|

市場調查報告書

商品編碼

1636575

超級電容器 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Ultracapacitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

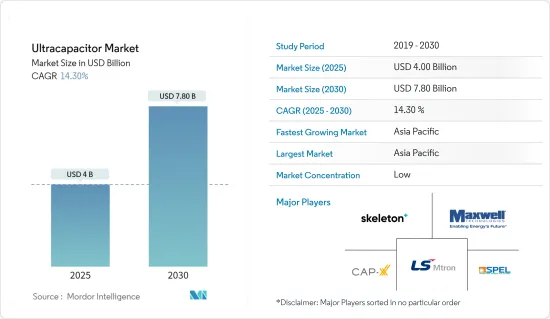

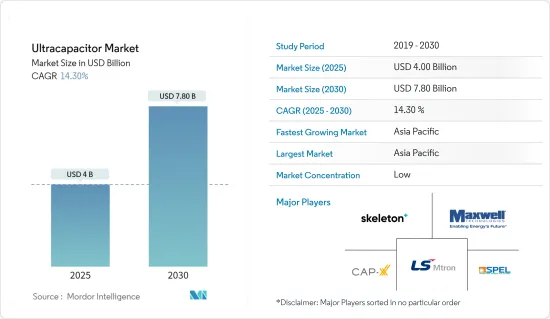

超級電容器市場規模預計到 2025 年為 40 億美元,預計到 2030 年將達到 78 億美元,預測期內(2025-2030 年)複合年成長率為 14.3%。

主要亮點

- 汽車產業正在推動電容器市場。隨著產業轉向永續和節能車輛,電容器擴大用於再生煞車、引擎啟動停止系統和能源回收系統等應用。電容器快速供電的能力提高了它們在這些應用中的有效性。此外,汽車製造商目前正在探索混合能源儲存解決方案,將電池和電容器結合以最佳化性能。

- 隨著可再生能源計劃的激增,對高效能源儲存和電網穩定解決方案的需求不斷成長。超級電容器透過在高峰生產時間儲存多餘的能量並在低生產時間釋放能量,在幫助穩定電網方面發揮著至關重要的作用。這項功能凸顯了超級電容器在可再生能源系統(尤其是風能和太陽能)中的重要性。

- 正在進行的研究和開發旨在提高電容器的能量密度,使其與傳統電池相媲美。特別是使用石墨烯和奈米碳管的材料創新有望在不犧牲高功率或快速充電的情況下增加儲存容量。 2023 年,總部位於墨爾本的 EnyGy 推出了一款採用尖端石墨烯技術的超級電容器。

- 然而,超級電容在長期能源儲存有其限制。它們的放電率超過了鋰離子電池,每天會產生10-20%的自放電損失。電池在耗盡之前保持幾乎恆定的電壓,但電容器的電壓在充電時會線性下降。

- 全球對清潔能源的推動和嚴格的環境法規正在為電容器市場創造有利的氛圍。旨在減少碳排放和促進電動車和可再生能源採用的措施正在推動市場成長。此外,政府和私營部門在研發方面的投資,特別是能源儲存技術,正在加速先進電容器的發展。

電容器市場趨勢

汽車和運輸業需求旺盛

- 電動和混合動力汽車的快速普及極大地增加了對電容器的需求。與傳統電池不同,電容器具有高功率密度並允許快速充電和放電。這使得它們特別適合再生煞車和怠速熄火系統等應用。利用超級電容實施帶來的挑戰與機遇,超級電容技術廣泛應用於再生煞車檢查設備。其卓越的功率密度和循環特性使其非常受歡迎。

- 例如,Skeleton Technologies 的超級電容就安裝在本田 CR-V 混合動力賽車上。該演示車展示了本田性能開發能力,並推出了本田 2023 年印地賽車混合動力單元技術。得益於骨架超級電容,賽車提高了高功率性能。這種超級電容被視為回收煞車能量和增加加速度的完美解決方案。超級電容具有內阻低、循環性能高、耐老化性能好等顯著優點。

- KAIST(韓國科學技術院)的研究人員宣布了一種創新的能源儲存解決方案。這個新系統結合了超級電容的優勢與鈉離子電池化學的成本效率和供應鏈優勢。研究團隊預計這項新系統將擴展到電動車領域。這種新型電池整合了正極和先進的負極,並採用超級電容技術。這種協同效應使該電池成為鋰離子電池的強大競爭對手,兼具令人難以置信的儲存容量和快速的充電和放電速度。

