|

市場調查報告書

商品編碼

1636267

南美洲電動車用鋰離子電池:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

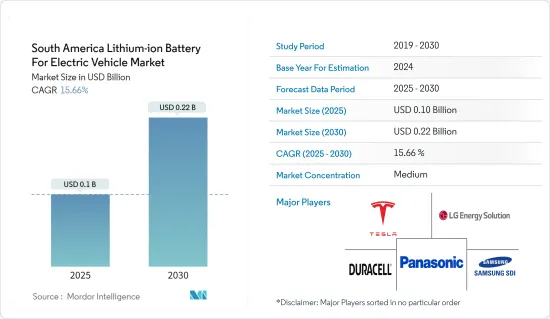

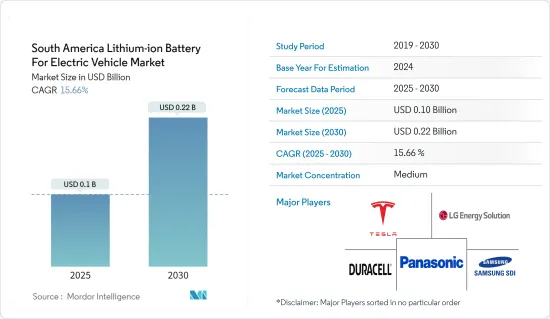

南美洲電動車鋰離子電池市場規模預計2025年為1億美元,2030年將達2.2億美元,預測期間(2025-2030年)複合年成長率為15.66%。

主要亮點

- 從長遠來看,鋰離子電池價格的下降以及巴西、哥倫比亞、阿根廷和智利電動車的普及預計將推動市場成長。

- 另一方面,與傳統內燃機汽車相比,電動車的資本成本更高,而巴西和哥倫比亞等新興國家缺乏強大的充電基礎設施和網路,預計將抑制市場成長。

- 然而,南美國家電動車採用固體鋰離子電池預計將為市場成長創造利潤豐厚的機會。

- 由於有利的政府政策和電動車的普及,巴西預計將主導市場。

南美洲電動車鋰離子電池市場趨勢

電池電動車 (BEV) 領域預計將主導市場

- 電池式電動車(BEV),通常也稱為電動車,使用大型牽引電池組為馬達提供動力。這種類型的電動車必須連接到牆壁插座或稱為電動車供電設備 (EVSE) 的充電設施。

- 南美地區汽車需求的增加、創新和先進技術的進步、消費者使用省油車的電池式電動車增強以及減少溫室氣體和排放氣體的意識增強等因素正在推動該地區汽車需求的成長。

- BEV 是全電動汽車,通常沒有內燃機 (ICE)、燃料箱或排氣管。為車輛提供動力的能量來自電池組並透過電網充電。純電動車是零排放車,這意味著它們不會產生傳統汽油動力汽車的有害廢氣排放和空氣污染風險。

- 近年來,南美汽車工業經歷了顯著成長。該地區對純電動車(EV)的需求正在增加,特別是在乘用車領域。這種激增是由於人們意識的增強、對環境問題的日益關注以及政府努力促進電動車的採用等因素造成的。與 2022 年相比,2023 年該地區的電動車銷量顯著成長 18% 以上。

- 2023年,巴西進口了價值7.35億美元的中國純電動車。中國對巴西純電動車出口成長遠超中國「新三大」產業(電動車、鋰離子電池、太陽能電池)整體出口成長。

- 鑑於上述情況,由於電動車使用量的增加,預計純電動車市場將在巴西、哥倫比亞和秘魯市場佔據主導地位。

巴西可望主導市場

- 巴西是最大的鋰離子電池市場之一,主要是由於對電動車的高需求。巴西對鋰離子電池的需求正在增加,這可能會顯著促進市場成長。

- Rota 2030計畫旨在提高交通部門的能源效率,預計將顯著提振巴西的電動車市場。電動車採用率的快速成長可能會在預測期內顯著促進市場成長。

- 根據國際能源總署 (IEA) 的數據,純電動車 (BEV) 銷量到 2023 年將達到約 19,000 輛,比 2022 年的約 8,500 輛成長超過 123.5%。隨著純電動車銷量的不斷增加,對鋰離子電池等電動車電池的需求變得越來越重要。

- 2024 年 5 月,礦商和鋰供應商 AMG Critical Materials 宣布擴大在巴西的採礦業務。在巴西,AMG的鋰精礦擴建正在按計畫進行,預計該廠的額定產能將在2024年第四季從先前的每年9萬噸達到13萬噸。

- 2024年5月,巴西政府宣布對電動和混合動力汽車的進口關稅進行重大調整。這項期待已久的政策轉變旨在刺激國內電動車生產並減少對進口車的依賴。透過引入配額制度,政府打算促進國內生產,同時平衡進口汽車的進入。

- 2024年2月,巴西礦業公司Sigma Lithium宣布計畫在巴西國家開發銀行融資下投資9,940萬美元。 Sigma 在巴西米納斯吉拉斯州的第二家新工廠預計產量將增加近一倍,達到每年 51 萬噸。

- 因此,預計巴西將在預測期內主導市場。

南美洲電動車鋰離子電池產業概況

南美洲的電動車鋰離子電池市場已被削減一半。該市場的主要企業包括(排名不分先後)特斯拉公司、LG Energy Solution Ltd.、松下控股公司、金霸王公司和三星SDI。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 鋰離子電池價格下降

- 電動車的擴張

- 抑制因素

- 原料供需不匹配

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按車型分類

- 客車

- 商用車

- 其他車輛(摩托車、Scooter等)

- 依推進類型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 按地區

- 巴西

- 哥倫比亞

- 秘魯

- 阿根廷

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- Contemporary Amperex Technology Co. Limited

- EnerSys

- Duracell Inc.

