|

市場調查報告書

商品編碼

1636475

南美洲電動車電池電解:市場佔有率分析、產業趨勢、成長預測(2025-2030)South America Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

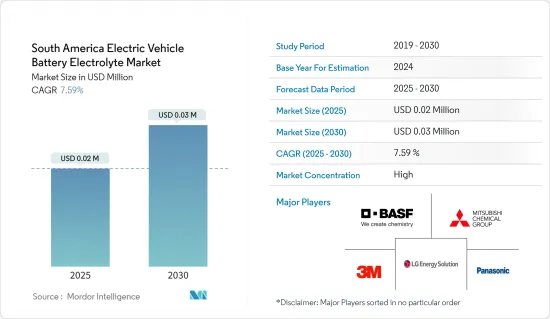

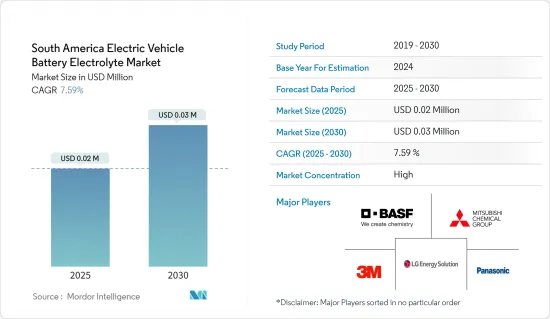

南美洲電動車電池電解市場規模預計到2025年為2000萬美元,預計到2030年將達到3000萬美元,預測期內(2025-2030年)複合年成長率為7.59%。

主要亮點

- 從中期來看,電動車在整個全部區域的滲透率不斷提高以及電池技術的進步預計將在預測期內推動電動車電池電解市場的需求。

- 另一方面,固體電解質的技術挑戰可能會嚴重抑制電動車電池電解質市場的成長。

- 提高電池性能、安全性和壽命的電解配方創新將在不久的將來為電動汽車電池電解市場創造巨大的成長機會,特別是高性能或遠距電動車。

- 由於電動車滲透率不斷上升,預計巴西將在預測期內成為南美洲電動車電池電解市場成長最快的國家。

南美洲電動汽車電池電解市場趨勢

鋰離子電池類型大幅成長

- 隨著電動車(EV)在南美洲的普及,電動車電池電解市場,特別是鋰離子電池電解市場正在快速成長。這種快速成長主要歸功於消費者需求的增加和旨在排放溫室氣體排放的嚴格政府法規。

- 由於具有高能量密度、更長的循環壽命和最小的自放電率,鋰離子電池在電動車市場中發揮著舉足輕重的作用。最近,鋰離子電池的成本對電動車的定價產生了顯著影響。考慮到其重要性,電解質在決定該地區這些電池的總體成本方面發揮關鍵作用。

- 例如,根據彭博社NEF報道,2023年電池價格將與前一年同期比較%至139美元/kWh。隨著技術創新和製造流程的不斷改進,電池組價格預計將進一步下降,2025年達到113美元/kWh,2030年達到80美元/kWh。隨著製造效率提高、原料批量採購和供應鏈最佳化,鋰離子電池產量規模擴大,預計電池電解的單位成本也將在預測期內下降。

- 南美洲傳統上被認為是鋰原料的上游來源地,但人們對建立與電池生產相關的當地產業(包括電解)的興趣越來越大。這一趨勢預示著本地生產設施的潛在出現,不僅將抑制進口依賴,還將加強區域供應鏈。

- 2023 年 4 月,全球領先的電動車製造商之一比亞迪宣布計劃斥資 2.9 億美元在智利北部安託法加斯塔地區建設一座鋰工廠,這是一項引人注目的舉措。這些努力預計將促進該地區的鋰產量,從而導致對鋰離子電池電解的需求增加。

- 此外,南美洲擁有世界上最大的鋰蘊藏量之一,估計佔世界鋰資源的54%。這種豐富的鋰對於生產為該地區電動車提供動力的鋰離子電池至關重要。作為一項戰略舉措,阿根廷政府於 2023 年 6 月承諾投資 17 億美元用於鋰生產,凸顯其成為全球供應商的雄心。這樣的承諾將滿足快速成長的鋰需求,進而增加對電池電解的需求。

