|

市場調查報告書

商品編碼

1636498

鑽機:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Drilling Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

鑽機市場規模預計到 2025 年為 996.6 億美元,預計到 2030 年將達到 1062 億美元,預測期內(2025-2030 年)複合年成長率為 1.28%。

主要亮點

- 從中期來看,天然氣需求的成長和天然氣基礎設施擴建導致的鑽探活動增加將在研究期間推動市場。

- 另一方面,全球向可再生能源技術的轉變預計將為市場帶來挑戰。

- 同時,水力壓裂技術的進步為未來幾年的市場提供了一個有希望的成長機會。

- 從地區來看,北美將處於主導。具體而言,美國上游活動的活性化加強了北美在研究期間的主導地位。

鑽機市場趨勢

海工業務實現顯著成長

- 配備先進工具和機械的鑽機對於從海底開採石油和天然氣蘊藏量至關重要。這些鑽機主要位於海上,為工程師和工人提供穩定的平台,以獲取蘊藏量在海底(有時深達數公里)的地下資源。

- 在全球石油和天然氣需求快速成長以及陸上蘊藏量枯竭的推動下,海上鑽油平臺市場經歷了持續成長。蘊藏量的枯竭使得必須在更深、更偏遠的地區探勘。巴西、墨西哥灣和西非等擁有大量未開發蘊藏量的地區是大規模海上計劃投資的主要目標。

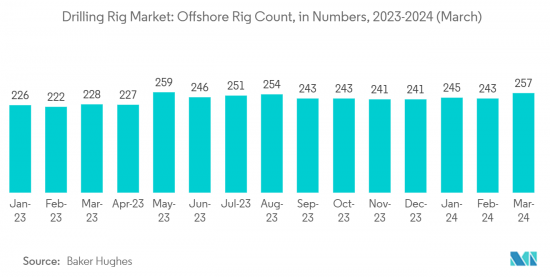

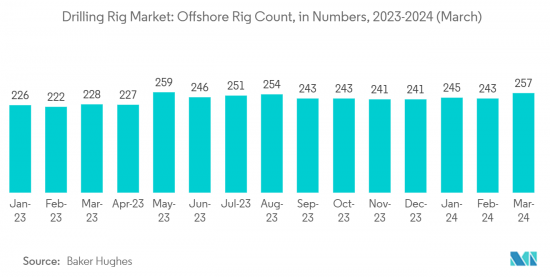

- 截至2024年3月,全球海上鑽油平臺數量已從2023年3月的228座增加到257座。由於海上領域投資的增加,預計鑽機數量將繼續增加。

- 2023年3月,巴西礦業和能源部長啟動了Potentializer探勘和生產計畫。此舉旨在推動巴西成為世界第四大石油生產國,並旨在增加石油開發投資。預計2029年巴西產量將比2021年增加80%,達540萬桶/日,其中鹽層下產量約佔80%。該計劃將重點關注重點探勘領域,並提倡對成熟地區和邊緣地區進行投資,從而擴大對鑽機的需求。

- 2023年8月,SFL Corporation Ltd.與Equinor ASA子公司在加拿大簽署了半潛式鑽機Hercules的鑽井契約,預計價值1億美元。該合約涉及一口主井,並可選擇一口二級井,預計於 2024 年第二季開始。

- 2024年3月,海上鑽井承包商Dolphin Drilling與印度石油有限公司簽署了半潛式鑽機的長期合約。該項目將耗時 14 個月在印度海岸鑽探 3 口井,預計耗資約 1.45 億美元。

- 鑑於這種投資情況以及隨著陸上蘊藏量下降而政府對離岸活動的關注,預計該行業將在審查期間成長。

北美市場佔據主導地位

- 北美在全球石油和天然氣市場中佔據主導地位,主要是因為美國近年來已成為世界領先的原油生產國。

- 此外,美國在石油和天然氣行業的資本支出方面一直名列前茅,而這一趨勢預計將持續下去。

- 美國擁有強大的海上石油和天然氣工業,主要集中在墨西哥灣和阿拉斯加沿岸。隨著鑽探深度的增加,技術可採蘊藏量迅速增加,吸引了大量投資到該地區。

- 2023年3月,在環境議題爭論中,拜登政府核准了阿拉斯加的一個大型石油鑽探計畫。它核准了Willow計劃的修訂版,允許康菲石油公司開始在阿拉斯加國家石油儲備區進行鑽探。康菲石油公司預計該作業日產量為 18 萬桶。

