|

市場調查報告書

商品編碼

1636490

美國電動汽車電池電解:市場佔有率分析、產業趨勢與成長預測(2025-2030)United States Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

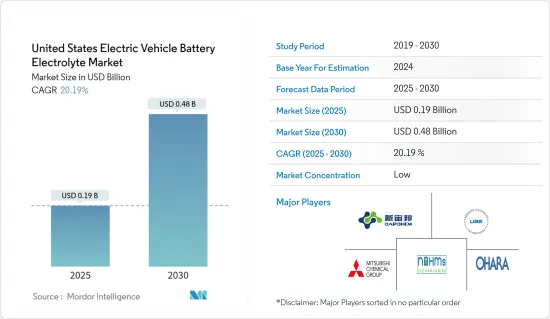

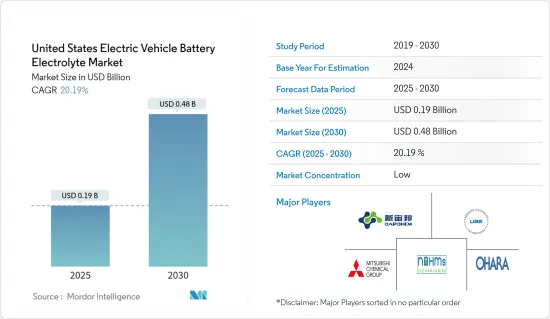

預計2025年美國電動車電池電解市場規模為1.9億美元,2030年將達4.8億美元,預測期間(2025-2030年)複合年成長率為20.19%。

主要亮點

- 從長遠來看,美國電動車(包括純電動車、插電式混合動力車和混合動力車)的使用量正在增加,政府促進電動車使用的措施預計將推動市場成長。

- 另一方面,中國等一些國家的壟斷造成的電池材料供應鏈差異預計將抑制未來市場的成長。

- 電解質材料和高效電解質的研究和進步的增加可能會提供市場成長的機會。

美國電動車電池電解液市場趨勢

鋰離子電池可望主導市場

- 鋰離子電池對於為電動車 (EV)動力來源、延長其使用壽命並最大限度地減少電池更換頻率至關重要。與其他電池類型不同,鋰離子電池不含鉛或鎘等有害物質,使其成為環保、清潔和安全的選擇。此外,其高功率對於需要快速加速和高速行駛的電動車來說至關重要。

- 根據永續能源商業委員會(BCSE)的數據,截至2023年,美國將擁有114GWh的鋰離子電池製造能力。隨著電動車銷量的增加,預計未來幾年汽車產業對鋰離子電池的需求將大幅成長。例如,國際能源總署報告稱,從 2021 年到 2023 年,美國和加拿大的電動車銷量將成長 54% 以上。鋰離子電池使用量的增加將推動對滲透電解質溶液的需求,這對於在正極和負極之間傳輸正鋰離子至關重要。

- 2023年,美國主要化學品製造商亨斯曼公司宣布計劃在德克薩斯州增加電解質溶劑碳酸伸乙酯的產量。此外,我們將與新宙邦聯合在美國設立工廠,進一步壯大該國電動車電池電解市場。

- 此外,2023年3月,白宮公佈了《國家鋰電池藍圖》,並制定了2021年至2030年該產業的發展方向。該藍圖強調強化原料採購和國內鋰加工,並強調電動車繁榮將導致美國鋰離子電池需求激增。

- 隨著電動車擴大採用鋰離子電池以及價格不斷下降,該領域有望在未來幾年實現強勁成長。

電動車的普及預計將推動市場

- 在消費者興趣增加和政府支持措施的推動下,美國電動車(EV)電池電解液市場正在迅速擴大。

- 技術進步,尤其是高鎳和電解的技術進步,正在提高電池性能和成本效益。同時,美國旨在加強鋰、鎳和鈷等關鍵材料的國內供應鏈,以減少對進口的依賴並確保穩定。

- 2024 年 1 月,麻省理工學院 (MIT) 的研究人員推出了突破性的電池材料,可以改變電動車的供電方式。該鋰離子電池採用創新的有機材料陰極和電解質溶液,標誌著傳統使用鈷和鎳的轉變。這些進步將擴大國內對電池電解質材料的需求。