- 總而言之,這些發展顯示南美洲鋰離子電池生產和電動車電解需求都呈現強勁成長軌跡。

巴西正在經歷顯著的成長

- 巴西正在鞏固其作為南美洲電動車電解市場主要企業的地位。憑藉強大的工業基礎、該地區電動車採用率的快速成長以及戰略舉措,巴西正在成為電動車電池組件(尤其是電解)開發和利用的關鍵中心。

- 近年來,由於消費者需求不斷成長、環保意識增強以及政府支持的稅額扣抵和退稅等獎勵,巴西電動車銷量大幅成長。隨著電動車越來越普及,對鋰離子電池和高級電池電解的需求也增加。

- 根據國際能源總署(IEA)預測,2023年巴西電動車銷量將達到15.2萬輛,比2022年成長驚人的1.81倍,比2019年成長25.8倍。隨著政府推出支持措施,銷售額預計將進一步增加。

- 巴西成熟的汽車產業為蓬勃發展的電動車供應鏈奠定了堅實的基礎。許多巴西公司正在大力投資電動車生產,展現出對永續交通的高度重視。

- 2024年1月,通用汽車(GM)宣布將在未來五年內投資14億美元加強巴西的電動車生產。預計此舉將在不久的將來擴大電動車電池電解的需求。

- 同時,巴西政府正在積極推動電動車的引進和必要的基礎設施發展。巴西政府與國家和國際領導人合作,目標是在未來幾年擴大電動車產量。

- 2024 年 5 月,由 Raizen、租賃汽車巨頭 Movida 和中國汽車製造商比亞迪組成的財團將電動車目標提高到 20,000 輛。該夥伴關係關係旨在發展巴西的城市交通,最初的目標是到 2025年終將 10,000 輛電動車整合到 99 個應用程式中。這些努力有望增加對電動車電池以及電池電解的需求。

- 鑑於這些發展,很明顯,巴西的舉措和計劃將在可預見的未來加強電動車生產並增加對電動車電池電解的需求。

南美洲電動汽車電池電解液產業概況

南美洲電動車電池電解市場正走向半固體。主要參與企業(排名不分先後)包括3M公司、BASF、LG化學有限公司、三菱化學集團公司、松下控股公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 電池技術的進步

- 抑制因素

- 固體電解質的技術問題

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

- 地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- 3M Company

- BASF Corporation

- LG Chem Ltd

- Mitsubishi Chemical Group

- Panasonic Holdings Corporation

- Solvay SA

- Asahi Kasei Inc.

- Albemarle Corporation

- Ganfeng Lithium

- Samsung SDI

- Soulbrain Co.Ltd.

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電解液配方的創新

簡介目錄

Product Code: 50003742

The South America Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.02 million in 2025, and is expected to reach USD 0.03 million by 2030, at a CAGR of 7.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and advancements in battery technology across the region are expected to drive the demand for the electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the technological challenges in Solid-State electrolytes can significantly restrain the growth of the electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs creates significant growth opportunities in the electric vehicle battery electrolyte market in the near future.

- Brazil is anticipated to be the fastest-growing country in the South American electric vehicle battery electrolyte market during the forecast period due to rising EV adoption.

South America Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Type to Witness Significant Growth

- As electric vehicles (EVs) gain traction in South America, the market for EV battery electrolytes, particularly those used in lithium-ion batteries, is experiencing rapid growth. This surge is largely fueled by increasing consumer demand and stringent government regulations aimed at curbing greenhouse gas emissions.

- Due to their high energy density, extended cycle life, and minimal self-discharge rate, lithium-ion batteries play a pivotal role in the EV market. Recently, the cost of lithium-ion batteries has had a pronounced impact on EV pricing. Given their significance, electrolytes play a crucial role in determining the overall costs of these batteries in the region.

- For instance, a Bloomberg NEF report highlighted that in 2023, battery prices fell to USD 139/kWh, marking a 13% drop from the previous year. With ongoing technological innovations and manufacturing improvements, projections suggest battery pack prices will further decline, hitting USD 113/kWh in 2025 and USD 80/kWh by 2030. As lithium-ion battery production ramps up-thanks to enhanced manufacturing efficiencies, bulk raw material procurement, and optimized supply chains-the cost per unit of battery electrolytes is also expected to decrease during the forecast period.