- 主要石油和燃氣公司已宣布 2023 年及以後的資本支出增幅高於平均值。例如,2022年12月,雪佛龍公司為合併子公司額外設定了140億美元的2023年有機資本投資預算,為權益法附屬公司設定了30億美元的額外有機資本投資預算。

- 2023 年 12 月,康菲石油公司開始進行石油生產建設,這是預計將增加其鑽機服務需求的重要一步。

- 2024年6月,美國能源開發公司(美國 Energy)宣布了針對二疊紀盆地的雄心勃勃的計劃,為下一會計年度累計超過7.5億美元,重點關注二疊紀計劃。

- 透過這些策略投資,北美有望在可預見的未來保持其在石油和天然氣市場的主導地位。

鑽機產業概況

鑽機市場分散。市場上營運的主要企業包括(排名不分先後)Nabors Industries Ltd.、Transocean Ltd.、Saipem SpA、Seadrill Ltd. 和 Schlumberger NV。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 原油產量(百萬桶/天):至 2023 年

- 天然氣產量(十億立方英尺):到 2023 年

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 天然氣需求增加和天然氣基礎設施發展

- 鑽井活動增加

- 抑制因素

- 採用更清潔的替代燃料

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按部署地點

- 陸上

- 離岸

- 按類型

- 頂起

- 半潛式

- 鑽孔船

- 其他類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 俄羅斯

- 挪威

- 西班牙

- 北歐國家

- 土耳其

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 卡達

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Nabors Industries Ltd.

- Transocean Ltd.

- Noble Corporation PLC

- Saipem SpA

- Arabian Drilling Company

- ADES International Holding PLC

- Shelf Drilling Holdings, Ltd.

- Seadrill Ltd

- Saudi Arabian Oil Company(Saudi Aramco)

- Schlumberger NV

- 其他主要企業名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 水力壓裂製程技術進步

簡介目錄

Product Code: 50003777

The Drilling Rig Market size is estimated at USD 99.66 billion in 2025, and is expected to reach USD 106.20 billion by 2030, at a CAGR of 1.28% during the forecast period (2025-2030).

Key Highlights

- In the medium term, rising drilling activities, coupled with an increasing demand for natural gas and the expansion of gas infrastructure, are poised to propel the market during the study period.

- On the flip side, the global shift towards renewable energy technologies is anticipated to pose challenges to the market.

- Meanwhile, advancements in hydraulic fracturing technology present promising growth opportunities for the market in the coming years.

- Regionally, North America is set to take the lead. Specifically, the uptick in upstream activities in the United States bolsters North America's dominant position during the study period.

Drilling Rig Market Trends

Offshore Segment to Witness Significant Growth

- Drilling rigs, equipped with advanced tools and machinery, are pivotal in extracting oil and gas reserves from the ocean floor. Primarily stationed in offshore locales, these rigs serve as stable platforms, enabling engineers and workers to access reserves buried deep beneath the seabed, sometimes reaching depths of several kilometers.

- Driven by a global surge in oil and gas demand and the depletion of onshore reserves, the offshore drilling rig market has witnessed consistent growth. This depletion has necessitated exploration in deeper, more remote waters. Regions like Brazil, the Gulf of Mexico, and West Africa, boasting vast untapped reserves, have become prime targets for heavy investments in offshore projects.

- As of March 2024, the global offshore drilling rig count rose to 257, up from 228 in March 2023. With increasing investments in the offshore sector, the rig count is expected to continue its upward trajectory in the coming years.