- 在美國,主要有三種快速充電標準。 CHAdeMO,組合充電系統(CCS),北美充電標準(以前的特斯拉標準)。其中,CCS方式在快速充電站數量方面處於領先地位。根據美國能源局的資料,到2024年,將有7,315個CCS站、5,720個CHAdeMO站和2,280個NACS站。這項基礎設施擴建將支持電容器在電動車中的擴大使用。

- 超級電容器在能源回收系統中發揮著至關重要的作用,特別是在電動巴士、路面電車和高速列車等公共交通領域。汽車產業的一個關鍵挑戰是採購能夠承受高循環使用而不磨損的零件。超級電容器在這一領域大放異彩,可以毫不費力地承受數百萬次充電/放電週期,且劣化最小。隨著業界更加傾向於電氣化、燃油效率和永續性,超級電容器的重要性持續成長。

亞太地區引領市場

- 中國、日本和韓國在電動車生產方面處於領先地位,並得到了大力投資創新能源儲存解決方案的成熟汽車產業的支持。該地區電動車基礎設施的快速擴張,加上對永續交通的大力推動,預計將進一步推動市場發展。

- 除了電動車之外,亞太地區在可再生能源投資方面也發揮著重要作用。隨著中國和印度等國家加大太陽能和風力發電計劃的力度,對能源儲存解決方案的需求正在激增。 Carbon Brief的研究凸顯了這一趨勢,指出清潔能源投資將與前一年同期比較%,到2023年總額將達到8,900億美元。這一成長是中國經濟投資激增的全部原因。超級電容器以其快速充電和放電能力而聞名,事實證明對於穩定這些可再生能源系統至關重要。

- 亞太地區以其強大的製造基礎和先進的技術而聞名,非常注重研發。在大量投資的支持下,這項重點不僅提高了電容器的性能,而且還擴大了其在從家用電子電器產品到工業機械等各個領域的應用。

- 印度於 2024 年 10 月在喀拉拉邦坎努爾開設了第一家超級電容製造廠,這是電子製造業的重大飛躍。該工廠旨在為印度國防、電動車甚至太空任務等各個領域生產頂級超級電容。

- 政府為減少碳排放和支持綠色能源解決方案所做的努力正在刺激電容器的快速部署。加強電動車生產和可再生能源計畫的誘因和補貼有望促進電容器市場的成長。

電容器產業概況

超級電容器市場競爭激烈,老牌跨國公司和新興企業都將創新和市場拓展放在第一位。該領域的知名參與企業包括 axwell Technologies、Skeleton Technologies、LS Mtron Ltd 和 Eaton Corporation。這些公司透過強大的全球足跡、全面的研發能力和廣泛的產品系列鞏固了自己的地位。

隨著汽車、可再生能源和工業應用等領域需求的不斷增加,競爭也加劇。領先公司正在加強研發力度、爭取投資和資金籌措,以鞏固其市場地位並擴大其產品線。例如,Skeleton Technologies 於 2023 年 10 月獲得了 1.08 億歐元的融資,旨在快速追蹤下一代產品的開發並擴大超級電容的製造規模。

在電容器市場,持續的研究和開發對於獲得競爭優勢至關重要。該公司正在研究奈米碳管和石墨烯等先進材料,以提高能量密度並降低成本。展望未來,市場競爭將變得越來越激烈,重點是技術突破、成本效率和適應關鍵產業動態的能源需求。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 對節能解決方案的需求不斷成長

- 電動車 (EV) 市場的成長

- 可再生能源系統的進步

- 市場限制因素

- 初始成本高

- 與電池相比能量密度較低

第6章 市場細分

- 按類型

- 靜電電容

- 贗電容

- 混合電容器

- 按最終用戶產業

- 汽車和交通

- 消費性電子產品

- 能源/電力

- 工業製造

- 航太/國防

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Skeleton Technologies

- Maxwell Technologies

- CAP-XX

- SPEL TECHNOLOGIES PRIVATE LTD.

- LS Mtron Co., Ltd.