- Clarios(Formerly Johnson Controls International PLC)

- Panasonic Holdings Corporation

- LG Energy Solutions Ltd

- VARTA AG

- Market Ranking/Share(%)Analysis

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

第7章 市場機會及未來趨勢

- 電動車採用固體鋰離子電池

簡介目錄

Product Code: 50003549

The South America Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 0.10 billion in 2025, and is expected to reach USD 0.22 billion by 2030, at a CAGR of 15.66% during the forecast period (2025-2030).

Key Highlights

- Over the long term, declining lithium-ion battery prices and the growing adoption of electric vehicles in Brazil, Colombia, Argentina, and Chile are expected to drive the growth of the market.

- On the other hand, the higher capital cost of electric vehicles compared to traditional internal combustion vehicles and the lack of robust charging infrastructure and networks in developed countries such as Brazil and Colombia are expected to restrain the market's growth.

- Nevertheless, the adoption of solid-state lithium-ion batteries for electric vehicles in South American countries is expected to create lucrative opportunities for the growth of the market.

- Brazil is expected to dominate the market, with favorable government policies and increasing adoption of electric vehicles.

South America Lithium-ion Battery For Electric Vehicle Market Trends

The Battery Electric Vehicle (BEV) Segment is expected to Dominate the Market

- Battery electric vehicles (BEVs), also commonly referred to as Electric Vehicles, use a large traction battery pack to power the electric motor. These types of EVs must be plugged into a wall outlet or charging equipment called electric vehicle supply equipment (EVSE).

- Factors like increasing demand for automotive vehicles across South America, growing innovation and advanced technology, rising consumer awareness about the use of fuel-efficient cars, and growing awareness to reduce greenhouse gasses and emissions are driving the demand for battery electric vehicles (BEV) across the region.

- BEVs are fully electric vehicles and typically do not have an internal combustion engine (ICE), fuel tank, or exhaust pipe; they rely only on stored electricity for propulsion. The energy to run the vehicle comes from the battery pack, which is recharged from the grid. BEVs are zero-emissions vehicles, as they do not generate any harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The South American vehicle industry has witnessed notable growth in recent years. The region has seen increased demand for battery electric vehicles (EVs), especially in the passenger car segment. This surge can be attributed to factors like heightened awareness, growing environmental concerns, and governmental initiatives promoting EV adoption. EV sales in the region saw a notable increase of more than 18% in 2023 compared to 2022.

- Brazil imported USD 735 million worth of Chinese BEVs in 2023. The growth in Chinese exports of BEVs to Brazil far exceeded the overall rate of increase in exports across China's "new three" industries: electric vehicles, lithium-ion batteries, and solar photovoltaic cells.

- Owing to the above points, the battery electric vehicle segment is expected to dominate the market due to the increasing utilization of electric vehicles in Brazil, Colombia, and Peru.

Brazil is Expected to Dominate the Market

- Brazil is one of the largest markets for lithium-ion batteries, mainly due to the high demand for electric vehicles. The demand for lithium-ion batteries in Brazil is increasing, which may offer a significant boost to the market's growth.

- The Rota 2030 program aims to improve energy efficiency in the transportation sector, which would be a major boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to significantly boost market growth during the forecast period.

- As per the International Energy Agency (IEA), the battery electric vehicle (BEV) cars sales were around 19,000 units (BEV cars) in 2023, an increase of over 123.5% from around 8,500 units in 2022. As the sales of BEVs continue to rise, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- In May 2024, Miner and lithium supplier AMG Critical Materials announced the expansion of its mining operations in Brazil. In Brazil, the expansion of AMG's lithium concentrate has been progressing as planned, with the plant expected to reach a full nameplate capacity of 130,000 mt/year during Q4 2024, up from a previous capacity of 90,000 mt/year.

- In May 2024, the Brazilian government announced significant changes to the import tariffs for electric and hybrid vehicles. This long-awaited policy shift aims to stimulate national production of electrified vehicles and reduce the dependency on imported cars. By implementing a quota system, the government intends to balance the entry of imported vehicles while fostering local manufacturing.

- In February 2024, Sigma Lithium, a Brazilian mining company, announced its plans to invest USD 99.4 million in Brazil, backed by financing from the National Development Bank. The new plant, Sigma's second one in the Brazilian state of Minas Gerais, is expected to almost double its output to 510,000 metric tons annually.

- Thus, Brazil is expected to dominate the market during the forecast period.

South America Lithium-ion Battery For Electric Vehicle Industry Overview

The South American market for lithium-ion batteries for electric vehicles is semi-fragmented. Some of the key players in the market (in no particular order) include Tesla Inc., LG Energy Solution Ltd, Panasonic Holdings Corporation, Duracell Inc., and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-Ion Battery Prices

- 4.5.1.2 Growing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Colombia

- 5.3.3 Peru

- 5.3.4 Argentina

- 5.3.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 Duracell Inc.

- 6.3.5 Clarios (Formerly Johnson Controls International PLC)

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 LG Energy Solutions Ltd

- 6.3.8 VARTA AG

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-State Lithium-Ion Batteries for Electric Vehicles

02-2729-4219

+886-2-2729-4219