- 隨著電動車普及率的飆升,美國正在優先考慮加強其電池製造供應鏈。這一勢頭預計將刺激國內電動車電池組件(包括電解液)的生產。

- 2023年6月,中國領先的研發公司新宙邦宣布計畫斥資1.2億美元在俄亥俄州南部建造一座電解液工廠。同時,Dongwha Electrolyte 正在田納西州開設一座耗資 7,000 萬美元的工廠,目標是每年生產超過 7 萬噸電解。此外,Soul Brain 正在印第安納州建立一家耗資 7,500 萬美元的電解工廠,該工廠位置優越,可容納附近的電池工廠。

- 未來,隨著電動車普及率的不斷提高,美國預計將重點研發旨在提高能量密度、降低成本、延長電動車續航里程的電池技術,從而重振電池正極市場。

- 國際能源總署(IEA)的資料顯示,美國電動車銷量將大幅成長,從2022年的99萬輛躍升至2023年的139萬輛。

- 預計到2030年,美國將有2,600萬輛電動車投入使用,預計將需要1,290萬個充電端口,為電動車電池正極市場的快速成長鋪平道路。

- 由於電動車的加速採用和技術進步,預計美國將在預測期內引領市場。

美國電動汽車電池電解液產業概況

美國電動車電池電解液市場呈現半分裂狀態。市場的主要企業包括(排名不分先後)Advanced Electrolyte Technologies LLC、三菱化學控股、深圳新宙邦科技、Nohms Technologies Inc.和Ohara Corporation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車(包括 BEV、PHEV 和 HEV)的使用增加

- 政府促進電動車使用的有利措施

- 抑制因素

- 電池材料供應鏈差異

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Advanced Electrolyte Technologies LLC

- Mitsubishi Chemical Holdings

- Shenzhen Capchem Technology Co., Ltd

- Nohms Technologies Inc

- Ohara Corporation

- BASF SE

- LG Chem Ltd

- Targray Industries Inc.

- 市場排名/佔有率(%)分析

- 其他知名公司名單

第7章 市場機會及未來趨勢

- 電解質材料的持續研究與進展

The United States Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.19 billion in 2025, and is expected to reach USD 0.48 billion by 2030, at a CAGR of 20.19% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing usage of electric vehicles, including BEVs, PHEVs, and HEVs, and favorable government policies to promote the usage of electric vehicles in the United States are expected to drive the market's growth.

- On the other hand, the supply chain gap in battery materials created by the monopoly of some countries like China is expected to restrain market growth in the future.

- Nevertheless, the ongoing research and advancement in electrolyte material and efficient electrolytes may offer opportunities for market growth.

United States Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery is Expected to Dominate the Market

- Lithium-ion batteries, pivotal for powering electric vehicles (EVs), extend the lifespan of these vehicles, thereby minimizing the frequency of battery replacements. Unlike some other battery types, lithium-ion batteries are deemed environmentally friendly, as they lack toxic materials such as lead or cadmium, making them a cleaner and safer option. Furthermore, their high power output is essential for EVs, which demand swift acceleration and elevated speeds.

- As of 2023, the United States boasts a lithium-ion battery manufacturing capacity of 114 GWh, according to the Business Council for Sustainable Energy (BCSE). With rising electric vehicle sales, the automotive sector's demand for lithium-ion batteries is poised for significant growth in the coming years. For example, the International Energy Agency reports that electric vehicle sales in the United States and Canada surged over 54% from 2021 to 2023. This uptick in lithium-ion battery usage will subsequently boost the demand for penetration electrolyte solutions, vital for transporting positive lithium ions between the cathode and anode.