- IOXUS

- Nippon Chemi-Con Corporation

- Shanghai Aowei Technology Development Co., Ltd

- KEMET Corporation

- Eaton Corporation

- Yunasko

- VINATech Co., Ltd

- SECH

第8章投資分析

第9章 市場的未來

The Ultracapacitor Market size is estimated at USD 4.00 billion in 2025, and is expected to reach USD 7.80 billion by 2030, at a CAGR of 14.3% during the forecast period (2025-2030).

Key Highlights

- The automotive sector drives the ultracapacitor market. As the industry shifts towards sustainable and energy-efficient vehicles, ultracapacitors are increasingly used in applications like regenerative braking, engine start-stop systems, and energy recovery systems. Their capability to deliver quick energy bursts enhances their effectiveness in these roles. Furthermore, automakers are now exploring hybrid energy storage solutions, merging batteries with ultracapacitors for optimized performance.

- With the surge in renewable energy projects, the demand for efficient energy storage and grid stability solutions has intensified. Ultracapacitors play a pivotal role by storing excess energy during peak production and releasing it during low generation periods, thus aiding grid stabilization. This functionality underscores their importance in renewable energy systems, particularly in wind and solar power.

- Ongoing research and development efforts aim to boost the energy density of ultracapacitors, allowing them to rival conventional batteries. Material innovations, especially with graphene and carbon nanotubes, promise enhanced storage capacity without compromising on high power output and rapid charging. A notable example is EnyGy, a Melbourne-based company, which in 2023 unveiled an ultracapacitor leveraging cutting-edge graphene technology.

- However, supercapacitors have limitations in long-term energy storage. Their discharge rate surpasses that of lithium-ion batteries, leading to a self-discharge loss of 10-20 percent daily. While batteries maintain a near-constant voltage until depleted, capacitors experience a linear decline in voltage with charge.

- Global pushes for cleaner energy and stringent environmental regulations have created a conducive atmosphere for the ultracapacitor market. Policies aimed at reducing carbon emissions and promoting electric vehicles and renewable energy adoption have bolstered market growth. Moreover, both government and private sector investments in research and development, particularly in energy storage technologies, have accelerated the evolution of advanced ultracapacitors.

Ultracapacitor Market Trends

Automotive and Transportation Sector Experiencing Demand

- The swift rise in the adoption of electric and hybrid vehicles has significantly driven up the demand for ultracapacitors. Unlike conventional batteries, ultracapacitors boast a high power density, enabling rapid charging and discharging. This makes them particularly suited for applications like regenerative braking and start-stop systems. Supercap technologies are being extensively utilized in regenerative braking test rigs, capitalizing on the challenges and opportunities presented by supercapacitor implementation. Their remarkable power density and cycling characteristics make them highly desirable.

- For example, Skeleton Technologies' supercapacitors are featured in the Honda CR-V Hybrid Racer. This demonstration vehicle highlights the prowess of Honda Performance Development and showcases Honda's 2023 IndyCar hybrid power unit technology. Thanks to Skeleton's supercapacitors, the race car enjoys enhanced high-power performance. These supercapacitors are touted as the perfect solution for braking energy recovery and boosting acceleration. They come with notable advantages: low internal resistance, high cyclability, and excellent aging resistance.

- Researchers at KAIST (Korea Advanced Institute of Science and Technology) have unveiled an innovative energy storage solution. This new system merges the strengths of supercapacitors with the cost-effectiveness and supply chain benefits of sodium-ion battery chemistry. The research team envisions their creation making waves in the electric vehicle sector. Their novel battery integrates an advanced anode with a cathode tailored for supercapacitor technology. This synergy enables the battery to boast both impressive storage capacities and swift charge-discharge rates, positioning it as a formidable contender against lithium-ion batteries.

- In the U.S., three primary fast-charging standards dominate: CHAdeMO, Combined Charging System (CCS), and the North American Charging Standard (previously Tesla's standard). Among these, the CCS method leads in the number of fast-charging stations. Data from the U.S. Department of Energy reveals that in 2024, there were 7,315 CCS stations, 5,720 CHAdeMO stations, and 2,280 NACS stations. This expanding infrastructure bolsters the growing use of ultracapacitors in electric vehicles.

