|

市場調查報告書

商品編碼

1636422

碳捕獲和利用 (CCU):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Carbon Capture And Utilization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

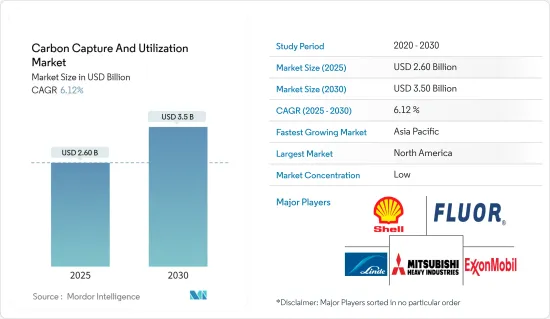

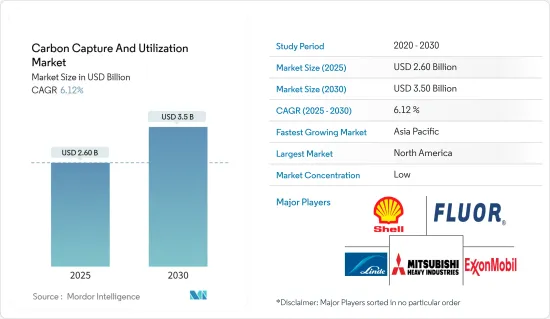

碳捕獲和利用(CCU)市場規模預計到 2025 年將達到 26 億美元,預計到 2030 年將達到 35 億美元,預測期內(2025-2030 年)複合年成長率為 6.12%。

碳捕獲和利用 (CCU) 領域正在圍繞捕獲工業過程和大氣中排放的二氧化碳 (CO2) 並將其重新利用為有價值的產品而迅速發展。這些技術對於遏制溫室氣體排放、應對氣候變遷、同時產生經濟效益發揮至關重要的作用。

CCU 市場受到多種因素的推動,例如人們對氣候變遷的認知不斷增強、政府嚴格的排放法規以及對永續產品的需求不斷增加。 CCU 技術提供了一種減少二氧化碳排放的方法,同時生產化學品、燃料和建築材料等有價值的產品,從而創建循環經濟方法。

隨著政府、產業和消費者越來越重視應對氣候變遷的永續解決方案,CCU 市場有望實現顯著成長。相關人員之間的持續創新和協作對於釋放 CCU 技術的全部潛力和實現全球氣候變遷目標至關重要。

碳捕集與利用 (CCU) 市場趨勢

石油和天然氣產業是市場的主要最終用戶

石油和天然氣產業是碳捕獲和利用 (CCU) 技術的重要採用者,特別是由於石化燃料生產和精製過程中二氧化碳 (CO2)排放較高。

CCUS 技術最初應用於石油和天然氣領域,可將二氧化碳封存在陸地和海上的深層地質構造。二氧化碳通常與石油不混溶,但當注入儲存時,它會增加壓力並有助於將石油轉移到生產井。

CCU技術不僅可以為石油和天然氣產業捕獲二氧化碳,還可以重新利用排放的二氧化碳,減少對環境的影響。回收的二氧化碳可用於多種用途,包括提高石油採收率 (EOR)、作為化學品和燃料生產的原料以及用於碳化建築混凝土。透過採用CCU技術,石油和天然氣產業不僅可以減少碳排放,還可以擴大收益來源並促進更永續的能源格局。

北美在碳捕獲和利用(CCU)市場中佔據最大佔有率

由於政府的大力支持、技術進步和成熟的工業基礎等多種因素,北美在碳捕獲和利用(CCU)市場中佔據最大佔有率。該地區處於 CCU 技術開發和部署的前沿,其中美國和加拿大在這些技術的研究、開發和部署方面處於領先地位。

特別是美國,有許多 CCU計劃和舉措得到聯邦資金和激勵措施的支持。包括石油和天然氣行業在內的廣大工業部門為 CCU 的實施提供了充足的機會。此外,對減少碳排放和應對氣候變遷的日益重視正在加速 CCU 技術在北美的採用。

在技術進步、有利的政府行動以及對永續氣候變遷解決方案需求的日益認知的推動下,北美有望引領 CCU 市場。

碳捕集與利用 (CCU) 產業概覽

碳捕獲和利用(CCU)市場是分散的,由許多參與者組成。碳捕獲和利用(CCU)公司正在採取各種策略來推動市場成長和創新。關鍵策略之一是開發具有成本效益且可擴展的 CCU 技術,以捕獲和利用工業製程和大氣中排放的二氧化碳 (CO2)。主要參與者包括荷蘭皇家殼牌公司、福陸公司、三菱重工、林德公司和埃克森美孚公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 環境法規和氣候變遷目標

- 人們對減少二氧化碳排放的興趣日益濃厚

- 市場限制因素

- 實施成本高

- 儲存容量有限

- 市場機會

- CCUS技術的研發工作

- 價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察產業技術進步

- 洞察塑造市場的各種監理趨勢

- COVID-19 對市場的影響

第5章市場區隔

- 按服務

- 收集

- 運輸

- 使用

- 貯存

- 依技術

- 預燃燒

- 氧氣燃燒回收

- 燃燒後回收

- 按最終用戶

- 石油和天然氣

- 發電

- 鋼

- 化學/石化

- 水泥

- 其他最終用戶

- 按地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- ExxonMobil Corporation

- Royal Dutch Shell PLC

- Chevron Corporation

- TotalEnergies SE

- BP plc

- Equinor ASA

- Mitsubishi Heavy Industries Ltd

- Air Products and Chemicals Inc.