- In March 2023, Brazil's Minister of Mines and Energy launched the "Potencializa" exploration and production program. This initiative, aimed at amplifying oil exploration investments, seeks to elevate Brazil to the status of the world's fourth-largest oil producer. Projections for 2029 forecast Brazil's production at 5.4 million barrels daily, an 80% increase from 2021, with pre-salt areas accounting for roughly 80% of this output. The program will emphasize key exploration zones and advocate for investments in both mature and marginal fields, thereby amplifying the demand for drilling rigs.

- In August 2023, SFL Corporation Ltd. secured a drilling contract in Canada, valued at an estimated USD 100 million, with Equinor ASA's subsidiary for the semi-submersible rig Hercules. The contract encompasses one primary well, with an option for a second, and is slated to commence in Q2 2024.

- In March 2024, Dolphin Drilling, an offshore drilling contractor, clinched a long-term contract with Oil India Limited for its semi-submersible rig. Set off the coast of India, the operations involve drilling three wells over 14 months, with a projected cost of around USD 145 million.

- Given this investment landscape and the government's pivot to offshore activities due to dwindling onshore reserves, the segment is poised for growth during the study period.

North America to Dominate the Market

- North America stands as a dominant player in the global oil and gas market, largely because the United States has emerged as one of the world's leading crude oil producers in recent years.

- Moreover, the United States consistently ranks among the top in capital expenditures within the oil and gas industry, a trend that's expected to persist in the coming years.

- The United States boasts a robust offshore oil and gas industry, primarily centered around the Gulf of Mexico and offshore Alaska. As drilling depths have progressed, the surge in technically recoverable reserves has drawn significant investments to the region.

- In March 2023, the Biden administration, amidst environmental debates, sanctioned a significant oil drilling venture in Alaska. They approved a modified version of the Willow project, permitting ConocoPhillips to initiate drilling in Alaska's National Petroleum Reserve. ConocoPhillips projects a daily output of 180,000 barrels from this venture.

- Major oil and gas corporations have unveiled above-average hikes in their capital expenditures for 2023 and the years to follow. For example, Chevron Corporation, in December 2022, set its 2023 organic capital expenditure budgets at USD 14 billion for its consolidated subsidiaries and an additional USD 3 billion for its equity affiliates.

- In December 2023, ConocoPhillips took a significant step by commencing construction for oil production, a move expected to elevate the demand for drilling rig services.

- In June 2024, US Energy Development Corporation (US Energy) unveiled its ambitious plans in the Permian basin, earmarking over USD 750 million for the upcoming year, with a primary emphasis on Permian projects.

- Given these strategic investments, North America is poised to maintain its dominance in the oil and gas market in the foreseeable future.

Drilling Rig Industry Overview

The drilling rig market is fragmented. Some of the major players operating in the market (in no particular order) include Nabors Industries Ltd., Transocean Ltd., Saipem SpA, Seadrill Ltd, and Schlumberger NV, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Crude Oil Production in Million Barrels Per Day, till 2023

- 4.4 Natural Gas Production in Billion Cubic Feet, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Demand for Natural Gas And Developing Gas Infrastructure

- 4.7.1.2 Increase in Drilling Activities

- 4.7.2 Restraints

- 4.7.2.1 Adoption of Cleaner Alternatives

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type

- 5.2.1 Jack-ups

- 5.2.2 Semisubmersible

- 5.2.3 Drill Ships

- 5.2.4 Other Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC Countries

- 5.3.2.6 Turkey

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Thailand

- 5.3.3.6 Indonesia

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nabors Industries Ltd.

- 6.3.2 Transocean Ltd.

- 6.3.3 Noble Corporation PLC

- 6.3.4 Saipem SpA

- 6.3.5 Arabian Drilling Company

- 6.3.6 ADES International Holding PLC

- 6.3.7 Shelf Drilling Holdings, Ltd.

- 6.3.8 Seadrill Ltd

- 6.3.9 Saudi Arabian Oil Company (Saudi Aramco)

- 6.3.10 Schlumberger NV

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Hydraulic Fracturing Process

02-2729-4219

+886-2-2729-4219