- Ultracapacitors are carving out a pivotal role in energy recovery systems, especially in public transport realms like electric buses, trams, and high-speed trains. A key challenge in the automotive industry is sourcing components that can endure high-cycle usage without substantial wear. Ultracapacitors shine in this domain, effortlessly handling millions of charge and discharge cycles with minimal degradation. As the industry leans more towards electrification, fuel efficiency, and sustainability, the significance of ultracapacitors is poised to grow.

Asia-Pacific Region is Driving the Market

- China, Japan, and South Korea lead the charge in electric vehicle production, bolstered by their established automotive industries that heavily invest in innovative energy storage solutions. The region's rapid expansion of EV infrastructure, coupled with a strong push towards sustainable transportation, is set to propel the market further.

- Beyond electric vehicles, the Asia-Pacific region is a significant player in renewable energy investments. With countries like China and India intensifying their solar and wind energy projects, the demand for energy storage solutions has surged. Research from Carbon Brief highlights this trend, noting a 40% year-on-year rise in clean-energy investments, totaling USD 890 billion in 2023. This growth accounted for the entirety of the investment surge across China's economy. Ultracapacitors, known for their swift charging and discharging capabilities, are proving to be pivotal in stabilizing these renewable energy systems.

- The Asia-Pacific region, renowned for its strong manufacturing base and technological advancements, is channeling its focus on research and development. Backed by substantial investments, this emphasis has not only enhanced ultracapacitor performance but also broadened their applications across diverse sectors, from consumer electronics to industrial machinery.

- In a significant leap for electronics manufacturing, India inaugurated its first supercapacitor manufacturing plant in Kannur, Kerala in October 2024. This facility aims to produce top-tier supercapacitors for various sectors, including the Indian defense, electric vehicles, and even space missions.

- Government initiatives, targeting a reduction in carbon emissions and championing green energy solutions, have catalyzed the swift adoption of ultracapacitors. With incentives and subsidies bolstering EV production and renewable energy initiatives, the environment is ripe for the ultracapacitor market's growth.

Ultracapacitor Industry Overview

The ultracapacitor market is fiercely competitive, featuring both established multinational corporations and emerging players that prioritize technological innovation and market expansion. Notable players in this arena include Maxwell Technologies, Skeleton Technologies, LS Mtron Ltd, and Eaton Corporation. These companies have cemented their positions through a robust global footprint, comprehensive R&D capabilities, and a wide array of product offerings.

Competition intensifies with rising demand from sectors like automotive, renewable energy, and industrial applications. Major players are bolstering their R&D efforts, securing investments, and raising funds to solidify their market positions and broaden their product ranges. For example, in October 2023, Skeleton Technologies secured EUR 108M in funding, aimed at fast-tracking the development of next-gen products and expanding supercapacitor manufacturing.

In the ultracapacitor market, continuous R&D is paramount for gaining a competitive edge. Companies are delving into advanced materials, such as carbon nanotubes and graphene, to boost energy density and cut costs. Looking ahead, the market is poised for heightened competition, focusing on technological breakthroughs, cost efficiency, and adapting to the dynamic energy demands of key industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macroeconomic Trends on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Energy-Efficient Solutions

- 5.1.2 Growing Electric Vehicle (EV) Market

- 5.1.3 Advancements in Renewable Energy Systems

- 5.2 Market Restraints

- 5.2.1 High Initial Cost

- 5.2.2 Lower Energy Density Compared to Battery

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electrostatic Ultracapacitors

- 6.1.2 Pseudocapacitors

- 6.1.3 Hybrid Capacitors

- 6.2 By End User Vertical

- 6.2.1 Automotive and Transportation

- 6.2.2 Consumer Electronics

- 6.2.3 Energy and Power

- 6.2.4 Industrial Manufacturing

- 6.2.5 Aerospace and Defense

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Skeleton Technologies

- 7.1.2 Maxwell Technologies

- 7.1.3 CAP-XX

- 7.1.4 SPEL TECHNOLOGIES PRIVATE LTD.

- 7.1.5 LS Mtron Co., Ltd.

- 7.1.6 IOXUS

- 7.1.7 Nippon Chemi-Con Corporation

- 7.1.8 Shanghai Aowei Technology Development Co., Ltd

- 7.1.9 KEMET Corporation

- 7.1.10 Eaton Corporation

- 7.1.11 Yunasko

- 7.1.12 VINATech Co., Ltd

- 7.1.13 SECH