- South America, traditionally recognized for its upstream supply of raw lithium, is witnessing a burgeoning interest in establishing local industries tied to battery production, including electrolytes. This trend hints at the potential emergence of localized production facilities, which would not only curtail import dependencies but also bolster regional supply chains.

- In a notable move, in April 2023, BYD Co Ltd, the world's leading electric vehicle manufacturer, unveiled plans for a USD 290 million lithium factory in Chile's northern Antofagasta region. Such initiatives are poised to boost lithium production in the region and subsequently elevate the demand for electrolytes in lithium-ion batteries.

- Moreover, South America boasts some of the globe's largest lithium reserves, accounting for an estimated 54% of the world's lithium resources. This lithium abundance is vital for producing lithium-ion batteries that power the region's electric vehicles. In a strategic move, Argentina's government, in June 2023, pledged a hefty USD 1.7 billion investment in lithium production, underscoring its ambition to be a dominant global supplier. Such commitments are set to meet the surging lithium demand and, in turn, amplify the need for battery electrolytes.

- In summary, these developments signal a robust growth trajectory for both lithium-ion battery production and the demand for EV battery electrolytes in South America.

Brazil to Witness Significant Growth

- Brazil is solidifying its position as a key player in the South American EV battery electrolyte market. With a robust industrial foundation, a surge in regional EV adoption, and strategic initiatives, Brazil is emerging as a pivotal hub for the development and utilization of EV battery components, notably electrolytes.

- In recent years, Brazil has seen a notable uptick in EV sales, driven by heightened consumer demand, growing environmental consciousness, and government-backed incentives like tax credits and rebates. As EV adoption rises, so does the demand for lithium-ion batteries and premium battery electrolytes.

- According to the International Energy Agency, electric vehicle sales in Brazil reached 152,000 units in 2023, marking a 1.81-fold increase from 2022 and a staggering 25.8-fold jump from 2019. With the government rolling out supportive policies, sales are projected to climb further.

- Brazil's established automotive sector has laid a robust groundwork for the burgeoning EV supply chain. Numerous Brazilian companies are heavily investing in EV production, signaling a pronounced pivot towards sustainable transportation.

- In January 2024, General Motors Co. announced a USD 1.4 billion investment in Brazil over the next five years, aiming to bolster the country's EV production. This move is set to amplify the demand for EV battery electrolytes in the near future.

- In tandem, the Brazilian government is actively championing electric vehicle adoption and the requisite infrastructure development. Collaborating with both local and global leaders, the government aims to elevate EV production in the coming years.

- In May 2024, a consortium comprising Raizen, car rental giant Movida, and Chinese automaker BYD, upped its electric vehicle target to 20,000. This partnership, dedicated to advancing urban transportation in Brazil, originally set a goal of integrating 10,000 electric cars with the 99 app by the end of 2025. Such endeavors are poised to boost the demand for EV batteries and, by extension, battery electrolytes.

- Given these developments, it's evident that Brazil's initiatives and projects are set to bolster EV production and elevate the demand for EV battery electrolytes in the foreseeable future.

South America Electric Vehicle Battery Electrolyte Industry Overview

The South American electric vehicle battery electrolyte market is semi-consolidated. Some of the key players (not in particular order) are 3M Company, BASF Corporation, LG Chem Ltd, Mitsubishi Chemical Group, Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Battery Technology

- 4.5.2 Restraints

- 4.5.2.1 Technological Challenges in Solid-State Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Company

- 6.3.2 BASF Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 Mitsubishi Chemical Group

- 6.3.5 Panasonic Holdings Corporation

- 6.3.6 Solvay SA

- 6.3.7 Asahi Kasei Inc.

- 6.3.8 Albemarle Corporation

- 6.3.9 Ganfeng Lithium

- 6.3.10 Samsung SDI

- 6.3.11 Soulbrain Co.Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Electrolyte Formulations

02-2729-4219

+886-2-2729-4219