及對永續性的日益關注,電動車電池負極市場的鋰離子電池領域正在快速發展。

亞太地區前景將主導市場

- 亞太電動車(EV)電池負極市場正在經歷顯著成長,這主要得益於中國在電動車產業的主導地位。中國是電動車產銷量的領先者,在電池負極供應鏈中發揮至關重要的作用。全球電動車銷量從2019年的106萬輛激增至2023年的約810萬輛,增幅驚人,超過650%,對高效、高容量電池負極的需求日益明顯。

- 中國積極擴張電池負極產能尤其值得注意。多個部會制定了大幅提高產量的雄心勃勃的目標。一些省份宣布了雄心勃勃的增產計劃。例如,貴州省計畫在2025年建成年產80萬噸電池負極材料及原料的生產能力。同樣,江蘇華星城新能源材料計畫在2025年建成年產能20萬噸的負極材料生產設施。

- 中國在電動車生產和銷售方面處於世界領先地位,對電池電解的需求做出了巨大貢獻。根據國際能源總署(IEA)預測,全球電動車銷量將從2019年的106萬輛增加至2023年的810萬輛,增幅超過650%。政府的大力支持,包括對電動車採用的補貼和激勵措施,正在加速這一趨勢。

- 此外,該公司處於電池材料創新的前沿。例如,2023年10月,印度領先的電池材料公司Epsilon Advanced Materials (EAM)宣布計劃在北卡羅來納州布倫瑞克縣建造一座耗資6.5億美元的石墨陽極製造工廠。該工廠標誌著印度公司在美國電動車 (EV) 電池市場的首筆也是最大一筆投資。預計到2030年將支援電動車的生產110萬輛。預計 2024 年開始建設,2026 年開始生產,並於 2031 年達到全面運作。全面運作後,該廠將採用綠色技術生產高容量負極材料,年產石墨負極5萬噸。

- 因此,由於上述因素,預計亞太地區市場將產生需求。

電動汽車電池負極產業概況

電動車電池負極市場正走向半固體。主要參與企業(排名不分先後)包括三菱化學集團、貝特瑞新材料集團、杉杉股份、Targray Industries Inc和Nexeon Ltd。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車需求增加

- 政府支持措施

- 抑制因素

- 劣化等技術問題

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛蓄電池

- 其他電池類型

- 電池材料類型

- 石墨

- 矽

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐的

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 越南

- 泰國

- 印尼

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 卡達

- 奈及利亞

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mitsubishi Chemical Group

- BTR New Material Group Co. Ltd

- Shanshan Co.

- NEI Corporation

- Sionic Energy

- Targray Industries Inc.

- Nexeon Ltd

- LG Chem Ltd

- Tokai Carbon Co. Ltd

- Nippon Carbon Co. Ltd

- 市場排名/佔有率分析

- 其他知名公司名單

第7章 市場機會及未來趨勢

- 永續材料的開發

簡介目錄

Product Code: 50003539

The Electric Vehicle Battery Anode Market size is estimated at USD 6.08 billion in 2025, and is expected to reach USD 10.97 billion by 2030, at a CAGR of 12.54% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, technical challenges associated with anode materials like graphite are expected to hinder the market growth during the forecast period.

- However, technological innovations and the development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across the various countries in the region.

Electric Vehicle Battery Anode Market Trends

The Lithium-Ion Batteries Segment to Dominate the Market

- The lithium-ion batteries segment plays a crucial role in the performance and efficiency of electric vehicles. As the demand for electric vehicles continues to surge, the need for high-performance lithium-ion batteries has become more pronounced. Lithium-ion batteries, known for their high energy density, long cycle life, and relatively low self-discharge rates, are essential components in the EV ecosystem, particularly in their anode design.

- One significant trend impacting the lithium-ion batteries segment is the declining price of lithium-ion batteries, which has made electric vehicles more accessible to a broader range of consumers. As of 2023, the average price of lithium-ion batteries dropped to around USD 139 per kWh, representing a decrease of over 82% since 2013.

- This ongoing decline in costs is projected to continue, with estimates suggesting prices could fall below USD 113/kWh by 2025 and reach USD 80/kWh by 2030. The reduction in battery prices makes EVs more affordable and encourages manufacturers to invest in advanced anode materials and technologies that enhance battery performance.