- In 2023, Huntsman Corporation, a leading American chemical manufacturer, unveiled plans to boost production of the electrolyte solvent ethylene carbonate in Texas. Additionally, in collaboration with Capchem, they are establishing a plant in the United States, further bolstering the country's electric vehicle battery electrolyte solution market.

- Moreover, in March 2023, the White House unveiled the "National Blueprint for Lithium Batteries," charting the industry's course from 2021 to 2030. The blueprint emphasizes enhancing raw material sourcing and bolstering domestic lithium processing, underscoring the anticipated surge in lithium-ion battery demand in the United States driven by the electric vehicle boom.

- Given the rising adoption of lithium-ion batteries in electric vehicles and their declining prices, the segment is set for substantial growth in the coming years.

Increasing Adoption of Electric Vehicles is expected to Drive the Market

- Driven by rising consumer interest and supportive government policies, the United States is witnessing a rapid expansion in its electric vehicle (EV) battery electrolyte market.

- Technological advancements, particularly in high-nickel and electrolyte solutions, are boosting battery performance and cost-effectiveness. Concurrently, the U.S. is bolstering its domestic supply chain for critical materials such as lithium, nickel, and cobalt, aiming to reduce import reliance and ensure stability.

- In January 2024, MIT researchers unveiled a groundbreaking battery material set to transform electric vehicle power sources. This lithium-ion battery, featuring an innovative organic material-based cathode and electrolyte solution, marks a shift from the traditional cobalt or nickel usage. Such advancements are poised to amplify the nation's demand for battery electrolyte materials.

- As electric vehicle adoption surges, the United States is prioritizing the fortification of its battery manufacturing supply chain. This momentum is likely to spur domestic production of electric vehicle battery components, including electrolytes.

- In June 2023, Capchem, a China-based R&D-centric company, unveiled plans for a USD 120 million electrolyte plant in southern Ohio. Simultaneously, Dongwha Electrolyte commenced a USD 70 million facility in Tennessee, targeting an annual production of over 70,000 metric tons of electrolytes. Additionally, Soulbrain is establishing a USD 75 million electrolyte plant in Indiana, strategically located to cater to a nearby battery factory.

- Looking ahead, as EV adoption continues its upward trajectory, the United States's R&D focus on battery technology-aimed at boosting energy density, cutting costs, and extending EV range-will likely invigorate the battery cathode market.

- Data from the International Energy Agency highlights a significant jump in United States EV car sales, soaring to 1.39 million units in 2023 from 0.99 million in 2022.

- With projections of 26 million electric vehicles by 2030, the United States anticipates a need for 12.9 million charging ports, paving the way for a burgeoning electric vehicle battery cathode market.

- Given the accelerating adoption of EVs and technological strides, the United States is poised to lead the market during the forecast period.

United States Electric Vehicle Battery Electrolyte Industry Overview

The United States Electric Vehicle Battery Electrolyte Market is semi-fragmented. Some of the major companies operating in the market (in no particular order) include Advanced Electrolyte Technologies LLC, Mitsubishi Chemical Holdings, Shenzhen Capchem Technology Co., Ltd, Nohms Technologies Inc., and Ohara Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Usage of Electric Vehicles, including BEVs, PHEVs, and HEVs

- 4.5.1.2 Favorable government policies to promote the usage of electric vehicles

- 4.5.2 Restraints

- 4.5.2.1 The Supply chain gap in battery materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Advanced Electrolyte Technologies LLC

- 6.3.2 Mitsubishi Chemical Holdings

- 6.3.3 Shenzhen Capchem Technology Co., Ltd

- 6.3.4 Nohms Technologies Inc

- 6.3.5 Ohara Corporation

- 6.3.6 BASF SE

- 6.3.7 LG Chem Ltd

- 6.3.8 Targray Industries Inc.

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Ongoing Research and Advancement in Electrolyte Material