- Aker Solutions ASA

- Schlumberger Limited

第7章 市場趨勢

第 8 章 免責聲明與出版商訊息

The Carbon Capture And Utilization Market size is estimated at USD 2.60 billion in 2025, and is expected to reach USD 3.50 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

The carbon capture and utilization (CCU) sector is swiftly advancing, centered on capturing carbon dioxide (CO2) emissions from industrial processes or the atmosphere, and repurposing them into valuable commodities. These technologies play a pivotal role in curbing greenhouse gas emissions, combating climate change, and simultaneously generating economic benefits.

The CCU market is driven by several factors, including increasing awareness of climate change, stringent government regulations to reduce emissions, and the growing demand for sustainable products. CCU technologies offer a way to reduce CO2 emissions while producing valuable products, such as chemicals, fuels, and building materials, thereby creating a circular economy approach.

The CCU market is poised for significant growth as governments, industries, and consumers increasingly prioritize sustainable solutions to combat climate change. Continued innovation and collaboration among stakeholders will be vital to unlocking the full potential of CCU technologies and achieving global climate goals.

Carbon Capture And Utilization Market Trends

Oil & Gas Industry was the Major End User in Market

The oil and gas industry stands out as a significant adopter of carbon capture and utilization (CCU) technologies, driven by its substantial carbon dioxide (CO2) emissions, notably in fossil fuel production and refining.

Originally pioneered in the oil and gas domain, CCUS technologies sequester CO2 in deep geological formations, both onshore and offshore. While CO2 is typically immiscible with oil, its injection into reservoirs boosts pressure, aiding in oil movement towards production wells.

CCU technologies empower the oil and gas industry to not only capture but also repurpose CO2 emissions, thereby lessening their environmental impact. The repurposed CO2 finds diverse applications, from enhancing oil recovery (EOR) and serving as a feedstock for chemical and fuel production to being utilized in concrete carbonation for construction. Through the adoption of CCU technologies, the oil and gas industry not only reduces its carbon footprint but also broadens its revenue streams, thereby fostering a more sustainable energy landscape.

North America Holds Largest Share in Carbon Capture and Utilization Market

North America holds the largest carbon capture and utilization (CCU) market share, driven by several factors, including strong government support, technological advancements, and a well-established industrial base. The region has been at the forefront of developing and implementing CCU technologies, with the United States and Canada leading in the research, development, and deployment of these technologies.

The United States, in particular, has many CCU projects and initiatives supported by federal funding and incentives. The country's vast industrial sector, including the oil and gas industry, provides ample opportunities for CCU implementation. Moreover, the mounting emphasis on curbing carbon emissions and addressing climate change has hastened the uptake of CCU technologies in North America.

North America is poised to lead the CCU market, propelled by technological strides, favorable governmental measures, and a growing recognition of the imperative for sustainable climate change solutions.

Carbon Capture And Utilization Industry Overview

The carbon capture and utilization market is fragmented and consists of many players. Carbon capture and utilization (CCU) companies are adopting various strategies to drive growth and innovation in the market. One key strategy is to develop cost-effective and scalable CCU technologies that can capture and utilize carbon dioxide (CO2) emissions from industrial processes or the atmosphere. The key players include Royal Dutch Shell PLC, Fluor Corporation, Mitsubishi Heavy Industries Ltd, Linde PLC, and Exxon Mobil Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Environmental Regulations and Climate Change Goal

- 4.2.2 Growing Focuse on Reducing Co2 Emission

- 4.3 Market Restraints

- 4.3.1 High Implementation Costs

- 4.3.2 Limited Storage Capacity

- 4.4 Market Opportunties

- 4.4.1 Research and Development Efforts in CCUS Technologies

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Insights on Various Regulatory Trends Shaping the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Capture

- 5.1.2 Transportation

- 5.1.3 Utilization

- 5.1.4 Storage

- 5.2 By Technology

- 5.2.1 Pre-combustion Capture

- 5.2.2 Oxy-fuel Combustion Capture

- 5.2.3 Post-combustion Capture

- 5.3 By End User

- 5.3.1 Oil and Gas

- 5.3.2 Power Generation

- 5.3.3 Iron and Steel

- 5.3.4 Chemical and Petrochemical

- 5.3.5 Cement

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 India

- 5.4.1.2 China

- 5.4.1.3 Japan

- 5.4.1.4 Australia

- 5.4.1.5 Rest of Asia- Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 ExxonMobil Corporation

- 6.4 Royal Dutch Shell PLC

- 6.5 Chevron Corporation

- 6.6 TotalEnergies SE

- 6.7 BP plc

- 6.8 Equinor ASA

- 6.9 Mitsubishi Heavy Industries Ltd

- 6.10 Air Products and Chemicals Inc.

- 6.11 Aker Solutions ASA

- 6.12 Schlumberger Limited