- Anodes in lithium-ion batteries are primarily made from graphite, favored for its excellent conductivity and ability to intercalate lithium ions. However, there is ongoing research into alternative materials, such as silicon and silicon-based composites, which can significantly enhance energy storage capacity. The push toward these new materials is partly driven by the need for higher performance and efficiency in EV batteries, as manufacturers seek to increase driving range and reduce charging times for consumers.

- The governments of the major developing countries globally have been supporting the increasing adoption of electric vehicles and making the country self-reliant for battery manufacturing, further creating the demand for batteries and battery anodes.

- For example, the Indian government aims to transition two and three-wheelers to 100% electric vehicles and achieve 30% e-mobility in total automotive sales by 2030.

- As more consumers and governments push for cleaner transportation, the production of EVs is rapidly increasing. This surge in production directly boosts the demand for EV batteries and, consequently, their components, including anodes.

- Moreover, several countries encouraged domestic and international companies to invest in electric vehicle battery production. For instance, in May 2023, Northvolt, a Swedish battery manufacturer, announced plans to invest several billion euros in building an electric-vehicle battery cell plant in Germany. The company plans to invest approximately USD 8.8 billion in the plant, with the German government providing around half a billion euros in subsidies.

- Overall, the lithium-ion battery segment of the electric vehicle battery anode market is evolving rapidly, driven by technological advancements, declining battery prices, and a growing emphasis on sustainability.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific electric vehicle (EV) battery anode market is witnessing significant growth, primarily driven by China's dominant position in the EV industry. China leads in electric vehicle production and sales and plays a pivotal role in the battery anode supply chain. With global electric vehicle sales skyrocketing from 1.06 million in 2019 to approximately 8.1 million in 2023, a staggering increase of over 650%, the demand for efficient and high-capacity battery anodes has never been more pronounced.

- China's aggressive expansion of battery anode production capacity is particularly noteworthy. Several provinces are setting ambitious targets to enhance their output significantly. Several provinces have announced ambitious plans to increase their production. For instance, Guizhou province aims to build 800,000 tons per year (t/yr) of battery anode and feedstock materials capacity by 2025. Similarly, Jiangsu HSC New Energy Materials is set to complete a 200,000 t/yr anode material production facility by 2025.

- China leads the world in electric vehicle production and sales, contributing to a substantial demand for battery electrolytes. According to the International Energy Agency, global electric vehicle sales grew from 1,060,000 in 2019 to 8,100,000 in 2023, representing an increase of more than 650%. The country's strong government support, including subsidies and incentives for EV adoption, accelerates this trend.

- Moreover, companies are at the forefront of battery material innovation. For instance, in October 2023, Epsilon Advanced Materials (EAM), India's leading battery materials company, announced plans to construct a USD 650 million graphite anode manufacturing facility in Brunswick County, North Carolina. This facility marks the first and largest investment by an Indian company in the US electric vehicle (EV) battery market. It is projected to support the production of 1.1 million electric vehicles by 2030. Construction is set to begin in 2024, with manufacturing expected to start in 2026 and full operational capacity reached by 2031. Once fully operational, the facility will utilize green technologies to produce high-capacity anode materials, with an annual production capacity of 50,000 tons of graphite anode.

- Hence, owing to the above factors, the market is expected to create demand in Asia-Pacific.

Electric Vehicle Battery Anode Industry Overview

The electric vehicle battery anode market is semi-consolidated. Some of the major players (not in particular order) include Mitsubishi Chemical Group, BTR New Material Group Co. Ltd, Shanshan Co., Targray Industries Inc., and Nexeon Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Technical Challenges like Degradation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Other Battery Types

- 5.2 Battery Material Type

- 5.2.1 Graphite

- 5.2.2 Silicon

- 5.2.3 Other Battery Material Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Turkey

- 5.3.2.8 NORDIC

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Vietnam

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 BTR New Material Group Co. Ltd

- 6.3.3 Shanshan Co.

- 6.3.4 NEI Corporation

- 6.3.5 Sionic Energy

- 6.3.6 Targray Industries Inc.

- 6.3.7 Nexeon Ltd

- 6.3.8 LG Chem Ltd

- 6.3.9 Tokai Carbon Co. Ltd

- 6.3.10 Nippon Carbon Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Sustainable Materials

02-2729-4219

+886-2-2729-4219